Summary:

- Nike’s stock has regained some footing but is showing signs of struggle.

- The company is experiencing a decrease in retail stores and issues with employees.

- Nike is growing its inventory, but sales are slowing.

code6d

Thesis

Nike (NYSE:NKE) is a global athletic footwear, apparel, and equipment industry. It was founded in 1967 and is currently the largest supplier of athletic footwear – its greatest revenue source – and athletic apparel. It is also a major manufacturer of sports equipment.

Having experienced a major dip in its earnings in 2020 – the pandemic year – the apparel giant has managed to regain its footing in the market. However, instead of accelerating from this point onwards, the company shows signs of a further slowdown, with symptoms like market share stagnation, accumulating inventory, and cost-cutting strategies.

In addition to this, another cause for worry is the tax payment-related issues that it is encountering. Recently, Nike came under fire for tax-related issues, which could be fined $530 million. With all these issues currently faced by the apparel giant, it is crucial to analyze how the company will likely perform financially in the equity market.

Stagnant/Falling Market Share

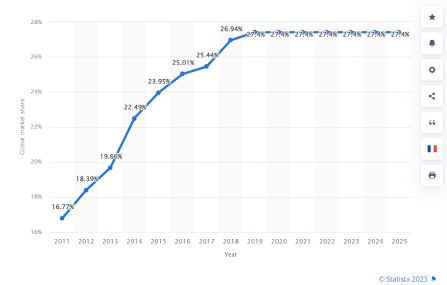

The biggest contributor to Nike’s revenue is footwear. Footwear Revenues Account for 64% of Total Revenues – Nike’s footwear segment has consistently been the company’s main revenue generator, accounting for an increasing percentage of total revenues over the years. Therefore, the overall performance of the company heavily depends on the performance of the athletic footwear market and how Nike is positioned in the market. The graph below shows the market share of Nike since 2011 and also forecasts till 2025.

Statista

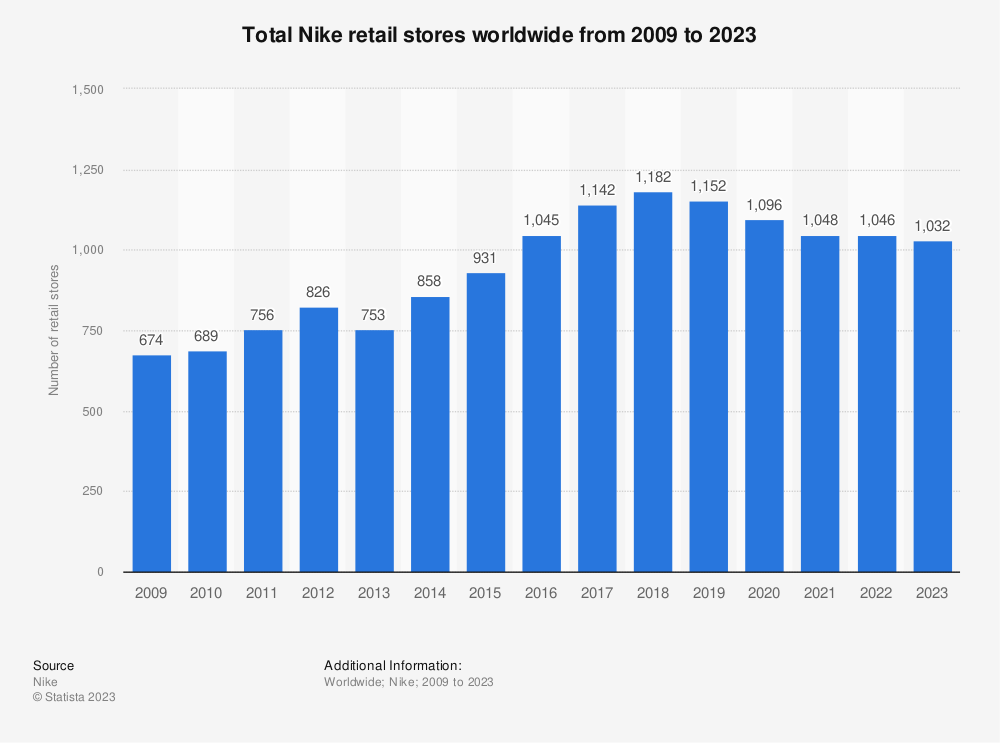

As we can see, the market share has been stagnant for quite a period at 27.4%. Therefore, this is not a sanguine sign for Nike’s performance in the athletic footwear section. In addition, there is another added problem – a decreasing trend in the number of Nike retail stores. The graph below displays the trend and how it has reversed after reaching a peak in FY18, and there has not been any sign of rise in the number of retail stores.

Statista

Therefore, both these factors combined, I believe that Nike is likely to experience difficulties in the future prospects, which could adversely affect its fair value.

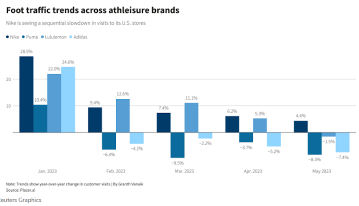

Reuters

The graph above shows a weakening North American demand for athletic footwear. This is concerning for Nike because North America is their biggest market, and athletic footwear is their biggest source of revenue.

Another issue that recently came to light is that Nike has decided to lay off employees in order to cut costs by a total of $2 billion as an indication of the difficulties it has been facing in its topline. Moreover, given the possibility of an upcoming recession, Nike is currently facing headwinds in the form of dropping sales, reductions in the bottom line, etc. Nike’s chief financial officer, Matt Friend, said the slashing of Nike’s revenue expectations reflected the indications of more cautious consumer behavior around the world.

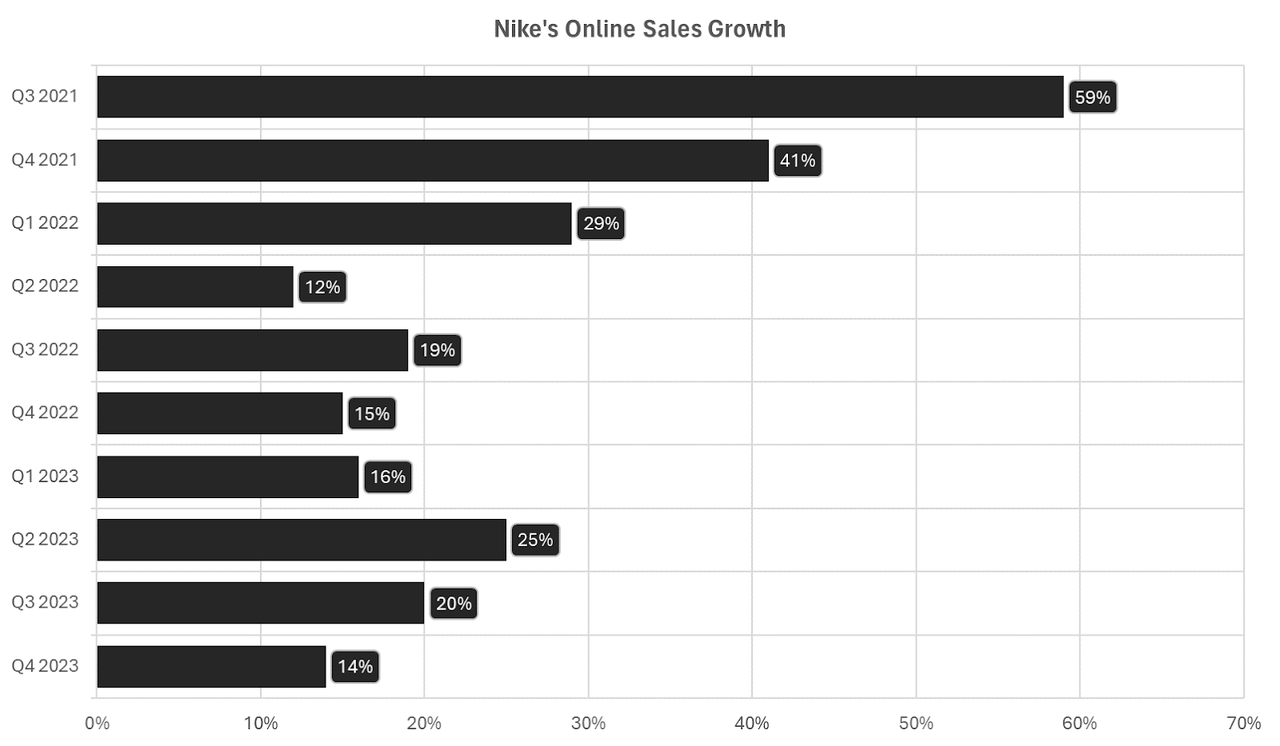

An additional concerning trend regarding sales of Nike products has been the reducing growth rate of the online sales of Nike products. Below is a chart that displays the growth rate of online sales at Nike since Q3 of 2021. As we can see, the growth rates have been falling significantly since FY21.

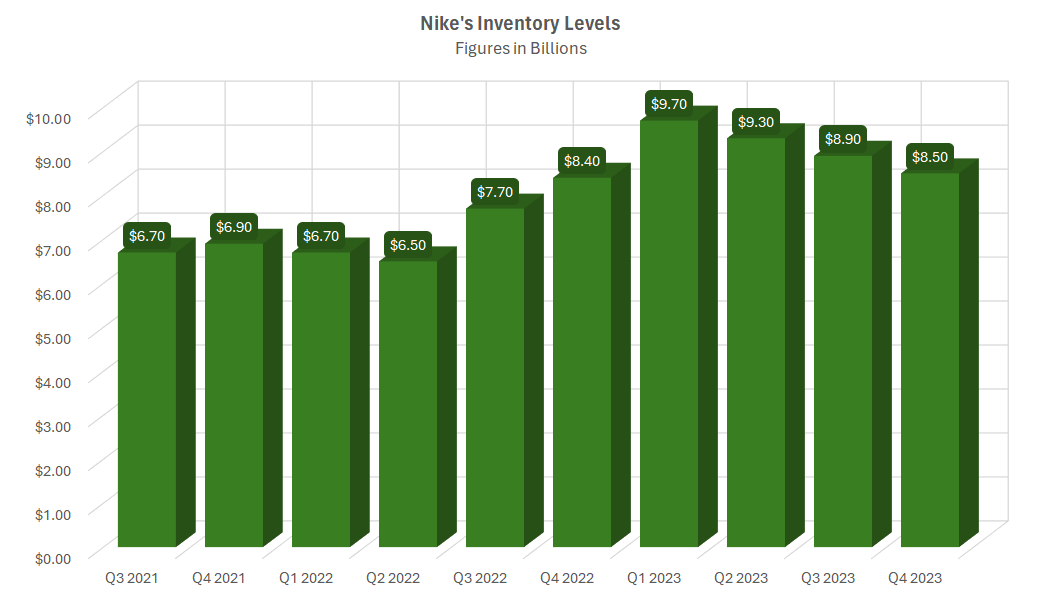

The slower rate of growth of Nike in terms of sales has led to growing accumulation of inventory. The figure below illustrates a rising trend in inventory value for Nike.

The Motley Fool

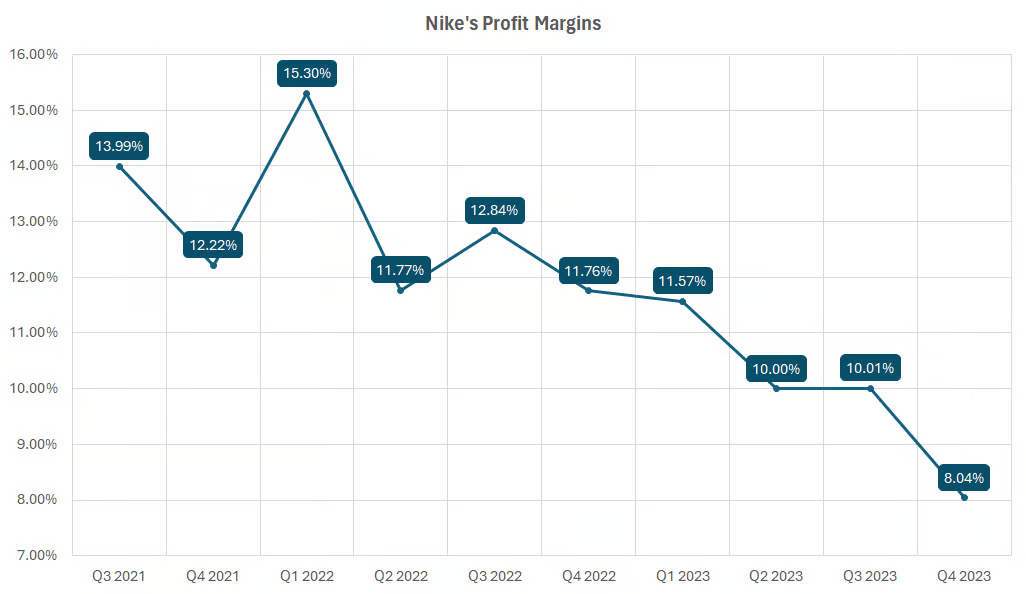

All these problems have led to reduced profit margins for Nike. The graph below illustrates almost a monotonic decreasing trend of the apparel giant.

The Motley Fool

These are the primary reasons why I believe that Nike is standing against headwinds and is likely to lead to a reduced fundamental value in the upcoming financial year.

Tax-Related Issues

Based on a recent report by the Guardian, Nike has run into tax payment related issues and therefore, there could be repercussions on the financial aspect of the business and also on the reputational aspect.

Misclassification Risks

Extent of Misclassification: Independent reports, notably from People2.0 and Pro Unlimited, reveal that approximately 25% of assessed contractors employed by Nike may have been incorrectly classified. This misclassification increases the company’s exposure to financial obligations traditionally associated with full-time employee status.

Financial Liabilities: The potential financial impact of misclassification is substantial. Nike faces potential liabilities exceeding $530 million, with specific breakdowns indicating $293.2 million in the US, $53.7 million in the UK, $76.4 million in the Netherlands, and $106.8 million in Belgium. This not only highlights the financial risks but also underscores the global nature of the issue.

Regulatory Landscape

Biden Administration’s Focus: The Biden administration’s increased scrutiny of companies violating rules related to the use of independent contractors poses a significant regulatory threat to Nike. Stringent regulations in various countries, particularly the US and the UK, aim to safeguard workers’ rights and ensure equitable tax practices.

Financial Implications

Liabilities Breakdown: People2.0’s comprehensive review provides a detailed breakdown of potential liabilities. In the US alone, Nike could face a liability of $293.2 million, encompassing payments related to misclassified workers. The figures for the UK, Netherlands, and Belgium contribute to an aggregate liability exceeding $530 million.

Additional Tax Liability: Pro Unlimited’s findings suggest an additional tax liability of $2.4 million, emphasizing the multifaceted financial implications arising from the misclassification issue.

Potential Risks

Explorations into Emerging Markets

Nike has been making headway into the emerging markets of India and China. Emerging markets are a massive opportunity for Nike. Asia and Latin America in particular are set to become the firm’s primary growth engines. Both regions will continue experiencing strong demand for its products due to increasing economic prosperity and a strong interest in sports. The brand is already the leading player in China with more than $2.4 billion in sales in 2012.

However, one of the primary problems is that China has been known to be an unpredictable market in terms of consumer behaviour and also in terms of policies.

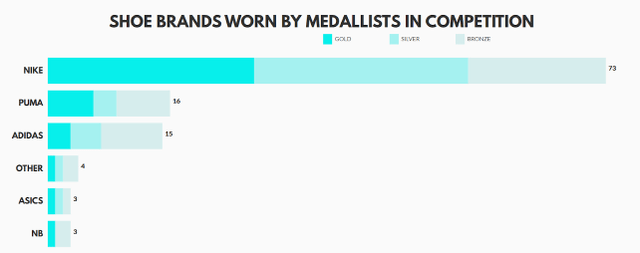

Most Popular Shoe Brand in Olympics

Nike has been the most popular Olympic shoe brand till and tops the chart far ahead of any other brand than any other as the graph below shows.

Therefore, we can see in this graph that Nike has a huge lead ahead of the second ranking Puma which highlights the large gap in the popularity of Nike. However, it is to be noted that there are some potential risks that Nike is currently facing even here. For example, the count is down from 89 to 73 whereas Puma has increased from 4 to 16 which could possibly mean that Nike might very soon face a strong competitor in Puma and that could translate to decline sales in the Nike footwear products.

Financials

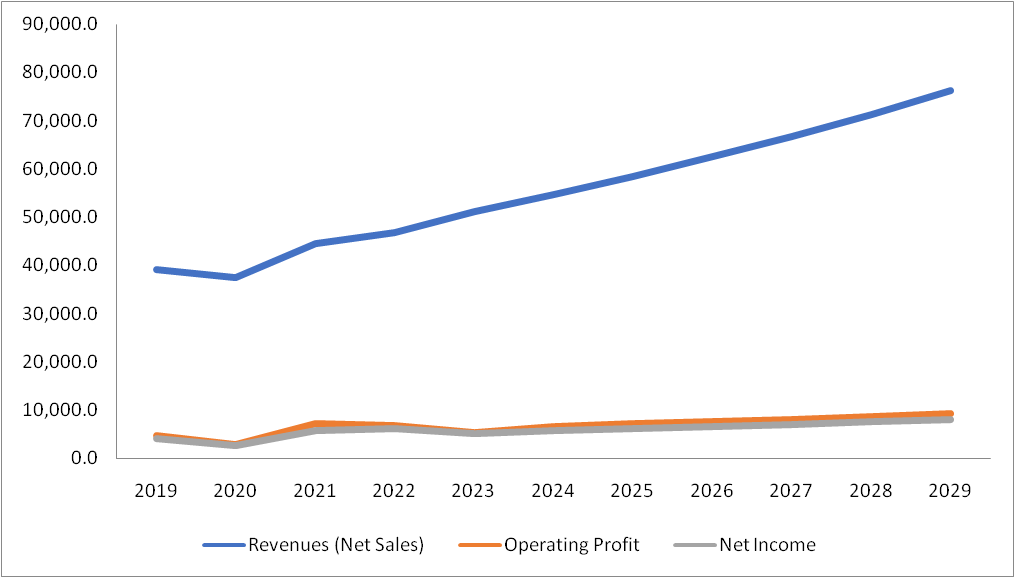

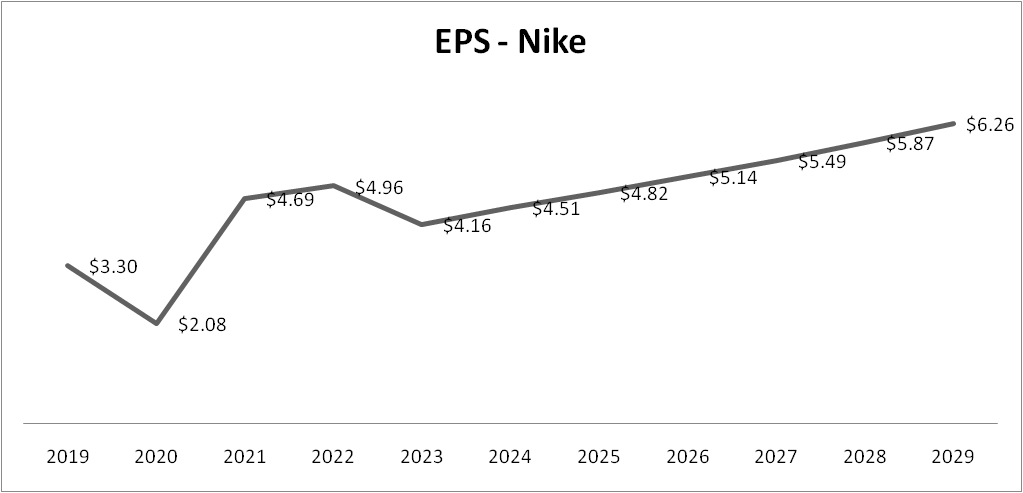

Given below are the trends of net sales, operating profit, and net income. As we can see, the revenue and profits fell in FY20 because of the pandemic before going on an uptrend again. However, the gap between net sales and net income is expected to widen in the future, clearly implying that net income growth will be slower compared to net sales. A similar image is further confirmed by the EPS trend which fell sharply in FY20, before rebounding the very next year. However, based on forecasts, EPS on average is expected to grow relatively slowly.

Author’s Material Author’s Material Author’s Material

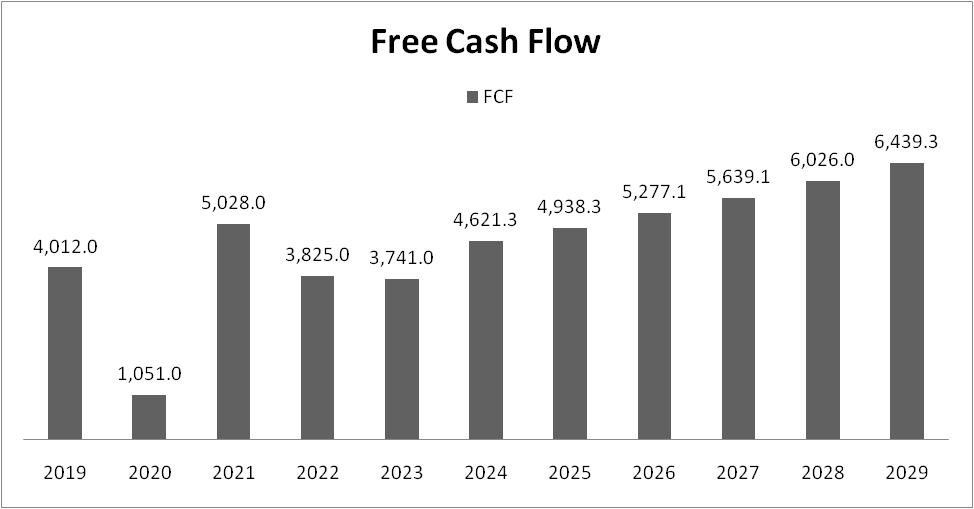

Moreover, in terms of their cash flows, their operating cash flow value decreased from FY2019 ($18,371 million) and therefore is yet to catch up with the FY2020 level ($17,403 million). A similar trend can be noted for their end cash position, signifying potential liquidity issues, as can also be understood from the sharp decrease in the amount of free cash flow from FY2021 ($15,584 million to $13,367 million).

Valuation

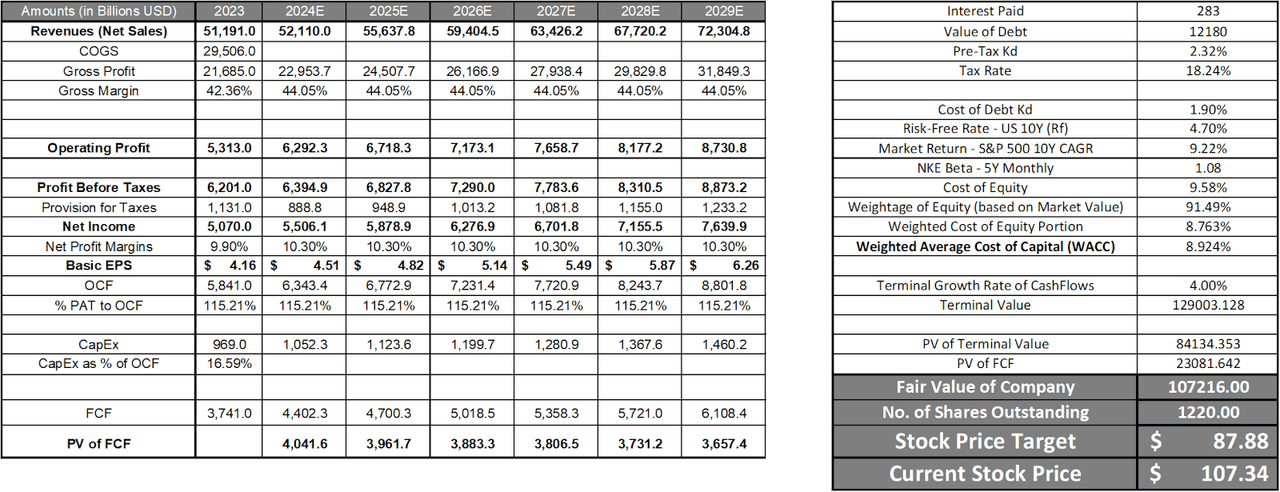

To assess Nike’s valuation, I have undertaken a DCF Valuation. Below is an image of a DCF Valuation performed on NKE. I have assumed 4.0% revenue growth from 2024 to 2029 because the primary market is USA, which is a slow-growing economy. However, I have kept the estimates slightly high because Nike has a significant presence in India and China.

I believe unfavourable headwinds in the form of divestments in the Argentinian and Nigerian markets will likely lead to lower sales growth in the coming years. Moreover, since the consumer goods giant is already in the mature phase and caters mostly to a mature economy, we can assume that the long-term growth will likely hover around 4.0% because a good proportion of Nike comes from emerging markets, which are growing rapidly. Further, Berkshire Hathaway’s divestment of Nike stock indicates the unfavorable headwinds for the corporation. Given Nike’s prospects, I believe that this estimate aligns with Nike’s expected future growth. Based on the estimates, the valuation that was performed on Nike is given below.

I assumed that NKE’s net profit margins will remain at 10.30% in 2024 and beyond. Ultimately, we get a Fair Value/ Price Target of $87.88 in the base case scenario. The DCF analysis gives us a value which has a downside of 18.12%.

Conclusion

Overall, the stock is providing a relatively pessimistic picture. A close look at some of the financial and operational aspects does not provide a bright picture as it signals reductions in sales figures, profit margins, accumulating inventory, etc. Moreover, the tax payment related issue could be a further burden on the company in terms of the financial impact (result of the $530 million fine) and the operational aspect (adverse reputation). As I have already surmised, NKE is likely to face demand-side difficulties, and the $2 billion is merely a symptom of the problem. So, overall, my recommendation for the stock would be a SELL.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.