Summary:

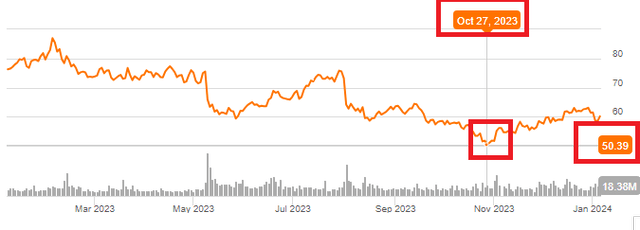

- PayPal’s stock has bounced strongly from October 2023 lows, recent downgrades notwithstanding.

- While the stock was undoubtedly overvalued in 2021, how much punishment is too much?

- The company is making smart moves even as revenue continues increasing, with an eye on shareholders.

- Technicals indicate strong support close to the current market price.

JasonDoiy

If 2021 was the sin, 2022 was the comeuppance and 2023 was the revival. Or in sporting terms, if 2021 was the penalty, 2022 was the time-out and 2023 was the re-entry. Many stocks have been forgiven for their 2021 overvaluation sins with a rewarding 2023 but “Fintechs” have not only remained in their timeouts but have also apparently committed further penalties. Case in point, PayPal Holdings, Inc. (NASDAQ:PYPL) was slapped with not one but two downgrades, just four trading days into the new year.

My most recent coverage of PayPal was almost three months ago when I rated the stock a “Buy”, citing extreme pessimism as the indicator of a bottom and turnaround. Since then, the stock has gone up nearly 18% compared to the market’s near 13% run, despite the two recent downgrades. I am presenting a few thoughts in this article, making the case for PayPal’s stock to perform better in 2024 than it did the last few years. Let us get into the details.

Growing Revenue

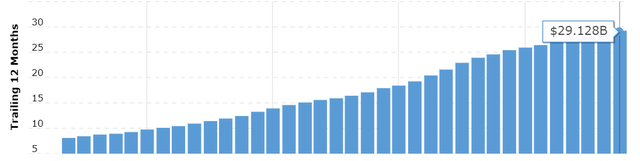

While the stock price is back where it was about 7 years ago, the revenue has been consistently going up. In every trailing twelve months [TTM] period dating back to at least 2014, PayPal’s revenue has been trending up. As a consequence, PayPal’s stock is trading at a sales multiple of 2.22 based on TTM revenue of $29.12 billion. 2024 revenue estimate of $32.14 billion means the stock is trading a forward multiple of almost 2 exactly.

PYPL Chart (Seekingalpha.com) PYPL TTM Revenue History (macrotrends.net)

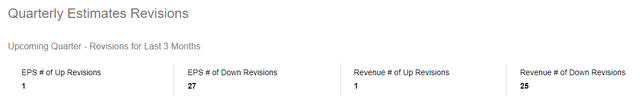

Muted Expectations and Valuation

Expectations on PayPal heading into its Q4 earnings are muted, to put it mildly. 27 out of 28 EPS revisions and 25 out of the 26 revenue revisions have been to the downside. Hence, even a slight beat, backed by reasonable 2024 guidance could spark a rally. This scenario becomes more plausible when you consider that PayPal has beaten EPS estimates 75% of the time in the last two years and the stock is trading at its lowest ever PE multiple range. No wonder the stock made it to this list from Goldman Sachs (GS) as a top growth stock trading at a reasonable valuation.

PYPL Earnings Revisions (Seekingalpha.com) PYPL PE (YCharts.com)

Business and Shareholder Moves

Total payment volume grew by 15% in the most recent quarter, backed by 11% transaction growth. Once again, these numbers don’t reflect a business that is in peril (as the stock performance suggests). What is likely happening here is that the stock was so excessively overvalued till 2021 that the slingshot effect is now having its impact in the opposite direction. Meaning, the stock needs to and likely has gone to extremely cheap levels before it can bounce off meaningfully.

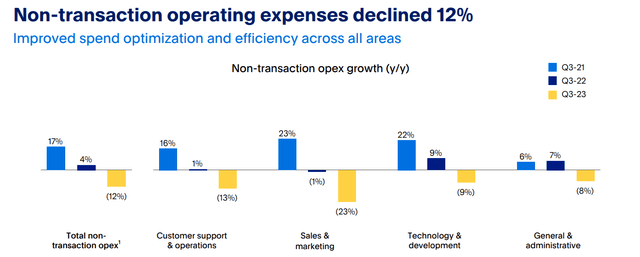

Getting back to business moves, non-transaction expenses declined 12% in Q3, following the 11% decline in Q2. Once again, the company seems to be making all the right moves in cutting down its expenses to help trigger a turnaround in the market sentiment.

Non-Trans Expenses (investor.pypl.com)

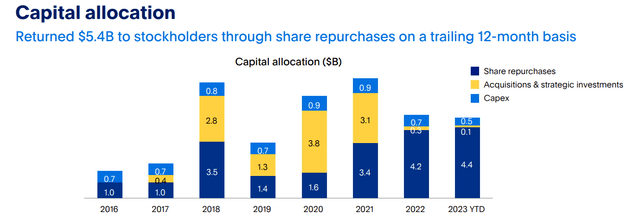

Sometimes, the world doesn’t appreciate your worth. There are only two things one can do in those circumstances: believe the others or believe in yourself. PayPal is clearly believing in itself as the company has used the pullback in its share price to retire 8% of its shares in the last 3 years. Over the last 12 months, the company has returned $5.4 billion to shareholders in the form of repurchases. With its cash position and debt position almost being equal, we can expect the company to spend more on buybacks should the market continue punishing its stock.

Pypl buyback (investors.pypl.com)

New Year, New Leaders (Or At least, New Laggards)

While I am not as confident as Seeking Alpha Analyst Millennial Dividend to claim that PayPal will have a Meta Platforms, Inc. (META) like comeback, I firmly believe the upside potential for PayPal stock far outweighs the downside potential.

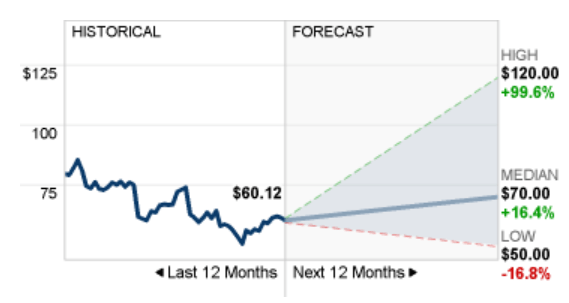

As an example, there is a general consensus that technology stocks will hit rough waters due to valuation and their run in 2023 and the market may opt for cyclical, value stocks like PayPal. In addition, the 37 analysts covering PayPal stock have a median price target of $70, suggesting a 16% upside from here. But let’s focus on the downside since the stock has been on a heavy downtrend over the last couple of years. The lowest target is $50, exactly the spot from which the stock turned around in October 2023.

PYPL Price Target (f-most-powerful-women-ibm-ceo-ginni-rometty-research-watson-supercomputer fortune) PYPL Chart Lows (Seekingalpha.com)

Technical Indicators

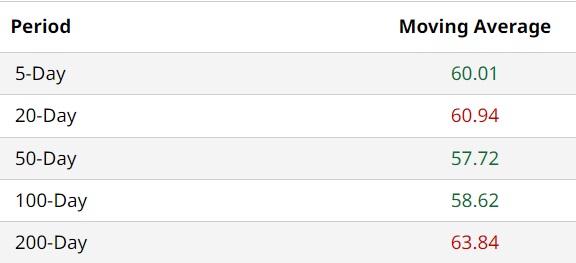

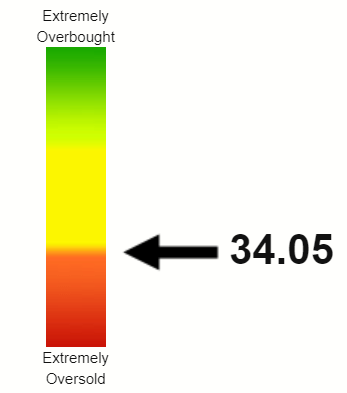

PayPal’s stock recently moved past its 100-Day moving average and is only 6% away from the 200-Day moving average. Looking at the table below, it is not unreasonable to assume that the stock has formed a strong base in the $50 to $60 region. A Relative Strength Index [RSI] of 34 also suggests the stock is oversold, despite the 3% jump in the last month.

PYPL Moving Avgs (Barchart.com) PYPL RSI (Seekingalpha.com)

Risk And Conclusion

I am not pretending that PayPal does not have fundamental issues and challenges to deal with. The Federal Reserve could still surprise and spook the market when it comes to interest rates, which impacts Fintechs more disproportionately than many sections of the market. The profitability concerns that triggered the two recent downgrades are real but the company is well aware of it as general expenses have gone down about 10% in the last two years (based on September quarters). The fact that Amazon.com (AMZN) is set to stop accepting Venmo could be deemed as a negative but a silver lining could be that PayPal could focus those resources elsewhere.

But everything said and done, trading at about 2 times TTM sales and at 12 times forward earnings, PayPal stock appears enticing heading into 2024. Two full years in time-out is more than enough in my opinion and the stock deserves some time in the playing field. Hence, I am sticking with my “Buy” rating on the stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META, PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.