Summary:

- Thermo Fisher Scientific revises full-year revenue guidance due to sluggish growth in China and diminishing COVID-related revenue.

- The company has experienced solid organic growth driven by the pharmaceutical and biotech industry, new product launches, and the impact of the global pandemic.

- Acquisitions have been a significant driver of growth for Thermo Fisher, with successful integration and expansion of their global portfolio.

JHVEPhoto

Thermo Fisher Scientific (NYSE:TMO) has revised their full-year revenue guidance, attributing the adjustment to a 1% core organic growth, primarily influenced by sluggish growth in China and the diminishing impact of COVID-related revenue. Their outlook for FY24’s core organic revenue growth mirrors the levels seen in FY23, indicating another year of modest expansion. In light of these factors, I am initiating coverage with a ‘Hold’ rating and assigning a fair value of $510 per share.

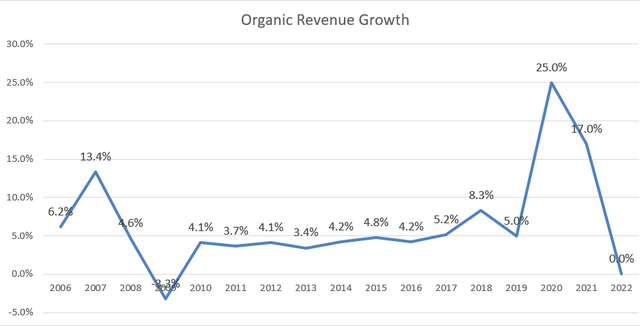

Solid Organic Growth in the Past Driven by Pharma and Biotech Growth

Thermo Fisher offers a diverse range of medical devices, consumables, diagnostics, analytical instruments, and lab products for the life science and industrial industries. Services and consumables constitute 82% of total revenue, making them a highly recurring aspect of the business. Over the past decade, the company has experienced robust organic revenue growth, averaging 7.7% annually.

Their growth is propelled by several key factors. Firstly, with 58% of revenue exposure in the pharmaceutical and biotech industry, Thermo Fisher’s portfolio of reagents, instruments, and consumables plays a crucial role in biological and medical research, as well as the discovery and production of new drugs and vaccines. The recent advancements in mRNA and stem cell technologies have further amplified growth opportunities for Thermo Fisher.

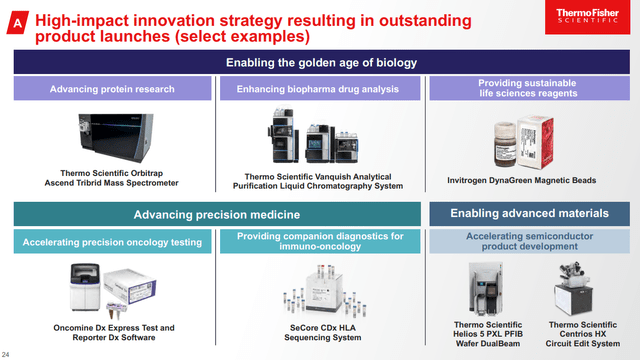

Secondly, Thermo Fisher has demonstrated a commitment to innovation through consistent new product launches. With a team of 7,300 R&D scientists and engineers and an annual R&D spending of almost $1.5 billion, the company is well-positioned for the design and launch of cutting-edge products.

The introduction of new product launches not only positions them to gain market share but also contributes to an improvement in their gross margins.

Lastly, the recent global pandemic significantly bolstered their growth and revenue profile. Thermo Fisher’s solutions experienced heightened demand for COVID testing, as well as increased demand for therapies and vaccines. However, it’s important to note that their growth has been impacted in the post-pandemic period.

Covid Related Revenue Fading Away

During Q3 FY23, Covid-19 testing revenue experienced a 4% year-over-year decline. Anticipating a run-off of $1.3 billion in COVID-related revenue in 2024, by the end of FY24, such revenue will constitute only 3% of the group’s total revenue. To provide context, COVID-related revenue accounted for more than 18% of the group’s total revenue in FY21, representing a peak in revenue. In essence, Thermo Fisher is navigating past the significant COVID-related revenue peak, and the financial impact moving forward is expected to be minimal.

Weak China Growth

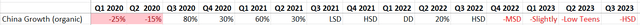

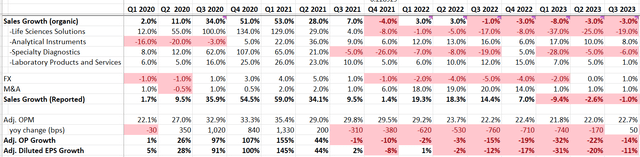

Historically, China accounted for around 10% of the group’s revenue, displaying double-digit growth and contributing 1-2% of organic revenue growth to the overall group. However, in the post-COVID era, the Chinese economy began to contract, leading to a decline in healthcare spending. Consequently, Thermo Fisher witnessed negative growth in this region, as depicted in the table below.

In FY24, I anticipate Thermo Fisher will persist in facing growth headwinds in China. During the pandemic, Chinese local governments allocated substantial funds towards COVID testing and implementing city lockdowns. Presently, these local governments are grappling with tight budgets and funding constraints. Additionally, the Chinese government initiated a healthcare anti-corruption campaign last year, contributing to ongoing downturns in healthcare spending in China. Consequently, I do not foresee a turnaround for Thermo Fisher in China in the near future.

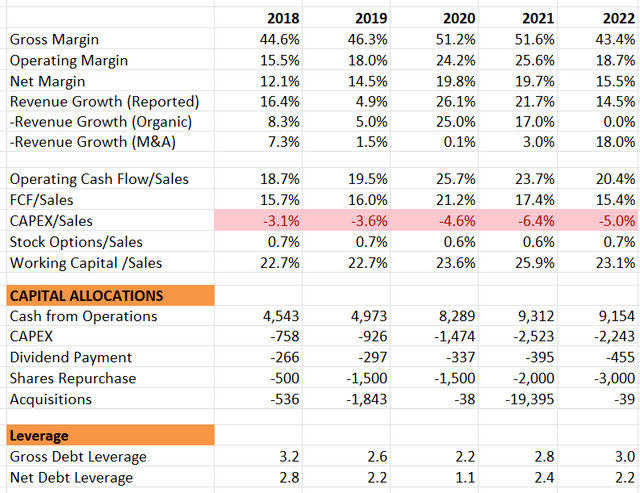

Acquisition Growth

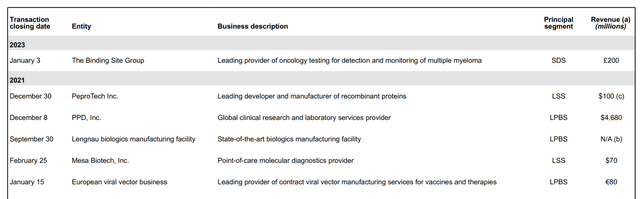

Acquisitions stand out as a significant driver of growth for Thermo Fisher. As illustrated in the table below, M&A activities are contributing substantially to the company’s top-line growth.

In terms of capital allocation, Thermo Fisher has predominantly directed its cash towards share repurchases and acquisitions. Despite the relatively modest dividend payments compared to the substantial cash generated from operations, the company boasts a commendable long-term track record in effectively integrating acquired companies. Furthermore, their balance sheet remains robust, with a gross debt leverage of approximately 3x.

One of Thermo Fisher’s most recent significant deals involves the acquisition of PPD for $17.4 billion, a global clinical research and lab services provider. This strategic move positions Thermo Fisher to broaden its presence in the global CRO market. Anticipating substantial revenue and cost synergies, the acquisition is particularly advantageous due to the shared customer base and the ease of integration for the back office and sales teams into Thermo Fisher’s global business model.

In October 2013, Thermo Fisher acquired Olink for $3.1 billion, a leader in next-generation proteomics. Olink’s solutions offer biopharmaceutical companies and leading academic researchers a rapid and efficient understanding of disease at the protein level. Once again, the companies share a similar customer base in the life sciences sector. These strategic acquisitions have significantly expanded Thermo Fisher’s global portfolio.

Financial Review and FY24 Preview

Over the past decade, Thermo Fisher achieved an average organic revenue growth of 7.7%, with acquisitions contributing an additional average of 7.1%. Leveraging their operating efficiency, the company’s margin expanded from 19.5% in FY13 to 24.5% in FY22. This impressive performance underscores Thermo Fisher’s status as a growth company with a high-recurring business model.

In Q3 FY23, Thermo Fisher experienced a 3% decline in organic revenue and an 11% drop in adjusted EPS year-over-year, primarily attributable to the weakened growth in China and a decline in COVID-related business. Their year-to-date free cash flow amounted to $3.7 billion, with net capital expenditures of $1 billion, and the gross debt leverage stood at 2.7x by the end of the quarter. Undoubtedly, the business is currently in a cyclical downturn.

For FY23, Thermo Fisher’s guidance indicates an expected revenue of $42.7 billion, with a core organic revenue growth of 1% and an adjusted EPS of $21.50. I do not anticipate any surprises in their FY23 results, considering they have already factored in the weakened growth in COVID-related business and China.

As for the FY24 guidance, they project a similar core organic revenue growth level as FY23. It appears that the initial FY24 guidance has already accounted for market downturns and various growth headwinds, making it a reasonable projection to me.

Valuation

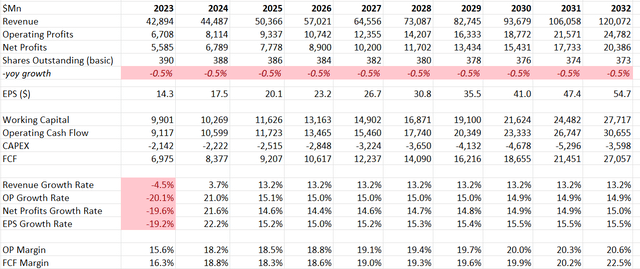

The model’s assumptions for both FY23 and FY24 are aligning with Thermo Fisher’s guidance. For the normalized period, I assume a 7.5% organic revenue growth and a 5.7% acquisition growth, closely mirroring their historical averages.

TMO DCF – Author’s Calculation

Given Thermo Fisher’s consistent long-term record of margin expansion, I anticipate the continuation of operating leverage. Additionally, their new product offerings have the potential to enhance gross margins in the future. Based on my calculations, it seems plausible for them to achieve an annual 30bps margin expansion.

The model employs a 10% discount rate, 4% terminal growth, and a 10% tax rate, resulting in an estimated fair value of $510 per share.

Key Risks

Apart from the challenges posed by China and the weakened COVID-related business, the current high-interest rate environment poses concerns for the entire pharmaceutical and biotech industry, particularly impacting mid-sized and small startups. Funding constraints could lead to a pause in new drug and therapeutics developments, potentially creating growth headwinds for Thermo Fisher.

Furthermore, it’s advisable for investors to closely monitor Thermo Fisher’s debt leverage in the future. The quarter ended with $6.2 billion in cash and $35.3 billion in total debts, a substantial amount compared to other medical device companies.

Verdict

While recognizing Thermo Fisher as a well-managed growth company, it’s important to acknowledge the significant growth headwinds they currently face in the near term. Consequently, I am initiating coverage with a ‘Hold’ rating and assigning a fair value of $510 per share.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.