Summary:

- American Airlines stock price has stagnated, down over 50% since 2020 despite the company’s rebounding operations.

- The company has rebounded to pre-pandemic levels in terms of revenue and demand for air travel.

- The stock is currently undervalued with a forward P/E of 5.5x, providing a margin of safety for investors.

Alvin Man

Introduction

Down over 50% since 2019, American Airlines (NASDAQ:AAL) stock price has been in a downward spiral. While it has never truly rebounded in price since the onset of the COVID-19 pandemic, the business is booming. So what is causing this disconnect, and is it an opportunistic time to invest?

Operations Booming, Stock Busting

Like many other airlines, American has seen results bounce back to pre-pandemic levels, but the stock has not followed suit. Has this provided a nice margin of safety to invest in, or are the risks warranting this halving of market cap?

Current And Previous Years Performance

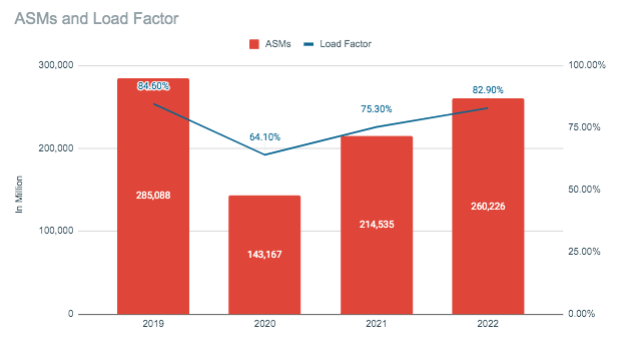

American Airlines ASMs and Load Factor (SEC.gov)

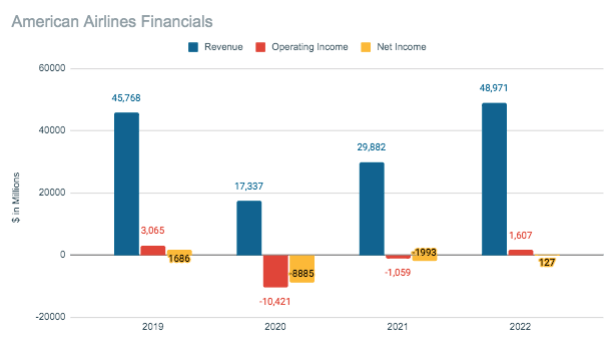

American Airlines has rebounded to normalcy in the past three years. In 2022, the company posted revenue that was 7% higher than pre-pandemic. And if anyone remembers, 2019 was a great year for this industry. There is a lot of demand for air travel right now, with ASMs just 9.5% below 2019 levels. The load factor is on par too, at around 83%, showing an all-around healthy industry environment.

American Airlines Financials (SEC.gov)

Valuation

Since 2020, the company has seen its stock price halved. The largest drop was at the start of the pandemic but has stayed in this range since the rebound. So what the market is saying is this company right now is worth the same as the company in the midst of a pandemic.

Right now, American Airlines is trading around $13, and the 2023 EPS estimate is $2.37. Therefore, the business has a forward P/E of 5.5x. While I have always felt the company deserved a multiple lower than the competition, mainly based on the weak balance sheet, this valuation seems low.

Margin Of Safety Or Baked In Risk

The question begs, does the stock now have a margin of safety, or are the risks properly priced in? Here are the risks I hear about: rising labor costs over time, the possibility of increasing fuel costs, and the possibility of a recession.

The rising cost of labor is hardly a unique event in this industry as collective bargaining agreements get renewed and renegotiated. Delta, Southwest, and United have all seen significant increases in labor costs this year too. And the same goes for fuel costs; each of American’s competitors has felt the same high jet fuel prices over the past few years. Airfare has adjusted on average to these increased expenditures as they affect the entire industry. For this reason, I see these as much more short-term risks.

The last thing that has probably kept the stock price low is the expectation of a recession. While it is inevitable, I am not one to try and predict such events. Also, fuel prices tend to decline in recessions. So yes, a recession should be baked into the price, but to this level?

Overall, I do think American Airlines is trading at a place that provides a decent margin of safety. The risks above, even if added together, do not make the company worth the same amount as during an active pandemic. That’s just wild logic because no one flew in 2020, and we have sky-high demand now. I think there is easily a 10-15% margin of safety on this stock. American Airlines traded on average around a P/E of 7-9x pre-pandemic.

Conclusion

There are some headwinds that American Airlines will have to deal with in the short term, but the industry as a whole is feeling the same pressures. And there is a possibility a perfect storm hits, with a recession starting along with these higher costs. But even so, this is not equal what was experienced during the pandemic, and the valuations should not be on par. I think there is a nice margin of safety on this stock, and that the risks are a bit overhyped.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.