Summary:

- Comcast is a highly undervalued investment opportunity with high margins and a diverse collection of assets.

- Despite challenges in its broadband business, CMCSA has prioritized price over volume and has seen faster bottom-line growth.

- CMCSA has a strong balance sheet, consistent dividend growth, and share buybacks, making it an attractive investment at the present discounted price.

Richard Drury

Investing in cash-rich companies that generate high margins while trading at low valuations can be a good investment strategy. While these attributes may remind investors about tobacco companies, I’m talking about something completely different.

This brings me to Comcast Corporation (NASDAQ:CMCSA), which currently trades well below its historical valuation while generating high margins for its investors. I last covered CMCSA here back in October of last year with a ‘Strong Buy’ rating, noting its undervaluation and potential benefits from the anticipated sale of its stake in the Hulu streaming service.

CMCSA hasn’t seen the same run-up as the rest of the market since October, as its price has remained virtually unchanged since my last piece, and has been bested by the 11.6% rise in the S&P 500 (SPY) over the same timeframe.

That’s not a bad thing, however, for value investors, as patience is a virtue, and those who are willing to invest in quality businesses during periods of mediocre returns may see the best long-term results over chasing growth stocks that get pricier by the week. In this article, I provide an update and discuss why CMCSA remains a top-shelf value pick in today’s frothy market, so let’s get started!

Why CMCSA?

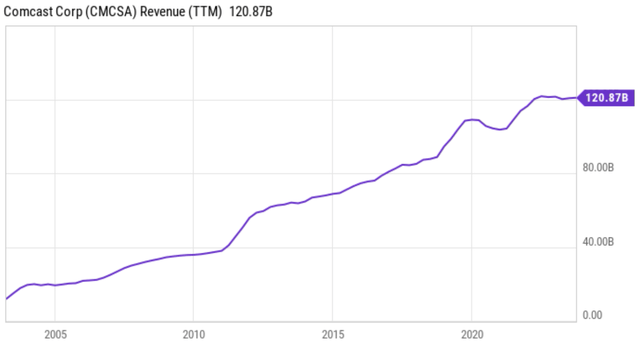

Comcast is different from any other media company in that it has moat-worthy infrastructure assets through its cable and growing fiber business, as well as media channels, streaming services, and real estate holdings in its Theme Parks business. CMCSA has had a steady track record of growing its revenue over the past 2 decades with a business that’s rather recession resilient as revenue grew during the 2008-2009 recession and barely dipped during the recession in 2020, as shown below.

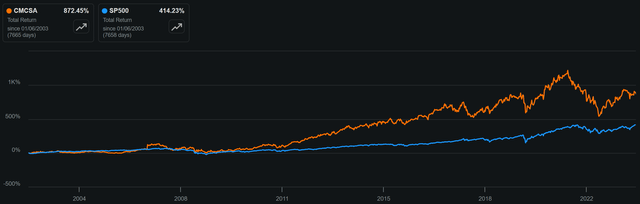

While most companies would rather shy away from complexity risk, CMCSA has cobbled impressive returns through its diverse collection of assets. As shown below, CMCSA has produced an 872% total return over the past 2 decades, which is more than double the 414% return of the S&P 500.

CMCSA vs. SPY Total Return (Seeking Alpha)

Of course, those who are following CMCSA know that recent performance hasn’t held up as well against the overall market, considering that CMCSA’s share price has declined by 14% over the past 3 years, as shown below.

CMCSA vs. SPY 1-Yr Price Return (Seeking Alpha)

One of the concerns around CMCSA has been concerns around a slowdown in broadband subscribers as the market has become saturated. CMCSA is also facing new competition from wireless companies that are serving traditional broadband customers with fixed wireless alternatives from their 5G networks.

This is reflected by the fact that CMCSA lost 18K net broadband customers during the third quarter, which is nearly the same as the prior quarter. This is comparatively worse than the 19K gain in net subscribers that CMCSA saw in the prior year period, while telecom giants T-Mobile (TMUS) and Verizon (VZ) have been adding hundreds of thousands of new broadband customers per quarter.

Notwithstanding the loss in subscriber count, CMCSA is making the move to prioritize price over volume, by reducing promotions in lower-tier plans. That’s because broadband customers tend to be sticky with their internet service providers, considering that an 18K loss in customers in the last reported quarter is a drop in the bucket compared to 52.3 million customers that pay CMCSA over $100 per month.

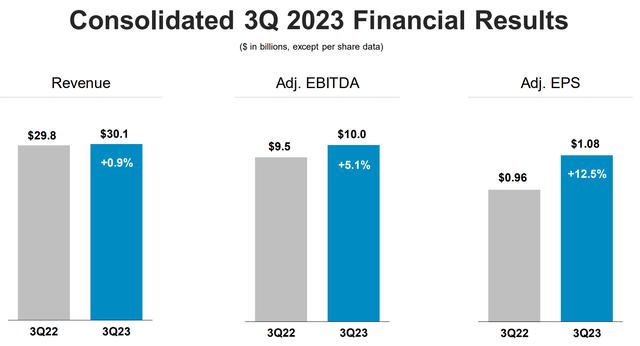

As shown below, while YoY revenue growth was just 1% during Q3, higher margins have enabled faster adjusted EBITDA growth of 5% and adjusted EPS growth of 12.5%.

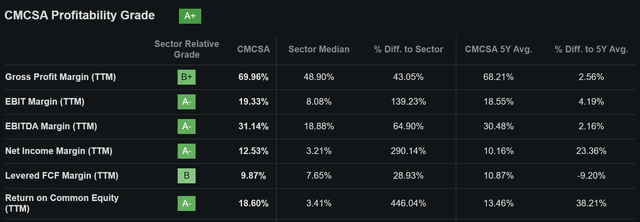

At the same time, CMCSA maintains an industry-leading profitability grade of A+, with EBITDA margin of 31% and Net Income Margin of 12.5%, both of which sit well above the sector median, as shown below.

Looking ahead, Wall Street may be overly rotated on CMCSA’s weakness in broadband subscribers while ignoring the upside potential in its pricing power, in which average revenue per user grew by 3.9% in the last reported quarter. In addition, CMCSA continues to see encouraging growth in its wireless segment through its wholesale agreement with Verizon. CMCSA has successfully driven bundled offerings through its cable, broadband, and wireless offerings and has recently grown its wireless customer base to over 20 million customers.

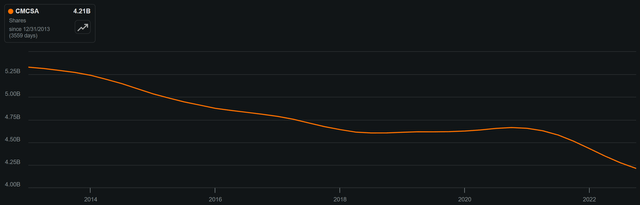

Meanwhile, CMCSA continues to be shareholder-friendly with its free cash flow. This is reflected by its returning $4.7 billion to shareholders in the last reported quarter alone in the form of share buybacks and dividends. Over the past 10 years, CMCSA has reduced its share count by a material 21%.

Share buybacks have accelerated since 2021, which not surprisingly coincides with a more attractive valuation in the share price, leading to a higher earnings yield for every dollar spent on buybacks, as shown below. Moreover, I would expect for share repurchases to continue at an elevated pace, considering that CMCSA recently reached an agreement with Disney to sell its one-third stake in the streaming platform for $8.6 billion.

CMCSA Shares Outstanding (Seeking Alpha)

Risks to the thesis include potential for labor disruptions including the Writers’ strike of 2023, which puts content production to a halt and disrupts CMCSA’s media division, with it having to rely on previously watched content. In addition, irrational pricing from CMCSA’s fiber rival, AT&T (T) could put margin pressure on CMCSA’s broadband business. Plus, while CMCSA’s own streaming platform, Peacock, saw 60% YoY revenue growth and its first YoY improvement in EBITDA since 2020 during the last reported quarter, it’s still losing money at an expected $2.8 billion in 2023 (down from the prior expectation of $3 billion). It remains to be seen when and if the streaming service will become profitable one day.

Turning to the balance sheet, CMCSA carries a strong A- credit rating and has reasonably low leverage, with a net debt to EBITDA of 2.3x. This is driven partly by a material $20 billion reduction in net debt since the end of 2018.

While CMCSA’s 2.7% dividend yield isn’t particularly high, it’s well protected by a 29% payout ratio and has a 5-year CAGR of 8.9%. I see the dividend as being very safe considering CMCSA’s very robust unlevered free cash flow of $14.5 billion over the trailing 12 months, more than covering the $4.8 billion dividend commitment and leaving plenty of remaining cash for share buybacks.

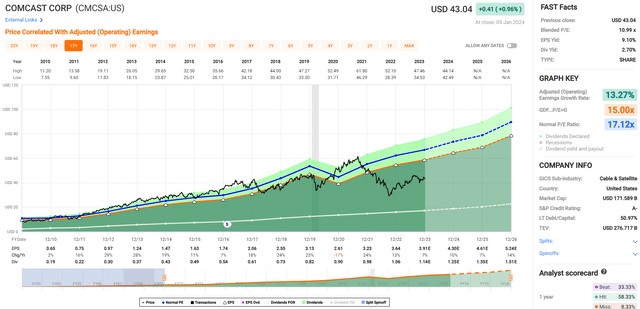

Lastly, I continue to see attractive value in the stock at the current price of $43 with a forward PE of just 11.0, sitting well below its normal PE of 17.1 over the past 15 years. With sell-side analysts estimating 8% to 16% annual EPS growth over the next 3 years, CMCSA appears to be materially undervalued at the current price.

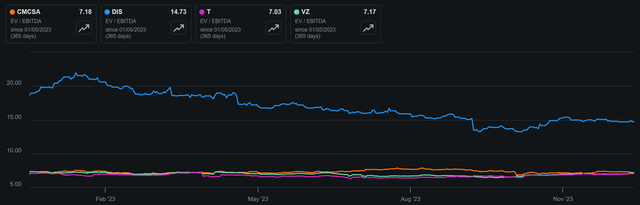

CMCSA also appears to be far cheaper than rival media giant Disney (DIS) with an EV/EBITDA of 7.2x compared to Disney’s 14.7x. It also trades in line with the 7.0x and 7.2x EV/EBITDA of emerging broadband rivals AT&T and Verizon, respectively, despite CMCSA’s better credit rating and stronger track record of shareholder returns.

CMCSA vs. Peers EV/EBITDA (Seeking Alpha)

Investor Takeaway

While Comcast is facing some challenges in its broadband business, it has successfully shifted its focus towards prioritizing price over volume and has seen faster bottom-line growth compared to the top-line as a result. It also maintains sector-leading profitability.

In addition, CMCSA’s growth potential should not be overlooked, especially with its success in offering bundled services that include wireless services and the potential for its streaming platform, Peacock, to become profitable in the future.

Investors can also have confidence in CMCSA’s strong balance sheet, consistent dividend growth, and share buybacks which materially add value at the current discounted price. Considering all the above, I maintain a ‘Strong Buy’ rating on CMCSA stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CMCSA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not an investment advisor. This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Gen Alpha Teams Up With Income Builder

Gen Alpha has teamed up with Hoya Capital to launch the premier income-focused investing service on Seeking Alpha. Members receive complete early access to our articles along with exclusive income-focused model portfolios and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%.

Whether your focus is High Yield or Dividend Growth, we’ve got you covered with actionable investment research focusing on real income-producing asset classes that offer potential diversification, monthly income, capital appreciation, and inflation hedging. Start A Free 2-Week Trial Today!