Summary:

- PayPal Holdings, Inc. is currently valued at PE of 11.72x despite its strong growth potential, and there is a chance for a turnaround similar to Meta’s.

- Meta Platforms, Inc. experienced a rollercoaster ride in stock performance from 2021 to 2023, but bounced back in 2023 with a 194% increase.

- In Q3, pivotal metrics surged: TPV grew by 15%, EPS soared by 20% YoY, and promising e-commerce trends signal a bright future ahead.

- If PayPal’s valuation reverts to the mean, there is potential for a one-year return of 178% by the end of 2024, or a 48% annual return until 2026 if it takes longer.

JasonDoiy

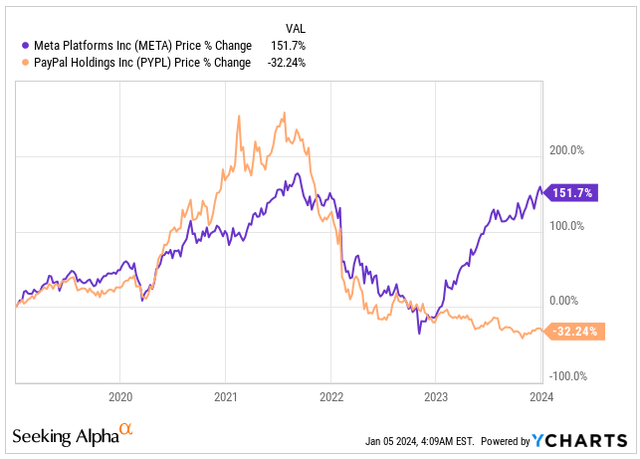

Do you recall how Meta Platforms, Inc. (META) performed wildly from 2021 to 2023?

It went through a rollercoaster ride, dropping from its peak of about $380 to a low of $88 amid a slowing economy, higher rates, and a slowdown in overall ad spending.

External factors such as an economic slowdown and ad spending slowdown played a role, but Meta’s own choices, like diving into the metaverse and burning through cash quickly, added to the negative sentiment toward company management.

But then, after hitting rock bottom in late 2022, the stock bounced back big time. In 2023, it shot up by over 194%, becoming the second-best performing stock right after Nvidia Corporation (NVDA), which returned 239%.

Who could’ve guessed, right?

It’s a clear example of how emotions drive the market. Even when a company’s fundamentals stay the same, stocks can swing wildly from being overvalued to undervalued in no time.

PayPal Holdings, Inc. (NASDAQ:PYPL) also falls into the same category. It’s a fundamentally robust company with a healthy business model that has historically known nothing but growth and has never focused on cost-cutting initiatives.

Despite its impressive performance from 2020 to 2021, things took a turn in 2022 to 2023, and the company hasn’t been getting much love lately.

Price Change (Seeking Alpha)

I believe the negativity surrounding the company isn’t justified. They’re growing reasonably fast, and the favorable industry tailwinds coupled with cost cutting initiatives should propel them forward again.

Let me show you why I foresee a potential turnaround for PayPal, akin to what happened with Meta. I think achieving more than a 100% return from this point is entirely feasible.

Business Update

During the pandemic, digital payment companies like PayPal had a heyday as people relied more on online transactions. PayPal’s revenue soared from $17.8 billion in 2019 to over $25 billion in 2021, and its stock reached unprecedented heights of $289.

However, as pandemic restrictions eased, PayPal’s stock growth took a nosedive. In just a year, it lost all the gains it had made during the pandemic due to disappointing earnings reports, today trading at $58.

When the pandemic was at its peak, online sales made up 16.4% of total retail sales in the U.S. But since then, the growth has slowed down, hovering below 15% for the past two years.

Although PayPal’s overall payment volume has been increasing steadily, its stock growth has slowed. The rise in competition within the digital payment sphere has played a significant role in this slowdown.

In my opinion, investor worries which have pushed PayPal’s stock down 80% are way overdone and this presents a good investment opportunity with a significant margin of safety.

Currently, PayPal manages a worldwide network with around 430 million active accounts, facilitating $1.5 trillion in payment volume through 24 billion transactions. Their operations span across 200+ global markets.

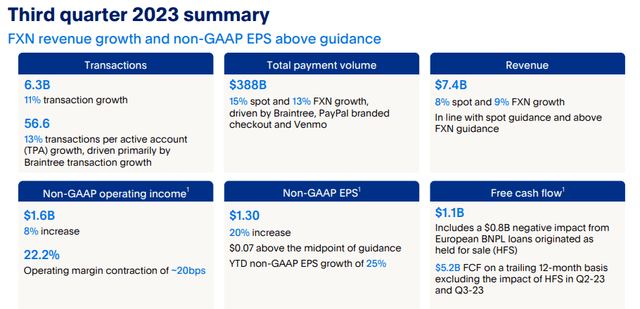

In my opinion, Q3 2023 signaled a turning point for the slower growth, with a 9% revenue increase, reaching $7.8 billion. This surpassed management’s original guidance of 6% to 7% growth for the quarter.

Q3 Results (PYPL IR)

Though sales growth hasn’t been as robust as many hoped, several other key indicators are looking quite robust. Despite a decrease in active accounts, transactions per account have surged by 13% to 56.6, with total transaction growth rising by 11% to 6.3 billion.

Operating income has seen an 8% uptick to $1.06, while Non-GAAP EPS hit $1.30, marking a substantial 20% year-on-year increase and surpassing the original guidance midpoint by $0.07. This EPS growth was significantly fueled by share buybacks, as PayPal repurchased close to 5% of outstanding shares in the last 12 months.

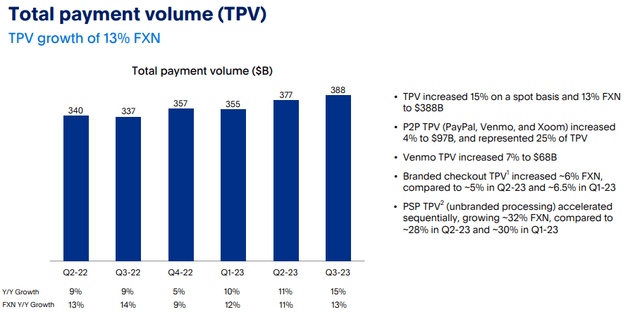

The robust lineup of products within PayPal’s portfolio, including Venmo, Xoom, and Braintree, has propelled total payment volume or “TPV” to $388 billion, marking a 15% increase from the previous year and the swiftest growth in the past six quarters.

TPV (PYPL IR)

Given the substantial recovery in TPV, which I consider the most important metric of PayPal, from the 5% to 9% growth lows experienced by PayPal between Q2 2022 and Q4 2022, I anticipated the stock to have already rebounded. This growth recovery hasn’t been a one-time event but has persisted over the past three quarters. Surprisingly, investors seem to underappreciate this growth recovery, despite the new CEO, Alex Chriss, making what appears to be the right decisions in terms of innovation.

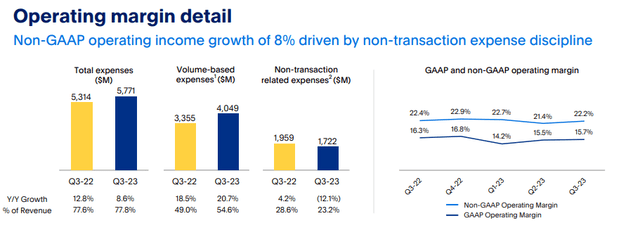

Investors are primarily concerned about rising competition and shrinking margins at PayPal, which holds truth as its operating margin declined from approximately 23% in Q2 2019 to 22.2% in Q3 2023. At the peak of the pandemic, the company’s operating margin hit 28%.

In a statement on November 1, PayPal’s CEO highlighted, “Our cost base remains too high, it is actually slowing us down.” The CEO outlined plans to significantly reduce costs, aiming for $900 million in cuts, mainly through layoffs, consolidating real estate, and cutting back on projects. This was evident in the 7% reduction in headcount announced in January 2023, involving the elimination of 2,000 positions.

As PayPal trims its expenditures, it’s expected that margins will likely improve. This could lead investors to adopt a more positive outlook on PayPal stock, similar to Meta’s turnaround, which was partly fueled by substantial cost reductions.

Operating Margin (PYPL IR)

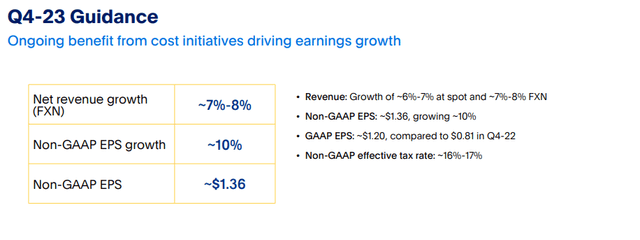

PayPal is set to announce its Q4 2023 earnings on January 30, and the projected EPS stands at $1.36, indicating a growth of around 10%. Net revenue growth is anticipated to reach a range of 7-8%.

I anticipate that PayPal will outperform these estimates. The recent recovery in holiday e-commerce shopping, demonstrated during Black Friday with a record $9.8 billion in US online sales, up by 7.5% from last year, should positively impact PayPal’s performance.

Q4 Guidance (PYPL IR)

Valuation

Here’s where things get intriguing.

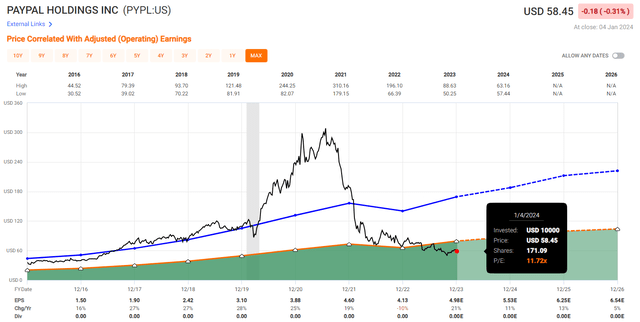

PayPal’s stock is currently trading at a Blended P/E of 11.72x.

Looking back to 2016, the company typically had a P/E Ratio of 33.96x. However, this figure might seem a bit inflated due to the high valuations during the trading frenzy of 2020 and 2021.

Despite this, PayPal managed to sustain a 15.9% growth rate in its EPS during that period, indicating robust growth qualities.

Although 2022 saw a decline in EPS by -10%, 2023 marked a recovery year driven by cost cutting measures and strong share buybacks.

Projections indicate that PayPal will maintain an annual EPS growth of around 10% moving forward:

- 2023: EPS of $4.98, 21% growth

- 2024: EPS of $5.53, 11% growth

- 2025: EPS of $6.25, 13% growth

- 2026: EPS of $6.54, 5% growth

With an anticipated 11% growth for the upcoming year and a Blended P/E of 11.72x, this suggests that the stock is presently trading at a PEG ratio of 1.07, a relatively uncommon find.

To provide context, let’s compare it to other companies experiencing reasonable growth:

- Visa, Inc. (V): PE of 28.63x, 13% expected EPS growth = PEG of 2.2

- Mastercard, Inc. (MA): PE of 34.46x, 18% expected EPS growth = PEG of 1.9

- Nvidia Corporation: PE of 41.31x, with 18% expected EPS growth = PEG of 0.63

- Meta Platforms, Inc.: PE of 24.05x, with 22% expected EPS growth = PEG of 1.09

This goes to show how undervalued PayPal is trading today, not just compared to similar businesses in the payment industry, but also in comparison to other growth sectors.

PYPL Valuation (Fast Graphs)

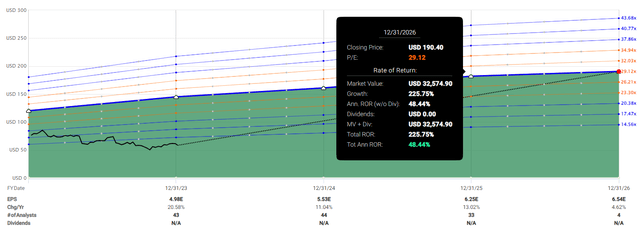

Though I don’t anticipate a return to the historical valuation average of a Blended P/E of 33.96x, I believe a reasonable valuation for a company with around 10% EPS growth would be a Blended P/E of 29x.

If the company does recover to trade more in-line with what appears to be a reasonable valuation, we could potentially witness an annual return of 48.4% by 2026, reaching a stock price of $190.40.

Should the valuation revert to the mean sooner than expected, my price target by the end of 2024 stands at $161, assuming PayPal earns $5.53 per share. This implies a one-year return of 178% from today’s price, a similar turnaround as to what Meta achieved over the past year.

Potential Return (Fast Graphs)

Takeaway

PayPal hasn’t received much love lately due to several quarters of underwhelming results. However, it remains a highly profitable business, and despite increased competition, it’s riding the favorable waves of growing e-commerce.

The appointment of a new CEO, focused on innovation, seems to have put PayPal back on track. The company has shown three consecutive quarters of growth in its crucial TPV metric. Additionally, the cost-cutting measures implemented are expected to yield positive results starting next year.

Despite these promising factors, PayPal’s current valuation is surprisingly low, almost as if the market expects no growth. Yet, analysts foresee an average EPS growth of 10% over the next three years. Considering its blended P/E of 11.72x and a PEG ratio of 1.07, I believe PayPal is on the verge of a turnaround, akin to what happened with Meta. This could lead to renewed interest and potentially a return to its average valuation.

If this reversal unfolds in 2024 and PayPal earns an EPS of $5.53, my price target stands at $161. However, even if the turnaround takes a bit longer, I expect around a 48% return by 2026.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.