Summary:

- Nvidia Corporation’s strong revenue growth and margin expansion going into FY25 provide the firm the potential to be valued at $1.6T.

- The company faces challenges in doing business with China; however, strong demand across other regions has the ability to offset the loss of business in China.

- Despite these challenges, Nvidia is well positioned in the market, with a strong growth trajectory in gaming, data center, and automotive.

da-kuk

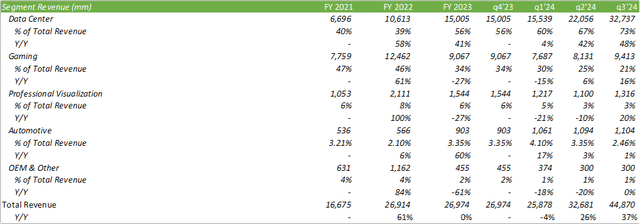

NVIDIA Corporation’s (NASDAQ:NVDA) revenue in fiscal Q3 ’24 went into hyperdrive as the data center grew a massive 48% Y/Y on a TTM basis, with gaming and professional visualization returning to high-growth rates of 16% and 20%, respectively. It is clear the renaissance of generative artificial intelligence, or AI, isn’t over the horizon quite yet and that growth will potentially continue as firms fight to remain competitive with their data lakes. Considering Nvidia’s runway for growth, I provide NVDA shares a BUY recommendation with a price target of $666/share at 20x my forecasted eFY25 revenue.

The Elephant In The Room

As management had outlined on their Q3 ’24 earnings call:

These regulations require licenses for the export of a number of our products, including our Hopper and Ampere 100 and 800 series and several others. Our sales to China and other affected destinations derived from products that are now subject to licensing requirements have consistently contributed approximately 20% to 25% of Data Center revenue over the past few quarters. We expect that our sales to these destinations will decline significantly in the fourth quarter. So we believe will be more than offset by strong growth in other regions. – Colette Kress, Nvidia CFO.

On January 8, 2024, the Wall Street Journal published a barrage of stories centered around risks relating to doing business with China that are very specific to Nvidia. Much of the information detailed in these articles has been touched up on by Nvidia management; however, the challenges faced may be more drastic than what was outlined in the quarterly earnings call. As The Journal reported, Chinese cloud companies aren’t interested in buying lower-powered AI chips and that Alibaba Group Holding Limited (BABA) and Tencent Holdings Limited (OTCPK:TCEHY) are actively shifting some of their orders to China-based companies such as Huawei Technologies and chips developed in-house. Other tech firms such as Baidu and TikTok are doing much of the same. The article suggests that these cloud companies had sourced 80% of high-end AI chips from Nvidia and may reduce their exposure to 50-60% in the next 5 years.

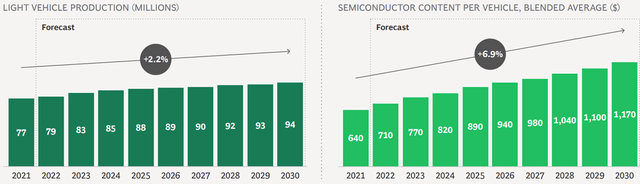

In addition to the high-powered chip restrictions, lawmakers are seeking to implement tariffs on less-advanced chips, which could potentially harm a smaller portion of Nvidia’s automotive business by association. What I mean by this is that with higher costs for analog chips for vehicles may come higher costs for vehicles and potentially fewer vehicles sold as a result, thereby affecting Nvidia’s more advanced chip sales to the automotive industry. According to Boston Consulting Group, 50% of semiconductor capacity growth for the automotive industry comes from mainland China.

As far as Nvidia is concerned, only ~2.5-3% (automotive & Professional Visualization) of revenue is associated with the automotive industry and that this segment taking a small hit won’t be damaging to their growth trajectory. Aside from the automotive industry, tariffs on low-powered semiconductors can bleed into communications, industrials, medical devices, and computing, amongst others. Again, the challenge posed by this will be associated and not necessarily directly affecting Nvidia’s high-powered chips. Overall, I don’t believe this will be much of a hindrance to Nvidia’s growth trajectory for automotive, especially given the initiative to manufacture low-powered chips domestically. In fact, Nvidia should experience economies of scale as chips demanded for autos become more advanced. The challenge I see relating to this is sourcing skilled labor to work at the foundries and the higher costs relating to manufacturing low-dollar chips domestically.

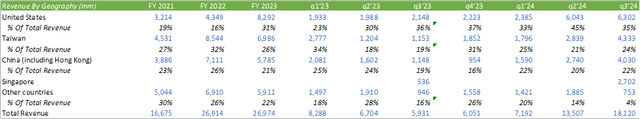

Turning the tables to chip sales to China, I believe imposing these tariffs on Chinese chips along with performance restrictions on chips sold to Chinese firms may lead to longer-term retaliatory effects, as sales to China accounted for 22% of total sales in Q3’24.

I believe the two biggest challenges associated with trade with China will be data centers and gaming. As discussed above, I believe cloud computing firms in China will attempt to transition away from Nvidia’s chips after inventories and receivables are drawn down. This may take through CY25 for the full effects to be felt; however, management has already suggested sales to China will be hindered in Q4’24.

Domestic sales to hyperscalers remain strong as more firms leverage deep learning and generative AI applications powered by Nvidia computing. One other challenge Nvidia may face is competition from domestic hyperscalers designing their own AI chips in-house, such as Amazon.com, Inc. (AMZN) with their Inferentia and Trainium chips, Apple Inc.’s (AAPL) M3 GPU, Alphabet Inc.’s (GOOG, GOOGL) TPU v5e, and Microsoft Corporation’s (MSFT) Azure Maia 100 and Cobalt 100 chips. Many of these chips are either currently available or will be available later in 2024. How much this will impact Nvidia’s future growth is to be seen. The impact may be minimal, as the demand for these high-powered chips remains beyond Nvidia’s ability to produce them. The impact may also be substantial, as customers may opt for other designers’ chips to keep up with their own AI developments.

Nvidia also sees a market with sovereign government bodies using their chips for AI cloud infrastructure and applications. Nvidia sees this as a huge opportunity given data privacy and protection laws for sharing data across borders (think GDPR and CCPA) and the limitations or restrictions of using public cloud services as a government body. As sovereign governments seek to utilize their collected data for their respective use cases, I believe Nvidia is positioned well in relation to their flexibility to either sell or throttle and sell chips to foreign entities. I do believe that as geopolitical tensions rise, both protecting and analyzing data will become more and more valuable to government entities that may use Nvidia’s GPUs.

For gaming, Nvidia launched the GeForce RTX 4090 D, a modified version of its GeForce RTX 4090, that was adapted to comply with U.S. regulations. Accordingly, this modified version is merely 5% slower than the RTX 4090.

Outside of trade-restricted countries, Nvidia continues to improve their gaming series GPUs. The fireside chat at the CES conference with JPMorgan as the host showcased Nvidia’s new line of AI-enabled RTX SUPER series, with prices ranging from $600-1000. In conjunction with their DLSS 3, management boasts speeds that are 2x faster when compared to the 30 series.

Though management anticipates a sequential decline in gaming revenue for Q4’24 due to seasonality, I believe their latest series of gaming chips can continue to drive consumer growth, if anything, at a moderate pace. According to an article published by Barron’s, U.S. consumers are expected to increase spending on tech, reversing a two-year decline. The CTA, or Consumer Technology Association, forecasts 2.3% growth in hardware for 2024, a reversal from the 5.4% decline seen in 2023. The CTA also anticipates a 12% growth in gaming subscriptions.

Looking Ahead To FY25

Management outlined in their Q3’24 earnings call that China and other restrictive regions have contributed 20-25% of data center revenue over the last few quarters. Management also believes that they will be able to offset sales to these affected regions with sales in other countries.

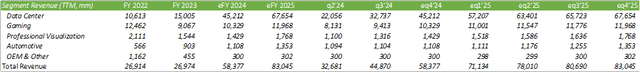

Overall, I expect a robust year going forward. Though I anticipate growth figures to moderate as new entrants begin selling their competitive AI chips, I do believe the broader market demand can accommodate for the additional competition.

Looking to Taiwan Semiconductor Manufacturing Company Limited (TSM) for guidance on the manufacturing front:

“Global semiconductor sales increased on a year-to-year basis in November for the first time since August 2022, an indication that the global chip market is continuing to gain strength as we enter the new year. Looking ahead, the global semiconductor market is projected to experience double-digit growth in 2024.”

Despite the strong reported November data, December sales declined by 8.4% for a full-year decline of 4.5%.

TSMC December 2023 Revenue Report

TSM does have a growth plan for 2024 as a result of Nvidia’s AI chip demand. TSM anticipates doubling their advanced chips packaging capacity, or CoWoS, by the end of CY24. In short, the CoWoS platform is used for manufacturing advanced chip and provides the highest integrated density for high-performance computing applications. I believe that this should debottleneck the supply chain challenges Nvidia faced in CY23 and will allow for greater chip manufacturing and sales. Given that this additional capacity will not be finalized until the end of the calendar year, additional capacity won’t affect FY25 figures in full and will have more of an impact in FY26.

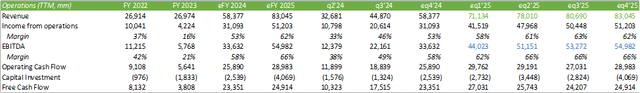

Financials

Starting with revenue, I anticipate Nvidia to continue their strong performance going into the end of the fiscal year through 2025.

I do anticipate data centers to continue driving the majority of growth with strong growth in gaming throughout 2025. I also expect automotive to experience higher growth mid-eFY25 as more advanced automotive chips grow in demand.

For operations, I expect strong margin expansion through FY25 as Nvidia experiences economies of scale through volume sales.

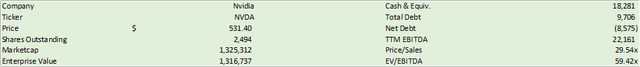

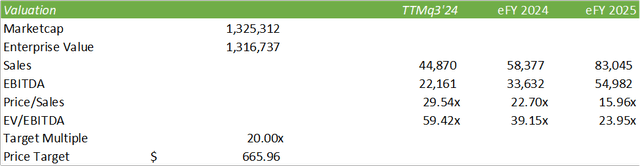

Valuation

NVDA shares currently trade at 29x sales, a very rich and robust valuation. Considering their growth trajectory, this valuation may be justified considering the long runway for their AI chips.

Looking at the firm’s outlay, I provide NVDA shares a BUY recommendation and price shares at $666/share at 20x my eFY25 sales forecast for a market cap of $1.6T.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.