Summary:

- Amazon stock has outperformed its peers and the S&P 500, stunning bearish prognosticators who messed up because they were unjustifiably focused on its valuation.

- Valuation should not be the sole factor in determining the attractiveness of a growth stock like Amazon.

- Amazon’s strong growth drivers and market-leading position support its long-term potential.

- Moreover, AMZN’s price action indicates it hit peak pessimism in late 2022/early 2023. Consequently, it doesn’t make sense to maintain a bearish posture.

- Amazon’s remarkable recovery is a classic case study, allowing growth and value investors to learn how to assess its thesis better and not repeat the same mistakes.

FinkAvenue

Amazon (NASDAQ:AMZN) stock has likely continued to baffle bearish investors looking at its earnings multiples and contend that the stock is expensive relative to its consumer discretionary (XLY) peers and the broad market (SP500). In my previous article, I urged investors to maintain their bullish posture, as AMZN “could be primed for an epic rally after we get past the transitory downturn fears.”

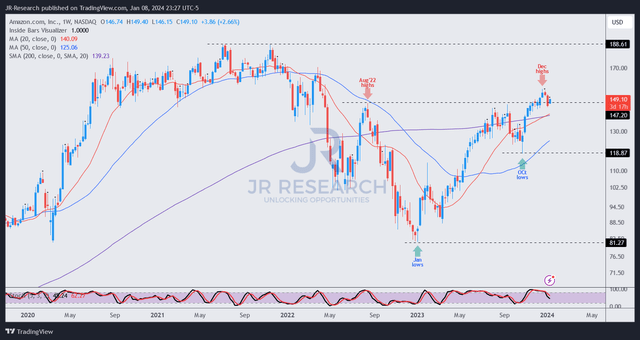

AMZN bottomed out the same week at the $118 level before mounting a surge toward its recent December 2023 highs, up more than 32%. AMZN has also markedly outperformed the S&P 500 over this period and since my article, justifying my bullish bias. With AMZN arguably in the fair value zone, I believe the most attractive risk/reward level has moved out of reach at the current levels. However, is a bullish rating still reasonable?

Accordingly, AMZN has gained more than 70% over the past year, beating the S&P’s 24% total return over the same period, hands down. It also lifted AMZN’s 5Y total return CAGR of 13% to a more “normalized” range. In other words, AMZN fell into peak pessimism in late 2022/early 2023, leading to a valuation bifurcation that saw investors bailing out in a hurry, worrying about the worst. As a result, the normalization can be attributed to a mean-reversion rally that can be assessed from AMZN’s price action (more on that later). With the stock’s highly remarkable recovery, AMZN buyers have recovered its long-term uptrend bias.

However, buyers who waited and waited for the stars to align, I feel obliged to ask, what were you waiting for when the risk/reward was at its most attractive in late 2022 or early 2023? I sincerely hope the “crystal balls” from the consensus bearish Wall Street prognosticators didn’t scare you off. If that was the case, I urge you to be more circumspect and adopt independent thinking in the future.

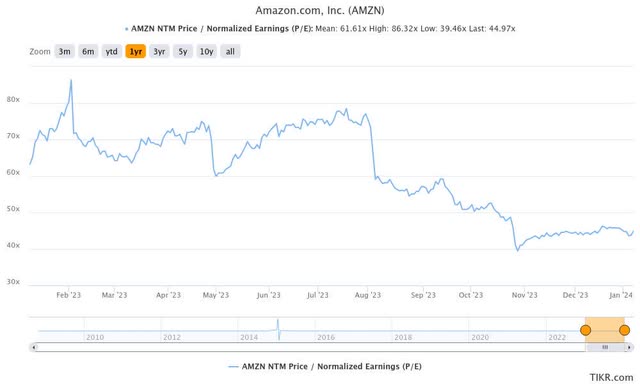

AMZN forward earnings multiple (TIKR)

The “value” investors who rely primarily on AMZN’s valuation to articulate their thesis likely also missed its upside and substantial recovery over the past year? Why? AMZN’s P/E traded at a low of 39x and a high of 62x in the past year. If investors considered the S&P’s 19.7x earnings multiple expensive, what would they have considered AMZN’s valuation? Let me tell you, they would probably have said unjustified. Despite that, AMZN still outperformed the market and delivered a remarkable mean-reversion recovery, notwithstanding these concerns.

It’s not that I’m against valuation. Please don’t be mistaken. However, to cast AMZN aside despite its wide moat business model and robust market leadership, and focus solely or mostly on its valuation isn’t wise. Everyone makes mistakes (and that includes me). Therefore, we need to learn about our mistakes and not repeat them. If we keep repeating our mistakes, that to me is the cardinal sin in investing. Therefore, we should avoid repeating past mistakes and saying AMZN is expensive, expensive, expensive. Or saying that “the market is wrong!” I’ve learned from esteemed Seeking Alpha analyst Avi Gilburt not to blame the market long ago, which he re-emphasized in a recent piece:

The market is always right; analysis is what can be wrong. Too many are overloaded with information and cannot appropriately sift out what is most important to focus upon. – Avi Gilburt, 28 August 2023 Seeking Alpha article

Therefore, please remember that valuation isn’t everything and shouldn’t be the main decisive factor, particularly for a growth stock like AMZN. Seeking Alpha assigns AMZN with an “A-” growth grade. It has a best-in-class “A+” profitability grade, thanks to its wide-moat business model. It has also executed well, assigned an “A” earnings revisions grade, suggesting even Wall Street was too pessimistic about its recovery.

Think about it. What are Amazon’s secular growth drivers that sustain its market-leading profitability metrics and leadership? Its e-commerce leadership in the US is undisputed. Consumer spending has remained robust, defying the consensus bearish economists over the past year. Investors who relied on these economists to derive their bearish economic pessimism and attributed it to AMZN have made a very wrong call.

In addition, Amazon has demonstrated several growth drivers in its e-commerce and streaming business, particularly in advertising. Recall that Amazon has a more than 200M Prime subscription business that shouldn’t be understated. As a result, Amazon has continued to pull its advertising levers in to bolster its primary growth pillars, driving high-margin accretion as Amazon looks to become a formidable ad market leader. The basis of its Prime base has given Amazon a massive moat that cannot be replicated nor overtaken easily. Notwithstanding the intense challenges from TikTok (BDNCE), Temu (PDD), and Shein in Amazon’s key US market, they still couldn’t match Amazon in the efficiencies of its delivery infrastructure. They probably will not likely surpass it in the near term.

Next, Amazon Web Services or AWS. At its recent re:Invent conference, AWS demonstrated its adaptability and ambitions to match Microsoft Azure (MSFT) while fending off Google Cloud’s (GOOGL) (GOOG) challenges. Microsoft’s partnership with OpenAI has given it the advantage of leveraging a market-leading proprietary LLM. However, AWS has indicated that it’s committed to competing and also has custom AI chips designed to help its customers stay on AWS’s infrastructure. Furthermore, as the most significant IaaS player in the market, Amazon continues to generate substantial scale efficiencies in its deployment, providing Amazon with sustainable competitive advantages against its smaller peers.

Therefore, I’m confident it should allow Amazon sufficient time to catch up with Azure on the platform and software layers as Microsoft integrates its co-pilot into its bundled enterprise offerings. With the AI space continually evolving, Amazon’s ability to drive growth through scale shouldn’t be understated, driving operating leverage. Hence, if the company can invest astutely to compete with Microsoft, I expect the two-horse race between MSFT and AMZN to remain well and alive.

To be clear, the thesis on AMZN isn’t bulletproof. In its retail business, it’s pretty clear that the leading fast fashion retailers like Shein and Temu have made significant progress. In addition, TikTok is also committed to gaining clout on Amazon’s most critical North American turf. As a result, Amazon must remain in Day One, and not fall prey to the fallout seen in China. Investors should recall that Alibaba (BABA) has fallen behind PDD Holdings (Temu’s parent company) in market cap, requiring Alibaba to undergo significant changes in its top leadership.

In addition, Microsoft’s ability to leverage AI to catch up with Amazon must never be ruled out. While Amazon remains the IaaS leader, if the AI PC momentum continues to gain traction, it could lead to a fundamental shift in more enterprise workloads moving to Microsoft, given their bundling advantages in the PaaS and SaaS areas. This shift is not expected to be short-term in nature, and therefore could take time to play out. However, investors must continue to observe these developments, as AMZN as the bearish investors would point out, isn’t priced for disappointment.

AMZN price chart (weekly) (TradingView)

AMZN faced resistance at the $150 level as it topped out in December 2023. After a surging run where it easily outperformed the S&P, profit-taking shouldn’t be surprising as dip-buyers likely reallocated.

However, I didn’t glean a bull trap (false upside breakout) suggesting holders must be cautious and reduce exposure significantly, as AMZN is “overvalued.” In other words, I assessed the recent shallow pullback provides investors another opportunity to buy into the AMZN opportunity. However, they must be realistic about not expecting another significant outperformance to replicate the performance in 2023. Notwithstanding my caution, I have confidence that AMZN buyers remain on board, likely anticipating it grinding higher as it looks to retake its all-time highs at the $190 level (and the move need not be linear).

Back to the valuation discussion. Based on AMZN’s valuation metrics over the past year, it has remained far above what the S&P currently trades at, as discussed earlier.

Yet, AMZN bottomed out in December 2022/January 2023 at the $80 level. How do I know? I assessed AMZN’s price action as it formed a bear trap (false downside breakdown), forcing selling capitulation and allowing dip buyers to accumulate at highly attractive zones.

While I noted AMZN’s valuation metrics, I didn’t become obsessed with it, nor was I obsessed with the bearish prognostications of the economists and strategists as I began 2023. I focused on AMZN’s price action. Recall that I posted the following commentary in mid-December 2022 before AMZN bottomed out:

We view a potential re-test constructively, which could help form its eventual bottom before staging a potential bullish reversal toward a medium-term recovery.

I believe you know what happened (you can also glean from its price chart above). AMZN bottomed out (formed a bullish reversal) in December 2022/January 2023 at the $80 level. The rest, they say, is history (and a great learning opportunity about how to assess AMZN’s thesis).

Rating: Maintain Buy

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, GOOGL, MSFT, BABA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!