Summary:

- Despite historical success, Comcast struggles to showcase its true worth, trading at a significant discount since 2021.

- Comcast’s diverse portfolio, including broadband, wireless, business services, and streaming (Peacock), presents a compelling investment opportunity.

- Peacock’s robust cash flow, coupled with an 8.0% 2024E free cash flow yield, positions Comcast for strong long-term shareholder value.

Jeff Fusco

Introduction

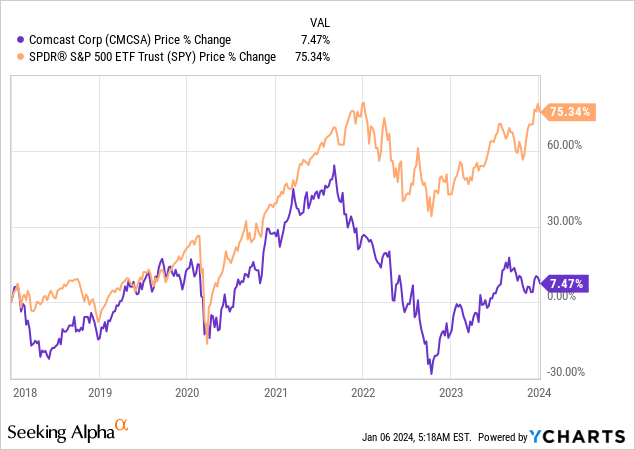

7.5%.

That’s how much Comcast Corporation (NASDAQ:CMCSA) shares have risen since January 2018. This performance is horrible, as investors in the S&P 500 made 75% during this period, with lower risks.

After all, a well-diversified basket of 500 stocks almost always has lower risks than a single stock.

My most recent article on the stock was written on August 23, 2023, when I went with the title “Comcast: Between Dead Money And Undervaluation.”

Here’s a part of my takeaway:

For now, I do not believe that CMCSA is a buy. It is much more attractive to buy companies with similar slow growth rates and higher yields or companies with more secular growth. The area in between isn’t attractive.

I will give the company a Hold rating. Investors looking to buy CMSA may be better off waiting for a correction. Given my view on the company and its valuation, I do not believe that the stock will take off anytime soon.

Since then, the stock has fallen 5.3%, while the S&P 500 has returned 5.9%.

In this article, I’ll update my bull case and focus on its valuation, which could be highly attractive if the company is able to maintain consistent growth and convince investors that it deserves to trade above its current (very subdued) valuation.

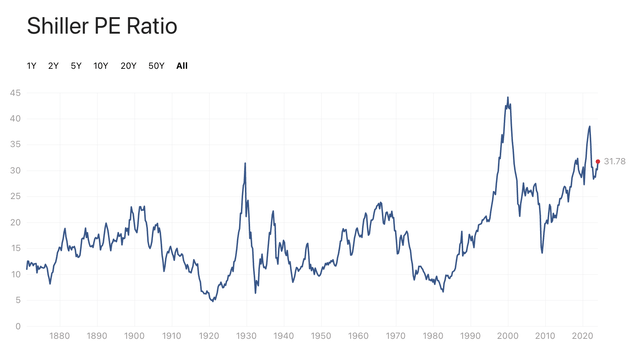

If everything goes right, CMCSA could be a highly attractive dividend growth stock in a market that is everything except cheap.

Multpl.com

So, let’s get to it!

Management Needs To Unlock Value

Comcast is not a bad company. However, it struggles to unlock shareholder value.

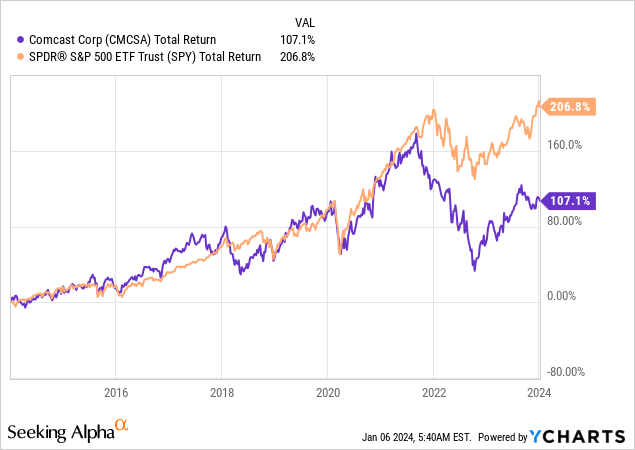

Looking at the past ten years, we see that Comcast shares have been able to keep up with the market quite well – until 2021.

Since 2021, the stock has weakened, ruining the total return picture going back to at least 2018.

However, CMCSA never turned into a “bad” company. It mainly suffers from a lack of trust.

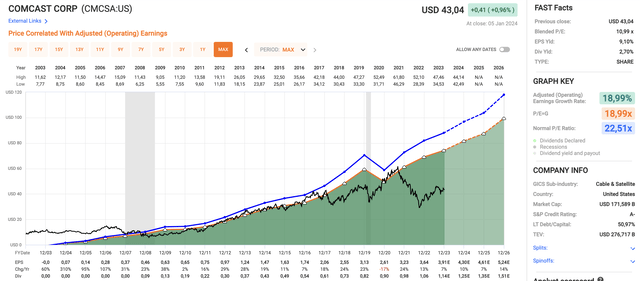

Using the data in the chart below:

- CMCSA had just one year of negative EPS growth going back to at least 2003.

- 2023 is expected to see 7% EPS growth, followed by 10% growth in 2024, 7% growth in 2025, and 14% growth in 2025. While these numbers are obviously subject to change, they show that analysts expect the company to maintain consistent EPS growth.

FAST Graphs

As we can see in the chart above, the stock has a normalized valuation of 22.5x earnings (the blue line). Until the pandemic years, this line has guided the stock price very well.

Since 2021, the stock has started to trade at a discount. Currently, CMCSA trades at just 11x earnings! That’s a blended P/E ratio consisting of the last twelve months and the next twelve months’ earnings per share.

In other words, if the stock were to get a valuation close to 20x earnings (by incorporation of the expected EPS growth rates), it would be trading at its prior all-time high, which is roughly 50% above its current price.

However, for value to be unlocked, two things need to happen:

- EPS growth needs to come in as expected (or better).

- Investors need a reason to give the stock a higher valuation.

In other words, growing the business is not enough. CMCSA needs to make the case that it has a bulletproof business capable of consistent long-term growth well beyond 2026.

It also needs rates to come down, as I will explain in this article.

How Comcast Is Growing Its Business

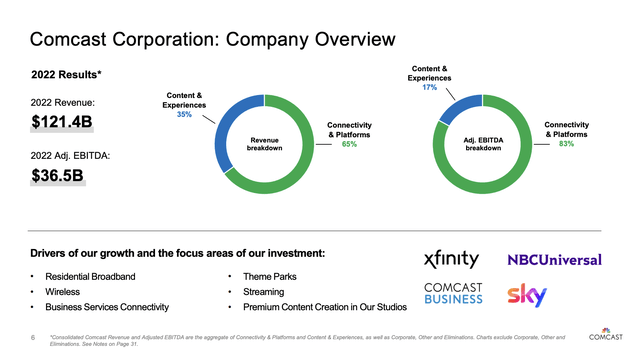

In its most recent full year (2022), the company generated more than $120 billion in revenue, most of it coming from Connectivity & Platforms.

The company, which is the number one broadband provider in the United States, operates in a highly competitive industry with significant secular growth drivers.

I believe that uncertainty with regard to the future of its industry is what keeps investors at bay – despite its good results.

Comcast Corporation

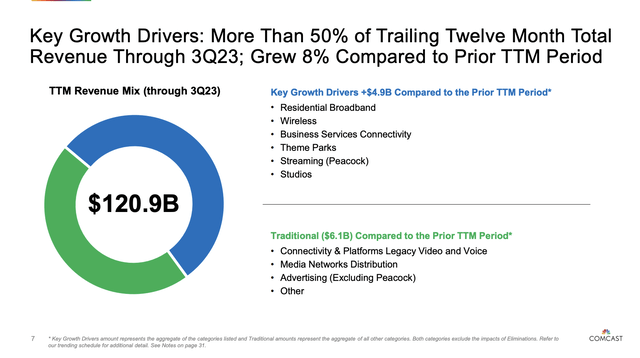

During last month’s UBS Global TMT Conference, the company elaborated on its path to sustained growth.

At the start of the conference, the company was asked about its below-GDP revenue growth and its strategy to drive higher revenue growth.

Michael Cavanagh, the President of Comcast, emphasized the company’s commitment to top-line growth and outlined the six key businesses contributing over 50% of their revenues, which are expected to provide the company with significant growth on a prolonged basis, with total business exposure rising from 50% to 75%.

Comcast Corporation

Residential Broadband: Comcast’s residential broadband segment, which has 32 million subscribers, plays a pivotal role in the company’s growth story.

The increasing demand for high-speed internet services, coupled with a growing trend in data consumption, presents a significant tailwind.

The strategic focus on enhancing network capabilities, including advancements in DOCSIS technology, positions Comcast to meet and exceed customer expectations.

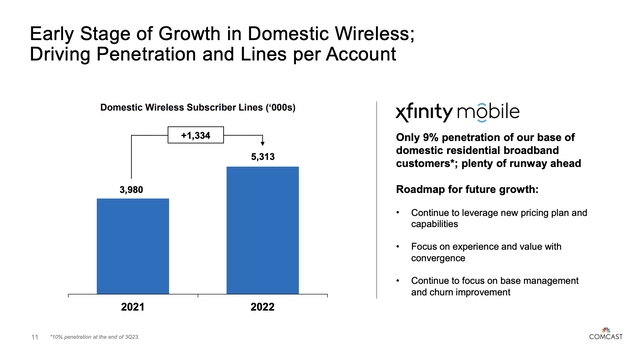

Wireless Business: The company’s wireless business, with approximately 6 million lines and a revenue growth of around 16% year-over-year, represents a growth opportunity.

With 5G technology gaining prominence and the proliferation of connected devices, Comcast believes it is well-positioned to capitalize on the expanding wireless market.

Comcast Corporation

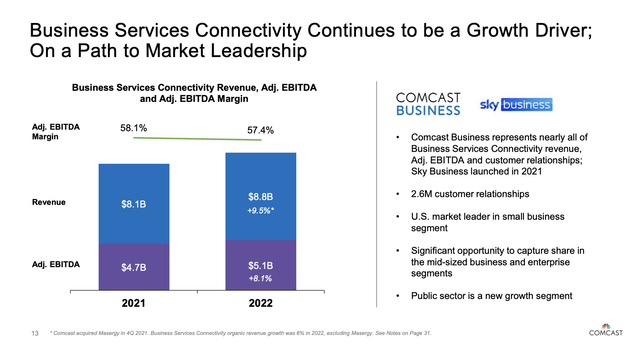

Business Services: Comcast’s business services segment, which contributes nearly $10 billion in revenues with 60% incremental margins, presents a lucrative avenue for growth.

As connectivity becomes increasingly critical for enterprises and mid-market businesses, Comcast’s focus on expanding into these segments aligns with the broader industry trends.

According to the company, the ongoing investments in technology and infrastructure, coupled with a disciplined approach to cost management, position it to tap into the evolving needs of the business community.

Comcast Corporation

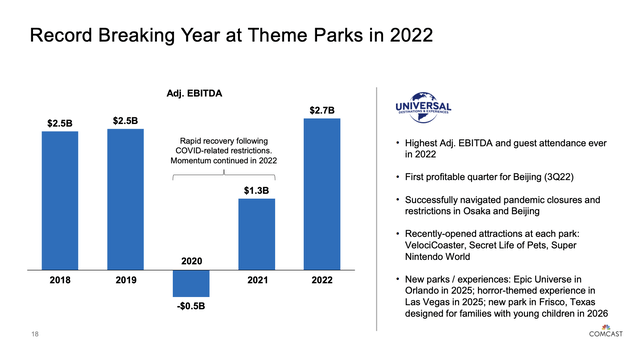

Theme Parks: Comcast’s theme parks business is experiencing remarkable growth, with ongoing investments in new attractions and experiences.

The company’s strategic approach to theme parks aligns with the rising demand for immersive entertainment experiences.

While I am not at all a fan of theme parks, I cannot deny that the company is right when it focuses on “immersive” experiences, as this is the go-to trend in both entertainment and marketing.

As we can see below, 2022 was a record-breaking year for its theme parks.

Comcast Corporation

Growth continued in 2023, as the third quarter saw 20.0% year-over-year adjusted EBITDA growth.

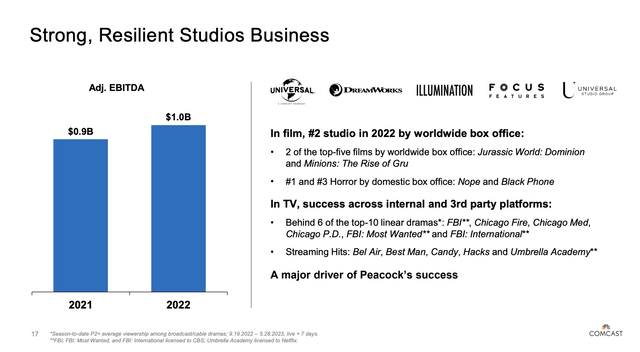

Related to entertainment, Comcast’s studios business, which is consistently ranking in the Top 2 in box office performance, shows the company’s success in content creation.

Comcast Corporation

As the PowerPoint slide above shows, the studio business is a major driver of Peacock’s success, which is growth driver number six.

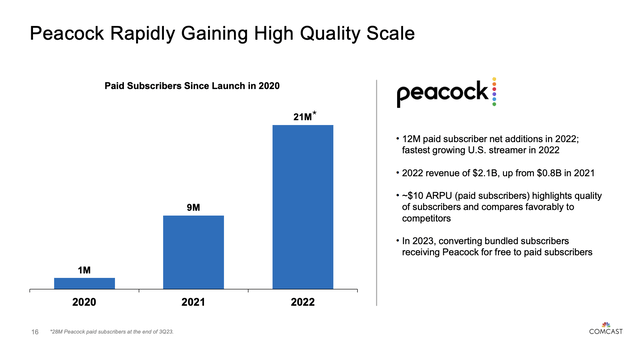

Streaming (Peacock): The company’s streaming segment, which is represented by Peacock, has achieved significant milestones. It currently has around 30 million paying subscribers.

In a competitive streaming environment, Comcast believes that its ability to carve a niche with a domestic service and achieve a substantial subscriber base is a major growth driver.

With a focus on unique content, strategic partnerships, and technological advancements, Peacock serves as a growth engine in the digital streaming realm.

Like any major streaming service, Peacock has achieved massive growth.

In 2020, it had 1 million paid subscribers. In 2022, it had 21 million paid subscribers. As of 3Q23, that number has grown to 28 million subscribers.

In the third quarter alone, Peacock added 4 million new subscribers.

Comcast Corporation

What’s even more impressive is that Peacock is able to achieve these high growth rates despite very weak consumer sentiment.

Attractive Shareholder Distributions

On top of having ambitious growth targets, Peacock is a cash machine.

In 2023, the company is expected to generate $13.4 billion in free cash flow. This year, that number is expected to rise to $13.8 billion, followed by a potential surge to $15.4 billion in 2025.

The company has a $173 billion market cap, which implies a 2024E free cash flow yield of 8.0%.

It also has a healthy balance sheet. Although CMCSA has $92 billion in gross debt, the net leverage ratio is 2.4x.

It has an investment-grade credit rating of A-, which is extremely healthy.

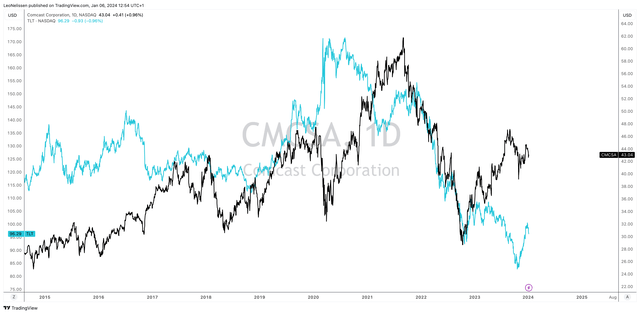

Nonetheless, I believe that its gross debt is a reason why investors avoided CMCSA when rates started to rise.

The chart below compares the CMCSA stock price to the iShares 20+ Year Treasury Bond ETF (TLT).

TradingView (CMCSA, TLT)

Going back to its free cash flow, the company has plenty of room to distribute cash.

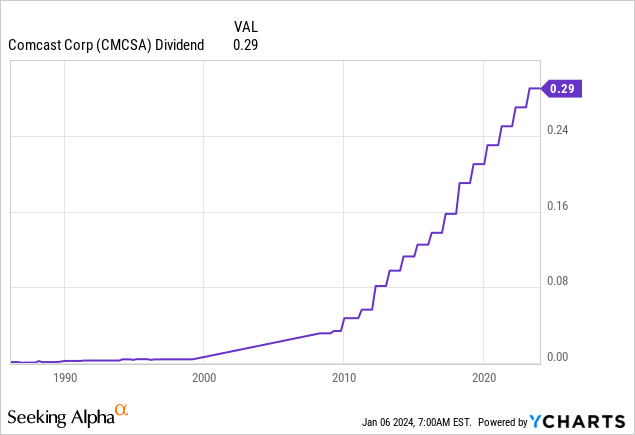

The company currently pays a quarterly dividend of $0.29 per share, which translates to a yield of 2.7%.

On January 26, this dividend was hiked by 7.4%. The five-year dividend CAGR is 8.8%.

This dividend is protected by a strong business, a healthy balance sheet, and a 27% 2024E earnings payout ratio, which is extremely low.

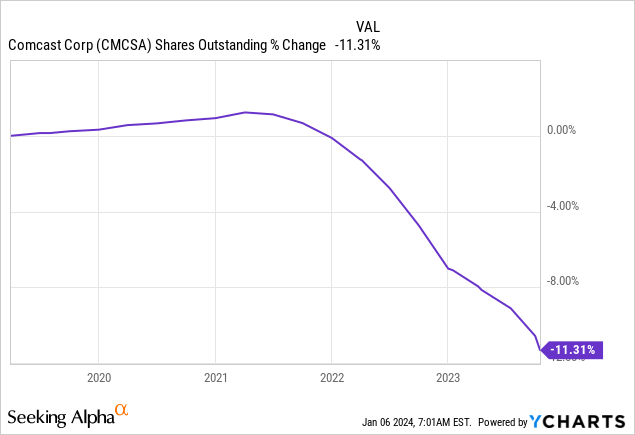

Hence, the company has room to distribute excess cash, which is used on buybacks.

Over the past five years, CMCSA has bought back 11% of its shares.

All things considered, I believe that CMCSA offers strong long-term shareholder value.

However, in order for this value to be unlocked, the company needs to be successful in managing growth projects and protect its balance sheet against what could be a prolonged period of elevated rates.

Once it is able to do this, I believe CMCSA will be able to generate consistent double-digit annual returns the moment interest rates come down further.

As a result, I am giving the stock a Buy rating, as I think CMCSA is an attractively valued stock in a market with a somewhat lofty valuation.

Takeaway

Comcast faces challenges in unlocking shareholder value, reflected in its underperformance since 2021.

Despite a history of consistent EPS growth, CMCSA’s stock trades at a substantial discount, presenting a potential investment opportunity.

Meanwhile, the company’s diversified business includes strengths in Residential Broadband, Wireless, Business Services, Theme Parks, and Streaming (Peacock).

With ambitious growth targets and robust cash generation, especially from Peacock, CMCSA boasts an attractive free cash flow yield.

Although managing growth projects and navigating interest rate challenges are crucial, the potential for double-digit annual returns makes CMCSA a compelling long-term buy, provided it successfully addresses these factors.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.