Summary:

- Apple Inc. recently experienced downgrades on its stock, causing a retreat in its price.

- These downgrades present buying opportunities because Apple’s long-term prospects remain strong.

- The article highlights Apple’s track record of rewarding shareholders and its underappreciated potential in artificial intelligence.

Justin Sullivan/Getty Images News

The New Year kicked off with the market having a bit of a tumble after an incredibly rare rally lasting nine consecutive weeks. One of the bigger surprises earlier in the New Year was two downgrades on the world’s most prodigious stock, Apple Inc. (NASDAQ:AAPL).

When looking more closely at these downgrades, as we will see below, I think you will find that they are decidedly low-conviction. Nonetheless, the stock indeed responded. After knocking at $200 in December, the downgrades created a retreat.

Furthermore, I think the adverse price action in Apple caused by these and similar other blips are buying opportunities. You should always own Apple and not trade it. Using dips to lower your cost basis is a safe bet with Apple. I will elaborate below.

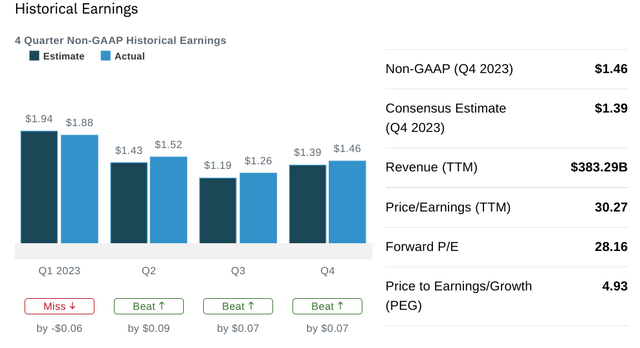

But I always find it helpful to remember that Apple has earned investor trust, and the higher valuation it has grown into in the wake of COVID necessarily means that a bit of weakness in hardware demand isn’t nearly enough to derail the positive momentum that has occurred in earnings over the last three quarters.

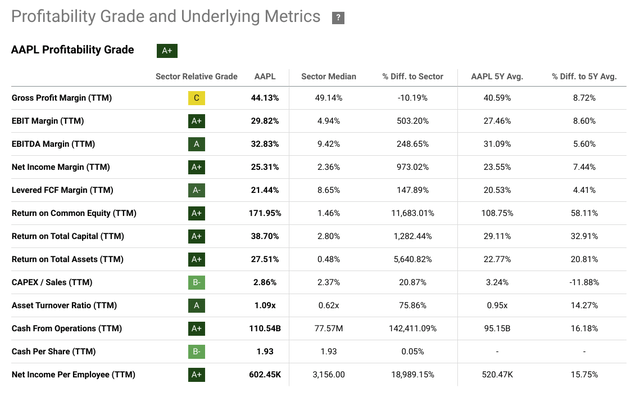

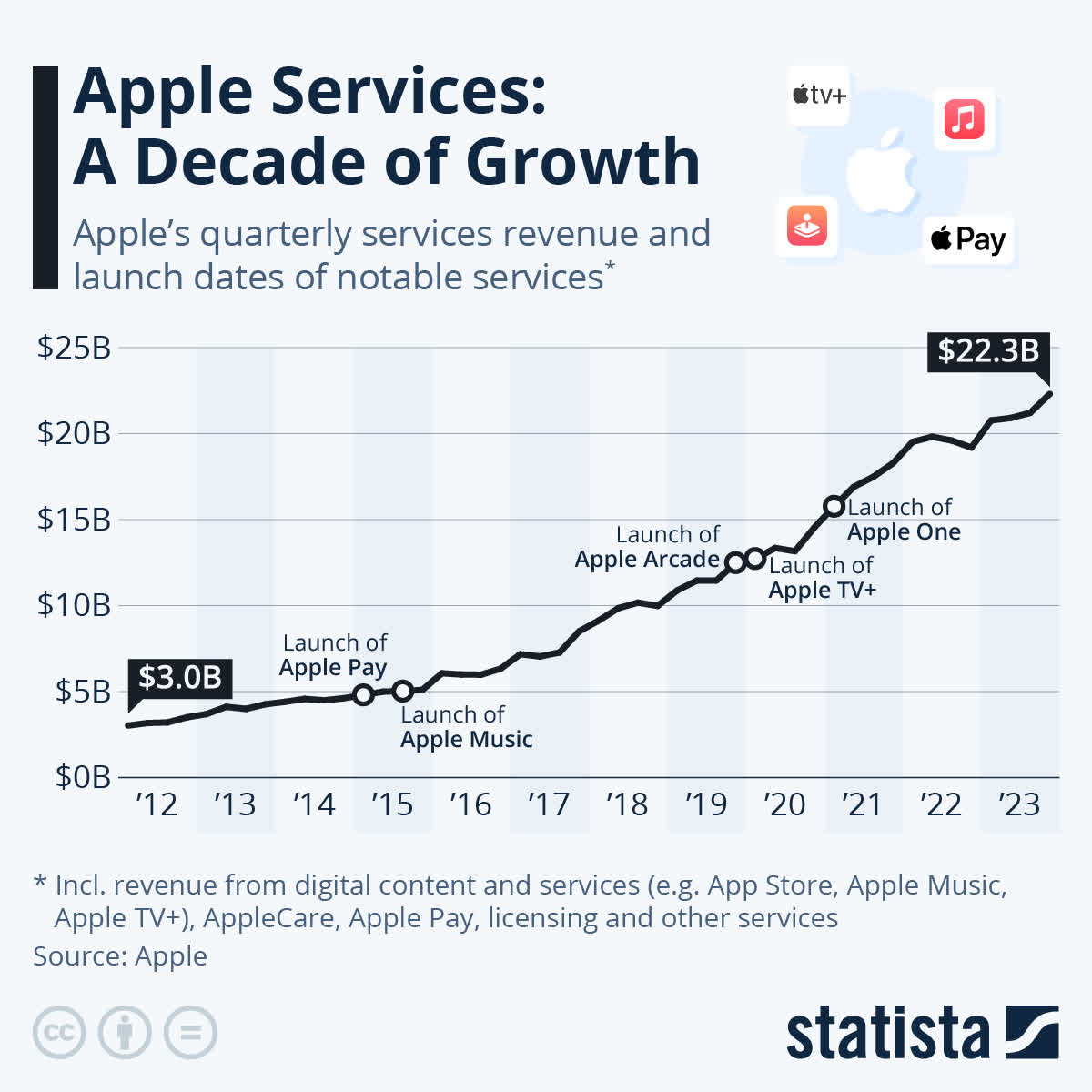

And let’s remember that hardware concerns are less relevant than they have ever been in Cupertino’s long and storied history. The very reason that Apple’s multiple has expanded so much is because the story in the Services segment continues to be positive. As I elaborated on in a previous Apple article, the Services segment and the recurring revenue dramatically enhance the intrinsic value of Apple’s shares and enable a superior multiple compared to hardware peers.

The critical thing to remember with Apple is that you own this stock for the long term, and you trust management’s ability to continue delivering to shareholders in a way that exceeds peers. There is a reason Apple has reached heights that no other company has. Its peers from the cadre formerly known as FAANG generally have far inferior profitability.

Why I Will Buy The (Low Conviction) Downgrades

There’s something about Apple that a lot of analysts won’t mention. It’s a juicy target. While I am not suggesting there are no legitimate reasons to downgrade Apple, I am suggesting there’s been a steady stream of analysts taking shots at Cupertino, and the majority of those shots bounce off the firm as if it were the USS Monitor.

A firm with the size and prestige of Apple not only has earned the benefit of the doubt of the largest institutional investors in the world, but the massive options markets for the stock give the price-specific stability and gravity of its own. As I said in my last Apple article when I poked fun at another analyst who was bearish about Apple on CNBC:

Apple bears are out in force. I even heard an analyst come on TV and say, “Someone should tell the market that Apple is not growing but is priced with a growth multiple,” or something to that effect. Good one! Yes, that must be it. The tens of thousands of discerning institutional investors who feel comfortable with the world’s most prodigious stock must have missed something you uncovered in your tireless spreadsheet work, right? Wrong.

Now, I don’t want to whistle past the graveyard. There are legitimate reasons to suspect that Apple may experience some short-term headwinds. For instance, the economic weakness in China may be hurting iPhone sales right on the heels of the iPhone 15 launch. And there is also evidence that a Chinese government ban on Apple devices may be heating up. Furthermore, the firm is also facing rising antitrust issues from Uncle Sam.

I do not dismiss that these are legitimate short-term headwinds. However, if you want to look under the hood of these downgrades, they will tell the same story I’m trying to tell in this article. If you are a long-term shareholder, these little wobbles and stumbles generally prove inconsequential over the long term.

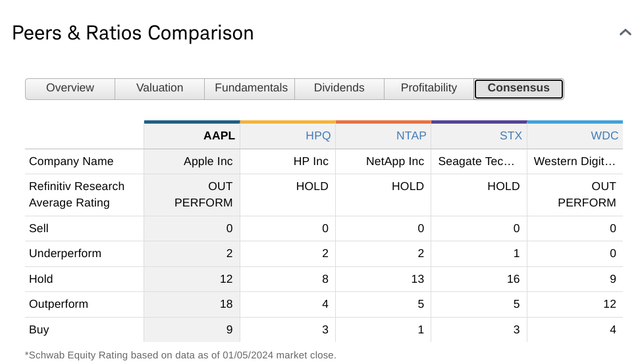

With a company as large and complicated as Apple, one of the main ways you can evaluate them is by the track record of their management in rewarding shareholders. Here, Apple is tough to beat. Remember that most of the analyst community still rates the firm a Buy/Outperform.

And now for the two downgrades in question. So, I’m not quibbling too much about the concerns about iPhone demand because they are legitimate, but I think they may prove overblown. Nonetheless, one significant way to evaluate a downgrade is by the price target change. The bigger the change, the more significant the call.

The Barclays downgrade took the price target from $161 to $160. Not a lot of conviction, in my opinion. If you look at the Piper Sandler downgrade, the price target decreased from $220 to $205. That’s more than a 10% upside from the current price. If you sold off these downgrades, you really took the wrong message, and you should repurchase the stock, in my professional opinion (without knowing about your goals and risk tolerance; there are always exceptions). And it would be best if you didn’t sell it for a long time.

Apple CEO Tim Cook Versus the Rest of Tech: Artificial Intelligence’s Rumble in the Jungle

The famed Rumble in the Jungle was one of the most epic boxing matches of all time. It was one of the crown jewels of the exemplary career of Mohamed Ali. He fought a boxer known for much raw kinetic power in his hit, the illustrious George Forman.

Before the fight, commentators were sure Ali would lose to the younger, more powerful fighter. However, Ali avoided taking direct hits by leaning on the ropes, what became known as the “rope-a-dope.” He could absorb Foreman’s punches and wear him down physically and mentally before finally striking a well-timed and placed final blow that ended the fight in a way that many thought impossible before it happened.

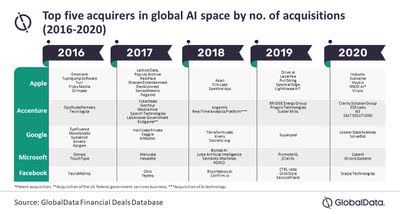

Like Ali, Tim Cook and the company he stewards enjoy commercial greatness and an unrivaled list of achievements. While there are signs that the iPhone is maturing, there are signs that Apple is much further and more equipped for an AI arms race than headline-chasing suggests. Remember that before the ChatGPT and LLM hype, Apple had been quietly making relevant AI acquisitions for years.

Global Data

So, in my opinion, the firm is not behind in AI like many think it is. It might be ahead in a way. While competition is heating up for productivity software and how businesses use AI, and many firms are stepping up to the plate to service this developing need in compelling and profitable ways, let’s remember how much Apple redefined the human experience with the iPhone.

With the Vision Pro coming out, although it is undoubtedly a first-adopter product, I can see the beginning of a future where Apple achieves a similar dominance over the individual consumer’s experience with AI and enhanced reality. Given management’s track record in delivering to shareholders and dazzling consumers, I don’t think selling the firm because of a slight macroeconomic weakness and government scrutiny will be proven a wise decision in a month, a year, or almost certainly ten years.

Apple is in a strong position. It can sustain a current period where it is not the darling of the AI gold rush, as Ali could hang on the ropes. However, when Apple finally chooses to make its AI strategy known, it will have some amazing products and a burgeoning services ecosystem to help it kick into gear. And let’s not forget the importance of data to successful commercial AI strategies. Apple is no slouch here, to be sure.

Risks and Where I Could Be Wrong

Some might point out that Apple hasn’t had a blockbuster product since the iPhone. I don’t think this is really the case, first of all, even if the progress in Services more than compensates for temporary hardware weakness. It reduces the cyclicality of the business and provides a springboard for AI. And here is the critical risk, I think, as well. Suppose Services shows a slowdown or any dramatic setbacks. In that case, Apple will be subject to a lot of valuation risk that could play off of macroeconomic weakness or disappointing iPhone 15 sales.

Statista, Apple

I have been a proponent of the soft landing thesis longer than most, and now that it has become more consensus, I get a little nervous that we could be in for an unforeseen macro risk. This is always a possibility, but I sense that whether or not markets are a bit early on Fed cuts, they are still on the way. Anything that reverses this or if progress on inflation abates could result in adverse price action for Apple.

Conclusion

It is always hard for any individual investor without extraordinary expertise to evaluate the R&D and Capex of a large Tech firm. So, you often have to rely on trusting management and evaluating a company’s track record. I have a lot of faith in Tim Cook. While some doubt his value and make undue comparisons to his predecessor, I think his legacy will be Apple’s approach to artificial intelligence, not the impressive achievements already under his belt.

Steve Jobs wisely picked a prolific operation expert to succeed him. Mr. Cook has been essential to the profitability of the iPhone and proved at the end of 2022 that he could navigate a nightmare crisis like the riot in Zhengzhou. Before that, he made his company indispensable during modern history’s most significant public health crisis. Mr. Cook, too, I think, is hungry for success in AI, which echoes that of his great mentor.

All these considerations should be more critical to Apple shareholders than the facts in recent downgrades, as legitimate and compelling as some may be. When a company has proven its ability to deliver to shareholders like Apple has, it has earned the benefit of the doubt.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.