Summary:

- Amidst a melt-up in speculative stocks, Affirm Holdings, Inc. has been a big winner.

- The company has shown accelerating GMV growth, with revenue growing even stronger due to easy comparables.

- Management has executed against improving profit margins and has issued ambitious medium and long-term targets.

- I critically analyze the long-term future of Affirm’s opportunity.

Neilson Barnard/Getty Images Entertainment

Affirm Holdings, Inc. (NASDAQ:AFRM) has been one of the biggest winners in the tech sector, bolstered by both strong fundamental performance as well as a broader tech sector melt-up. The company has made substantial strides in improving profitability all while maintaining a net cash balance sheet. Even so, I question whether the premium valuation is appropriate given the highly competitive environment and business model uncertainty. Too much optimism is being priced into the stock, and I reiterate my avoid rating.

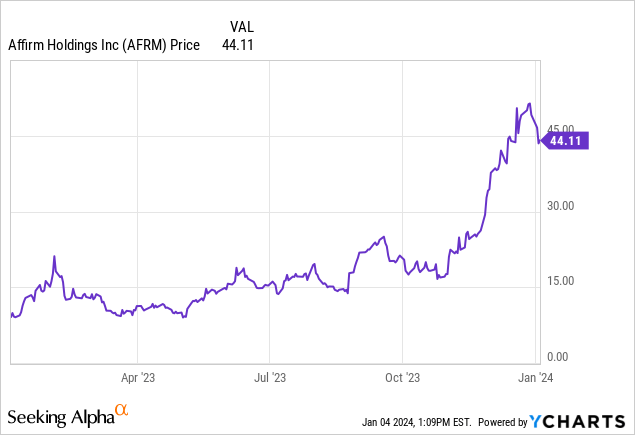

AFRM Stock Price

When I last covered AFRM in October, I downgraded the stock due to the interest rate risk. That downgrade proved premature, as the stock has proceeded to deliver 137% returns since then. Ouch!

It makes sense that AFRM has delivered stunning returns over the past year, given that it was one of the most beaten down names during the 2022 tech stock crash. However, just as the pendulum swung too negative in 2022, the stock has now swung to levels that do not look sustainable barring unusual outperformance.

AFRM Stock Key Metrics

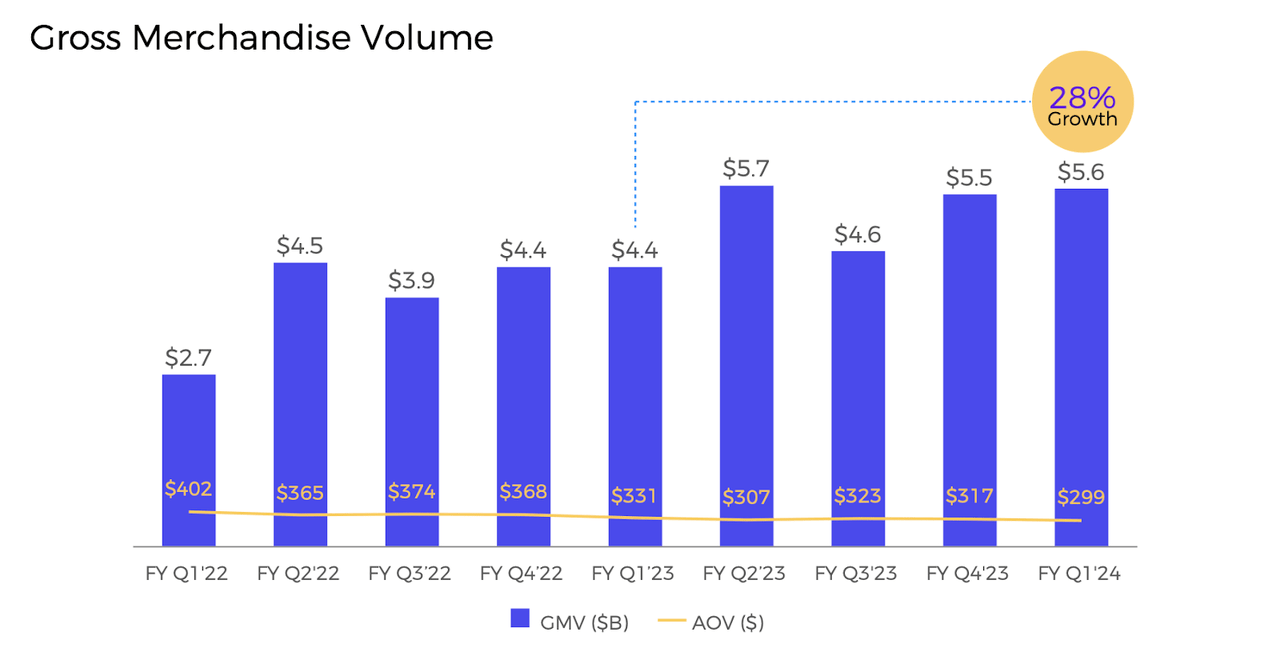

In its most recent quarter, AFRM saw GMV growth accelerate to 28%, with GMV coming in at $5.6 billion, outpacing guidance for $5.5 billion.

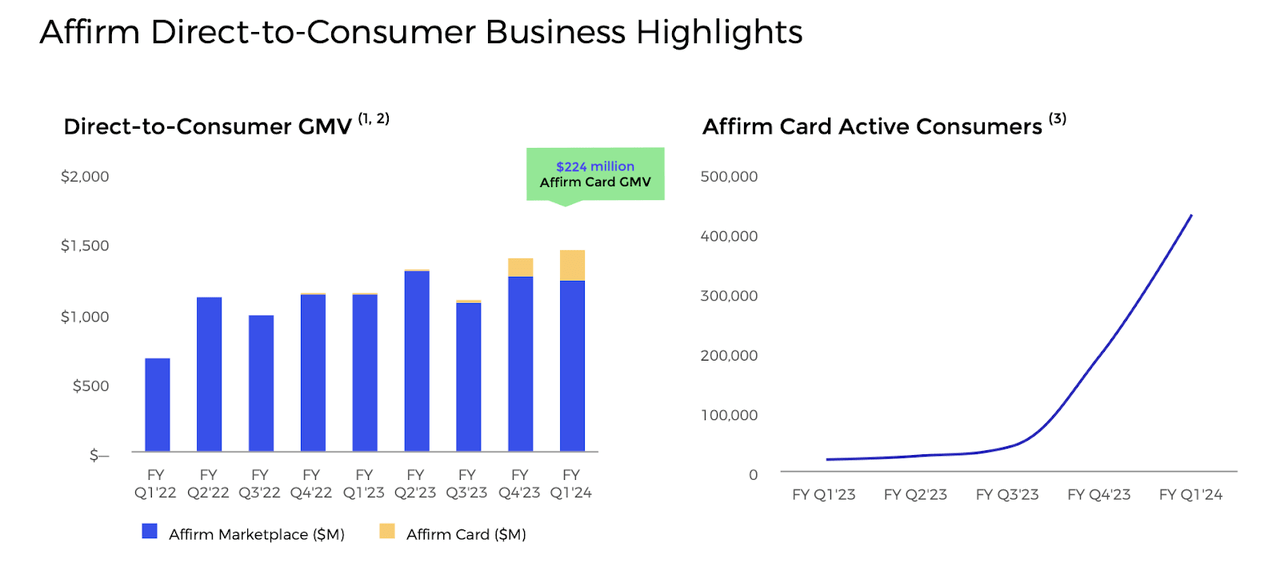

Some of that growth was driven by strength in its direct-to-consumer business, including the ongoing ramp of the Affirm Card.

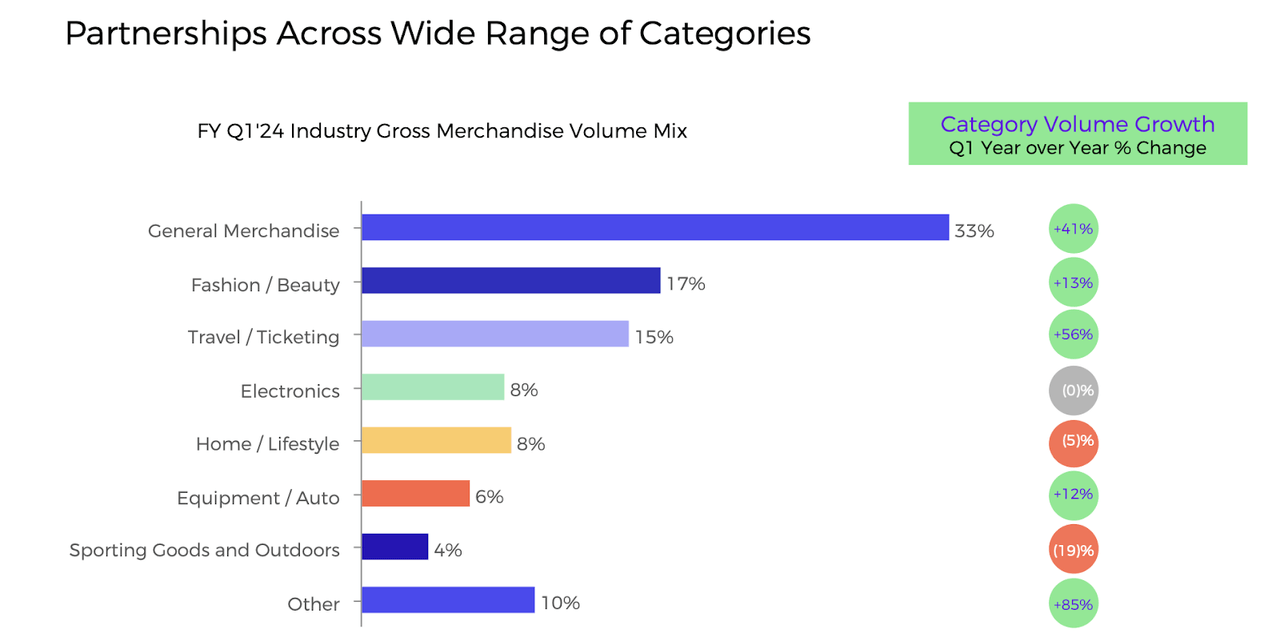

As a general buy now, pay later (“BNPL”) platform, AFRM has been able to benefit from diversified exposure to a range of categories.

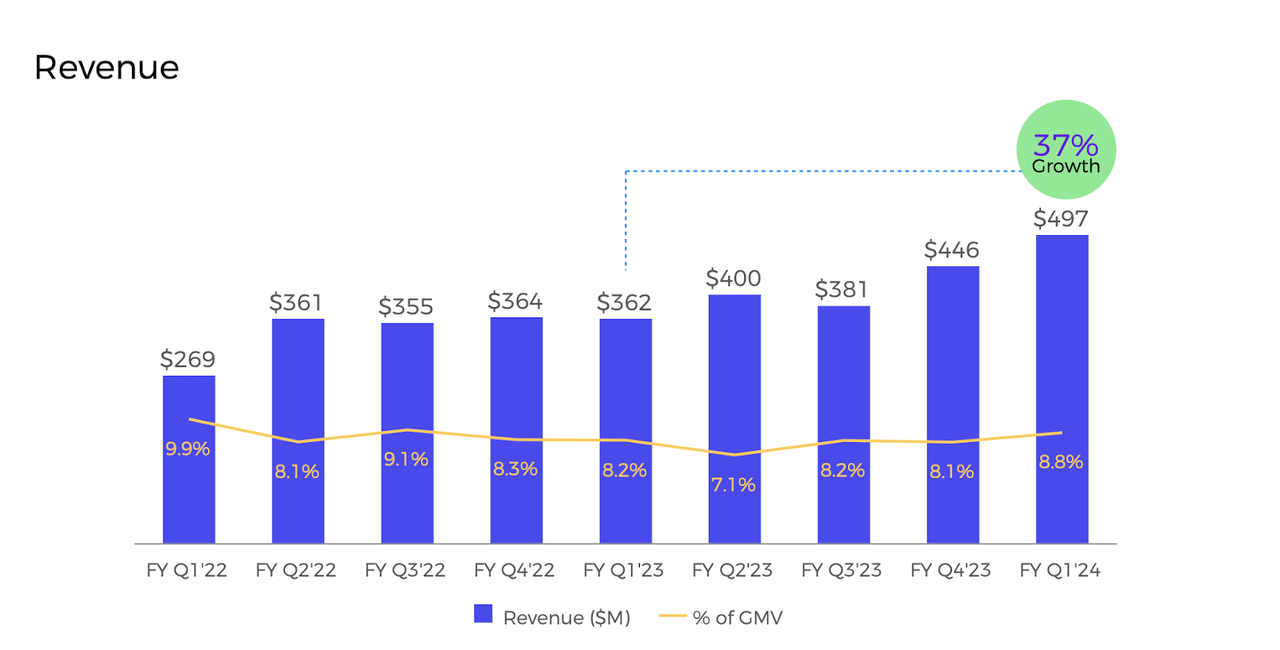

AFRM was able to translate the strong GMV growth into even stronger revenue growth, with revenue growing 37% YoY to $497 million, comfortably surpassing guidance for $455 million. I remind readers that AFRM had seen some underperformance on revenue as a percentage of GMV last year due to the rapid rise in interest rates.

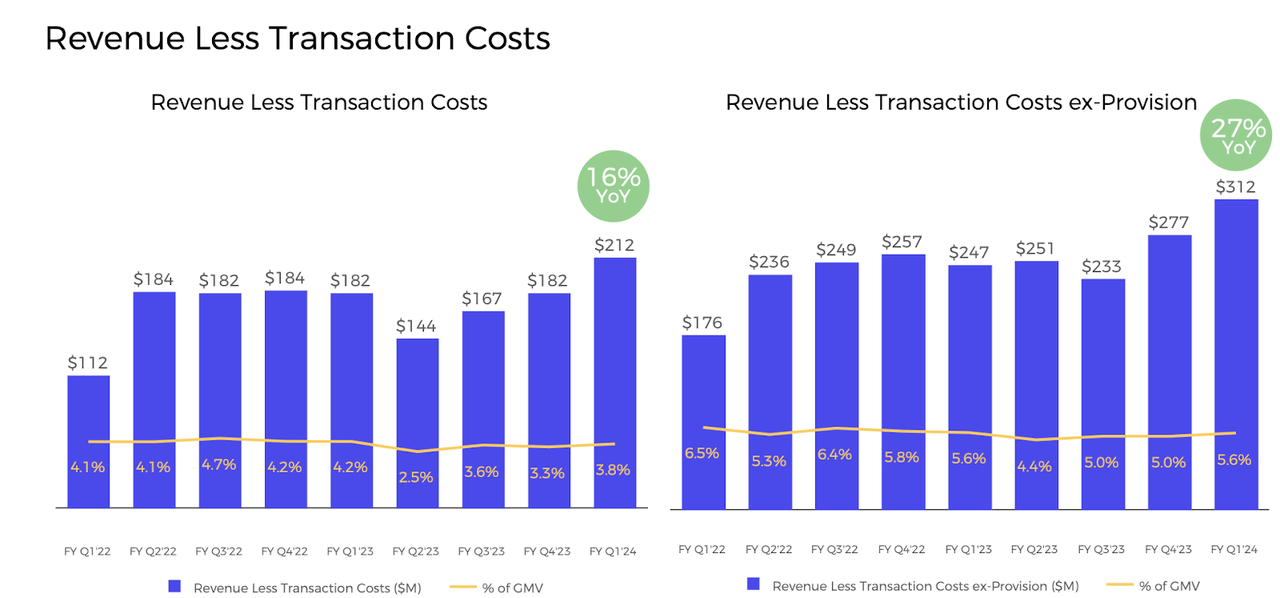

AFRM saw revenue less transaction costs (“RLTC”) grow slower at 16% YoY to $212 million, which was still enough to beat guidance for $190 million. AFRM continues to see pressure on this metric due to higher provision costs.

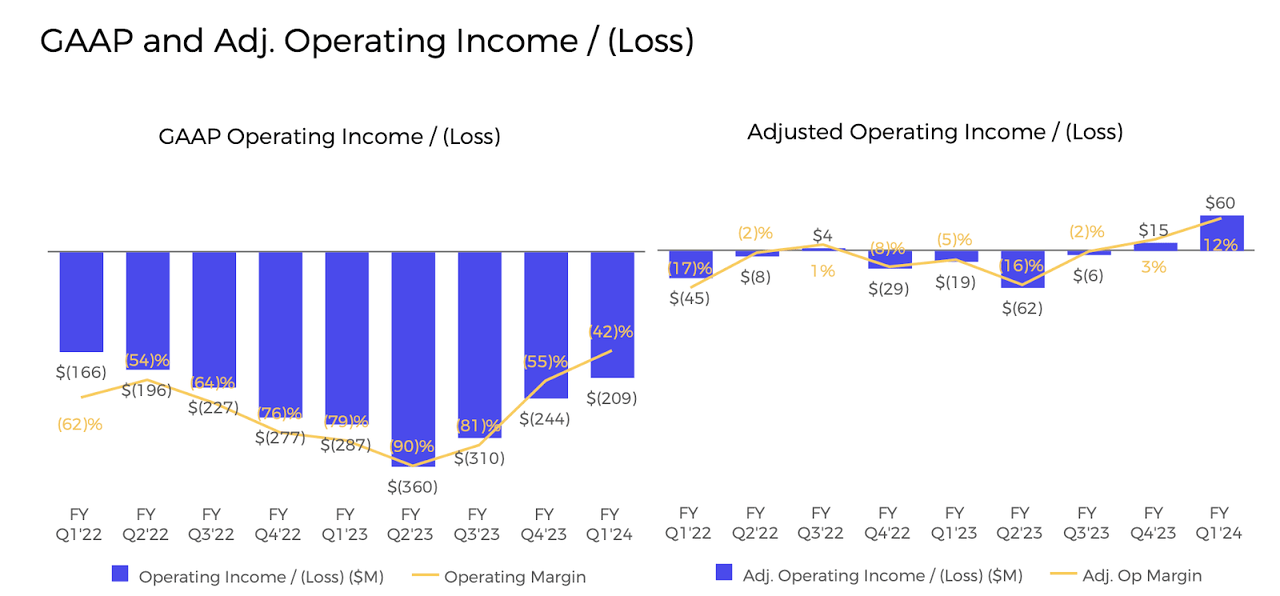

The biggest bright spot in the quarter was adjusted operating income, which came in at 12% of revenue, far surpassing guidance for 2% to 4%.

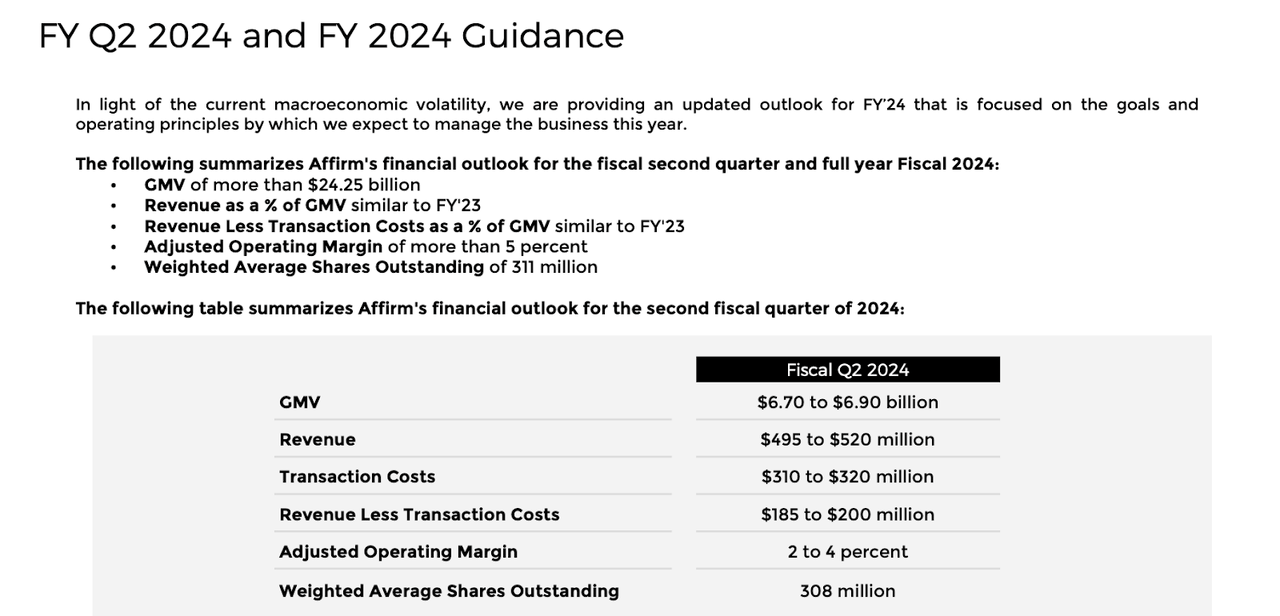

Looking ahead, management has guided for up to $6.9 billion in GMV, representing 21% YoY growth. Revenue is expected to come in at up to $520 million, representing 30% YoY growth. Management expects $200 million in revenue less transaction costs, representing 38.7% YoY growth – a welcome acceleration. The company is expected to generate an adjusted operating margin of between 2% to 4%, up from the 15.5% adjusted operating loss in the prior year. I expect the company to outperform these targets given management’s propensity to under promise and over-deliver. I believe that readers should focus more on GMV growth than revenue or RLTC growth due to the ongoing normalization.

On the conference call, management appeared to imply that the strong adjusted operating margin performance is “very close to run rate” but also noted that they intend to “make some investments in the back half of the year.” That does imply that margins may trend lower moving forward, though AFRM (and other tech names) have clearly shown that they can drive up profit margins “at will.” Management noted that they believe they are operating in a more “rational” competitive environment, a direct function of the higher interest rate which has made “growth at any cost” strategies prohibitively expensive.

Subsequent to the quarter end, AFRM landed a partnership with Walmart (WMT) to bring BNPL to self-checkout. The stock soared following that news, though I anticipate this partnership to bear modest gains relative to the stock price appreciation.

Is AFRM Stock A Buy, Sell, or Hold?

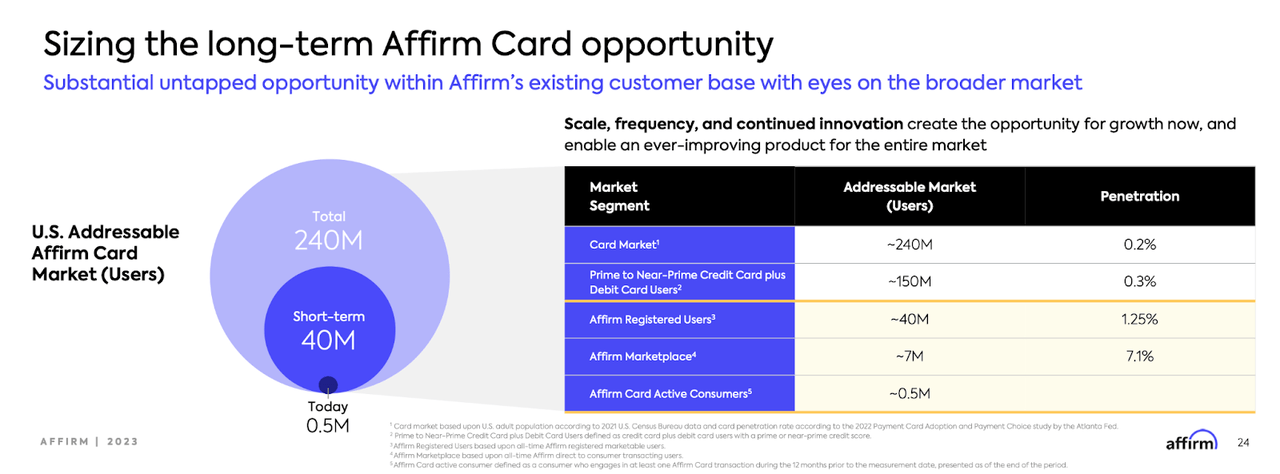

AFRM is a pure-play investment on the growth of the Buy Now, Pay Later market. The Affirm card is the most important growth lever in the near term, as it begins the company’s ambition to become a complete financial products company.

Management believes that they have a long growth runway given the low penetration, though I question whether credit cards are so ripe for disruption.

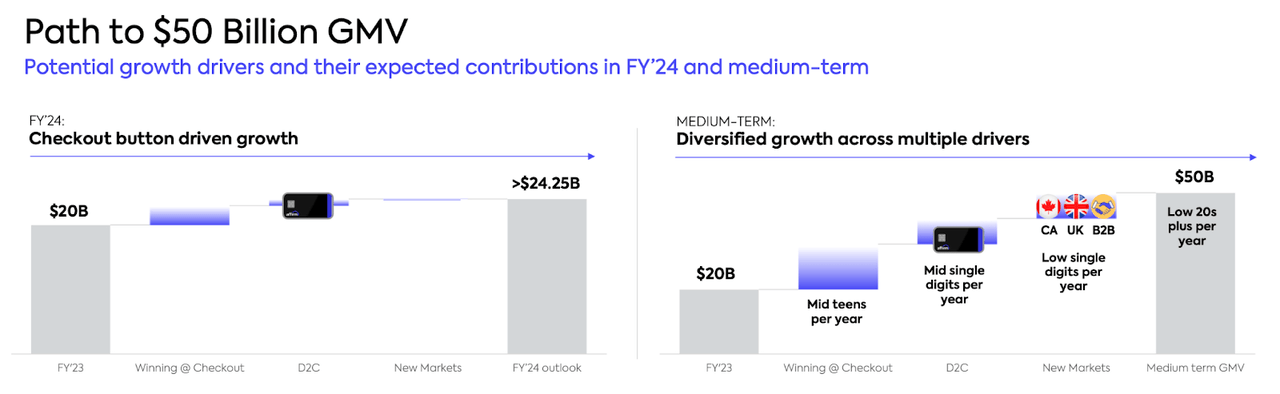

Between core checkout, direct to consumer, and new markets, management has guided for “low 20s” GMV growth over the medium term.

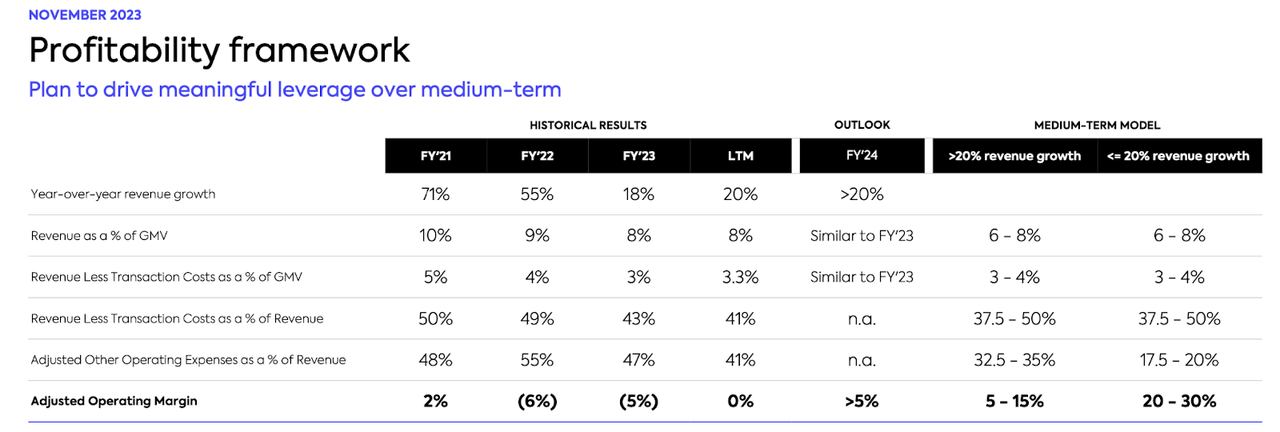

Management has given two profitability models. Management has guided for the company to sustain around 5% to 15% adjusted operating margins when revenue growth is in excess of 20%, and 20% to 30% operating margins when revenue growth falls below 20%. I note that during the pandemic, 30% was the target growth rate. Like many other e-commerce names, AFRM has had to dial back growth expectations following the pandemic.

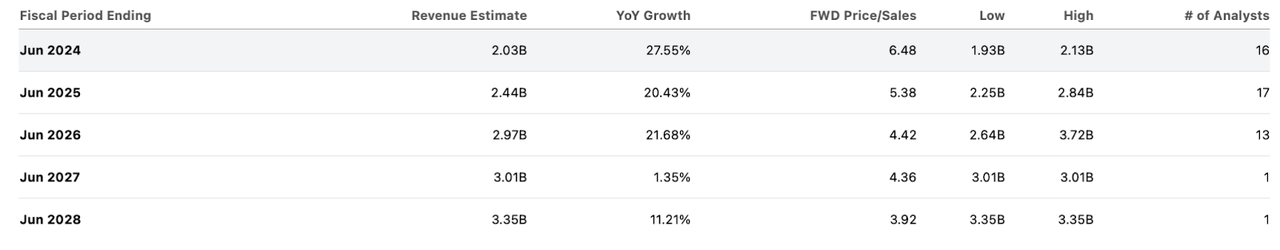

As of recent prices, AFRM was trading at around 6.5x sales. Consensus estimates appear skeptical that the company can sustain 20% growth for more than a couple of years.

Assuming 20% top line growth, 30% long term net margins (surpassing the high end of management guidance), and a 1.5x price to earnings growth ratio (“PEG ratio”), fair value might hover around 9x sales, implying solid upside. That, however, misses the big picture given that there may be some doubts in the company’s ability to sustain 20% top line growth for so long. Remember, this is not a subscription-based enterprise tech company and thus there are no obvious levers to drive “same-store” growth. AFRM is reliant on a strong economy, growing BNPL adoption, as well as increasing market share within BNPL. Consider that if growth were to slow down to the 15% level by 2027, then fair value would drop to around 6.8x sales, implying 15% potential annual upside over the next 3 years. But if growth were to then slow to 10%, then fair value would dip to 4.5x sales, pressuring annual return potential. An investment in AFRM at current prices requires strong conviction that above-market growth rates can continue for the long term.

But it’s not just that. AFRM has been able to garner premium valuations possibly due to being considered more like a Visa (V) than Bank of America (BAC). That is, investors seem to be focused more on the long term growth of the BNPL industry than the company’s cyclical attributes. Competition may spoil this view. Consider this snapshot of the company’s electronics customer list, taken directly from their website.

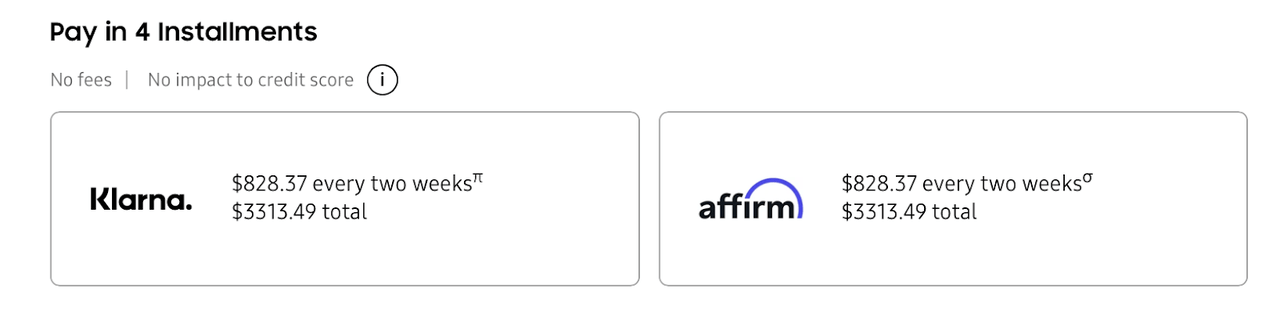

While iRobot and Theragun appear to exclusively work with AFRM, Samsung currently offers Klarna as well, with both providers being shown to prospective consumers in the following manner.

Samsung

E-commerce checkout screens typically do not have exclusive arrangements – consider that one can usually use any credit card, as well as any digital wallet at time of checkout. PayPal (PYPL) has seen great pressures to its growth model due to the increasing number of competitive wallets. I expect AFRM to face similar competitive pressures. Besides facing great competition from other BNPL providers like Klarna and Afterpay from Block (SQ), big names like PYPL and Apple (AAPL) have also entered the mix. I am doubtful that AFRM will remain the exclusive BNPL provider for many of its merchants for long, as e-commerce merchants typically want to reduce payment friction by accepting all preferred methods of payment. This begs the question: would consumers choose AFRM by default as their preferred payment method, similar as to how one might prefer Apple Pay? It may be too early to answer that question in the affirmative.

Besides the competitive risk, AFRM has inherent exposure to interest rate risk. I expect BNPL adoption to slow meaningfully if interest rates do not decline meaningfully from here. BNPL transactions typically involve some financing cost on the behalf of consumers (0% transactions are heavily financed by merchants), meaning that they are more expensive in times of higher interest rates. A decline in interest rates would be likely bullish for the company due to increasing the appeal of the product, though I note that it may also increase the intensity of the competitive environment.

Putting these together, I question whether the current stock price offers sufficient margin of safety. For a stock with this much risk, I would prefer to be investing with at least 20% potential annual upside, but I am seeing only 15% potential upside for Affirm Holdings, Inc. even using aggressive underlying assumptions. If the company could further execute on improving profitability, then I may reduce my target hurdle rates, but the potential reward is insufficient for the underlying risk. I reiterate my avoid rating for Affirm Holdings stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SQ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service “Best of Breed Growth Stocks”

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best deep-dive investment reports.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!