Summary:

- Tesla, Inc.’s quote is down roughly -20% from my previous Sell rating above $290 in July, but still overvalued at $240 per share.

- A recession scenario could easily lead to further downside in Tesla’s stock price, potentially pushing it under $200 or even $150.

- Interested buyers should wait for a significant selloff before acquiring new Tesla positions, to achieve a better risk/reward balance.

Justin Sullivan/Getty Images News

My last swing call on Tesla, Inc. (NASDAQ:TSLA) stock was a Sell rating at $290 in July here. Since then, TSLA stock is down about -20%. I still believe quotes around $300 are too high for 2024. We are all aware of mushrooming electric vehicle, or EV, competition hurting Tesla margins (think price cuts for EVs), while slowing auto deliveries and major auto recalls in the U.S. and China are hitting operations. CEO Elon Musk continues to be in the headlines in a negative way. And, a recession is increasingly likely in the months ahead in my view (based on the still inverted Treasury yield curve, 2023 contraction in total banking credit, and rotten leading economic indicators since September).

For this article, I want to focus on the likely valuation effects of a recession scenario on Tesla, where operating results disappoint and Wall Street rerates the stock on declining growth prospects.

At $240 a share in early January 2024, Tesla remains overvalued, pure and simple. However, I can see myself turning more bullish on a larger price drawdown during a recession. The good news is that long-term growth rates at the company will almost surely stay above average vs. the U.S. blue-chip universe. With current forecasts of 20%-30% increases in earnings and revenues for both this year (2024) and next (2025), a sizable growth-multiple does make rational sense. However, the issue is what should the valuation be on far slower growth than years past?

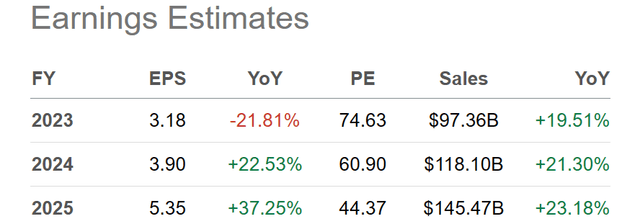

Seeking Alpha Table – Tesla, Analyst Estimates for 2023-25, Made January 7th, 2024

Typically, a P/E ratio of 30x to 40x forward 12-month forecasts is considered about right for a revolutionary-product company, already very large in size, expanding annually at rates under 25%, with prevailing inflation and Treasury security rates (US10Y) in the 4% to 5% area. So, if a recession hits soon, I fully expect Wall Street to push the stock quote under $200, perhaps all the way back to $150. I know bulls do not want to hear another bearish projection for price, but that is the most logical course, assuming historical comparisons still count for the company. Many perma-bull investors argue Tesla doesn’t follow the old-school rules of valuation. But, this bubble-based view has cost them dearly since the 2021 peak above $400 per share (split adjusted).

Extended Valuation

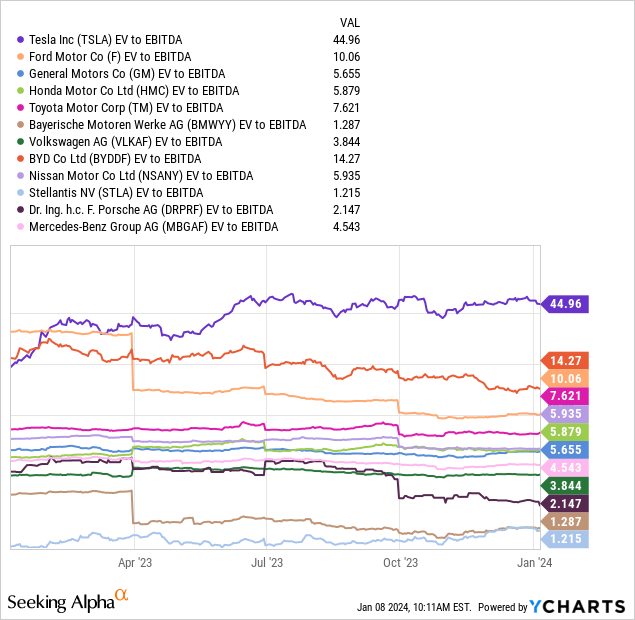

The overwhelming negative for Tesla investors remains a valuation much higher than similar businesses. As an example, we can take the equity market capitalization + total debt – cash on hand to create the enterprise value calculation, then compare/contrast Tesla with the leading auto names worldwide for total worth. On core cash EBITDA (trailing), Tesla is selling for a whopping enterprise value multiple of 45x vs. a median group average under 6x!

YCharts – Tesla vs. Major Global Automakers, Enterprise Value to EBITDA, 1 Year

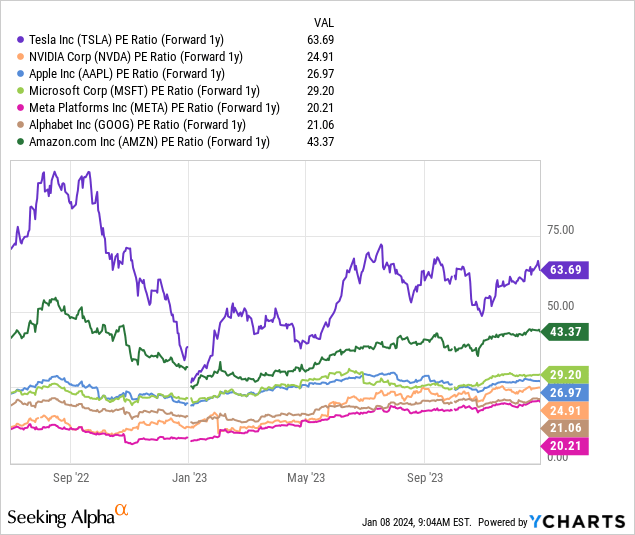

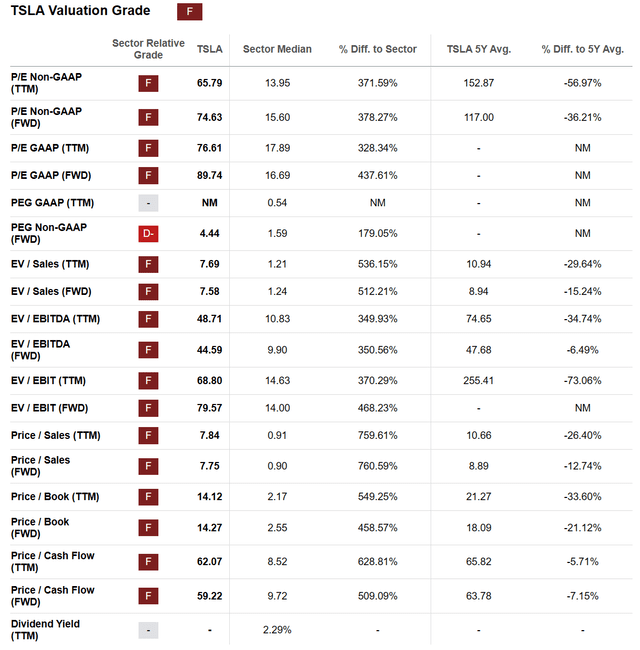

If you believe the company fits better as a Big Tech choice (with a range of products under development, not just autos), it is also clearly the most overvalued out of the Magnificent 7 enterprises today, when looking at cash flow and earnings. The forward 2024 outlook, using the share price to underlying after-tax earnings estimate, is an amazing 63x vs. the median Biggest Tech peer average of 27x.

YCharts – Tesla vs. Major Global Automakers, Price to Forward Analyst Estimated Earnings, Since July 2022

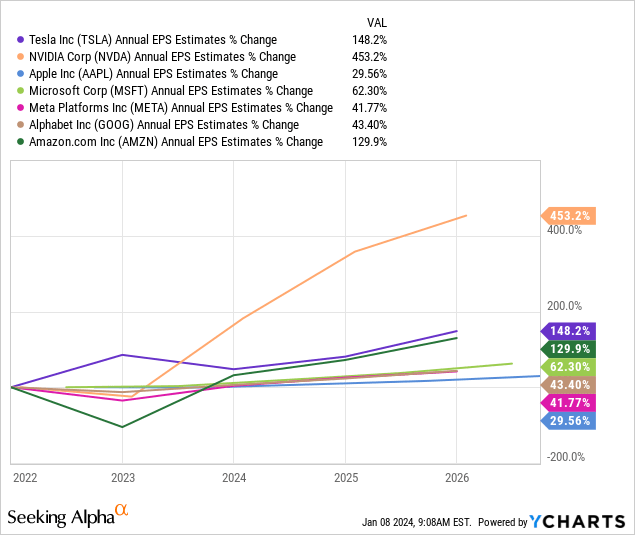

Of course, Tesla’s expected growth rate in earnings per share from 2022 into 2026 is the highest next to Nvidia (NVDA). However, even NVIDIA’s valuation on earnings and cash flow is dramatically lower than Tesla.

YCharts – Magnificent 7, Analyst Estimated Earnings Growth Rates into 2026, Made January 7th, 2024

Seeking Alpha’s Quant Valuation Grade is still an “F” score. I personally would have given the stock an F- nearer $300 in the summer. Today, I would lean more toward a D- after the stock quote decline and another six months of company growth.

Seeking Alpha Table – Tesla, Quant Valuation Grade on January 7th, 2024

Early Recession Effects

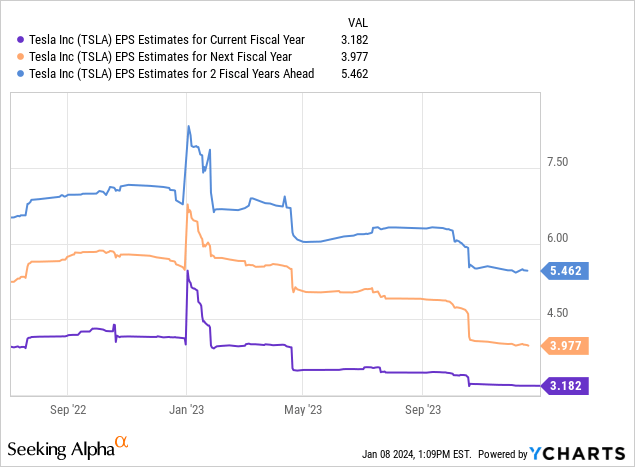

Even before we have officially entered a recession, Tesla’s earnings have been in downward revision territory since early 2023. The negative effects of rising competition are the main reason, which I screamed was the future in my September 2022 article here. A quick history: this effort turned into the most read, debated, and commented article I have written in over 10 years on Seeking Alpha. I put myself out on a limb and correctly projected a Tesla price of $100 was approaching, when its quote was over $300.

YCharts – Tesla, Analyst EPS Revision Trend for FY 2023-25, July 2022 to Present

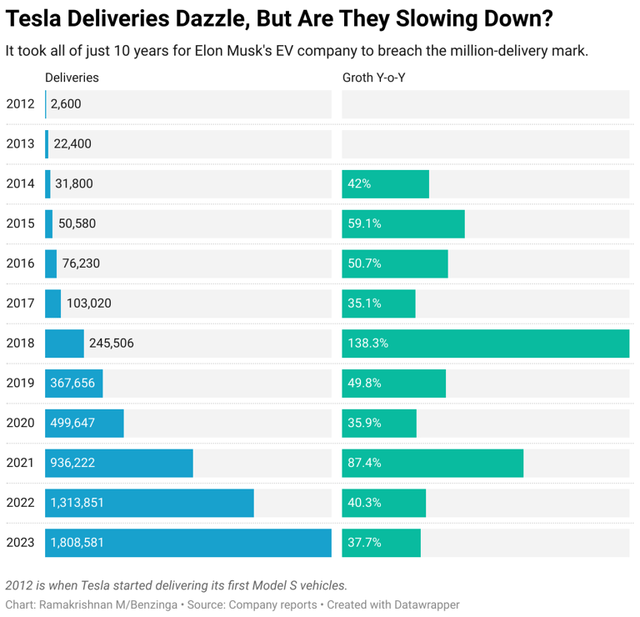

In terms of getting real for the bullish Tesla crowd, car/truck delivery growth is now estimated to be under 25% YoY for calendar 2024, which would be the weakest showing since the company began deliveries in 2012. Plus, if a recession hits, I would not be surprised by rates under 20% in 12 months. The end conclusion is – gone are the days of booming expansion.

Benzinga Telsa Article – Shanthi Rexaline, January 4th, 2024

Final Thoughts

In summary, Tesla appears to be fully valued to overvalued in my work at $240 per share in early January.

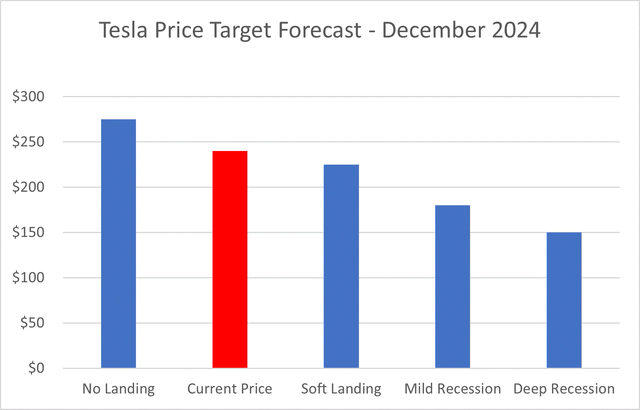

What are my price targets with rationale for the rest of 2024? Let’s begin with my most bullish scenario, where the economy does not slow down and operations slightly beat expectations. Retail investors stay bullish en masse and sentiment supports a 55x P/E ratio on $5.00 for 2024 EPS. My math puts price at $275 for an optimist. Such would be good for a positive +15% investment return from $240 now.

A soft-landing scenario for both the U.S. and global economy might mean earnings stay around $4. Again, if valuations start moving back to earth, a similar 55x multiple gets you to $225 a share for a target in 12 months (-5% loss for new investors today).

Then, we can visualize and put numbers on two recession outcomes. The first projection (and highest probability in my opinion) is a mild recession occurs this year. Under the moderate recession scenario, Tesla could find itself experiencing a double whammy of a reduction in earnings on top of greater selling my investors. Sustainable EPS of $3.50 (which might prove overly rosy) creates a price target of $175, on roughly 50x for Tesla’s P/E multiple (-25% loss from $240).

Lastly, a deep recession could drop EPS back to breakeven. However, since Wall Street is a forward-looking machine, I believe price would experience better support from institutions and hedge funds around $150 per share (-37% loss from $240). A rebound in the economy with stronger demand for EVs after 2024 could easily generate earnings in the $5 to $6 range. A P/E of 25x to 30x next year’s numbers (2025) would become the new focus, and represent a reasonable buy level.

Author Estimates – Tesla, 12-Month Price Targets Based on Economic Outcomes

Bullish possibilities for 2024 relate to investor sentiment, particularly a rerun of aggressive share buying and overconfidence in the company’s future, no matter the valuation logic. You could call this potential outcome either based in the Greater Fool Theory, or backed by a Federal Reserve that eases monetary policy too soon, or just the reappearance of stock market bubble-mania speculation. In terms of a reasonable outlook, while a bullish turn higher for a few months remains possible, I do not believe an extended run above $300 is in the cards this year. I personally place the odds of such at less than 10%.

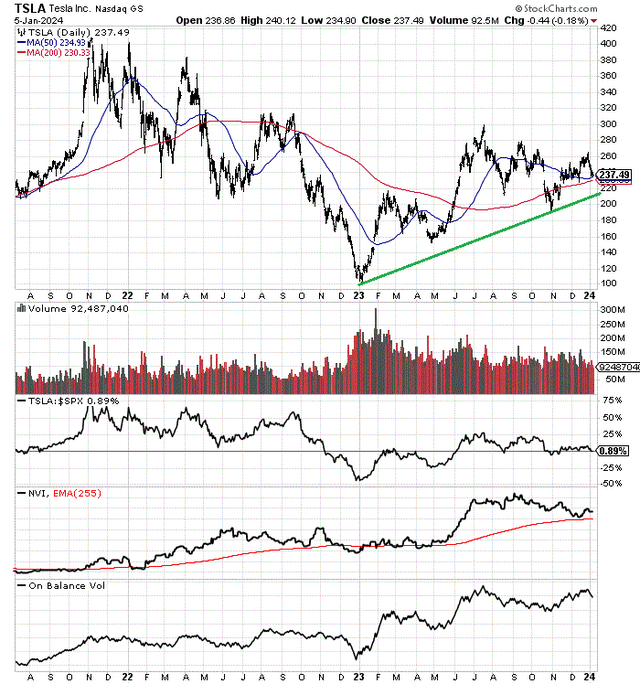

Another way to view the Tesla trading situation is through its daily chart. Even given a serious recession, I am not expecting the January 2022 low of $101 to be violated on the downside. Yet, traders are watching the latest pattern of higher lows for trouble. Below, I have drawn a green trendline under the price bottoms in January 2022 and October 2023. I am confident a break below this line (around $210 today) would cause many bulls to give up and a number of hedge funds to heavily go short. The net effect could be a quick pullback to $180 or lower. At that point, if it happens, I will again consider when to go long Tesla.

StockCharts.com – Tesla, Daily Price & Volume Changes, Since July 2021

I would also note, many of my technical momentum health indicators like the Negative Volume Index and On Balance Volume remain in bullish uptrends. So, there is ample cover today to at least believe a growth-based bottom will appear later in the year.

On a sharp move under $200, I am planning to upgrade my view to a Hold if not Buy rating. If you want to enter a Tesla position, I would wait for a meaningful selloff to increase your odds of investment success. At this stage, with the data I have available, a deep recession might open up a Strong Buy situation under $160 for long-term investors.

However you slice it, I prefer to search elsewhere for buying opportunities with Tesla at $240. Today’s price appears to be discounting several years of growth already. As an investor, you want to buy future growth when others are selling and valuations are low. That is definitely not the classic definition GARP (growth at a reasonable price) or PEG (low price to earnings to earnings growth rates) case for Tesla currently. Consequently, I continue to rate Tesla a Sell for my 12-month outlook.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am effectively short Big Tech in general through bearish positioning in S&P 500 and Nasdaq 100 index products.

This writing is for educational and informational purposes only. All opinions expressed herein are not investment recommendations and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. Any projections, market outlooks, or estimates herein are forward-looking statements based upon certain assumptions that should not be construed as indicative of actual events that will occur. This article is not an investment research report, but an opinion written at a point in time. The author's opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein. Any and all opinions, estimates, and conclusions are based on the author's best judgment at the time of publication and are subject to change without notice. The author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials. Past performance is no guarantee of future returns.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.