Summary:

- Unity’s stock price soared after its IPO but has since declined substantially.

- The company faced backlash from game developers over pricing changes, leading to broken trust and a CEO stepping down.

- The interim CEO plans to slash costs and refocus the business, but the company’s future growth is uncertain.

gorodenkoff

Unity (NYSE:U) is an exciting business. Who doesn’t want to invest in a cloud SaaS company catering to the gaming industry? The company was a high-flyer during the post-Covid tech boom when it IPO’ed in 2020, shooting over $200 a share.

I think it was pretty obvious at the time that price was unsustainable, with the market cap peaking in the ballpark of $70B for a company that just now is generating around $2B a year in sales and is unprofitable.

But that’s how these hype trains work. The story is more exciting than the actual nuts and bolts of the business. Some of the post-Covid darlings continue cooking with gas, like CrowdStrike (CRWD) and The Trade Desk (TTD). For these companies, the growth keeps coming and investors are looking at actual profitability and cash flows.

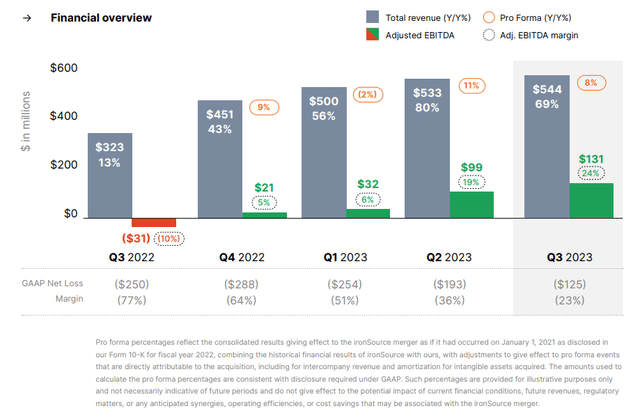

For Unity, not so much. Looking above, growth ran into a brick wall and we are still in the realm of a -42% ttm operating margin (adjusted EBITDA margins aren’t really worth the paper they’re printed on in my opinion). So, what happened?

The company really stepped in it. The company announced some pricing changes intended to improve monetization. Quoting Barron’s:

Social media was littered with game studios vowing to switch game engines, citing a lack of communication and the open-ended nature of the retroactive price changes. The most controversial part of the initial plan was the addition of a per-install cost, in which developers would get charged each time their game was installed after certain thresholds. Developers complained they had built their games on the Unity engine under certain assumptions, and the company was changing conditions after the fact.

But after the price changes, some of those creators said they would be switching to Epic’s Unreal Engine and Godot, an open-source game engine, which directly compete with Unity.

Within two weeks, the company was forced to apologize and backtrack on parts of its plan. “I want to start with this: I am sorry,” Marc Whitten, a Unity executive, said in a blog post. “We should have spoken with more of you, and we should have incorporated more of your feedback.”

This ultimately led to broken trust within the industry, the CEO stepping down (this wasn’t the first misstep in my view), and led to where we sit today. There are a lot of open questions. The run-time fee spooked video game developers and there’s going to be difficulties getting them back onboard with Unity’s vision.

The interim CEO, James Whitehurst, formerly of RedHat, pulled guidance and announced a plan to slash costs, refocus the business, and emerge on the back-end ready to lead Unity forward. From the earnings call:

So we will plumb it all out after the fact for you. You’ll know exactly, we’ll be completely transparent. But what I don’t want to have happen is people say, “Well, we kind of guided this. And so if we just wait another month before we do that, maybe we don’t close that until January 1 instead of November 30, you can make the numbers look better.” But I want to emphasize we got to move fast, and we got to be decisive and we’re going to emerge, I will say — I think we’re sandbagging when we say by the end of Q1. I’m hoping we can do it a lot faster than that. The faster we can get these things done, the faster we have kind of reset and we are focused, the better, and I want 0 incentive for anybody to do anything but that. So it was not a popular move, I can tell you, to say we weren’t going to do it. But I think it’s better to move fast and then be transparent after the fact. And I promise you after that, we will be reset. We’ll be confident in our numbers, and we will provide guidance for Q1 and the year and give you all the color and clarity you want. I just — in this period of time, I think it’s important that we have no barriers to moving fast.

He makes some good points. We as an investing community can get overly hung up on guidance and management teams focused on it can lose sight of the bigger picture. However, with growth slowing to a standstill and no profits in sight, what are investors buying today?

Ultimately, you’d be buying into the interim CEO’s vision of a turnaround for a company that hasn’t yet reached the point a turnaround should be necessary. Slashing costs and executing a reorganization is all well and good, but this is a high-flying growth company. If the growth doesn’t reignite, I believe this stock is dead on arrival.

There are green shoots. The product by all accounts is a great one. The company sees synergies between its create and grow solutions, as well as opportunities throughout the space to capture more spend from customers.

If grow solutions takes off, we are looking at a pretty exciting ad-tech business with a built-in customer base due to the create platform. There’s some fierce competition there in the form of companies like Google (GOOG), but as a long-time Trade Desk owner, I won’t declare the battle over before it starts. However, I think it’s an uphill battle starting where they are today. Some of the CEO’s plan is outlined below:

So when you started at one price point, you want to change it, you’re obviously going to get some backlash. So the way I’d rather think about it is if you think about development all the way through to operating a game is a $100 billion market, right? We’re a very, very, very small, less than 1% share of that.

So our ability to do things like whether it’s driving to DevOps or automated testing or if you think about other things that developer shop, especially teams of developers do, thinking about kind of security, thinking about compliance, identity management. There’s a whole set of things where we’re not raising price on what we’re doing, but we are looking at the costs around what someone does when they’re working with us, it has a tremendous opportunity just on the development side. And then obviously, on the operate side, continuing to look for places where, frankly, we have a right to win because of the strength of our editor and run time and our ability to understand what people are doing and how and the uniqueness around that. I think the run time fee is important for multiple reasons.

I do think there’s a chance. There’s always a chance. But this company is still a $15B company on around $2B in full year sales with an indeterminate going forward growth rate. I don’t want to overly focus on metrics here, but net revenue retention is only 102%. The going forward Rule of 40 is down to 31%, stock based compensation sits at 32%, and other costs are obviously high. The way these companies tend to succeed is growing into the costs. As much as slashing costs may work out in the short term, massive layoffs aren’t going to get the best talent in the door in my view. Ultimately, this company will live and die by revenue growth. Either they are getting traction or they aren’t, and no amount of cost controls will cover for a product that isn’t growing.

My plan is to wait. It’s easier to not swing at pitches I’m not sure about, and we get unlimited strikes at the plate here. Coming into the end of Q1, we should be able to see more on paper in terms of progress in both the reorganization and the plan going forward. I’d be more apt to buy into the vision then. Until then, this stock is a hold at best.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CRWD, TTD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.