Summary:

- T stock is very popular among income investors due to its attractive yield.

- However, I do not think it is worth buying right now.

- I explain why and also share some high-yielding, low-risk stocks that offer much better total return potential than T right now.

JamesBrey

AT&T stock (NYSE:T) is an extremely popular stock on Seeking Alpha due to the allure of its high yield that is seemingly well-covered by earnings and free cash flow, its relatively stable and defensive business model, and its seemingly extremely cheap stock price. Moreover, legendary billionaire investor Ray Dalio’s hedge fund – Bridgewater Associates – recently purchased a stake in the stock, further adding to the bullish consensus behind it.

That being said, I believe that Mr. Dalio’s firm is wrong to be bullish on T and income investors should be looking elsewhere for their long-term dividend income needs. In this article, I will explain why and share two alternative high-yield stocks that look much more attractive than T right now.

Why Ray Dalio And Bulls Are Wrong About T Stock

As we wrote in a recent article, dividend stocks should pass four key tests before they earn a spot in a portfolio:

- a defensive and durable business model

- a strong balance sheet

- a safe and growing dividend payout

- high enough current dividend yield.

However, when assessing T stock against these criteria, the company falls short in several respects, and therefore I think that Ray Dalio and other bullish investors are mistaken to be buying shares.

In terms of having a defensive and durable business model, T – despite its large-scale operations in telecommunications and lengthy track record in the sector – remains in a very vulnerable position today. The telecom industry, characterized by intense competition and a continuous need for high capital expenditures in order to remain viable against the plethora of choices that consumers enjoy, does not provide the same level of durability and predictability as other more defensive sectors, such as utilities (XLU). Instead, AT&T’s significant investments in infrastructure and acquisitions over the years have saddled it with a heavy debt burden while barely growing its revenues and earnings at all. Moreover, the mere threat of Amazon (AMZN) entering the business sent T’s stock plunging, further highlighting just how vulnerable the business model is.

Between its capital-intensive and competitive natures, T is seemingly stuck in an endless cycle of stressing its balance sheet with debt and CapEx while generating very low returns on those investments. This is not the kind of combination that bodes well for sustainable and dependable long-term dividend growth.

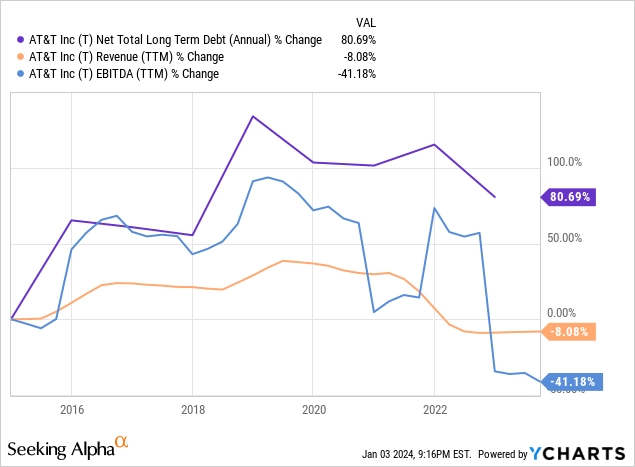

When it comes to its balance sheet, T – as already mentioned – has a massive debt load due to a combination of costly capital expenditures and acquisitions over the years that have failed to deliver commensurate revenue and EBITDA growth. As the graph shows below, over the past decade, T’s net total long-term debt has grown by 80.69% while its EBITDA has plunged by a startling 41.18%:

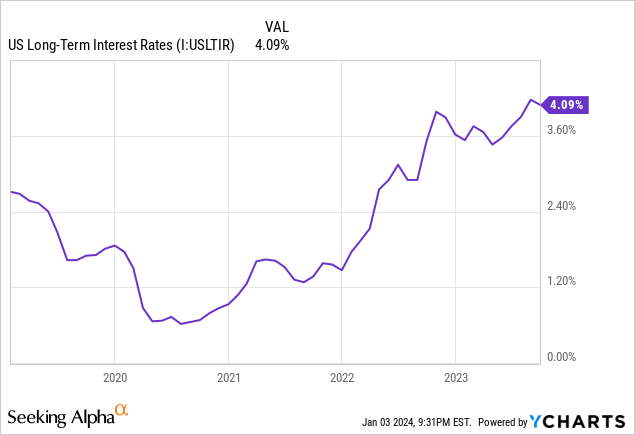

With interest rates rising and competition and capital expenditure demands as high as ever in the telecommunications space, T’s high debt level is putting a significant strain on the company’s balance sheet, forcing management to slash its dividend not too long ago and continue to prioritize debt reduction over dividend growth for the foreseeable future. As a result, shareholders are unlikely to see much in the way of capital return growth in the years to come, likely constraining total returns as well.

This brings us to test number three for a good dividend stock: a safe and growing dividend payout. Once again, T fails this test as it is unlikely to see much dividend growth at all until management can successfully bring down its heavy debt burden while also meeting its significant capital expenditure demands. Wall Street analysts clearly see this as the most likely scenario as well, forecasting a meager ~1% dividend per share CAGR through 2027, meaning that the payout will likely lose purchasing power over time to inflation. On top of that, a lingering investigation into T’s responsibility for toxic lead cabling and its potential impact on the dividend led to the CEO giving evasive responses during the Q2 earnings call, further calling into question the safety and growth potential of T’s dividend payout.

Finally, T’s best score comes on the size of its current dividend yield (6.5%), which does dwarf the S&P 500’s (SPY) minuscule 1.4% yield. However, when compared to its history, it is much less impressive, and in fact is below its five-year average yield of 6.78%, despite interest rates rising substantially over that period:

When combined with an EV/EBITDA multiple that stands roughly in line with its historical average despite interest rates mostly sitting at elevated levels and the company facing serious growth headwinds, T’s dividend looks much less impressive and the stock’s total return prospects appear to be quite weak.

Two Low-Risk High-Yield Stocks To Buy Instead

The good news is that investors do not need to settle for mediocre total returns and relatively high risk with a perennial underperformer like T stock. Instead, they can invest in the likes of Enterprise Products Partners stock (EPD) and W. P. Carey stock (WPC), which pass each of the four tests for a good dividend stock with flying colors.

EPD’s business model is diversified by geographic presence and energy commodity exposure and is also fully integrated, covering major shale basins in the US and key export facilities along the Gulf Coast. This diversification across various segments of the midstream energy sector – Natural Gas Liquids (NGLs), Crude Oil, Natural Gas, and Petrochemical and Refined Products Services – ensures EPD is not overly reliant on any single commodity or geographic region. Given the strategic positioning of its assets, the lengthy and commodity price immune terms of its contracts, and the mission-critical nature of the commodities that it services, EPD’s business model is both durable and defensive.

Moreover, EPD’s balance sheet is also quite strong, as evidenced by its industry-leading A- credit rating, impressive average debt maturity of nearly 20 years, and a substantial portion of its debt locked in at fixed rates for over 30 years. Combining these metrics with its $4 billion in liquidity and a conservative leverage ratio of 3.0x, EPD clearly has a fortress balance sheet.

EPD’s track record of steadily increasing its distribution for the past twenty-five years, current distribution coverage ratio of 1.7 times on a distributable cash flow basis, and ~5% distribution CAGR in recent years all combine with its durable and defensive business model, stellar balance sheet, and the plethora of ongoing growth projects to point to the fact that EPD’s distribution is not only safe but also poised for inflation-beating growth for years to come.

Last, but not least, its current distribution yield of EPD stands at an attractive 7.7%, and its EV/EBITDA multiple of 9.29x is at a meaningful discount to its five-year average of 9.82x as well as that of peers such as Enbridge (ENB).

WPC, meanwhile, also exhibits all four qualities of an ideal dividend stock. Its recent aggressive transition away from office real estate assets to increased exposure to industrial and warehouse properties signifies a strategic shift towards a more defensive and durable business model given that office real estate is facing significant disruption from the growing work-from-home movement whereas industrial and warehouse properties are enjoying strong tailwinds from deglobalization and the growth of e-commerce. Moreover, it’s very conservative triple net lease business model makes it one of the most defensive businesses around.

WPC’s balance sheet is also quite strong as evidenced by its significant liquidity and BBB+ credit rating. It also enjoys a built-in hedge against rising interest rates – normally a major headwind for triple net lease REITs – via its significant exposure to CPI-linked leases, as these enable its rental income to rise at a faster clip when inflation is elevated. Given that higher inflation levels largely result in higher interest rates – and vice versa – WPC enjoys a natural offset that many peers such as Realty Income (O) lack.

While it recently cut its dividend as part of its hasty exit from the office sector, WPC’s dividend is on firm footing moving forward, with a projected payout ratio below 80%, a strong balance sheet, and a very stable cash flow profile. Moreover, its increased retained cash flows and robust acquisition pipeline indicate that it should be able to grow dividends at an accelerated pace moving forward.

Finally, WPC’s 5.33% dividend yield is sufficiently high to make it an attractive dividend stock. When combined with its expected accelerating dividend growth moving forward and discounted valuation (1.09x current P/NAV vs. 1.14x 5-year average and 16.57x current EV/EBITDA vs. 17.80x 5-year average), WPC offers an attractive combination of current yield, growth, and multiple expansion potential along with the low-risk profile that comes with its strong balance sheet and defensive and durable business model.

Investor Takeaway

T’s business model is weighed down by intense competition and high capital expenditure requirements, amplifying the weight of its heavy debt load and weak growth prospects. As a result, its dividend growth prospects appear abysmal for the foreseeable future and its valuation is less than impressive as well. While its current dividend yield may seem attractive compared to SPY or even large dividend ETFs like the Schwab US Dividend Equity ETF (SCHD), there is just not enough else besides the current yield to make it worth buying.

Instead, we are buying much better quality high-yield stocks like EPD, WPC, and many others that combine a truly durable and defensive business model, strong balance sheets, safe and growing dividends, and attractive current yields and valuations.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of EPD, O either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Join 1,700+ Subscribers…

At Just ~1/3 Of The Regular Rate!

For a Limited-Time – You can join Seeking Alpha’s #1-rated community of high-yield investors at just $25 per month

Try it Free for 2-Weeks. If you don’t like it, we won’t charge you a penny! We have over 150 five-star reviews from happy members who are already profiting from our high-yield strategies.

We spend 1000s of hours and over $100,000 per year researching the market for the most profitable investment opportunities and share the results with you at a tiny fraction of the cost.