Summary:

- AFRM continues to break expectations, with the robust consumer spending contributing to its expanding GMV and cost optimizations triggering its improving profitability.

- The fintech is still well positioned for growth, thanks to the growing external funding capacity and the net accretive effect of loans held on the balance sheet.

- While these are promising developments indeed, we do not believe that it warrants AFRM’s eyewatering premium valuations over its historical means and sector median.

- Combined with the elevated short interest and overly optimistic rally by +161.6% since the October 2023 bottom, we believe that there may be a deep pullback in the near-term.

- Inversely, traders may consider taking part of their gains at these levels and coming back in after the exuberance has been moderated.

VPanteon

We previously covered Affirm (NASDAQ:AFRM) in August 2023, discussing its positive FCF generation, attributed to the higher interest rate environment, increased APRs from its processed loans, and expanding GMV.

Thanks to its highly sticky offerings and relatively reasonable delinquency rate, we had rated the stock as a speculative Buy then.

In this article, we will discuss why we are downgrading the AFRM stock to a Hold, due to the overly optimistic rally by +161.6% since the October 2023 bottom. While the fintech continues to demonstrate profitable growth, we do not believe that the stock’s eye-watering premium is sustainable.

Combined with the elevated short interest, we believe that there may be a deep pullback in the near-term. Interested investors may want to take a step back and observe its movement for a little longer.

The AFRM Investment Thesis Is Overly Lofty Here

For now, AFRM reported a double beat FQ1’24 earnings call, with revenues of $496.55M (+11.3% QoQ/ +37.3% YoY) and GAAP EPS of -$0.57 (+17.3% QoQ/ +34.5% YoY).

Much of the top-line tailwinds is attributed to the expansion observed in its Gross Merchandise Volume to $5.6B (+1.8% QoQ/ +27.2% YoY), Active Consumers to 16.9M (+0.4M QoQ/ +2.2M YoY), and number of transactions per Active Consumers to 4.1 (+0.2 QoQ/ +0.8 YoY).

These metrics indicate the growing popularity of its offerings amongst new users and stickiness amongst existing consumers, further demonstrating why the Affirm Card GMV has been gaining traction to $224M by the latest quarter (+73.6% QoQ).

While we are previously concerned about the restart of the federal student loan repayment from October 2023 onwards, AFRM also moderately raises its FY2024 GMV guidance to over $24.25B and adj operating margin guidance to over 5%.

This is compared to the previous guidance of $24B and 2% offered in the FQ4’23 earnings call, respectively, implying that the consumer spending remains robust with no signs of deceleration.

This further exemplifies AFRM’s profitable growth trend as the cooling inflation/ robust labor market accelerates its top-line growth, with the tightened operating expenses of $420.17M (-0.8% QoQ/ -10.5% YoY) directly contributing to its improving bottom line.

Most importantly, the management has been able to do this without relying on expensive transaction costs at only approximately 3.3% of its GMV (+0.2 points QoQ/ +0.7 YoY).

This is while maintaining a higher standard of credit score with only 2.5% (+0.25 points QoQ/ +0.5 YoY) of its active balances delinquent over 30+ days by the latest quarter.

We also believe that AFRM’s partnerships with multiple commerce players, such as Amazon (AMZN), Shopify (SHOP), and Walmart (WMT), have contributed to its great results, with 103K merchants (+7K QoQ/ +15K YoY) generating over $1K in TTM GMV and 163K merchants (+5K QoQ/ +6K YoY) less than $1K in TTM GMV.

At the same time, the fintech is still well positioned for growth, thanks to the increased availability of its external funding capacity of $13.1B (+11.9% QoQ/ +18% YoY), allowing the fintech to maintain a healthy loan level held on balance sheet at $4.6B (+2.2% QoQ/ +70.3% YoY).

Readers should not be concerned about AFRM’s growing loan held on balance sheet as well, since this allows the management to recognize interest incomes of $262.67M by the latest quarter (+22% QoQ/ +92% YoY), thanks to the Fed’s hikes thus far.

With it being net accretive to the fintech’s profitability, we believe that the related risks remain reasonable ahead.

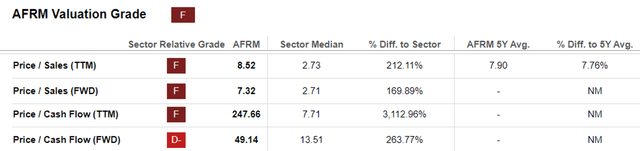

AFRM Valuations

While these are promising developments indeed, we do not believe that it warrants AFRM’s eyewatering premium FWD Price/ Sales valuation of 7.32x and Price/ Cash Flow valuation of 49.14x, compared to the sector median of 2.71x and 13.51x, respectively.

Readers may also want to note that these numbers are relatively elevated when compared to its fintech start up peers, such as Upstart (UPST) at FWD Price/ Sales valuation of 6.84x and SoFi (SOFI) at 4.64x.

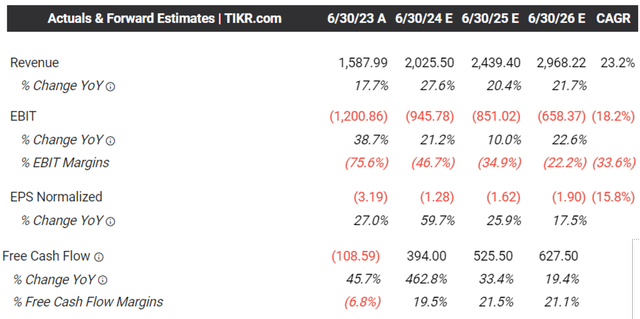

The Consensus Forward Estimates

This is especially since AFRM’s forward estimates imply a top line growth at a CAGR of +23.2% through FY2025, matching SOFI’s CAGR of +24.4%, though improved compared to UPST’s CAGR of -0.8% over the same time period.

So, Is AFRM Stock A Buy, Sell, or Hold?

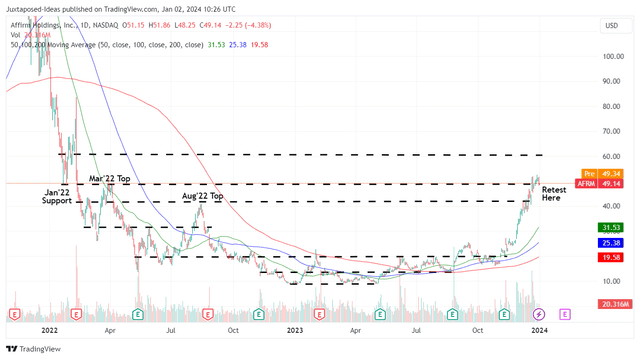

AFRM 2Y Stock Price

As a result of AFRM’s over valuation and the baked in growth premium, we believe that there is a good chance that the stock’s recent rally may not be sustainable, with the upward momentum likely to stall sooner than later.

In addition, readers must remember the stock’s elevated short interest of 18.70% at the time of writing, with its remaining to be seen if the previous support levels of $48s may hold.

As a result of the potentially painful correction, we prefer to downgrade our rating on the AFRM stock to a Hold (Neutral) here. There is no need to chase this rally, with the stock trading way above our previous estimated fair value of $23.

Inversely, traders may consider taking part of their gains at these levels and coming back in after the exuberance has been moderated.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.