Summary:

- Altria Group is a popular choice among dividend investors, with a dividend yield of 9.4% and 54 years of consecutive dividend raises.

- MO is adapting to changing market conditions by venturing into the non-combustible space with products like On! and NJOY.

- Despite economic uncertainties and regulatory risks, MO’s debt management and strategic goals position it for long-term success, with a potential upside of 31% and double-digit annual returns.

Mario Tama

Overview

MO stands for “Must Own”: a popular comment here. This is for good reason, too! With a dividend yield of 9.4% and 54 years of consecutive dividend raises, it’s no wonder MO is a popular choice amongst dividend investors. I recently wrote an article on Philip Morris (PM) where a lot of the same principles with the company will apply. PM and MO are “sin stocks” and trigger people’s moral compass on whether it’s alright to earn income from companies whose products are responsible for health issues. However, free will is a thing amongst the consumer base, and therefore I am free to collect these growing dividends every year as a non-smoker.

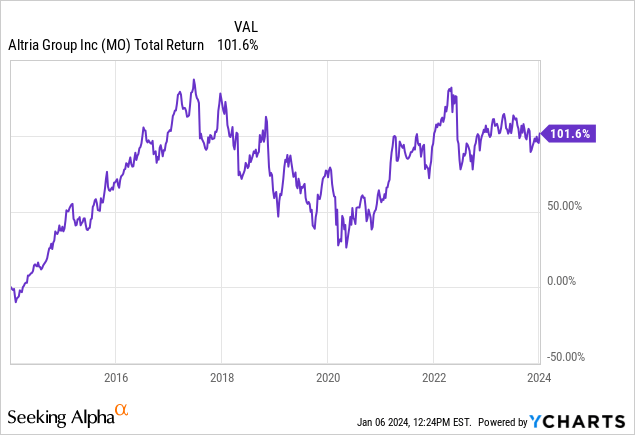

Altria Group (NYSE:MO) manufactures and markets both smokeable and oral tobacco products within the United States. The company specializes in offering cigarettes, cigars, and pipe tobacco. MO also has smokeless tobacco products as part of their portfolio. Additionally, the company sells on! oral nicotine pouches. Its primary distribution channels include wholesalers, distributors, and major retail entities, such as chain stores. The company has earned the rep of a dividend king and has the strong cash flow to support a continually increasing dividend payout to shareholders. Although the share price performance has been poor over the last decade, the total return has been decent due to the high distribution level.

Recent Earnings

MO adjusted its full-year guidance for adjusted diluted earnings per share (EPS) to a narrowed range of $4.91 to $4.98, as compared to the previous range of $4.89 to $5.03. MO reported adjusted EPS of $1.28 on net revenue of $5.28 billion, marking a 2.4% year-over-year decrease. Overall net revenues also declined by 4.1% to $6.3 billion, primarily driven by reduced net revenues in the smokeable products segment. The net revenues of smokeable products experienced a 5.3% decline. This can be attributed to lower shipment volume and increased promotional investments.

As a positive, MO repurchased 5.9 million shares at a total cost of $260 million. Share repurchases by a company are advantageous because it often indicates that the management perceives its stock to be undervalued. Secondly, buybacks can lead to an increase in earnings per share as the total number of outstanding shares decreases, making the stock more attractive on a per-share profitability basis.

MO has set ambitious enterprise goals for 2028, including achieving an Operating Companies Income (OCI) margin of 60% or higher over the next five years. This target underscores the company’s commitment to operational efficiency and profitability. Attaining such a margin would not only solidify Altria’s financial position but also generate robust cash flows. These cash flows, in turn, are earmarked for crucial purposes, such as funding expansion initiatives and facilitating market penetration in the rapidly growing non-combustibles segment.

Strategy & Products

Despite what seems to be a negative earnings report, MO has been strategizing to efficiently counteract this. Over the last decade, tobacco companies have managed to still make more money each year even though they sold fewer cigarettes/ tobacco products. They did this by raising prices, so the people who are smokers paid more for the same product. However, this can’t continue forever, as you can only raise the prices so high until your customer base eventually finds an alternative. To replace the money from declining sales, MO needs new products that adapt to acceptable market conditions.

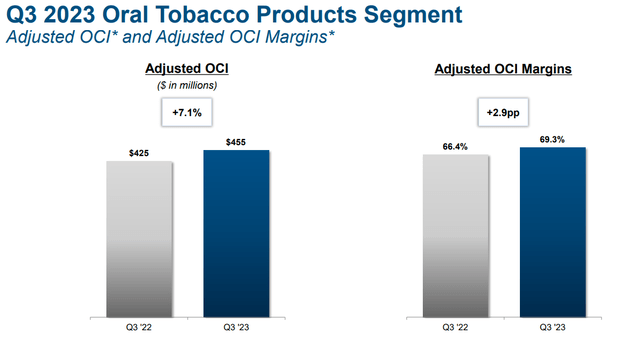

To adapt, Altria has ventured into the non-combustible space with products like On! and NJOY. On! oral nicotine pouches provide a smoke-free and discreet option for consumers seeking nicotine satisfaction without traditional smoking. On! was acquired back in 2019. The oral products segment saw a 7.1% in adjusted OCI (Operating Companies Income).

Altria Q3 Presentation

Additionally, Altria’s involvement in the retail distribution of NJOY products signifies a strategic move to tap into the expanding market for vaping and e-cigarettes. Management anticipates the continued expansion of ACE into 70,000 stores by the end of the year, constituting approximately 70% of e-vapor volume and around 55% of cigarette volume.

By integrating these non-smoking alternatives into its portfolio, MO is demonstrating its commitment to adapt. So far, they have made smart moves to ensure their products remain relevant in a changing landscape. Especially when regulations continue to actively push against smoking. Speaking of a push against smoking, let’s dive into the risk profile.

Risk Profile

MO maintains a prudent and manageable debt profile, evident in its debt-to-EBITDA ratio of 2.1x. In addition, they boast a comfortable return on total assets of 24%. However, with talks of an economic downturn this year, consumers tend to opt for lower-end tobacco brands, which could unfavorably impact Altria’s premium product portfolio. Similarly, inflationary pressures may cause a decline in consumer spending, further affecting Altria’s revenues. On a positive note, however, the Fed is anticipated to cut interest rates several times this year. I believe this would help serve as a catalyst for MO’s price movement.

In addition to economic factors, ongoing risks for Altria include regulatory changes and increased taxes on tobacco products. The tobacco industry is heavily regulated, and alterations in the regulatory environment could impose additional constraints on Altria’s marketing, sales, and product development. This is nothing new, though, as the push against these sorts of products has been commonplace for the last decade.

Dividend

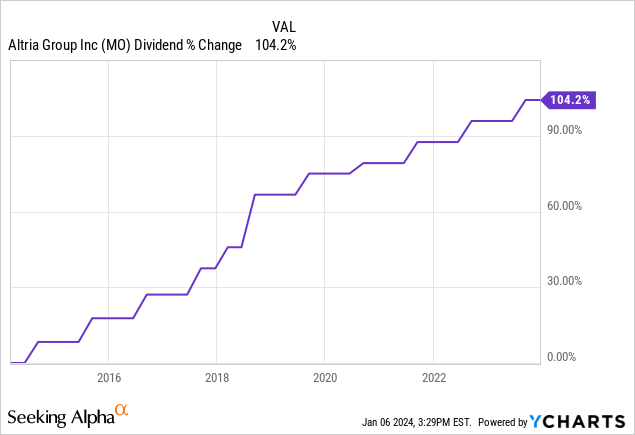

As of the latest declared quarterly dividend of $0.98/share, the current starting dividend yield is about 9.4%. As previously mentioned, the current dividend increase streak is 54 years, earning MO the title of a dividend king. The latest declared dividend also represents an increase of 4.3% that took place back in August 2023. Over the last decade, the dividend has increased 104%.

The payout ratio sits at a comfortable 77%. In comparison, PM’s payout ratio currently sits at 84%. The growth story here has been nothing short of amazing. On a ten-year time frame, the dividend CAGR has been 7.63% compared to the sector median of only 5%. Even on a shorter time frame of only five years, the dividend CAGR is still high at 5%. This is great considering the starting yield is so high to begin with.

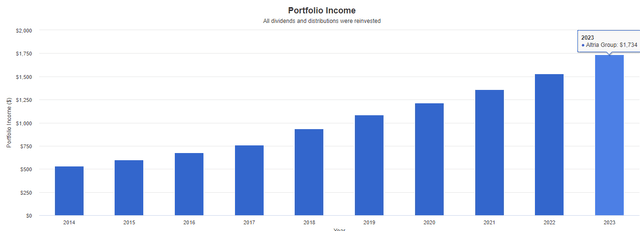

The current annual payout is $3.92/share, but the estimated projections see the payout being as high as $4.13/share by 2025. If this happens, that means we can expect anywhere between a 5-7% raise in the short term. As per Portfolio Visualizer, a $10,000 investment as short as 10 years ago would’ve originally netted you $531 in dividend income. Today, that initial $10,000 investment would now net you over $1,700 in dividend income with only dividends reinvested and no additional capital deployed. Tripling my dividend income with no additional work required from my end is exactly why MO deserved a spot in my portfolio, to begin with. To reiterate, if you value price appreciation, MP probably isn’t the best match for you. However, if you value consistent and growing income, MO may be suitable.

Portfolio Visualizer

Valuation

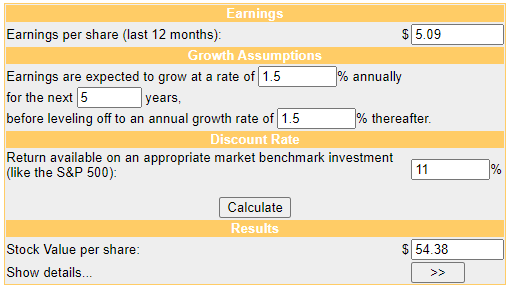

MO provided guidance for the entire fiscal year of 2023, focusing on adjusted diluted earnings per share. Management anticipates achieving an EPS within the range of $4.91 to $4.98. This projected range signifies a growth rate of 1.5% to 3%. Therefore, we can use 1.5% as the input for our conservative valuation estimate.

Using a DCF (discounted cash flow) model, we can determine an estimated fair stock value. For fiscal year 2024, the estimated EPS is set to be 5.09x. Using these metrics in our calculation nets us a fair estimated value of $54.38/share. This makes MO pretty cheap in terms of valuation and would represent a potential upside of 31% from the current price level. This potential upside combined with the current high dividend yield of 9.4% means we are looking at the chance to capture double-digit annual returns going forward.

Money Chimp

As additional reference points for valuation, the current P/E is 8.37x in comparison to the sector median P/E of 18.05x. Cash from operations is extremely healthy as well, with cash totaling $8.6 billion, while also having a return on total capital of 35%. This is why I rate MO a Buy and will continue accumulating shares.

Takeaway

Altria Group presents an interesting opportunity because of its dividend yield of 9.4% and an impressive track record of 54 consecutive dividend raises. Despite facing challenges in the traditional smoking segment, Altria is strategically adapting its portfolio to include non-combustible alternatives like On! and NJOY. These innovative products align with evolving consumer preferences and signify the company’s commitment to remaining relevant in a changing market landscape.

While economic uncertainties and regulatory risks persist, Altria’s prudent debt management, investment-grade ratings, and strategic goals for 2028 position it for resilience and long-term success. The recent share repurchases, coupled with a conservative valuation estimate suggesting a potential upside of 31%, further enhance the attractiveness of MO as an investment. With a current P/E ratio below the sector median and robust cash flow, Altria presents an opportunity for double-digit annual returns, making it a compelling Buy for investors seeking a blend of dividends and potential capital appreciation.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.