Summary:

- NextEra Energy is a blue-chip utility stock that may have a strong year in 2024.

- Volatility in the market has created an opportunity for NEE, which has underperformed but has upside potential.

- NEE has a strong balance sheet, with manageable debt and ample liquidity, and its dividend is well-covered with potential for growth.

- NextEra Energy’s dividend is well-covered and is expected to grow 10% in 2024.

- High interest rates suppressed the stock price in 2023 due to the business model heavily reliant on debt to fund growth, but if rates decline this year, NEE share price will likely reflect positively.

amgun

Introduction

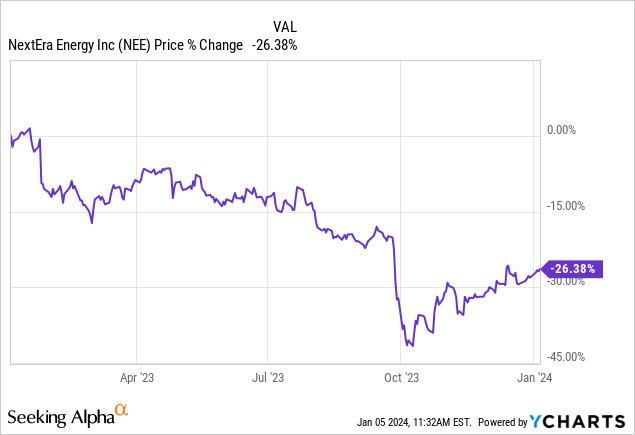

With 2023 in the past, many investors are probably wondering how the new year will shape up to be. Will we see a bull market? Or will 2024 be more of the same? I’m honestly looking forward to this year and think stocks will do fairly well, but some sectors may not. One stock in particular I think that can reward shareholders is NextEra Energy (NYSE:NEE). The company faced some headwinds last year which caused the share price to drop nearly 25%. But NEE is a blue-chip utility stock that I think has a lot of upside potential and in this article, I’ll tell you why the stock may be poised for a strong year.

Can NextEra Energy Stock Rebound?

NextEra is a blue-chip utility giant that produces clean energy electricity through wind & solar energy. Utilities underperformed heavily with the ETF Vanguard Utilities Index Fund (VPU) down roughly 10% over the past year. NEE, however, was down more than 25% over the same period.

With companies like NextEra Energy, volatility creates opportunity. Being a blue-chip, and the world’s largest utility company that has been around since 1925, that’s nearly a century of powering America! One reason for the huge drop in share price is the current macro environment. With interest rates being raised the fastest in history in 2022-2023, this placed downward pressure on the company.

Utilities are CAPEX heavy businesses that use a lot of debt to fund growth. And with interest rates higher, this made that debt a lot more expensive. It’s one of the reasons the REIT sector (VNQ) experienced a lot of volatility as well. REITs typically use debt to fund growth, and this made borrowing way more costly. NEE’s capital expenditures have only gone higher over the past 3 years from roughly $15 billion to $20 billion. Their main business unit, Florida Power and Light’s, CAPEX is expected to be $32-$34 billion through 2025.

But with rates expected to decline, 2024 could be a good year for NEE shareholders. I don’t know when rates will decline, some are saying by March this year and that we will see a total of 3 cuts. I don’t have a crystal ball and can’t say how many there will actually be, but I do think rates will be cut sometime during the year.

NextEra Energy Has Got Strong Balance Sheet

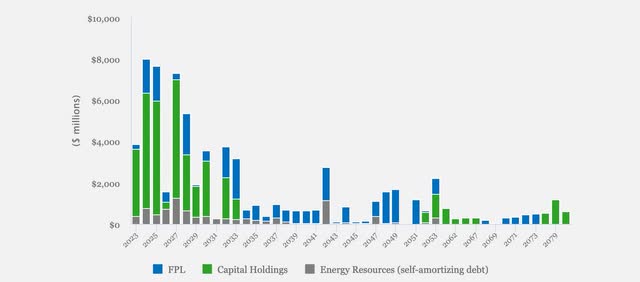

In the presentation below you can see NextEra Energy’s debt profile and the company has quite a bit of debt maturing in the next two years. Their debt has an average tenor of 12 years with a weighted-average interest rate of 3.56%. This is in comparison to the industry average of 14 years and 3.90% respectively.

Although their tenor is shorter, the have a slightly lower average interest rate. Furthermore, the utility giant had $8.1 billion of credit locked through the next 4 years and A & A- credit ratings from both Fitch and the S&P. They also have a Baa3 from Moody’s as well.

Even with likely having to refinance some of their debt at a higher rate, the company is well-positioned to navigate the current environment with ample liquidity available. Next month, NEE has roughly $3.3 billion of debt maturing. I think once interest rates are finally cut, NEE’s share price should see some appreciation as investor confidence is boosted from a sigh of relief. And if rates are indeed cut three times as mentioned, this will benefit the utility company greatly for the foreseeable future.

NEE’s Dividend Still Has Room To Grow

As a dividend investor, my main concerns are always “Is the dividend covered?” “Does it look well-covered for the long-term?” “Are earnings & cash flows stable enough to support the dividend?”

NEE ensures me that their dividend is well-covered and that they can continue supporting the payment of $0.4675. During Q3 earnings management stated they plan to grow the dividend at an annual rate of 10% for at least 2024.

And although net income did fall from $1.68 billion year-over-year to $1.22 billion, the company still beat analysts’ estimates. Adjusted EPS of $0.94 far surpassed the current dividend giving NEE a safe payout ratio. Revenues, however, did rise 6.7% year-over-year to $7.17 billion, in thanks to Florida Power and Light’s regulated utilities business adjusted revenues of $1.18 billion.

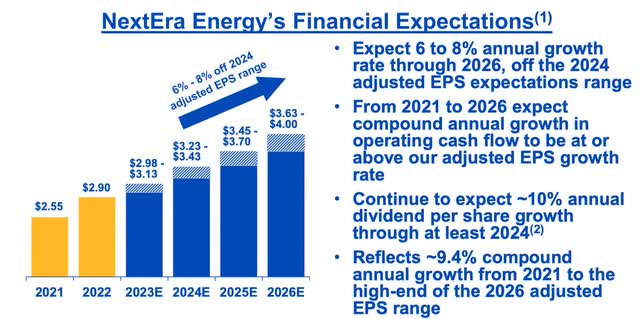

Furthermore, adjusted EPS is expected to grow 6% – 8% to $3.45 – $3.70 over the next year. For 2026 this is expected to grow to $3.63 to $4.00. FY 2023 EPS range is projected to be between $2.98 to $3.13. Even if EPS comes in on the lower end, the payout ratio is still very safe at roughly 63%. So, with the expected growth rate of 10%, the company is well-positioned with their earnings outlook to continue growing the dividend.

Growth Catalysts

NextEra energy stands to benefit from subsidiaries Florida Power & Light and NextEra Energy Partners (NEP). FPL’s retail sales continue to grow steadily at 3.0% year-over-year, benefitting from an influx of residents to the state. Florida posted a nearly 19% population growth and an overall growth percentage of 1.24% in 2023 alone. And this is expected to continue with a projected growth rate of roughly 1.27% the next 4 years. Although this is expected to somewhat slow, this is still an average increase of 300k people a year until 2028.

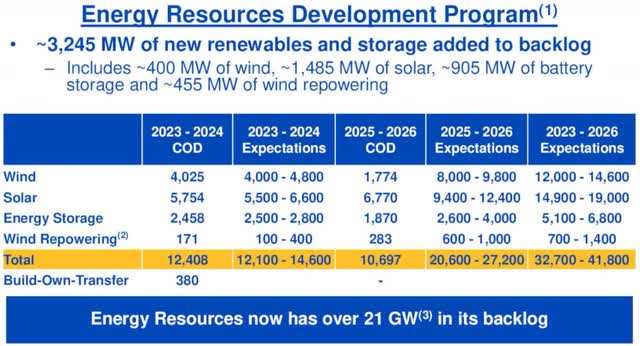

Furthermore, NextEra Energy Partners’ suspended its IDR fees through the next 2 years to replace gas pipeline cash available for distribution. They also been taking advantage of the surge in renewable energy demand. In Q3, energy resources had a record quarter in of new renewables & storage origination with 3.245 megawatts added to its backlog, the first time the company exceeded 3 GW in a single quarter.

They now have 21 GW in their backlog after taking into account roughly 1,025 megawatts of new projects placed into service since Q2. Additionally, they stand to greatly benefit from the tax credits made possible by the Inflation Reduction Act of 2022. The company saw $300 million in 2023, and this is expected to rise between $1.6 to $1.8 billion in the next two years. NEP is expected to grow distributions per unit 6% annually through 2026.

Outlook For 2024 – Is NEE Stock A Buy, Hold, Or Sell?

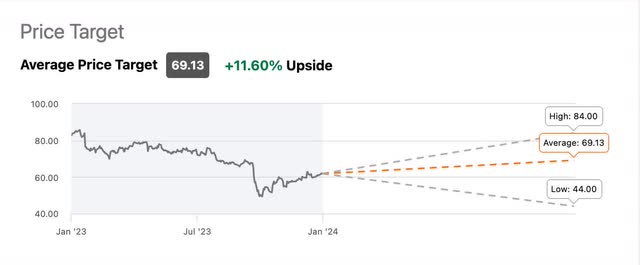

With interest rates expected to decline, I think the stock is poised for at least double-digit upside. Additionally, the utility behemoth was listed by Morgan Stanley (MS) as one of 24 stocks they were long in this year, citing 31% upside base case. Currently, the energy company offers some nice double-digit upside to its price target of roughly $69. If rates are indeed cut, particularly early as some say, I think the share price will likely surpass the current price target and move closer to the high of $84 towards the end of the year.

Risks To Thesis

A large risk for NextEra Energy are elevated interest rates, which in turn has affected the entire utility sector. Although they are expected to decline, the FED could pull a reversal and indeed keep them higher for longer or raise them higher. Of course, this is all data dependent. With utility companies heavily reliant on debt to fund growth, a higher for longer environment will continue suppressing the stock price for the foreseeable future. Higher interest costs will also continue to impact upcoming earnings. Furthermore, this would make refinancing their debt even more expensive than it already is and seeing how they do have quite a bit due this year and in 2025, this would likely cause growth initiatives to slow as well.

Another risk to the company is the weather. Florida Power and Light’s third quarter retail sales increased 3% due to the warmer weather, which had a positive impact on usage per customer. With January & February historically being the coldest months in the State of Florida, this could cause a decline in retail sales, affecting upcoming Q4 and fiscal year earnings as well.

Bottom Line

Although interest rate cuts are no sure thing, I think the FED does cut sometime in 2024. If so, this will likely cause NEE’s share price to trend higher as investors’ gain more confidence and cause a move back into the utility sector.

Furthermore, despite the macro environment, NextEra Energy remains committed to growing the dividend 10% for the year. The company is also projected to grow earnings by 6% to 8% over the next two years.

Despite the large debt burden and upcoming maturing debt, the balance sheet remains strong with investment grade ratings from all 3 major agencies. The utility giant also has ample liquidity available to help navigate a higher for longer environment if need be. 2023 created a great buying opportunity for NEE and I think sometime in 2024, the share price will see some nice upside, rewarding shareholders in the process.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.