Summary:

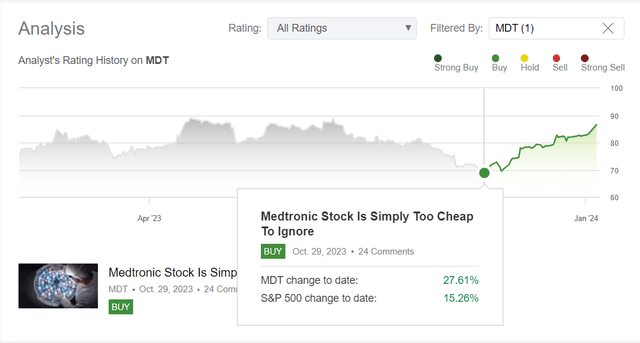

- Medtronic’s stock has increased by 27.61% since my previous ‘Buy’ rated article, outperforming the S&P 500. But what’s coming next?

- Medtronic continues to develop and expand its range of products, with strong revenue growth and increased EBIT margin in Q2 FY2024.

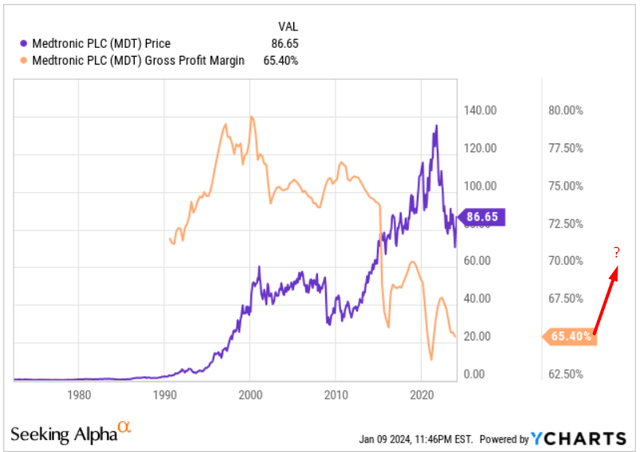

- MDT has a clear plan on how to lower its COGS and stop the ongoing decline in gross profit margin ASAP. I think we can expect GP expansion shortly.

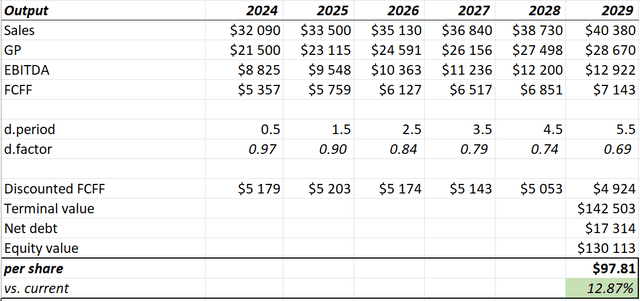

- Based on my DCF model, the MDT stock proved to be undervalued by ~13%.

- I reiterate my previous ‘Buy’ rating and expect MDT to receive a premium to its fair value, which is already above the current stock price.

JohnnyGreig

Introduction

You are now reading my second Seeking Alpha article on Medtronic plc (NYSE:MDT) stock. I initiated coverage of this stock in late October 2023 and was able to point out to investors that the company was cheap near the local bottom. Since publication, MDT is up a whopping 27.61%, while the S&P 500 Index (SPY) is up 15.26% (ex-dividends in both cases):

Seeking Alpha, the author’s coverage of MDT stock

Although part of my old thesis that MDT is ‘too cheap to ignore’ no longer sounds as convincing as it did in October, some factors still lead me to believe that MDT’s full potential has not yet been realized.

Why Do I Think So?

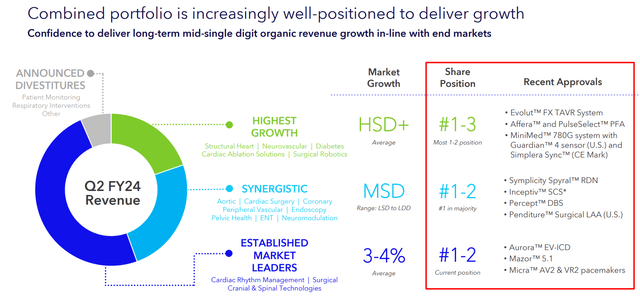

In case you don’t know the company, Medtronic is a major (~$118 billion market cap) global medical technology company based in Minnesota, specializing in various medical devices across five key segments. The Cardiovascular segment is the largest, focusing on heart-related disorders. Other significant segments include Diabetes (for diabetes management), Medical-Surgical (surgical and disorder treatment products), and Neuroscience (products for neurological disorders). As you can probably guess from the size of its market capitalization, MDT is one of the top players in the markets in which it operates:

JPM Conference presentation, MDT data, author’s notes

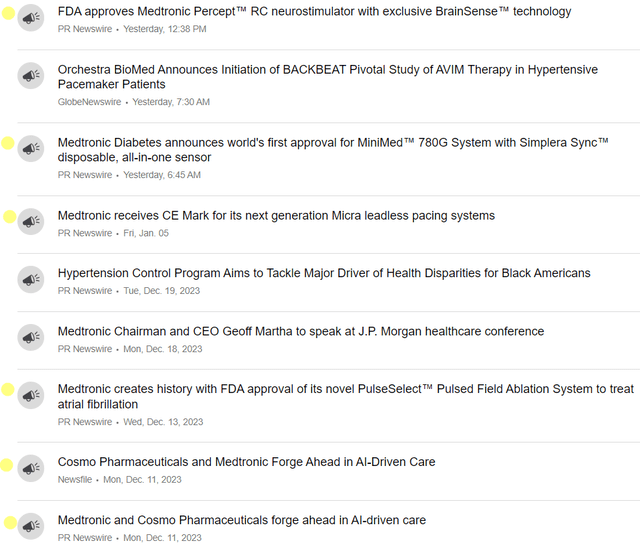

The company, which holds a leading position in the markets in which it operates, never stops developing and expanding the range of products it sells: Take a look at how in the last two months, MDT regularly reported the launches of its next project or a new FDA-approved product.

Seeking Alpha, MDT’s news, author’s notes

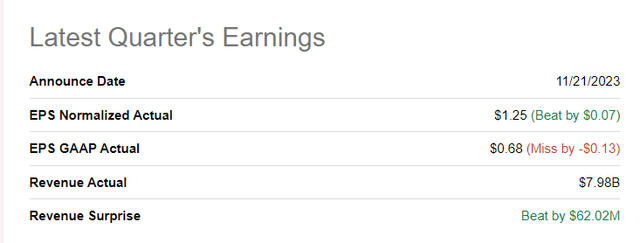

In Q2 FY2024 MDT’s revenue grew 5.26% YoY (the absolute revenue figure turned out to be 8.4% ahead of consensus expectations). The growth was broad-based across multiple businesses and geographies, with cardiovascular, neuroscience, and medical-surgical segments growing mid-single-digits and diabetes accelerating to high-single-digit growth.

Geographically, revenue growth demonstrated diversification, with high-single-digit growth in Western Europe, mid-single-digit growth in Japan, and robust growth in emerging markets, excluding Russia.

MDT’s EBIT margin expanded by 84 basis points YoY. Thanks to that fact and also the lower effective tax rate, the adjusted EPS was $1.25, $0.07 above the midpoint of their guidance range (and the consensus estimate):

Seeking Alpha, MDT’s Earnings page

The management addressed concerns about the potential impact of GLP-1 drugs on Medtronic’s markets, expressing confidence that, outside of a temporary impact on the bariatric surgery market, these drugs would not significantly affect the company’s long-term growth outlook. I’m happy to believe that because the diabetes segment only accounts for 7.6% of the company’s total consolidated sales (as of Q2 FY2024); so the overall negative impact should actually be limited.

At the JPM conference in January (link above), the company gave a presentation in which one of the slides particularly caught my eye:

![MDT's IR materials [JPM conference, January 2024]](https://static.seekingalpha.com/uploads/2024/1/9/49513514-17048616451194801.png)

MDT’s IR materials [JPM conference, January 2024]

MDT has a clear plan on how to lower its COGS and stop the ongoing decline in gross profit margin as soon as possible. I think we can expect GP to recover in the medium term, thanks to the measures already taken (in the slide above) and the measures MDT plans to continue shortly.

YCharts, author’s notes

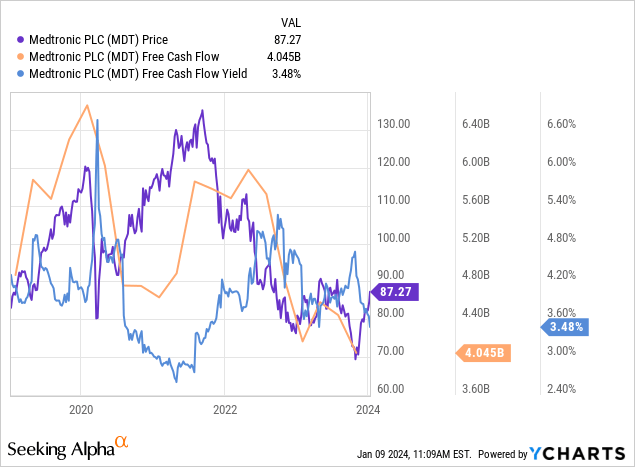

The market has already begun to price in this possibility, as despite MDT’s FCF falling to $4.045 billion (TTM), the stock began to rise sharply after the Q2 results were released, bringing the FCF yield down to 3.48%. This means that Mr. Market apparently believes that Medtronic’s free cash flow will recover strongly soon (hence the stock’s sharp move up in advance).

The most important question is: How long can this repricing last? Let’s approach the answer to this question via the company’s valuation.

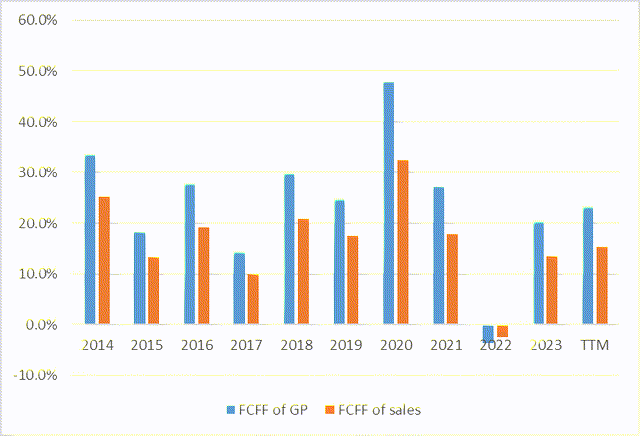

Let’s assume that the consensus forecasts for MDT’s sales over the next few years are correct. If we then assume a gross profit margin expansion, even if only slight, we can express the implied FCFF projections in terms of GP, as this metric historically follows FCFF/sales very consistently:

Author’s calculations, SA data

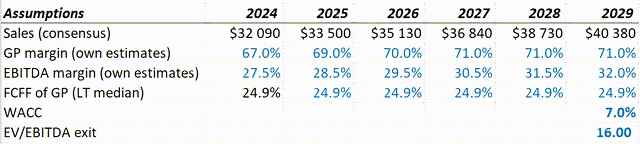

In the base scenario of my DCF model, MDT’s WACC would be 7%, which seems relatively fair under current market conditions. The long-term EV/EBITDA ratio for MDT is slightly higher than 16x – let this be my exit multiple.

So here are my root assumptions:

Author’s calculations, SA data

With these assumptions in mind, the MDT stock proved to be undervalued by ~13%:

Author’s calculations, SA data

A premium may need to be added to this output, as my model assumes a stabilization of the situation and not a resumption of active business growth, which may occur against the backdrop of an expansion of pipeline projects. I, therefore, conclude that the existing spread between MDT’s current price and the company’s fair value offers comfortable upside potential and the possibility that the current rally may continue.

The Bottom Line

As I noted in my previous article on MDT, the stock has its risks that should be carefully considered by every potential investor. First off, competition from major medical device firms, such as Johnson & Johnson (JNJ), Abbott Laboratories (ABT), and Boston Scientific (BSX), may impact pricing and margins. Secondly, changes in reimbursement rates or policies pose a risk to revenue and profitability. Thirdly, with a significant debt load, Medtronic could be sensitive to economic downturns or rising interest rates. Additionally, specific business segments, such as Cardiovascular and Diabetes, confront unique challenges and competition.

However, the same risk factors can be applied to every other stock out there. In the case of MDT, I like that management has a strategy to increase margins through new technologies, cost-cutting, and optimization processes. The market has already priced in this margin expansion potential, and based on the results of my DCF model, the stock price is still quite low to fully reflect what Mr. Market expects. Therefore, I reiterate my previous ‘Buy’ rating and expect MDT to receive a premium to its fair value, which is already above the current stock price.

Thanks for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in MDT over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!