Summary:

- Meta stock has recovered to pre-crash levels and is considered a Buy due to its strengthened position and growth potential.

- The company has invested in safety and security measures, including fact-checking and transparency around political advertising.

- There are opportunities for monetization through features like Reels and AI, and the company’s financial performance has improved.

- My overall sentiment for the stock is a Buy, even though it is no longer a value investment at the current price.

Kelly Sullivan

Meta (NASDAQ:META) stock had an unbelievable fall in 2022, but since has risen to pre-crash levels. In this thesis, I’m underlining why I believe the stock is still a Buy now the valuation is back to normal. The experience has arguably made the company stronger, leaner and set for further growth to come.

2024 Operations

There’s a discussion of Meta stock reaching $500 by 2024 year-end, with some predicting higher future values. The firm has integrated AI tools for its advertisers, producing a $10 billion run rate for Shopping Campaigns. Over 50% of advertisers are using Advantage+ Creative to improve ad images and text. There has been consistent growth from these efforts in Daily Active and Monthly Active People metrics as a result of these efforts.

The company has invested more than $20 billion in safety and security since 2016, including around elections, employing over 40,000 people in such areas. Meta is committed to the integrity of elections throughout its services, including a fact-checking network and transparency around political advertising. It is also updating policies to counter election and voter interference, harmful content and hate speech.

There are expectations that the firm will successfully monetize Reels and AI features such as avatars and chatbot assistants. The company’s AR glasses, including a 2024 demo plan, indicate strong innovation and revenue growth opportunities from continued product and service expansion.

2023 was Meta’s ‘Year of Efficiency’. This helped the stock value surge from the crash low, and the lean operational strategy is likely to continue to have a positive effect on the business in 2024 and beyond.

The organization has also been actively taking down misinformation networks. It removed thousands of fake accounts that were posting fake content about US-China relations.

Financial Peer Analysis

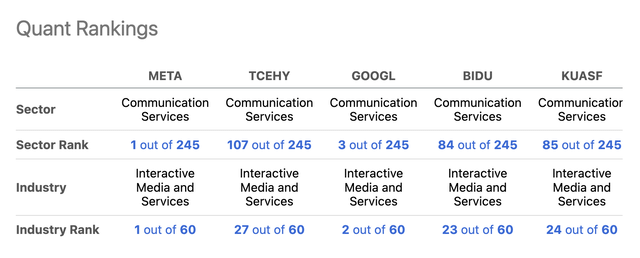

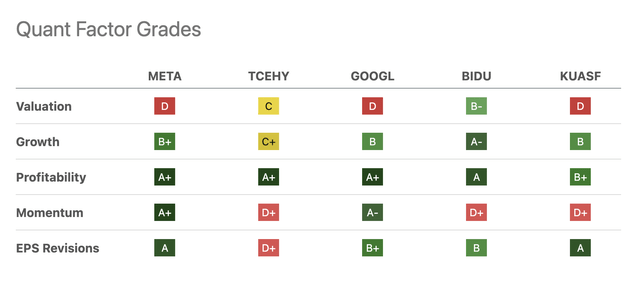

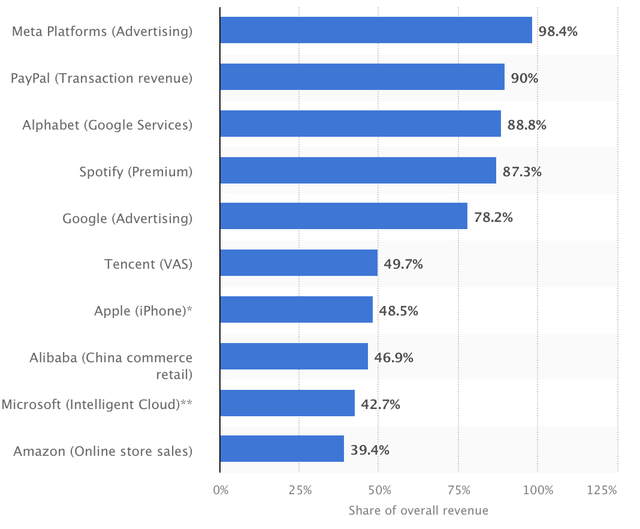

Understanding the company’s financials relative to peers is vital when considering portfolio allocation. SA Quant Rankings give Meta a 1 out of 245 Sector Rank, massively outperforming its peers, particularly from China.

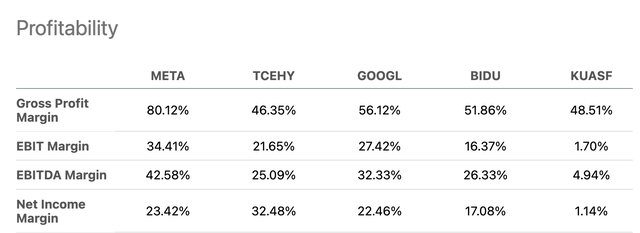

There’s an argument to be made that this is the best communication services stock to own on the market right now, and the company particularly shines on profit margins, with a massive 80.12% gross margin against Google’s (GOOG) (GOOGL) 56.12%. But, this comes down to a more reasonable 23.42% net income margin, lower than Tencent’s 32.48% (OTCPK:TCEHY) and just higher than Google’s 22.46%.

Meta has been making significant investments in new tools, like Buck2, to increase coding efficiency, but also heavier expenditures for larger projects like the Metaverse, which may cause net and operating margins to be lower than they could be in the medium term as new initiatives are scaled out. There’s an argument that a company as innovative as Meta will always have a high investment expenditure and operating cost to finance its continued growth and adaptation to advanced technology and market trends. I think this is important to bear in mind when evaluating the future margin outlook for Meta and other technology firms like it. Margin growth should be coming due to increased efficiencies related to automation, but the expenditures required to finance these efficient tools will mean the margin growth is slower and more incremental than otherwise.

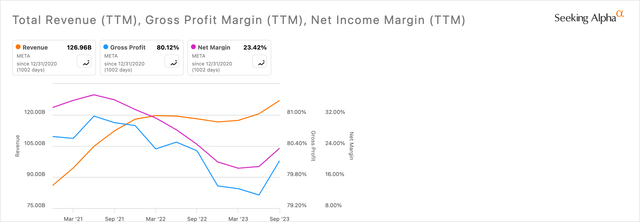

Looking at the present situation, after a difficult three-year period for revenues and margins in a long-term decline, the trend has now reversed, with margins up since June 2023 and revenue increasing again.

The firm’s operations, particularly related to the company’s ‘Year of Efficiency,’ are now seeing an effect on the company’s financial reports. While Meta’s margins are stellar and looking bright in the future because of this, there’s some reason to be skeptical about the firm’s revenue growth rates. With Meta’s prime revenue source being advertising, the business is largely dependent on continued user growth and associated advertising spending to keep up revenue growth. It may be more reasonable to consider the high-growth phase of Facebook over and a new, slower revenue growth stage but a higher margin potential period kicking in if the firm can continue to optimize efficiency through AI, cost-cutting, and a lean organizational structure focused increasingly on automation.

Valuation

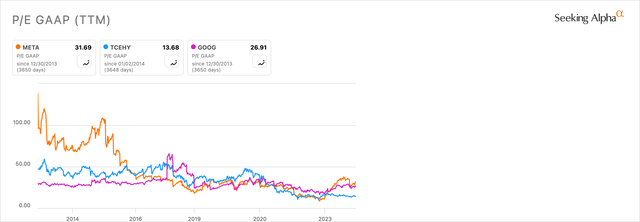

The weakest fundamental point for the company, as per Seeking Alpha’s Quant Factor Grades, is its valuation. Its forward P/E ratio of around 24 is roughly the same as Google’s. Yet, there’s an argument to be made that the company is fairly valued when considering its strong growth and exceptional profitability. It’s reasonable that an organization as dominant and profitable as Meta has a P/E ratio between 20-30, far lower than other technology stocks, with massive ratios of around 78 for Tesla (TSLA) and 40 for Nvidia (NVDA) as examples. Compared to historically, Meta’s current P/E ratio is favorable and further reinforces that it is selling at a reasonable price:

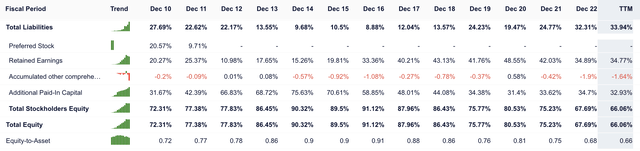

It’s worth considering that the company’s total equity is lower than historically, around 66% TTM, so the firm may be less agile than it would like in relation to financing advancements and innovations. This could also present some concerns in relation to the valuation of the stock. If the balance sheet remains this way or gets worse, the stock could be considered overvalued in due course as a result.

Further Notable Risks

There are multiple risks with Meta stock at the moment, which, while I do not think are significant enough to deter investment in an otherwise great company, do warrant attention.

The firm often faces regulatory challenges. For instance, Ireland’s Data Protection Commissioner issued the company with a €1.2 billion data privacy violation fine. These hurdles and related expenses add up and can affect the firm’s profitability—of course, Meta is not the only company facing such issues, and this is common with all large and exceptional businesses like it.

Its Reality Labs division, focused on augmented reality and virtual reality, is in the early stages and has financial concerns related to it. There are increasing operating losses for the segment, and public sentiment is sometimes negative in relation to its new initiatives. It may be some time before the positive effects of the company’s investment in this space pay off, causing lower short-term growth with high-growth, long-term potential.

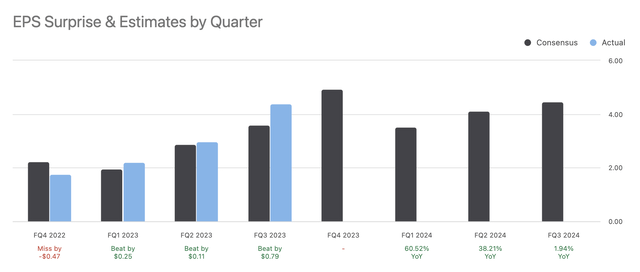

While the company has been beating earnings expectations consistently in the last year, CFO Susan Li has mentioned that the geopolitical unrest in the Middle East has contributed to a decline in the ad market. These global macro concerns are a reality for a firm with worldwide advertising revenue.

Conclusion

There are risks with Meta stock, particularly in relation to its market saturation, potential growth slowdown, and issues that may arise with its new virtual and augmented reality products. However, I think given the exceptional profitability, strong historical growth rates, and relatively stable financial statements, the company remains a Buy even after its recent crash recovery. The best time to buy the stock was undeniably at the end of 2022, but the stock remains strong today, even given a wider and non-contrarian Buy consensus.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in META over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.