Summary:

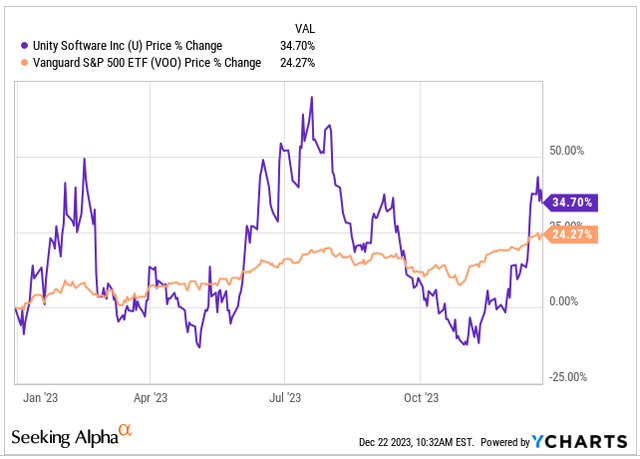

- Since the recent customer backlash over runtime fee introduction, shares have rebounded ahead of S&P 500, and risen 35% YTD.

- On the last earnings call, management pulled 4Q guidance as Unity is undergoing a product portfolio assessment and is likely to wind down some businesses.

- With a revenue contraction coming, lack of operating leverage in the existing business model, Unity is still trading at an unjustifiable premium valuation relative to peers.

Editor’s note: Seeking Alpha is proud to welcome Inevitable Investor as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

mihailomilovanovic/E+ via Getty Images

Introduction

2023 was certainly an eventful year for Unity Software (NYSE:U), with the positive being the announcement of its partnership with Apple (AAPL) for the Apple Vision Pro headset, and the negative being the disastrous pricing structure rollout that saw 1,000+ developers band together to threaten to leave the platform. Since this heavily covered debacle, changing of management has taken place, shares have rebounded, and even outpacing the S&P 500 by 10% YTD.

Outpacing the S&P500 YTD (YCharts, Seeking Alpha)

While I have been optimistic on Unity’s role in the Metaverse and Gaming industry for a few years now, management alluded to something that has shaken and broken my thesis. As such, I view Unity as overvalued and a SELL given the current weak fundamentals in its business.

Unity’s Role In The Metaverse And Gaming Industry

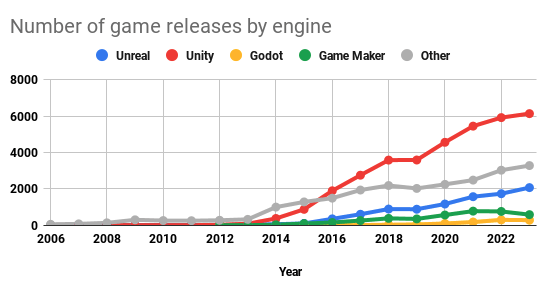

As a recap, Unity is a market leading game engine for creating 2D and 3D games, and has been used to develop 53 of the top 100 grossing mobile games. Examples of popular games developed using Unity’s game engine include Pokémon Go, Monopoly Go, Call of Duty Mobile, and Fall Guys. In the $90 billion mobile game market, Unity’s affordable pricing structure (relative to Unreal Engine) and monetisation capabilities make them a go-to solution for aspiring game developers’, as well as smaller to mid-sized game companies who desire a scalable and reliable game engine. Blogger Strahinja Milenovic, did some analysis using SteamDB data, which you can read here for a quick overview of the game engine market landscape.

Unity’s holds lion share in the game engine market (SteamDB, analysis by Strahinja Milenovic)

My past bullish thesis for Unity Software was that the company has a competitive advantage in the growing digital creator economy due to their high switching costs. The strong developer community backlash to the runtime fee introduction was so fierce, partially because their existing pipeline of games was affected, but more importantly because the switching costs of changing to a different platform are high for game developers.

So despite having dominant market share, a product with high switching costs, and a market projected to grow in low double digits till 2030, why am I down on Unity?

Reading Between The Lines

During the 3Q earnings call, Unity’s new management pulled guidance for 4Q’23, and deferred giving guidance for 2024. And when an analyst quizzed incoming CEO Jim Whitehurst on his view after assessing the business, he replied the following,

Look, the problem when you are looking to bluntly wind down or get rid of some businesses, which is part of what we’ll do is the longer you wait to do it, the better your revenue looks in the short run. I want zero incentive for anybody here to slow anything down.

We need to move, and we need to move fast. And the faster we move, the better shape we are.”

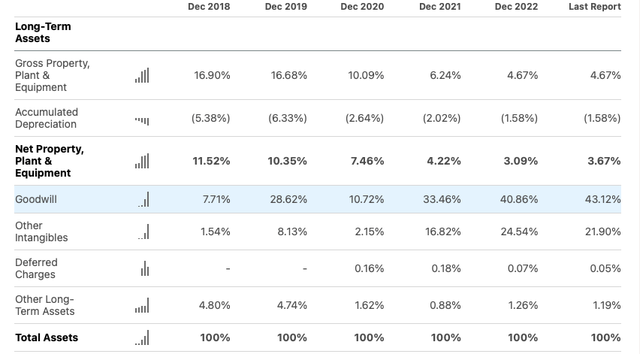

What caught my attention was the word “wind down or get rid of some businesses”. For the uninitiated, Unity Software under past CEO John Riccitiello has been on an acquisition spree post its 2020 IPO. Some of the larger acquisitions in recent memory includes Ironsource for $4.4 billion and Weta Digital for $1.6 billion. As a result of these acquisitions, goodwill stands at $3.2 billion as of Q3 end, an increase of close to $3 billion since IPO, and now represents 43% of total assets!

Goodwill at risk (Source: Seeking Alpha)

If Unity were to slow down investment or wind down those past acquisitions, Unity would potentially have to recognise a large impairment charge. However, long-term minded investors might counter that a goodwill impairment charge is a non-cash charge, and the more important to look at the outlook for revenue and free cash flow.

Financials: A Lack Of Pricing Power And Declining Profitability

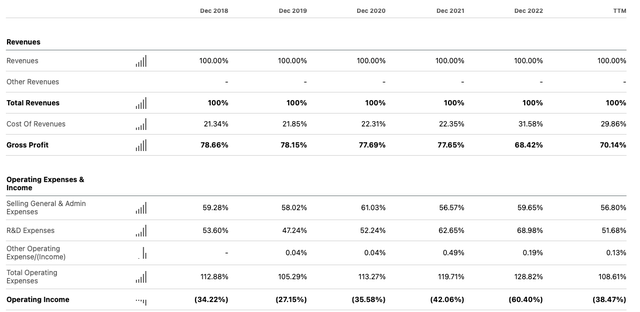

When Unity first IPO’ed in 2022, its gross profit margins were approximately 78%, but over the last two years, margins have contracted by 7 percentage points. This could be a result of inflation as server hosting costs have increased, but it is troubling that management has not been able to pass on these costs to customers in a meaningful manner.

Declining profitability (Seeking Alpha, Company filings)

But the more alarming picture is the trend on operating income. When Unity first IPO’ed, its operating profit margin was -36%, but as of the last twelve months, its operating margins have deteriorated to -38%. In simple speak, operating costs have kept pace and even accelerated at a faster pace than the 38% revenue growth. Over, its short time in the public markets, Unity has yet to prove on any modicum of operating leverage within its business model.

A rich valuation with a contraction on the way

As of 5th January 2024 closing, Unity Software trades at a forward price-to-sales multiple of 6.6x times, which feels irrationally overvalued when compared to the sector median of 2.9x times, or even against AppLovin’s (APP) ratio of 3.9x times, or even against Take-Two Interactive’s (TTWO) ratio of 4.9x times.

| In $ billions |

Dec-19 |

Dec-20 |

Dec-21 |

Dec-22 |

TTM |

| Revenues | 380.8 | 541.8 | 772.4 | 1,110.5 | 1,391.0 |

| YoY growth% | 42.29% | 42.58% | 43.77% | 25.26% | 12.24% |

Source: Seeking Alpha

This rich multiple might have been reasonable when revenue was growing at a prodigious page, as Unity has been at 38% CAGR (4-year CAGR), but given the big shifts coming to the strategic direction of the company, the last twelve months’ revenue doesn’t feel like a credible proxy for 2024. And to couple this with the lack of operating leverage within its business model as-is, its rich valuation is just not justifiable.

2 Key Risks To This Thesis

While I am bearish on the stock in the short to medium term, there are two potential upside catalysts for the stock or risks to this thesis.

The first risk is the continued adoption of the metaverse, which is an adjacent industry to gaming. Developers using Unity Software are able to develop games for Meta’s Oculus (META) or Quest headset. And in conjunction with the rollout of Apple’s Vision Pro, Unity has rolled out a development platform in beta named “Polyspatial” for Apple’s VisionOS. This new platform allows developers to port over existing games and create new experiences for Apple’s new headset.

Should the Vision Pro find success in its first year, such as selling over a million units, it could spur more developers to invest in AR/VR or Mixed Reality (MR) use cases or apps. This would, in turn, benefit Unity Software, as more developers would adopt Polyspatial.

However, one should note the Vision Pro’s high introductory price point of $3,499 and with supply chain rumours of the production complexities of the Vision Pro, analysts are forecasting less than 400,000 units to be sold in year one. In addition, when we also take into account that fellow “Magnificent 7” heavyweight Meta’s struggles with Reality Labs, I believe the overall metaverse adoption to remain placid.

The second risk that I could change sentiment to the upside, is a potential sale of Unity to a strategic buyer. Unity does have a sizeable customer base, and could be a valuable asset to the right buyer. This was illustrated in a leaked email which revealed that Mark Zuckerberg attempted to acquire Unity before in 2015. In addition, a tech name which WSJ reported is potentially undergoing a similar process is Docusign (DOCU), which also had a change in management about a year ago. Unity Software’s current interim CEO Jim Whitehurst previously led the sale of Red Hat to IBM, and I believe the board could or might be already thinking of similar options. While this is definitely an upside catalyst for Unity, it is also no secret that the regulatory bodies are giving corporates a great deal of scrutiny over M&A deals, such as in the case of Adobe’s now terminated deal to acquire Figma. Hence, I do view this risk as moderate.

The Hard Bottom Line

To conclude, Unity is a “Sell”. While a 2023 change in management was definitely warranted, it does feel a little too late, for a company which continues to hold such a large promise to the overall gaming and entertainment market. With a business and brand that is in urgent need of fixing, investors would be better served putting Unity in the penalty box.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of U either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.