Summary:

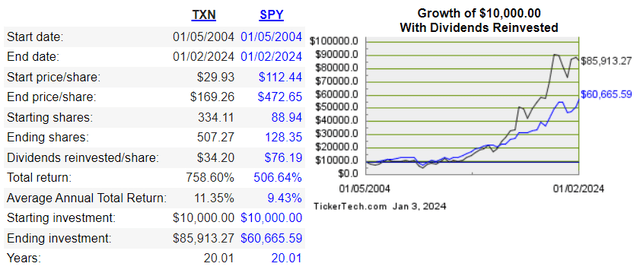

- In the last 20 years, the total returns of Texas Instruments have nearly doubled the S&P 500.

- Continued industrial weakness led to mixed third-quarter results for the semiconductor giant.

- The company’s vigorous financials earn it an A+ credit rating from S&P on a stable outlook.

- The current valuation leaves Texas Instruments with little room for error.

- Total returns through 2025 could be minimal and greatly lag the S&P, which is why I am waiting before adding to my position.

A closeup of $100 U.S. banknotes. chekat/iStock via Getty Images

I believe it is safe to argue that everyone reading this article desires to attain enough wealth to support themselves, their families, and their favorite charitable organizations. If nobody wanted to achieve this for themselves and their families, sites like Seeking Alpha wouldn’t exist.

So, what is the path to building proven wealth in the stock market? Since I tend to think of things in terms of equations, that is the format in which my following answer will be provided: Seed money and/or capital contributions + compounding + time = wealth.

The first input into the equation of seed money and/or capital contributions is the raw material of wealth building. The more somebody has to start or contribute over time, the more potential there is at the end of an investment timeframe.

Depending on the degree of compounding and time that an investor has over an investing lifetime, it may not take much raw material to build significant wealth. Investing in great businesses over long periods can lead to truly staggering results.

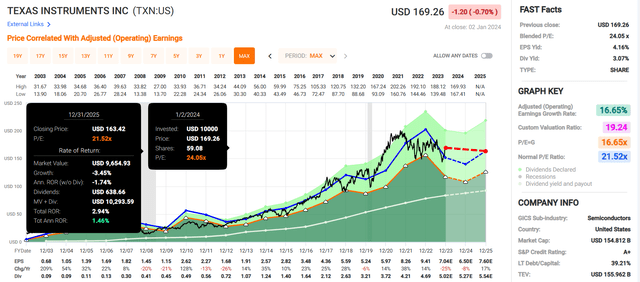

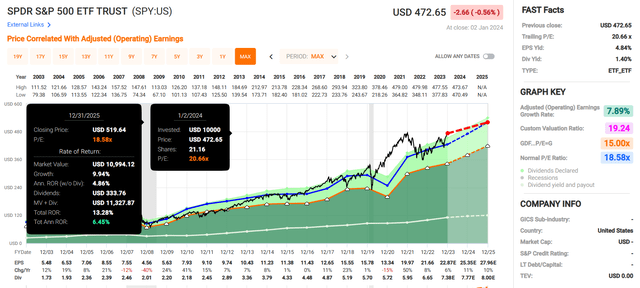

The semiconductor and integrated circuits company, Texas Instruments (NASDAQ:TXN), is proof of what is possible when this simple investing strategy goes right. In just 20 years, the semiconductor giant parlayed a $10,000 investment into $86,000 with dividends reinvested. That’s much more than the $61,000 that the same investment amount in the S&P 500 (SP500) index would be worth today with dividends reinvested.

I am so impressed with Texas Instruments that it is the seventh-biggest investment in my individual stock portfolio, comprising a 1.8% weighting. At the right valuation, I am inclined to believe that the semiconductor can continue to outperform the S&P 500 moving forward. Please allow me to dig into the company’s fundamentals and valuation to explain why I am initiating a hold rating for now.

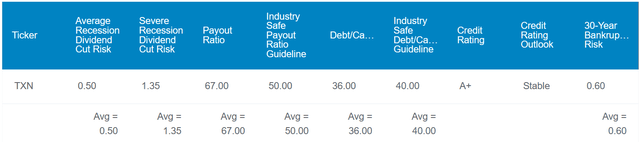

Dividend Kings Zen Research Terminal

Texas Instruments’ 3.1% dividend yield is twice as much as the 1.5% yield of the S&P. Besides this superior starting income, the company’s dividend is also reasonably safe.

Texas Instruments’ 67% EPS payout ratio is on the high side of the 50% EPS payout ratio that rating agencies like to see from semiconductor companies. However, it makes up for this with exceptional profitability and an excellent balance sheet. The company’s 36% debt-to-capital ratio registers moderately below the 40% debt-to-capital ratio preferred by rating agencies. Thanks to these reasons, S&P awards an A+ credit rating to Texas Instruments on a stable outlook. This implies the probability of the company folding in the next 30 years is just 0.6%.

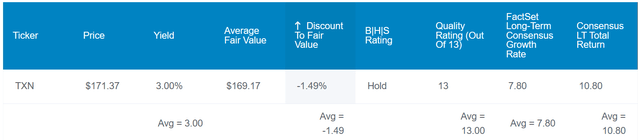

Dividend Kings Zen Research Terminal

Texas Instruments’ fundamentals are attractive. But after rallying nearly 20% from its 52-week low set last October, the same can’t be said of its valuation. Averaging out its historical dividend yield and P/E ratio, shares of Texas Instruments could be fairly valued at $169 each. Relative to its current $167 share price (as of January 3, 2024), this means the semiconductor is trading at a 1% discount to fair value. Although Texas Instruments has market-beating potential in the next 10 years, the margin of safety just isn’t there given its cyclical nature. That’s my biggest reservation with buying more of the stock right now.

If Texas Instruments reverts to fair value and grows as anticipated, here are the total returns that it could deliver in the next 10 years:

- 3.1% yield + 7.8% FactSet Research annual growth consensus + 0.1% annual valuation multiple upside = 11% annual total return potential or a 184% 10-year cumulative total return versus the 8.6% annual total return potential of the S&P or a 128% 10-year cumulative total return

Positioning Itself For The Next Industry Upswing

Since its founding in 1930, Texas Instruments has remained true to its mission of creating a better world by making electronics more affordable through semiconductors. Due to its innovations and acquisitions, the company’s portfolio has grown to roughly 80,000 products. It’s not a surprise that with this many products targeted toward various markets, including communications equipment, consumer electronics, and automotive, Texas Instruments’ customer base exceeds 100,000.

As a result of this massive scale, the company recorded over $20 billion in 2022. This revenue was generated in the following three segments:

- Analog: This segment is the company’s largest, accounting for almost $15.4 billion or 76.7% of revenue in 2022. The segment’s products convert real-world signals like sound and temperature into digital data that is processed by other semiconductors. In addition, these products are also typically utilized to manage the power in all electronic equipment. This is done through converting, distributing, and storing electrical energy.

- Embedded Processing: This segment made up nearly $3.3 billion or 16.3% of 2022 revenue. The segment’s products are used to help electronics perform specialized tasks. The applications vary from electric toothbrushes to motor control in automobiles.

- Other: This segment contributed to the remaining $1.4 billion or 7% of revenue in 2022. The company’s products are the ones many people may know the company most directly from their years as students. These include high-definition image projectors used in many classrooms and the eponymous TI-branded calculators (all details in the section to this point were sourced from pages 2-4 of 73 of Texas Instruments’ 10-K filing).

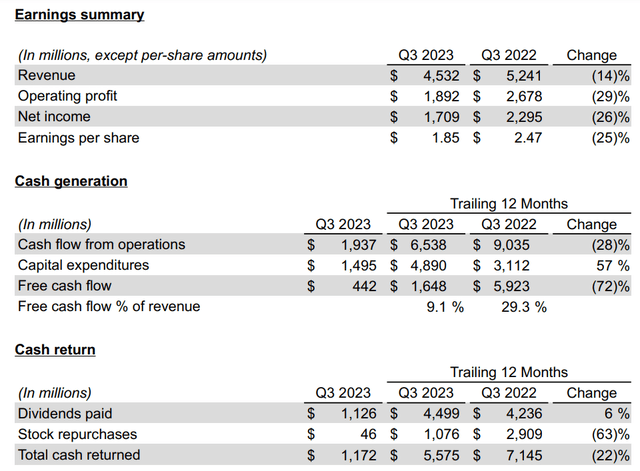

Texas Instruments Q3 2023 Earnings Press Release

Texas Instruments’ revenue was $4.5 billion in the third quarter ended September 30, which was down 13.5% over the year-ago period. For more context, this missed the analyst consensus by $60 million. What factors were behind these results?

The driving element of these results was that analog segment revenue dropped by 16% over the year-ago period to $3.4 billion for the third quarter. This was primarily due to weakness within the industrial market (the plurality of Texas Instruments’ total revenue) stemming from the current macroeconomic environment. Recovery-driven strength in the automotive market wasn’t enough to make up for this downturn in the industrial market.

Texas Instruments’ diluted EPS fell by 25.1% year-over-year to $1.85 during the third quarter. This topped the analyst consensus by $0.03. A lower revenue base and an uptick in research and development led the net profit margin to contract by over 600 basis points to 37.7% in the quarter. This explains how diluted EPS decreased at a faster rate than revenue for the quarter.

Looking ahead, the near term will remain bumpy for Texas Instruments. The current macroeconomic environment coupled with a heavy research and development cycle is why diluted EPS is expected to fall 6.5% from 2023 to $6.65 in 2024. Historically, however, Texas Instruments has rebounded from these situations as economic conditions eventually improved and its investments paid off. The company’s brand recognition in the growing semiconductor industry accounts for the 7.8% FactSet Research annual earnings growth consensus over the long haul.

Texas Instruments’ solvency also remains robust. The company’s interest coverage ratio through the first nine months of 2023 was 24 (details according to page 2 of 33 of Texas Instruments’ 10-Q filing). As Texas Instruments emerges from the latest semiconductor industry downturn, this should only improve.

Steady Dividend Growth Can Be Maintained

Texas Instruments has upped its dividend for 20 consecutive years. In the last five years, the quarterly dividend per share has compounded cumulatively by 68.8%. However, I expect dividend growth for the next few years to closely resemble the most recent dividend raise of 4.8%.

That is because, through the first nine months of 2023, Texas Instruments’ free cash flow was just $573 million. This wasn’t enough to cover the $3.4 billion in dividends paid during that time.

At a glance, this is less than ideal. Aside from the industry downturn weighing on operating cash flows, a doubling of capex from $1.8 billion to $3.9 billion explains the current situation (info per page 5 of 33 of Texas Instruments’ 10-Q filing). As Texas Instruments completes its capex cycle and returns to growth, the free cash flow payout ratio should become manageable again. Finally, it’s worth noting that Texas Instruments has grown its free cash flow per share by 11% annually from 2004 to 2022. If any company knows how to create value for shareholders, this semiconductor is near the top of the list.

Risks To Consider

Texas Instruments is a wonderful business, but there are risks worth weighing before considering taking an ownership stake in it.

For one, Texas Instruments is a highly international business. In 2022, 65% of the company’s revenue was derived outside the U.S. Revenue from China alone comprised about a quarter of total revenue (page 9 of 73 of Texas Instruments’ 10-K filing). This opens the company up to risks. For one, a recession in a major market such as China could negatively impact Texas Instruments. If relations were to sour further between the U.S. and China, this could impact trade. That could also end up hurting the company.

Another general risk is that as a semiconductor company, everybody wants a bigger piece of the industry pie. Texas Instruments’ continued innovation has allowed it to hold its own versus its competitors. But if the company can’t continue delivering on customer preferences, it risks losing market share.

Texas Instruments’ secular growth trends are appealing. However, they come with the drawback of operating in a highly cyclical industry. Not everyone can handle the boom and bust cycles that accompany investing in this industry.

Summary: For The Right Price, I’d Like To Own More Of Texas Instruments

FAST Graphs, FactSet FAST Graphs, FactSet

Texas Instruments’ 24.1 blended P/E ratio is moderately higher than its normal P/E ratio of 21.5 per FAST Graphs. I do recognize that industry headwinds partially account for this seemingly elevated valuation. But even accounting for this element, I see next to no margin of safety in the current valuation. That’s why I believe that total returns could be quite muted in the next couple of years for Texas Instruments, which explains my hold rating. If the stock were to experience a correction and fall into the $140s where it was not long ago, I would be more inclined to upgrade it to a buy rating.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TXN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.