Summary:

- AbbVie’s revenues are declining due to the expiration of the Humira patent and increased competition from biosimilars.

- Earnings have also declined, leading to a meaningful valuation expansion for AbbVie.

- AbbVie’s valuation is now higher compared to the past, while other biotech and pharma stocks have become more attractive.

Bet_Noire

Article Thesis

AbbVie (NYSE:ABBV) is a quality company that has a nice dividend growth track record. However the company also faces some problems due to the expiry of the Humira patent. In the near term, not a lot of business growth is expected, and yet, AbbVie has run up quite a lot in recent months. I believe that locking in gains now could be a smart move.

Past Coverage

I have covered AbbVie repeatedly in the past. My most recent article on the company was released last July, or roughly half a year ago. I gave the company a buy rating then, arguing that the share price decline during the previous couple of months made for a nice buying opportunity. Before that, I had downgraded AbbVie in April, following substantial gains since I had given it a buy rating in February of 2023.

Since my last article has been published roughly half a year ago, AbbVie has returned 19%, easily outpacing the S&P 500’s return of 8% over that time frame. Today, I’m less bullish on AbbVie, since the valuation is not as attractive as it was half a year ago, while the dividend yield has also declined. Last but not least, other stocks in the biotech and pharma industry have become increasingly attractive over the last couple of months, I believe, including Bristol Myers Squibb (BMY), Johnson & Johnson (JNJ), Pfizer (PFE), and so on.

In this article, I’ll update my thesis on AbbVie and will delve into the important recent news.

AbbVie’s Recent Results And Humira’s Ongoing Decline

Underlying business and earnings growth, or lack thereof, is an important contributor when it comes to the share price performance that can be expected of a stock in the future.

In AbbVie’s case, there’s no business growth right now. Instead, sales are actually declining, although not at a very fast pace. During the most recent quarter, AbbVie saw its revenues decline by 6% year over year. It should be noted that the company still outperformed expectations with that revenue number, as Wall Street analysts had predicted a more substantial top-line decline from the company.

This was purely driven by the sales decline in AbbVie’s biggest revenue contributor, which is the immunology drug Humira. Humira has gone off patent a while ago, and more and more competitors have pushed into the market with their biosimilars, some of which are sold at substantial discounts compared to the price of Humira. Not surprisingly, Humira has lost significant market share. That wasn’t really a surprise, however, as the same has happened with other drugs in the past, and even with Humira itself in Europe, where it went off patent earlier compared to the United States.

Still, the revenue decline that Humira experiences hurts, as sales of the drug went down by more than one-third during the most recent quarter, which made for a hefty revenue hit in the $2 billion range. For a company that generates revenues of around $14 billion per quarter, that’s quite a tough headwind — even though AbbVie’s non-Humira revenues continued to expand, overall company-wide sales were down by close to $1 billion, relative to the previous year’s quarter.

Not surprisingly, earnings also took a hit, as lower revenues for a pharma company generally go hand in hand with lower profits — many costs are more or less fixed, thus operating leverage works against pharma companies when their sales decline. AbbVie’s adjusted earnings per share declined by 19% year over year — that’s not disastrous, but still a pretty meaningful decline. Considering the fact that AbbVie currently is more or less flat compared to one year ago, the substantial profit decline results in meaningful valuation expansion — but more on that later.

AbbVie’s management believes that the headwinds from the Humira patent expiration will be temporary and that the company will get back to growth in the near term. AbbVie’s non-Humira revenues are growing, thanks in part to the strong growth seen by Skyrizi and Rinvoq, but analysts are not convinced that revenues will improve this year. They are forecasting that the revenue declines will continue during this year, 2024, although the expected revenue drop is pretty small, at 1%-2%. Still, if that happens, it isn’t great news for investors — they will have to wait a little longer for AbbVie to get back on growth track. If Wall Street analysts are right, then that will happen in 2025.

Valuation Matters

AbbVie has headwinds and that has been known for some time, although it was not perfectly clear how large the revenue declines would be and how long they would continue. Still, I knew about the Humira headwinds in the past, yet was bullish at times. The important additional factor to consider here is AbbVie’s valuation. When the company trades at 10x earnings, Humira patent issues are way easier to stomach compared to when AbbVie trades at 15x earnings, for example.

Following a nice run-up in its shares, AbbVie is now trading at a valuation that isn’t low any longer. Based on current earnings per share estimates for the company for 2024 — the consensus estimate stands at $11.18 — AbbVie is trading for 14.3x forward earnings. This compares rather unfavorably to how AbbVie was trading when I wrote my last article on the company (which was a bullish article). Then, AbbVie traded at a 12x earnings multiple and was thus considerably cheaper.

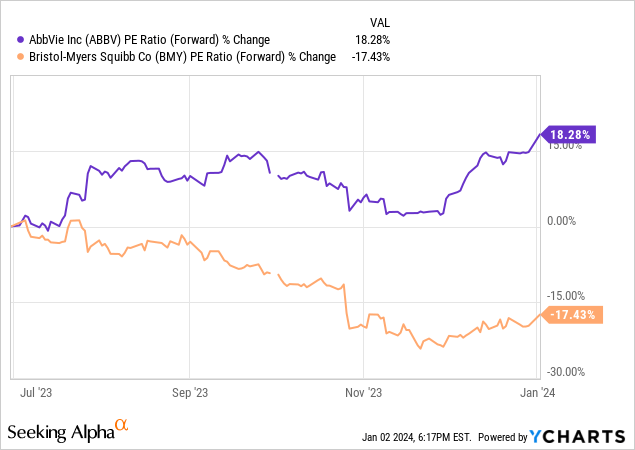

It is best to buy stocks when they are cheap and to sell them when they are expensive, thus valuations matter when it comes to the buy thesis for a stock. This does not only hold true when it comes to valuations in absolute terms, but also when it comes to valuations in relative terms. Contrast AbbVie’s valuation with that of Bristol Myers Squibb, for example:

Not only does AbbVie trade at a much higher valuation in absolute terms, but it has also become more expensive over the last half year, whereas BMY has become considerably cheaper. Shifting funds out of the company that has become more expensive and into the company that has become cheaper and thus more attractive seems like an opportune move to me.

AbbVie currently has a D+ Quant valuation rating, whereas BMY has a B valuation rating. Pfizer has a B+ valuation rating, GSK (GSK) has a B rating, and so on. We thus see that there are many stocks in the biotech and pharma industry that are more attractively priced than AbbVie today. This doesn’t mean that AbbVie is a bad company at all — but following substantial gains, its relative attractiveness has declined, while other stocks that have not run up to the same extent over the last half year have become more attractive on a relative basis.

This also holds true when it comes to dividend investing: Half a year ago, AbbVie’s dividend yield was 4.4%, but following the recent gains, AbbVie now yields “only” 4.0%. Peers such as BMY or Pfizer offer substantially higher yields now, which has not been the case last summer.

Takeaway

AbbVie is a quality company, I believe, and investors rightfully appreciate its dividend growth track record. But one shouldn’t fall in love with a stock, and when the relative attractiveness of an investment declines, it can make sense to opt for other investments.

This is the case with AbbVie right now, I believe. Due to the Humira patent expiration headwinds, revenues and profits are declining, and that will continue through the current year according to the analyst community. And yet, AbbVie has experienced substantial share price gains over the last six months or so. It is now more pricy than it used to be while the dividend yield is lower. Since other stocks in the same industry have become better values over that time frame, I now see other biotechs as more attractive compared to AbbVie. I have locked in gains and moved funds into companies such as BMY where I get a higher yield and where the risk-reward setup is, I believe, better — BMY will likely experience a small profit decline this year as well, but trades at a much lower valuation and has a significantly lower payout ratio, making its dividend safer.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BMY, JNJ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!