Summary:

- AT&T Inc.’s spinoff of Lucent in 1996 proved to be a successful move, leading to higher valuations for both companies.

- The Walt Disney Company similarly should consider spinoffs of its units to unlock shareholder value and address the challenges it faces in the changing entertainment industry.

- A spinoff could help Disney reduce its debt, become more nimble, and focus on specific markets, potentially leading to higher stock valuations.

Joe Raedle

Let’s agree that in recent years, AT&T Inc. (T) is not exactly a role model for how a mega-cap company can thrive in a complex, swiftly changing economic universe.

But that wasn’t always the case for Ma Bell. In earlier years, there was a fundamental corporate wisdom accelerated by forces both in and out of government that led to the historic 1996 spinoff of AT&T’s equipment business: Lucent.

It could not have been an easy decision. Bear in mind that Lucent included the global tech gem Bell Labs. And the timing, at the cusp of the tech revolution, could not have been better. The deal that eventually poured rich rewards on shareholders eventually sent Lucent into a succession of mergers to where it now sits: it’s a unit of Nokia (NOK), churning out one success after another. Forced to break up, in the end it proved a bonanza for patient investors who watched the parts outperform the whole. It can be a teaching moment for DIS.

The subsequent, more recent disaster of AT&T when it acquired Warner Bros. Discovery (WBD) notwithstanding, this was an example of how a spinoff under certain circumstances trumps efforts at just selling divisions. Its surely a crust of hard bread for big fans of the present company to swallow, i.e., the realization of just how outdated the DIS business model has become.

Skeptics may well conclude that this comparison of AT&T to DIS is a stretch in applying a spinoff in a tech sector to a consumer discretionary one built off entirely different business models. I agree that this comparative takes a bit of suspended disbelief. But on closer examination, we see a major pivot that has DIS, in our view, facing similar challenges in that it is sitting on assets which to an extent are melting ice cubes should they continue under the DIS banner. The company may be too outgrown to grow further. But as separate companies, they could well form the basis for much higher valuations.

True, the DOJ is no player here. But conceptually, judicious spinoffs of DIS units could work well in my view: you have a giant, complex enterprise that has by acquisition grown unwieldly. And you have an asset portfolio that can easily be seen to be worth far more in parts than the current whole.

Moved into spinoffs of some shoulder units, a new world of possibilities is captured, creating companies that will be pure plays with less debt, less corporate overhead, and a better potential earnings profile targeting more specific markets.

Above: New world, new same old mantras from management that needs to see the wall and the writing on it.

A spinoff vs. a sale

Nobody yet knows what Xs and Os may lie in the Nelson Peltz game playbook as the activist lines up his artillery for the coming proxy fight. Some pundits are already pronouncing Nelson’s foray dead on arrival. Time will tell. But this much is true: DIS is better off averting what may become an ugly, time-consuming, and expensive pose and gesture pillow fight between the opponents and instead consider major restructuring of its business, including spinsoffs.

Google

Above: The Disney businesses are too many and too complex to compete on too many fronts all at once.

Spin off the spinnable

I have long been a fan of DIS selling off assets which do not really fit in the company of 2024. ESPN and ABC-TV are among those businesses acquired during or before the halcyon days when Michael Eisner and David Katzenberg saw a DIS business like a tower of Christmas gifts only waiting to be opened. Every walking, breathing human being on earth was a potential DIS customer as long as they had functioning eyeballs was their mantra.

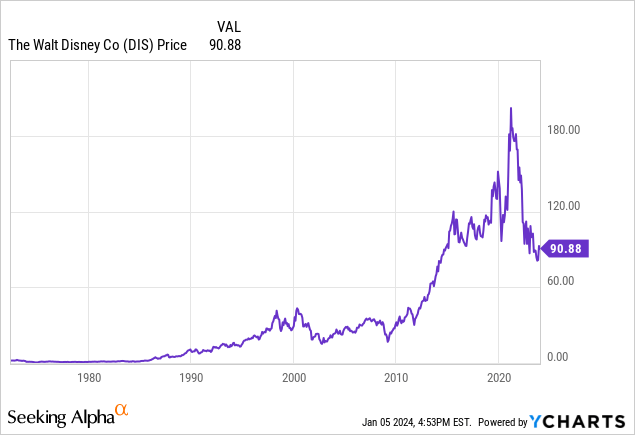

And over the Eisner and Katzenberg tenure, it proved true to a great extent. But clearly the world in which they entered DIS in the 1980s was a different planet to what entertainment and media operators face today. So, nursing and tweaking the business model of that time makes it hard to fathom how DIS shares can once more rappel up to the Olympian heights they once enjoyed. The company has become harder to understand in this industry of constant flux and challenges.

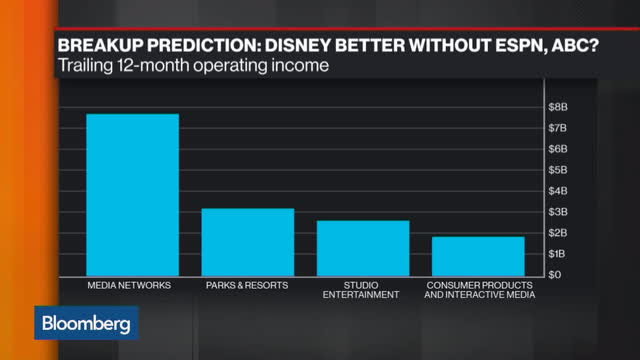

Above: Four possibly great businesses with a possible aggregate valuation significantly above $90 a share.

We are in a totally new world formed in the crucible of fire that was covid, streaming losses, inflation, and – God help us all – AI. So one and a half cheers for what DIS has done thus far to repair the self and market-inflicted damage to its model. But it’s hard to see how such moves can ultimately cut down the massive debt load, turn profitable on streaming as long as there are so many players in the sector fighting tooth and nail for new signups at untenable costs.

Selling assets off is a tedious tire-kicking exercise, and more often than not results in the sold units becoming the same orphans they were only under new logos.

The AT&T history is analogous — regardless of the different world in which it lived — because it would have been easy-peasy to just sell off the units. But the spinoff of the baby bells and Lucent in the end made greater sense for loyal shareholders, which in turn kept the stock strong. Ultimately, the payoff for investors was huge.

First forced by government to form the baby bells in 1984, AT&T went on over decades to reinvent itself by spinoffs that rationalized its many businesses into three discrete areas: communications (AT&T), equipment (Lucent), and NCR morphing into computers.

But the beginning of tire-kicking now among media moguls circling the most apparent companies ripest to be plucked is Paramount Global (PARA) and, not too far away, Lion’s Gate (LGF.A). But LGA just made the move to spin off before the bargain hunters began to make noise. They have separated the studio to a $4.3b SPAC deal. This may well portend a trend, as we see how the new LGA spinoff trades from this point forward and starts chin-stroking.

With today’s DIS, as it is now constituted, it appears that CEO Bob Iger and company see no wall and no writing. The tweaks and swinging cutlasses at costs thus far announced are fine as holding actions. But they do not, in my view, address the core challenges ahead: A new DIS for a new world.

Valuing spinoffs: DIS a perfect candidate

Structuring a spinoff scenario for DIS units lies well above my pay grade, or is best left to bankers and lawyers who form and monitor these corporate divorces. There are immediate wins, including losing the massive costs of bureaucracy and excess navel contemplation that goes with any behemoth the size of DIS. On the other hand, a spinoff is like the savvy move of a big time bookie taking on huge bets, who lays off some of the action to hedge his risk if the odds fail him with an upset. DIS can lay off its debt burden across one or multiple spinoffs.

The process isn’t easy, but it has become well-defined over time.

The process:

- Value the proportion of the spinoff stock.

- Prepare a cost basis of the original stock. Calculate the cost basis of the spinoff.

- Input earnings per share. Calculate the discounted cash flow, or DCF, value, separation costs, tax implications.

- Debt and equity structure assignable, survey employee retention possibilities, average cost basis, total amount of spent and planned capex.

At writing, DIS stock trades at around $90. Bear this number in mind in terms of this blueprint for a restructured DIS with four units spun off into this theoretical division. Our operating assumption here is that this aligns the company and its core addressable customer base closest to providing a clearer valuation of its targets. And it springs loose the most efficient use of capital with highly management debt.

The DIS revenue breakdown by segment now

Total revenue 2023: $90b

Segment (rounded) Percentage of revenue

Linear networks 36%

Content production, licensing etc. 11%

DTC 21%

Parks and experiences 33%

Largest single contributor to profit : Parks at 62%.

Think of the above as four separate businesses, each one beginning a life with a hefty multi-billion dollar revenue basis, sharing what was the debt load and bringing much greater clarity to investors in valuing their stocks.

We don’t imply that the segments noted above should be rationalized as existing. There are much more coherent assemblages, for sure. For example: The ABC television networks and ESPN together trading as a new entity would seem to make sense. A Disney+ standalone business as a great pure play head-to-head against Netflix (NFLX) likewise seems logical to us at this point.

Ask yourself this: If these four units were spun off in a massive move like that of Ma Bell creating the baby Bells, would you agree that the market would eventually value the parts far above the whole?

Synergies lost?

Today, there are clear benefits of course that all DIS units in one way or another benefit from the cross marketing and synergies of seeing a Disney customer as a viewer of filmed and TV content, a patron at the theme parks, a streaming subscriber. Yet for all its value, it does not in our view translate well in the new marketplace of a budget-challenged customer basis on the continuous hunt for bargain deals.

The price elasticity, once a given for DIS products, has failed in the crucible of stretched entertainment budgets. The poster child for this has been the disaster of the Star Wars hotel project. Price pressure at parks is increasing — not to the crisis point yet — but given the stubborn inflation, is likely to reach a breaking point that could impact attendance big-time. A smaller, more nimble parks business could probably be run on a better gross margin ex assigned overhead costs of DIS.

And finally, DIS IP, like that of its many competitors, is rapidly aging out. The superhero genre is getting tired, the old DIS animated characters are not the pop culture icons they once were. Trotting out old IP animation wine in new live action bottles is another fail. DIS needs to refresh its creative chops for certain. Whether that can happen under its current form is questionable. And the DEI fortress DIS has built is also long past its sell date, as even Iger has acknowledged it may not fit as snugly in smaller companies.

Conclusion

Spinning off one or more The Walt Disney Company businesses with the objective of making the company’s task in carving down its debt faster, becoming more nimble in attacking narrower but deeper markets, would go a long way to unlocking shareholder value. Dividends, increasing EBITDA recovery, buybacks, cost-cutting can all contribute. But it could be a tedious, long term process that could possibly move the shares to higher ground.

A judicious spinoff or spinoffs would be quicker, more well defined to understand, and benefit all who have skin in the DIS game. A Lucent spinoff traded at $26 at the open. For those with patience, it went to $116. You can make a case that a similar run could well be in the cards for DIS shareholders if the company got real about paving a new path to what could be a great future.

We invite readers to take a banker’s look at DIS and do the quick math of the value of a judicious, logical spinoff of some of its businesses. Then agree or disagree as to whether the total value of the resultant stock would not be greater than $90.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

The House Edge is widely recognized as the only marketplace service on the casino/gaming/online sports betting sectors, researched, written and available to SA readers by Howard Jay Klein, a 30 year c-suite veteran of the gaming industry. His inside out information and on the ground know how benefits from this unique perspective and his network of friends, former associates and colleagues in the industry contribute to a viewpoint has consistently produced superior returns. The House Edge consistently outperforms many standard analyst guidance with top returns.

According to TipRanks, Klein rates among the top 100 gaming analysts out of a global total of 10,000.