Summary:

- Johnson & Johnson’s leading product, Stelara, is nearing the end of its exclusivity, which will likely slow down the growth of earnings per share.

- JNJ prioritizes growth in investments, with a focus on pharmaceuticals, medtech, and potential inorganic growth.

- JNJ anticipates launching new therapies and targeting key areas in the pharmaceutical and medtech sectors to drive growth.

BlackJack3D

Stelara, Johnson & Johnson’s (NYSE:JNJ) leading product, is nearing the end of its exclusivity outside the US by mid-2024 and in the US by early 2025. Stelara is a significant part of JNJ’s sales and operating income, making up about 13% of total sales and 24% of operating income in 2023. This loss of exclusivity will likely slow down the growth of earnings per share (EPS) for JNJ, which is a shift from their previous aim of growing EPS faster than sales. Analysts currently predict declines of 26% in 2025, 24% in 2026, and 26% in 2027, largely due to concerns surrounding Stelara. However, these concerns have overshadowed the value of Johnson & Johnson’s other products in the market.

Recent investor day highlighted growth opportunities

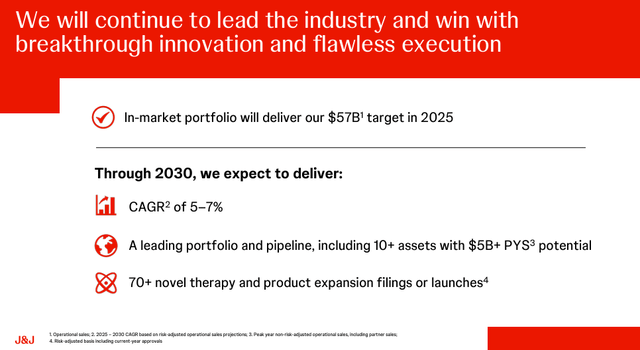

JNJ made it clear during their investor day that they now prioritize growth in their investments, contrasting with their previous emphasis on the Consumer segment. JNJ now anticipates a 5-7% annual revenue growth rate until the end of the decade, backed by substantial investment in research and development (about 17% of sales), promising new products in the pipeline, and a solid R&D plan. Although they didn’t delve much into leveraging opportunities, JNJ anticipates that their earnings per share growth will mirror their revenue growth.

The growth in expectations through 2030 is hinged on pharma, medtech, and potentially through inorganic growth.

Innovative medicine (pharmaceuticals) is the largest revenue contributor for JNJ. JNJ anticipates a 5-7% growth in this particular segment until 2030, with a minimum of 3% growth expected in 2025, despite facing biosimilar competition for Stelara. JNJ has shown robust growth in Pharma revenue, averaging around 8% over the last five years, surpassing industry peers by 200 basis points.

Company Filings

In Oncology, JNJ leads in Innovative Medicine with growth-driving therapies across various cancers like multiple myeloma, lung, bladder, and prostate. They anticipate launching about two new therapies annually until 2030, targeting seven assets with over $5 billion in potential sales and seven others between $1-5 billion. Their 2023 achievements included three approvals and five filings, with plans for 15 hematological malignancy filings, among others, from 2024 to 2030.

In Neuroscience, JNJ aims to lead the sector by 2030, targeting key areas like schizophrenia, Alzheimer’s, depression, and neuro autoantibody. Six major assets are expected to drive growth, with INVEGA and Posdinemab aiming for $5 billion+ peak sales, and other assets targeting $1-5 billion in peak sales.

In Immunology, Stelara’s loss of exclusivity poses a challenge, but JNJ focuses on non-remission patients, eyeing a market growth from $50 billion to $126.8 billion by 2030. Tremfya and oral therapies are pivotal for growth, with expectations of seven filings by 2025 and several innovative programs in the clinical pipeline.

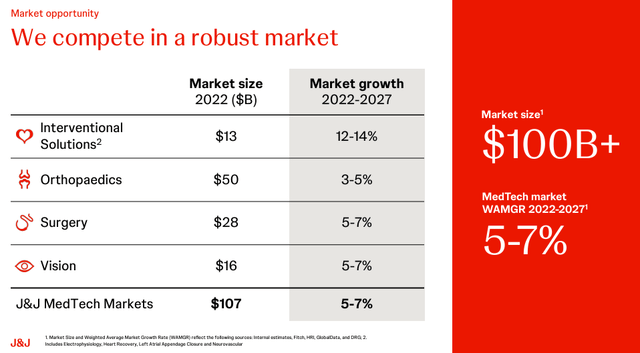

JNJ is confident about the growth potential within its Medical Technology (MedTech) sectors, projecting a 5-7% expansion over the next five years. Their aim is to position themselves at the upper echelon of this growth range. The company’s primary focus within MedTech lies in EP (making up 15% of this segment), Abiomed, surgical robotics, vision-related innovations, and orthopedics. These areas represent their core strategic priorities for development and investment.

Company Filings

Medtech is a giant $100B+ market today. JNJ’s MedTech focus lies in four core areas where it holds a strong market position: Ortho, Surgery, Interventional, and Vision. It boasts 12 $1 billion platforms, including four surpassing $2 billion, such as EP, trauma, wound closure, and contact lenses. Growth in this segment from 2017 to 2022, around 100 basis points annually, attributed to innovation, execution, expansion, procedure growth, and strategic M&A. R&D investment increased from 6.5% to 9.1% of sales during this period, aiming for one-third of 2027 revenue to stem from new products. M&A, especially in high-growth segments, also contributes to JNJ’s growth strategy.

Interventional MedTech addresses a $7 billion market (2022) expected to grow to $13 billion by 2027, primarily driven by electrophysiology and Afib treatment, which is currently underpenetrated. Abiomed’s inclusion widens JNJ’s market potential with significant room for expansion. JNJ’s Ottava system and Monarch offer extensive procedure TAM globally, particularly in lung cancer treatment in China following recent approvals.

In the Vision sector, JNJ leads in contact lenses with ACUVUE, targeting a $13 billion market by 2027. Their TECNIS family in intraocular lenses is also on track for expansion and launches in multiple regions, expecting five major launches in 2024.

Furthermore, JNJ plans to stay active in pursuing mergers and acquisitions, and while they’re open to larger deals, the likelihood leans towards smaller-scale transactions. JNJ has made progress with regard to their settlements related to talc cases, and their primary focus remains on achieving a consensual prepackaged bankruptcy resolution. Within the EP sector, there’s a high probability of Varipulse receiving CE Mark certification in early 2024, and the company expects approval for use in the United States sometime in 2025. This product’s certification and subsequent approval are anticipated to progress in different phases and regions and will be a positive contributor to growth.

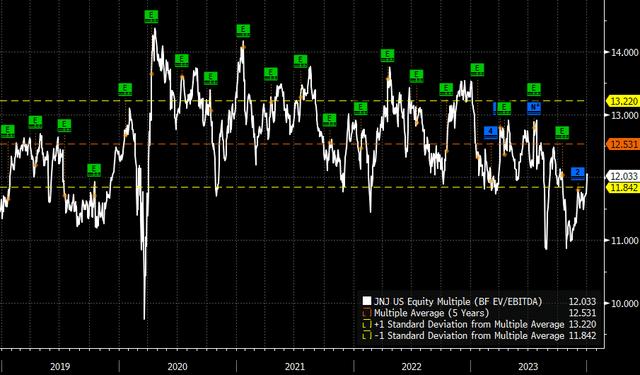

JNJ trading near trough valuations

Against an optimistic backdrop that charts several pathways of growth, JNJ is currently trading at a discount to its historical valuation because of concerns around the decline in Stelara sales.

Bloomberg

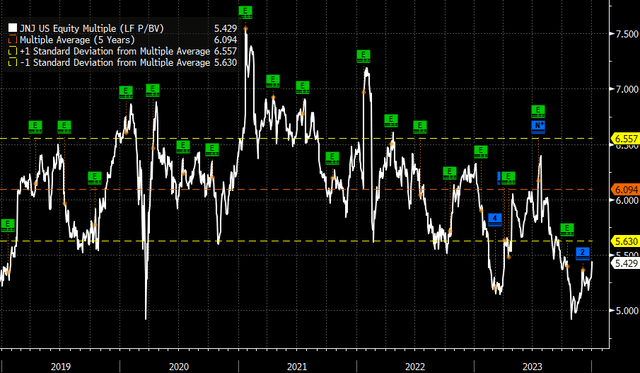

JNJ currently trades near the bottom of its 5-year EV/EBITDA multiple.

Bloomberg

Likewise, it trades near the bottom end of its 5-year P/BV range.

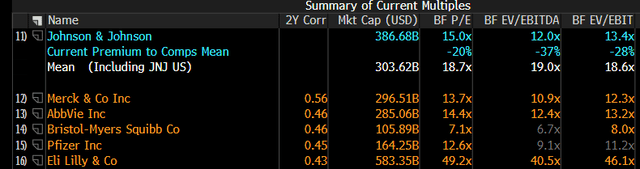

When compared to its peers such as Merck (MRK), AbbVie (ABBV), and Pfizer (PFE), Johnson & Johnson is trading at a discounted valuation.

Bloomberg

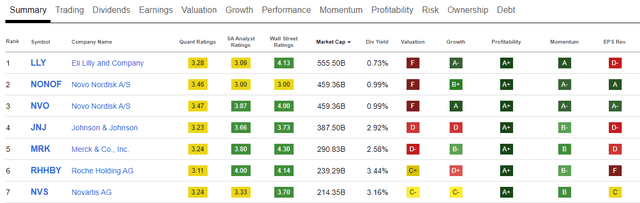

Looking at Seeking Alpha’s own quant rankings, JNJ’s quant ranking is largely in line with its peers with the exception of Novo Nordisk (NVO).

Seeking Alpha Quant

Conclusion

Johnson & Johnson has fallen out of favour with the market but its business has not. It is no secret that the best opportunities are found in out of favour names. JNJ’s fortunes are unlikely to sour overnight due to loss of exclusivity of Stelara. The company is still expected to grow its top and bottom lines over the next five years and the market is discounting this growth more than it has in the past five years.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.