Summary:

- Amazon holds a strong position in e-commerce and the public cloud, with potential for growth in financial services.

- Q3 results show promising signs of growth in AWS and suggest a potential rebound for the industry in 2024.

- Amazon’s expanding logistics network and deepening financial offerings contribute to its potential for future growth.

tigerstrawberry

Investment Thesis

Amazon.com, Inc. (NASDAQ:AMZN) holds a strong position as the leader in both e-commerce and the public cloud, with plenty of runway for growth. The company has built a global logistics network to support its growth and has diversified its operations to several sectors, including financial services, which provides a good opportunity for growth going forward. The stock is currently trading at a discount to its 3-year average multiple, which provides a good opportunity for long-term investors to get an entry. I assign a buy rating to the stock.

Q3 Review & Outlook

Amazon reported strong third-quarter results and provided a positive outlook for fourth-quarter earnings. While the fourth-quarter revenue projection was slightly below expectations, and there was no clear declaration that the third quarter marked the lowest point for AWS (Amazon Web Services), there were promising signs of growth in AWS deal numbers, optimization efforts, and discussions about the scale of AI usage. Amazon’s management comments indicated a stabilization in reduced client spending on cloud services, which may signify the bottom of AWS’s growth rate decline. AWS’s growth rate dropped to 12% in the third quarter in constant currency, down from 28% in the third quarter of the previous year and 39% in the third quarter of the year before that. This aligns with similar statements from Microsoft (MSFT) on October 24 regarding the strength of the cloud business, and it could suggest a potential rebound for the industry in 2024.

All in all, the management’s comments suggest a likely acceleration in the near future. With AWS poised for growth, North America’s operating income surpassing expectations, the international business nearing break-even, and steady double-digit revenue growth, Amazon remains a standout in terms of earnings growth prospects as we enter 2024.

Expanding Logistics Network To Support Growth

Amazon.com is building a global logistics network to support the explosive growth in its online and physical-store operations, as well as to control transportation costs that ballooned to $83.5 billion in 2022 from $16.2 billion in 2016. Most of the e-commerce giant’s logistics endeavors begin as internal solutions that evolve into services it can offer shippers inside and outside of its Marketplace. I believe Amazon.com has the potential to achieve over $1 trillion in GMV by 2026. I expect the growth to be powered by Amazon’s diversification into various product categories, even in the face of declining consumer confidence, particularly in the United States. Moreover, increased revenue from third-party merchants and the Buy With Prime program for non-Amazon sellers would also be catalysts for growth.

Amazon’s Deepening Financial Offerings

Amazon’s financial services, originally designed to boost user engagement within its ecosystem, have expanded beyond its platform. Amazon Pay, for instance, is gaining popularity with other retailers, and the company has introduced new offerings like Buy Now, Pay Later. In addition to making significant fintech investments in countries like India and Mexico, Amazon is actively developing new financial products, including voice-activated payments through Alexa, partnerships with companies like Hyundai, and payment systems using palm recognition for physical stores, starting with Whole Foods. Amazon’s financial services offerings directly compete with traditional banks, encompassing checking accounts, cards, lending, small business payments, and insurance services. In 2024, there is potential for further growth in checkout services, intensifying competition in e-commerce and omnichannel payments, where it faces rivals like PayPal (PYPL), Stripe, Adyen, and Apple (AAPL).

Integrated financial services are becoming the next phase for software-based business models, as companies aim to enhance the customer experience, improve sales conversion rates, foster deeper engagement, and gain a larger share of the wallet. This strategy allows them to diversify their revenue sources. For instance, both Amazon and Uber have expanded from their core businesses (e-commerce and rides, respectively) into payments, and then ventured into lending, insurance, and cash deposits. Their initial goal was to increase engagement on their platforms, reduce friction, and enable more buying and selling. Business models are evolving, with tech companies exploring new territories, while traditional banks are adapting, albeit at varying paces. The recent separation between Goldman Sachs and Apple, ending their partnership on Apple Card and Pay Later, creates opportunities for other players to step in.

Company Website

Financial Outlook & Valuation

Over the past decade, Amazon has invested over $114 billion in developing AWS, establishing a significant barrier to entry for potential competitors. According to IDC data, global spending on public cloud services was forecasted to reach $1.35 trillion in 2027, which provides plenty of room for the growth of AWS. I believe AWS’s sales could potentially reach $200 billion within the next 5-7 years. In the long term, I anticipate that AWS’s operating margin could exceed 40%, supported by the scalable nature of its business. The operating margin rebounded to 30% in the third quarter after five consecutive weaker quarters.

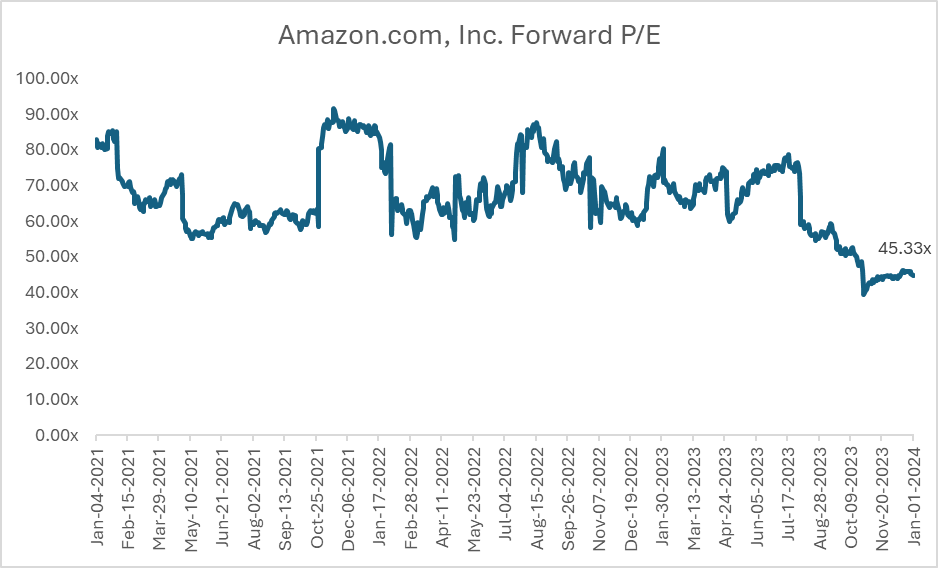

Amazon’s stock is currently trading at a forward P/E of 45.3x, which is at a discount to the company’s three-year average forward PE of 66x. Although consumer discretionary stocks have taken a beating over the past two years, Amazon has continued to trade higher. However, the company’s high multiple is justified by the company’s high earnings growth rate (5-year avg growth rate of 30.4%). I believe the current multiple is attractive compared to what the company’s has traded at over the past few years, given that there is still significant room for growth going forward till 2026. I remain optimistic on the company and assign a buy rating to the stock.

Capital IQ

Investment Risks

Amazon.com is looking to increase its presence in the food and apparel sectors, which already have well-established and efficient competitors both online and in physical stores. To drive growth, Amazon must expand its product range, particularly as some of its original categories, like media, have transitioned to streaming services. If AMZN is not able to take market-share from competitors in the food and apparel sectors that might result in downside for the stock. Moreover, there is limited visibility regarding long-term revenue growth and the possibility of margin expansion in AWS, if the company is not able to deliver margins as in-line with consensus estimates that might affect the stock price.

Conclusion

Amazon.com has the potential to continue expanding its market share driven by its highly efficient distribution and fulfillment network, along with substantial growth in the high-margin businesses of Amazon Web Services and advertising. AWS and advertising already demonstrate strong profit margins. The stock is currently trading at a discounted multiple compared to its three-year average, and since I am optimistic on the company’s growth prospects, I assign a buy rating to the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.