Summary:

- Texas Instruments has a market-beating dividend and aggressive buyback program with consistent dividend growth and a high dividend yield.

- The company is expected to encounter two years of negative EPS growth, but its long-term growth drivers in the automotive and industrial sectors remain strong.

- Texas Instruments maintains a competitive edge through its best-in-class manufacturing technology, broad product portfolio, and focus on direct sales.

Fischerrx6

Introduction

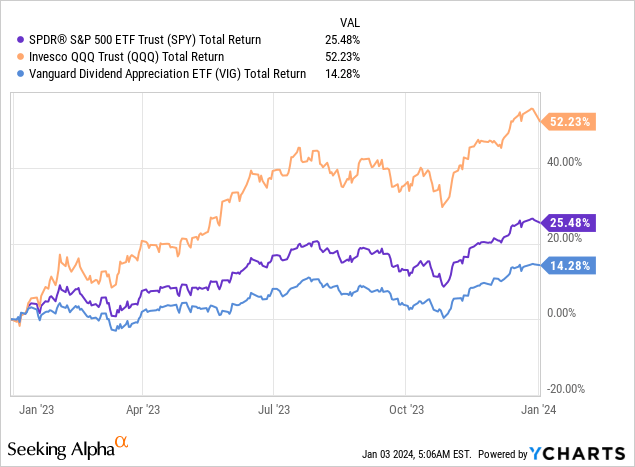

The market has run hot, which allowed the S&P 500 to return more than 25% over the past 12 months. The tech-heavy ETF (QQQ) returned more than 50% during this period.

Dividend growth stocks, as represented by the Vanguard Dividend Appreciation ETF (VIG), returned 14%.

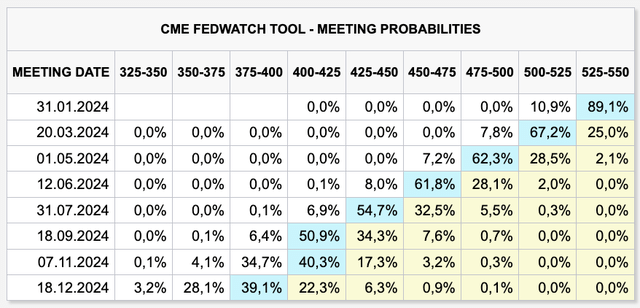

A big part of this rally was caused by expectations of lower interest rates in 2024 as the market has priced in six Federal Reserve interest rate cuts this year.

CME Group

The problem is that I don’t like this risk/reward.

While I’m far from bearish, I’m not chasing (most) stocks at current levels. I’m also increasingly focused on stocks that bring value to the table, as I believe we could see a rotation from growth back to value.

For example, I have a number of cyclical value stocks on my watchlist.

This is what I wrote in my 2024 Outlook article on Dec. 5:

I like beaten-down cyclical stocks. This includes railroads, machinery companies, and certain consumer stocks with proven track records, which I’m buying on weakness. This is based on the aforementioned phenomenon where cyclical stocks price in a recession well before it happens. I’m not going all in, but I’m gradually buying these stocks when the valuation offers a significant margin of safety.

This brings me to Texas Instruments (NASDAQ:TXN).

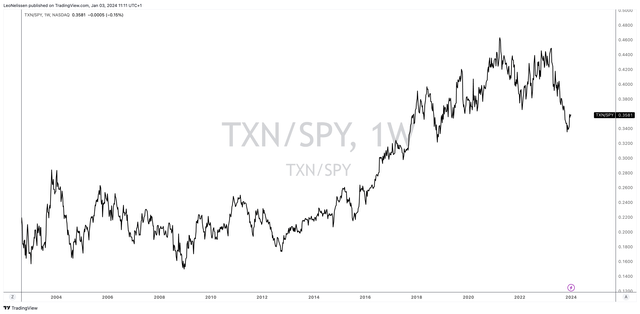

Since 2009, the stock has rather consistently outperformed the S&P 500 thanks to disciplined capital investments, consistent dividend growth, buybacks, and a favorable economic environment.

TradingView (TXN/SPY – Including Dividends)

Unfortunately, last year, the company started to underperform the market, caused by elevated capital investments (temporarily pressuring free cash flow), weakness in some of its end markets, and the fact that investors decided that high-growth stocks were a better choice, given their decision to bet on a much more dovish Fed.

On Oct. 9, I wrote an article on Texas Instruments titled “Down 20%, Yielding 3%; Let Texas Instruments Help You Retire (Early).”

Since then, shares are up 9.6%, including dividends, which slightly underperforms the S&P 500’s 10.6% return.

With that in mind, in this article, I will update my bull case and explain why I continue to believe that Texas Instruments’ future is bright, which means I’m looking to buy potential stock price weakness if I get the opportunity this year.

So, let’s get to it!

A Market-Beating Dividend And Aggressive Buybacks

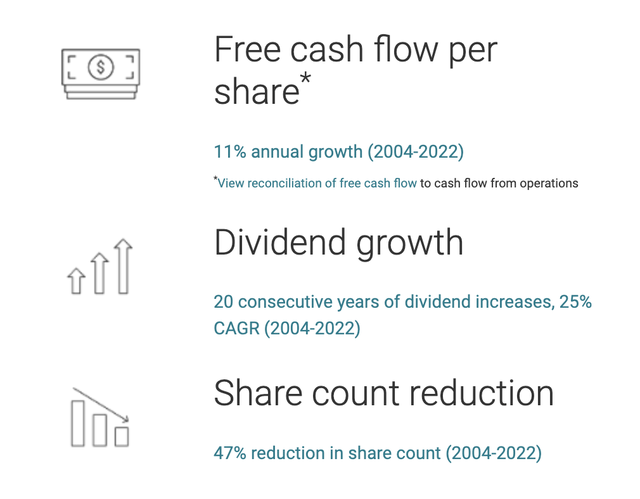

There are not many companies that are as transparent about their capital expenditures and goals to improve shareholder value as TXN.

A quick look at Texas Instruments’ Investor Resources website shows that it lists some of its biggest achievements:

- Free cash flow per share has grown by 11% per year in the 2004-2022 period.

- During this period, the dividend has been hiked by 25% per year.

- On top of that, the company has bought back almost half of its shares, which boosted the per-share value of its business (and its stock price).

Texas Instruments

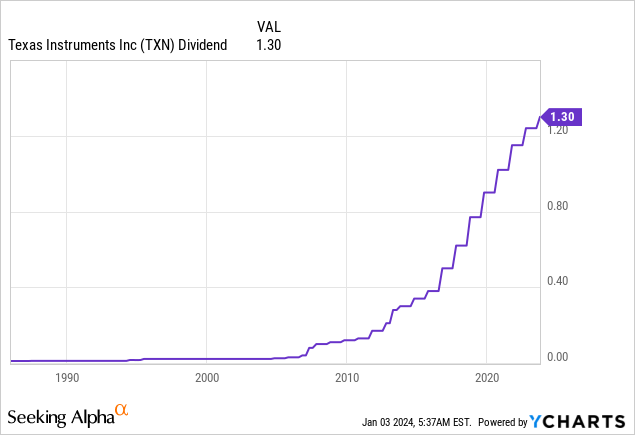

After hiking the dividend by 4.8% on Oct. 19, the company pays $1.30 in quarterly dividends per share, which translates to a dividend yield of 3.1%.

- This dividend is more than twice as high as the S&P 500’s 1.4% yield.

- The aforementioned Vanguard Dividend Appreciation ETF yields 1.9%.

The five-year dividend CAGR is 13.8%, which is very high. The dividend also is protected by an 80% 2024E EPS payout ratio.

Investors have also enjoyed consistency as the company has hiked its dividend for 18 consecutive years.

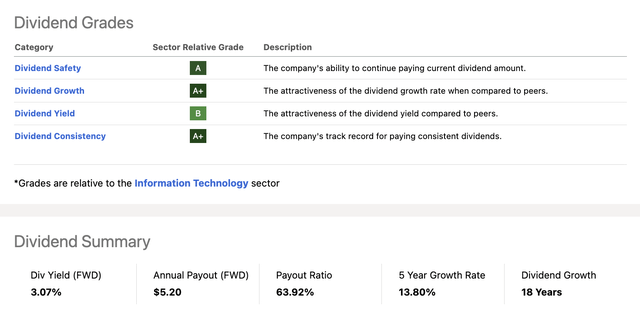

All of this explains why the company has such a good-looking Seeking Alpha dividend scorecard.

Seeking Alpha

With that said, as good as these numbers may be, two things stand out.

- Dividend growth has come down significantly.

- The 2024E earnings payout ratio of 80% is safe but a bit elevated.

Both of these issues are related and likely to be resolved soon.

Paving The Road For A Bright Future

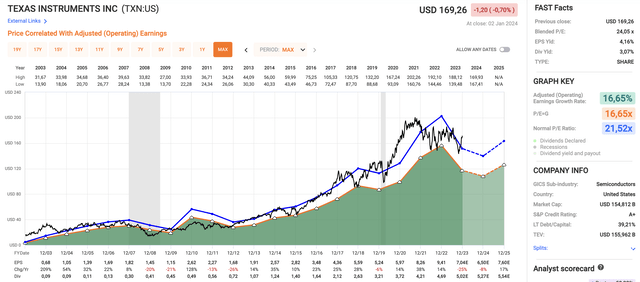

Looking at the lower part of the FAST Graphs chart below, we see that the company is expected to encounter two years of negative EPS growth.

After growing EPS by 14% in 2022, 2023 is expected to see a 25% contraction, potentially followed by an 8% decline in 2024.

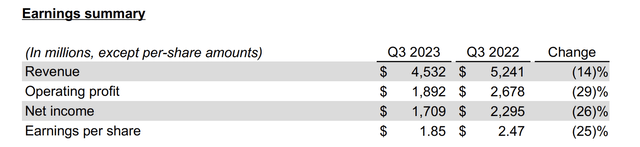

More recently, in the third quarter of this year, the company reported revenue in line with expectations, totaling $4.5 billion.

This figure reflected a flat sequential performance and a 14% decrease compared to 3Q22, caused by market headwinds.

Texas Instruments

During the quarter, the industrial market experienced a mid-single-digit decline, with weakness extending across nearly all sectors.

The good news is that the automotive market continued its growth trajectory, showing a mid-single-digit increase.

FAST Graphs

On a side note, we also see that TXN is trading at a blended P/E ratio of 24.1x, which is a bit above its long-term normalized multiple of 21.5x.

This implies that TXN shares are currently trading at their fair value.

Analyst price targets “confirm” this, as the consensus price target is $164, which is a few dollars below the current $169 stock price.

Based on this context, these headwinds explain the somewhat elevated dividend payout ratio and subdued dividend growth.

However, there’s more to it as the company has ramped up capital investments as well.

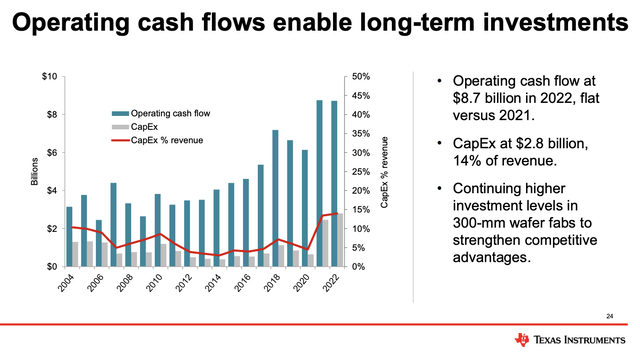

In 2022, TXN spent $2.8 billion on capex. In 2023, that number is expected to be $4.9 billion. Even next year, capex is expected to hover close to $4.8 billion.

As a result, net debt is expected to rise from -$330 million in 2022 (TXN had more cash than gross debt back then) to $4.5 billion in 2024.

Yet, despite this surge, the net leverage ratio is not expected to exceed 0.6x EBITDA, which is extremely healthy. The company also enjoys an A+ credit rating.

On top of that, the company is expected to boost free cash flow to $5 billion in 2025 despite elevated capex requirements. This bodes very well for its future, as we will soon get a situation where moderating capex requirements potentially meet accelerating income.

The chart below shows that the company boosted capex as a percentage of revenue after the pandemic, supported by higher operating cash flow.

Texas Instruments

With that in mind, during the UBS Global Technology Conference on Nov. 28, the company elaborated on its growth opportunities.

One of the most important comments was that TXN believes that current growth initiatives provide fertile ground for long-term growth.

Timothy Arcuri [Question]

So I’ll just lead off with a couple of questions here. So Rafael, I’ll ask you the first question that I get a lot, which is when people look at your long-term model and they look at 10% CAGR, and they look at all the capex dollars that you’re spending to add all this capacity, people have a hard time seeing how the growth can be 10% over the longer term. Can you sort of explain some of the underlying growth drivers that you think will transpire over the next five to seven years that justify you spending all this money?

Rafael Lizardi [Answer]

Sure. Good morning, everyone. So a couple of things. First, that 10% is optionality, it’s enablement. So it’s – we can – the investments that we’re making, so about $5 billion a year for the next four years through 2026, are going to position us to be able to achieve that type of growth if the market – if it comes to fruition in the market as we gain share.

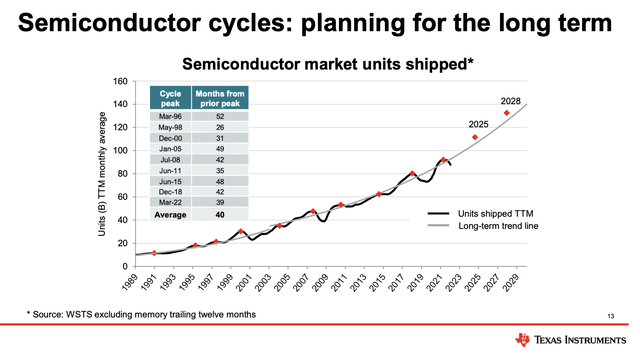

It also noted that the semiconductor market is experiencing secular growth, with increasing usage across various industries.

TXN strategically focuses on the automotive and industrial sectors where semiconductors play a crucial role.

The rise of electric vehicles and the integration of more electronics in traditional vehicles contribute to sustained demand in the automotive sector.

Additionally, industrial automation and advancements in safety features boost semiconductor demand in the industrial sector.

The chart below shows the company’s visualization of semiconductor cycles.

Texas Instruments

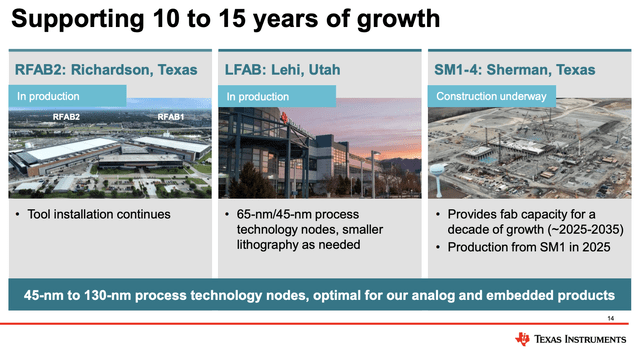

Even better, the company’s manufacturing investments, primarily located in Texas and Utah, provide geopolitical dependability. The company believes this reliability is crucial in the current global dynamics where geopolitical tensions can impact the semiconductor supply chain.

In other words, it benefits from re-shoring trends, which requires massive investments.

Texas Instruments

On top of that, despite increasing competition from Chinese companies and significant capital investments by entities like SMIC, Texas Instruments believes that it maintains a competitive edge.

The company’s competitive advantages include best-in-class manufacturing technology, a broad portfolio of products, and a focus on the industrial and automotive sectors.

Additionally, the company makes the case that its shift toward a direct sales model, with a focus on its website, has proven to be a smart move.

The company has significantly reduced its dependence on distribution partners and enhanced its online platform to offer customers a seamless experience.

This strategic move also allowed Texas Instruments to capture more sockets on boards and cater to customers who prefer direct transactions, thereby driving growth.

All things considered, I like Texas Instruments a lot.

While its valuation looks mildly unattractive due to declining earnings, the company is positioning itself for long-term growth, fueled by a potential cyclical rebound and its investments in new production capacities and products, allowing it to maintain double-digit growth rates on a prolonged basis.

I have the TXN ticker on my watchlist and will likely make it a core holding of my dividend growth portfolio if I get a correction opportunity in the months and quarters ahead.

Takeaway

Despite Texas Instruments’ recent underperformance, I see potential in its market-beating dividend, aggressive buybacks, and transparent capital strategies.

While facing short-term challenges, Texas Instruments positions itself for long-term growth, focusing on its role in the automotive and industrial sectors.

Meanwhile, the company’s strategic initiatives, including direct sales and geopolitical reliability, contribute to its competitive edge.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.