Summary:

- Coca-Cola has a 61-year streak of dividend growth and a secure 3.1% yield, making it an attractive investment opportunity.

- The company is focusing on digital transformation and expanding into untapped global markets to drive growth.

- If Coca-Cola successfully executes its growth plans, it has the potential to deliver annual returns of over 10%.

burwellphotography

Introduction

It’s time to talk about one of the most iconic companies in the world, the Coca-Cola Company (NYSE:KO). Headquartered in Atlanta, Georgia, the company barely needs any introduction, as it is one of the largest consumer staple companies in the world.

My most recent article on the company was written on September 16, when I used the title “Coca-Cola Dividends: Reasons To Buy Vs. Reasons To Avoid.”

Here’s a part of my takeaway (emphasis added):

On one hand, if you’re seeking stability and long-term growth opportunities, KO is a solid choice. With 60 consecutive years of dividend hikes and a resilient business model, it’s a sleep-well-at-night investment. The company’s focus on top-line-led growth, especially in emerging markets, indicates a promising future.

However, there’s an underperformance issue to keep in mind. KO hasn’t kept pace with some other similar investment options over the past decade, and its 3.2% yield might not be juicy enough for everyone, especially considering subdued dividend growth. But it’s worth noting that the company is making improvements to adapt to changing market dynamics.

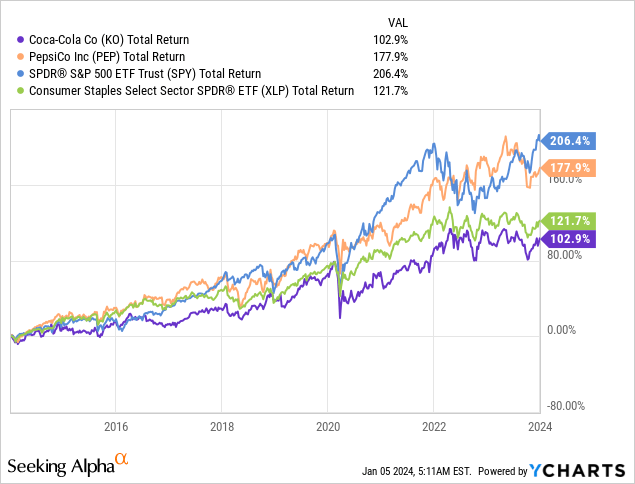

Generally speaking, the biggest issue I always had with Coca-Cola was its poor performance. As much as I liked its business and dividend growth, it wasn’t very appealing to me, which is why I opted for its peer, PepsiCo (PEP), in 2020.

Over the past ten years, KO shares have returned just 103%, including dividends. The S&P 500 returned 206%. Its peers in the Consumer Staples ETF (XLP) returned 122%.

Even worse, since my most recent article, KO shares are up 4%, which has lowered the dividend yield to 3.1%, which is nothing to write home about.

At least in my situation, I either go with a dividend stock yielding 3% or lower if it has high dividend growth or a stock with slow dividend growth if it has a higher yield.

Coca-Cola is trading in a grey area of subdued dividend growth and a yield that isn’t high enough to classify as a typical “high-yield.”

However, the situation isn’t half bad, as the company is still bringing a lot of value to the table, mainly thanks to business improvements.

So, in this article, we’ll assess the risk/reward of owning one of Buffett’s biggest holdings.

The KO Dividend

I already started discussing the dividend in the lengthy introduction.

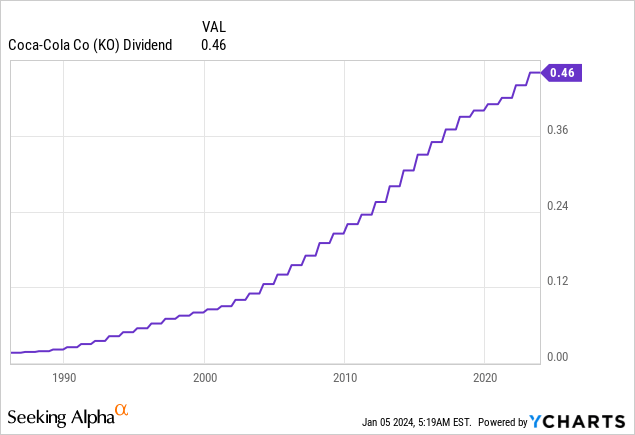

The company currently yields 3.1%, which is based on a $0.46 per share quarterly dividend.

On February 16, 2023, the company hiked its dividend by 4.5%, which is a bit above the five-year dividend CAGR of 3.4%.

The company has hiked its dividend for 61 consecutive years, which gives the company one of the longest uninterrupted dividend growth streaks on Wall Street.

Even better, the dividend is safe.

- This year (2024), the company is expected to generate $2.80 in earnings per share. This translates to a payout ratio of 66%.

- $10.5 billion… That’s how much the company is expected to generate in free cash flow this year. This translates to a 4.1% free cash flow yield and a 76% cash payout ratio.

- The company is expected to end this year with $25.3 billion in net debt. Although this may sound like a lot, it is just 1.7x expected EBITDA, which is a very healthy net leverage ratio. It also has an A+ credit rating, making it one of the safest companies on Wall Street.

So far, so good.

The problem is growth. After all, when I go with a ~3% yield, I want to own a company that is capable of delivering a solid total return (capital gains + dividends), as a yield of 3% is not enough to make it an income stock.

Betting On Growth

As some readers may have noticed, I started to pull the valuation parts of my articles a bit forward in some cases. I do this to assess the developments behind these expectations in the second half of my article.

Using the data in the chart below:

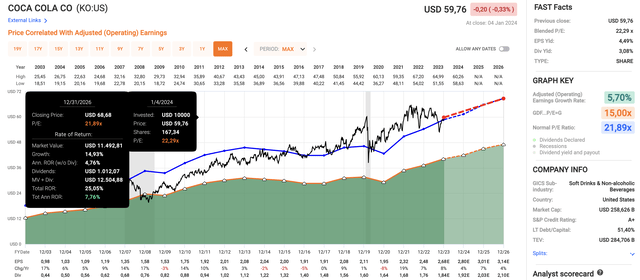

- KO is expected to maintain consistent earnings per share growth. After a few years of negative EPS growth caused by streamlining the business, the company is expected to see 5% average EPS growth through 2026. It is expected to see 4% growth in 2024, 7% growth in 2025, and a return to 4% in 2026.

- The company currently trades at a blended P/E ratio of 22.3x, which is a bit above its long-term normalized multiple of 21.9x.

- A return to 21.9x earnings by incorporation of expected EPS growth rates and its 3.1% dividend implies an annual return of 7.8% through 2026.

- Since 2003, KO shares have returned 6.5% per year, which implies a higher-than-usual growth path.

FAST Graphs

Moreover, although a 7.8% expected annual total return isn’t very high, the S&P 500’s expected annual return (using the same logic as in the chart above) is 7.1%.

In other words, while I (personally) would prefer to buy KO on a 5% to 10% stock price correction, I cannot make the case that KO offers poor value in this market, especially because the company is doing well.

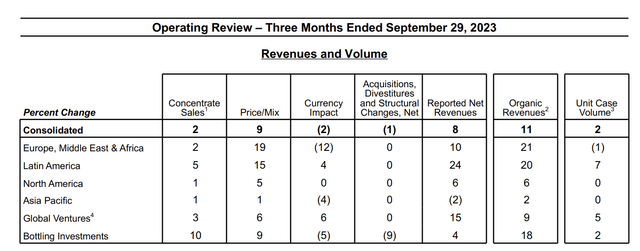

For example, in its third quarter, the company achieved an impressive 11% growth in organic revenues, reflecting robust market demand and effective strategic positioning.

Coca-Cola Company

Furthermore, maintaining positive volume growth in every quarter since the beginning of 2021, even when excluding the impact of suspending operations in Russia, shows the resilience and adaptability of the business to challenging circumstances.

On top of that, the comparable gross margin expanded by approximately 130 basis points, primarily due to underlying expansion and the benefits derived from bottler refranchising.

Even better, the company achieved volume and value share gains in both at-home and away-from-home channels, which shows its ability to capture market share in competitive environments.

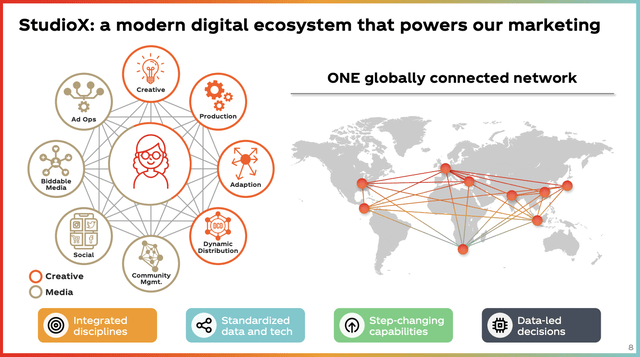

A big part of this success is based on the company’s digital transformation, with a significant shift in media spend towards digital channels.

Digital campaigns, such as Coke with Meals, Sprite Heat Happens, and Fuze Tea’s Made of Fusion, have resulted in high engagement.

Now, the company is leveraging generative AI in marketing with initiatives like Create Real Magic and Coke Y3000, which is a great way to stay on top of the aggressive marketing battle with its peers.

Coca-Cola Company

Coca-Cola gave us more details on its growth plans during last month’s Morgan Stanley Global Consumer & Retail Conference.

Essentially, the plan is not only to grow in mature markets like the United States and Europe but to focus on growth markets.

With that in mind, the company’s international development segment spans Latin America, Asia Pacific, Africa, Eurasia, and the Middle East. This geographic diversity presents significant market opportunities.

The territories covered are characterized by a relatively low per capita consumption of soft drinks and non-alcoholic ready-to-drink (“NRTD”) beverages, indicating substantial room for growth.

These markets are still in the early stages of development, providing ample opportunities for the company to expand its presence.

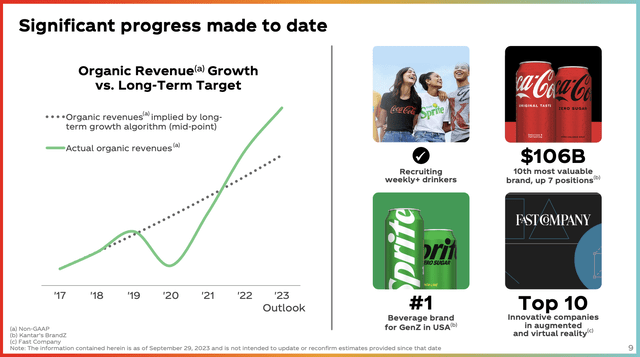

Coca-Cola Company

As we can see above, the company is currently growing above its long-term growth trend, which should continue to be fueled by international growth.

Adding to that, the aforementioned growth markets contribute to the company’s target of achieving 4% to 6% top-line growth and 7% to 9% earnings growth.

If the company were to achieve between 7% and 9% long-term earnings growth, it could return between 10% and 12% per year on the stock market, including its dividend, and without valuation changes.

That’s above the implied 7% to 8% annual return I showed earlier in this article.

The company’s objectives in the international development segment include accelerating growth, enhancing capabilities, and emphasizing network development with bottlers.

To achieve this, efforts have been made to lift and shift capabilities across markets, particularly focusing on revenue growth management (“RGM”) capabilities.

Coca-Cola Company

With regard to RGM, the company noted that this is considered a continuous iteration process that caters to both developed and emerging markets.

The fastest-growing opportunities are observed in developing markets, where building RGM capabilities accelerates potential growth.

India serves as a prime example, with a focus on sequencing brand expansion and leveraging data insights to drive sustainable growth.

Meanwhile, the aforementioned AI marketing investments are leveraging first-party data, such as transaction information from vending machines in Japan and eB2B platforms, enabling the company to gain valuable insights.

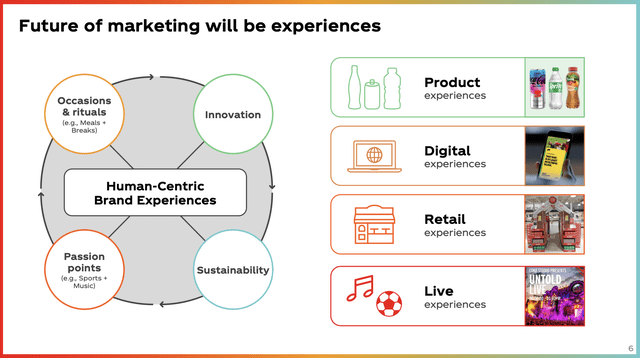

The goal is to focus marketing on experiences instead of only getting the word out about a certain product.

In today’s environment, where people have an attention span of a few milliseconds (it feels like it sometimes), marketing somewhat needs to be reinvented.

Coca-Cola Company

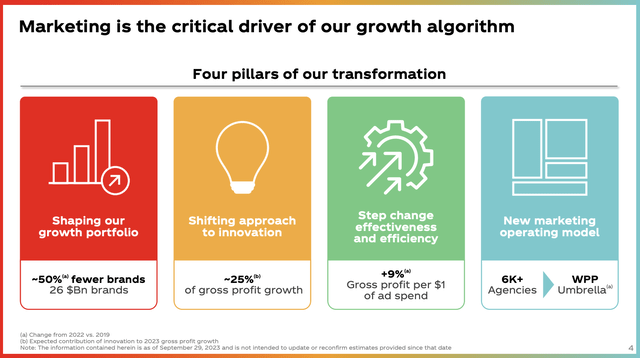

The goal is to not only streamline the company, which Coca-Cola has done in the past five years, but to emerge with a model of up to 50% fewer brands, a bigger focus on product innovation, more efficient operations, and an advanced marketing model.

In other words, the company focuses on quality over quantity when it comes to products and uses new technological developments to improve margins and marketing.

Coca-Cola Company

If the company is successful, it can gain market share in developed markets and significantly grow in emerging markets, where market penetration is much lower.

As such, while Coca-Cola can realistically return between 7% and 8% in the years ahead, it has a path to over 10% annual returns if it is able to perfectly execute its growth plans.

That is enough for me to maintain a Buy rating on the stock.

Takeaway

In the ever-evolving landscape of competitive consumer staple investments, Coca-Cola emerges as an attractive opportunity.

Beyond the fizz of its iconic beverage, the company’s strength lies in its 61-year streak of dividend growth and a secure 3.1% yield.

However, what sets Coca-Cola apart is its strategic pivot – a digital revolution and a targeted focus on untapped global markets. Q3 showcased robust results, affirming its adaptability and market resilience.

Crucially, the company’s commitment to a leaner, innovation-driven model promises something special.

With a potential annual total return surpassing 10%, Coca-Cola’s journey into streamlined efficiency, cutting-edge marketing, and expansion into emerging markets could unfold as a recipe for not just financial growth but for an improved brand and longer-term growth potential.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PEP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.