Summary:

- Eli Lilly’s weight-loss drug Zepbound, with increasing demand and expected insurance coverage, indicates a significant growth opportunity.

- Continued success in GLP-1 therapies positions LLY as a leader in the obesity management market, poised for profitability.

- Despite potential risks, the Company’s robust pipeline and market momentum suggest a strong buy as the obesity drug sector expands.

jetcityimage

Investment Thesis

I believe Eli Lilly (NYSE:LLY) is poised for continual growth due to the significant demand for weight-loss drugs and the increasing insurance coverage. My perspective is a belief in the future of GLP-1 therapies, particularly those targeting obesity. My main focus is on Eli Lilly’s pioneering drug, Zepbound, which I see tackling weight-related health issues- we could almost think of this new division of obesity management as a growth segment in the company, at least that’s how I view it. This article discusses beyond the initial buzz around Eli Lilly’s product and answers why this division is poised for continued growth. I’m convinced that the increasing demand and likely insurance coverage expansions in 2024 will propel these drugs into greater profitability. So as we dive in, I think this is a solid thesis to consider for a potential investment, one where the company’s innovative edge could offer substantial returns as we enter a year of grand potential in this space.

But throughout this entire piece, you will find that I intertwine an analysis that definitely highlights the importance of these GLP-1 drugs. I hope you enjoy reading this article as much as I enjoyed writing it.

Eli Lilly: Buy Rating

Continued GLP-1 Success In 2024

Both Eli Lilly and Novo Nordisk (NVO) have released weight-loss drugs and they have changed the pharmaceutical industry– and the world. Both of their products have been on the market, some believe that we are at the peak of their buzz, and others, like myself, see a bright future for them in 2024 (and other industries, which we will discuss later) The FDA’s approval of tirzepatide, marketed as Zepbound, marked a significant step in the fight against obesity. It is a promising avenue for those struggling with weight management. Zepbound’s active compound is shared with the diabetes drug Mounjaro, which has already shown impressive weight loss results. Zepbound stands out because of its dual-hormone mimicking mechanism, which is believed to be more effective in comparison to weight loss drugs like semaglutide. The clinical trials supporting this claim are compelling; patients lost about 18% of their body weight on average. I find this a very large and promising figure when thinking about the challenges associated with obesity and its treatment.

However, there are many side effects to consider and also note that Zepbound is not a one-size-fits-all solution. Individuals vary in their results, but the drug is particularly impactful for those with weight-related health risks.

I am confident that insurance coverage will be available for the weight-loss drugs, which is where much of my 2024 thesis revolves around. However, as of now the high out-of-pocket cost remains a concern for those without adequate coverage. But all in all, with a growing demand (and almost a need) I see this development as a strong indicator of the growing market for obesity drugs, highlighting Eli Lilly’s potential growth in this sector.

To dive in deeper, the surge of interest in weight loss drugs this year is what I think illustrates the upside in Eli Lilly. While some think the hype is long over, I suggest this market still holds upward movement; I don’t believe it will top off anytime soon. But in broad terms, the importance of these developments is impactful to say the least. Analysts are predicting the weight loss drug market to reach $100 billion by the end of the decade. Goldman Sachs (GS) forecasted 15 million U.S. adults to be on obesity medications by 2030; the stakes are high and I suggest, with these numbers, that everyone take a piece of the investment pie. I say this because of the growing demand and now increasing accessibility of the drugs, which we will continue to see rolling into 2024. And like I said, most of us know that there are current issues with supply and insurance coverage. For example, Eli Lilly’s Mounjaro has faced supply constraints. However, the companies are actively working to scale up production to meet these demands. This major impact on the medical community and the likelihood of increased insurance coverage down the road is what further supports my thesis to consider investing in Eli Lilly, the two companies that are most definitely leading this innovation.

Risks

I would like to note that it is essential to acknowledge the inherent risks associated with the company, and in the light of recent developments regarding their GLP-1 products, Mounjaro and Zepbound. Firstly, Eli Lilly’s warning against the misuse of these drugs for cosmetic weight loss raises concerns about off-label usage. I can see this potentially leading to unfavorable health effects, legal liabilities, and damage to the company’s reputation. The legal actions taken against compounding pharmacies and healthcare facilities for selling unapproved versions of their GLP-1 products signal potential regulatory hurdles. This legal battle implies ongoing legal costs for Eli Lilly and suggests the existence of a competitive and argumentative environment within the weight loss industry.

Moreover, the reliance on FDA approvals for their drugs leaves Eli Lilly vulnerable to regulatory changes and potential setbacks in the drug approval process. Any delays or rejections by the FDA can impact the company’s revenue streams and growth prospects.

Lastly, the highly competitive nature of the weight loss industry, with Novo Nordisk as a prominent rival, introduces market share risks. But I do think as each product gets better and more people adopt this weight loss management drug, then it will propel each company. I see Eli Lilly and Novo Nordisk as competitors but also complement the new, exciting sector of weight loss drugs. But in zooming out and in more general terms, Eli Lilly must continuously innovate and market its products effectively to maintain its competitive edge. Something that I will be watching and I advise interested investors to look at, too.

The bulls might argue that Eli Lilly’s strong track record, diversified portfolio, and robust research and development efforts can mitigate these risks. They may emphasize the company’s commitment to safety and adherence to FDA guidelines. However, I look at all perspectives and welcome all info, so to me, potential investors should carefully weigh these risks against the potential rewards when considering an investment in Eli Lilly.

Valuation

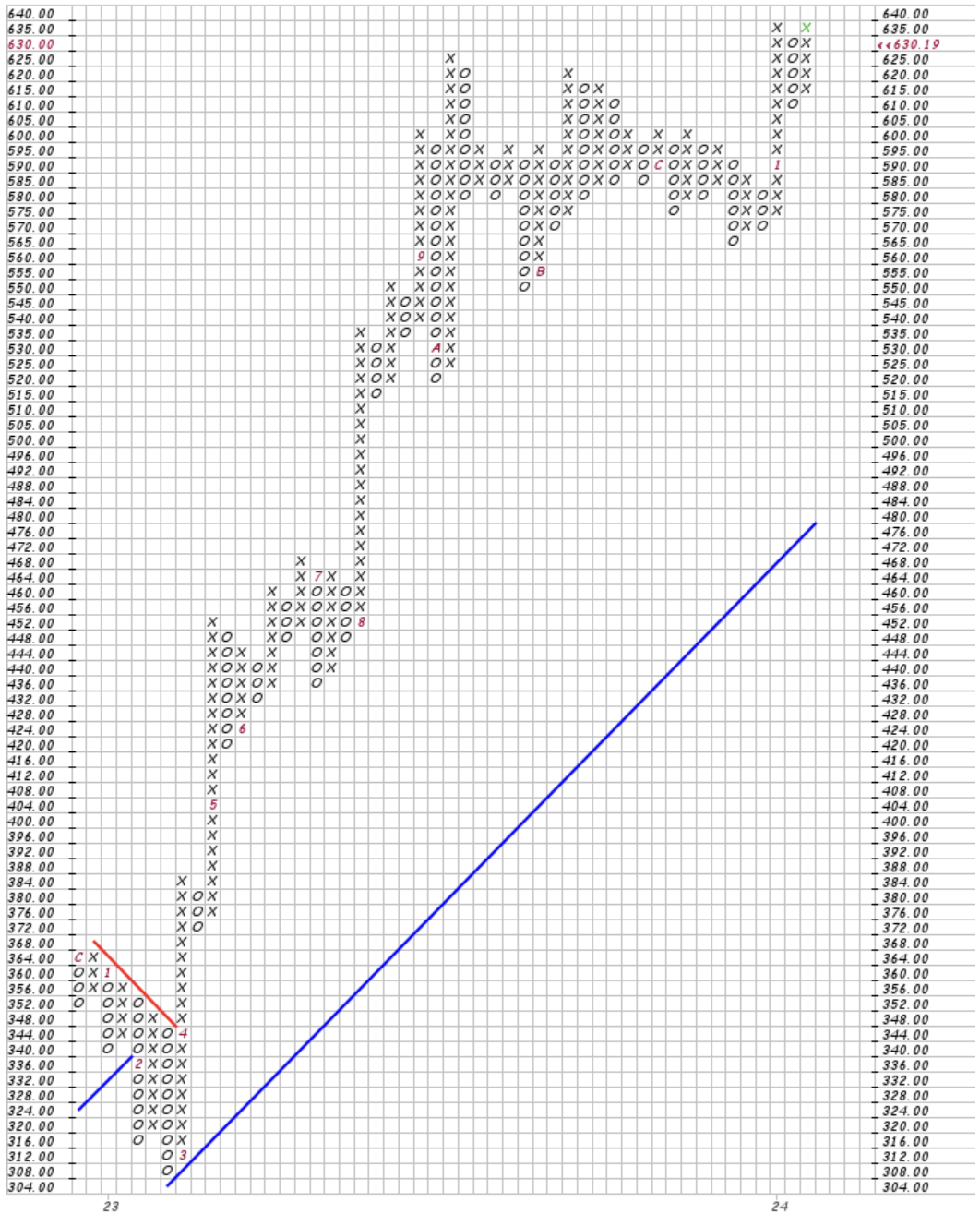

Eli Lilly has had major growth as we take a glance back. The stock is up +78.65% in a 1-year timeframe and up +443.55% over the past 5-year period. I enjoy viewing a point and figure chart, which I have added below. This is the traditional three box reversal method to understand support levels and trend lines. What sticks out to me is the momentum in Eli Lilly stock. As we can see in the chart there is a major blue-upward trend line. I strongly believe that if a stock is going up it will not stop until there is an external force to shift this momentum. This is much related to Newton’s law- an object will either continue in motion or stay at rest until an external force changes this state. So therefore, momentum is our friend!

LLY Point & Figure (Stock Charts)

With that graphical thought in mind, let’s move to the investment metrics. I think it is relevant to mention that these numbers would usually (and still might) depict a negative thesis if we were to solely look at this set of valuation data. However, with our point and figure graph in the forefront of our brains, I do believe that the momentum is a factor to emphasize. And with my thesis of increasing insurance coverage and increasing demand, in my opinion, I see this momentum continuing through a fundamental lens. This is a key reason why the data below may seem overvalued, but maybe we should just think deeper and differently.

Starting with the forward P/E at 101.75, which may raise eyebrows compared to the sector median of 29.27. This lofty P/E isn’t a red flag to me, it is illustrating the very growth we are speaking of in the alpha perspectives. Moving to the forward Price to Sales ratio, we land at 16.75, striking past the sector median of 4.13. Now, this D+ grade here might make some investors think twice as it may be a sign of overvaluation. But I see it supporting the stock’s premium quality. To say that Eli Lilly is a growth company would be interesting at the least, but I think its valuation metrics are directly related to what you’d see in the higher-end growth companies. I would say that this division of weight loss drugs, in my eyes, is the growth segment that may be causing the hype (and what I think will be continued hype).

Lastly, the forward Price to Cash Flow ratio. This metric tells us how much the market values every dollar of cash operations are expected to generate. A ratio of 92.03 against a median of 16.32, again with a D- grade, might seem alarming. But if the company’s cash flow is projected to balloon due to innovative strategies or market expansion, this ratio in my perspective is a moment before the stock hits its growth spurt.

|

Price / Earnings (FWD) |

Price / Sales (FWD) |

Price / Cash Flow (FWD) |

|

|

Novo Nordisk |

101.75 |

16.75 |

92.03 |

|

Sector Median |

29.27 |

4.13 |

16.32 |

|

Percent Difference |

247.64% |

305.81% |

463.94% |

So, what do these metrics mean for my buy thesis? Well, I don’t see them as discouraging signs. I view this data as an illustration of better than expected performance and what I think will promise. The stock has great upside and these numbers are showing something big. The metrics are high because expectations are high, sustaining my confidence in Novo Nordisk going forward.

The Key Takeaway

The emergence of GLP-1 weight-loss drugs like those from Eli Lilly is reshaping the pharmaceutical industry. The key takeaway is that Eli Lilly is poised to make an increase in 2024 due to the growing demand and likely chance of insurance coverage. These drugs are making major impacts in the obesity management market. Through this article, I’ve outlined not just the promise of their products but the wider impact on healthcare and investments. As we look to 2024, I remain confident in the company’s innovative drive and the significant role it plays in shaping a healthier future, making Eli Lilly a compelling choice for investors seeking growth and impact in their next investment.

Comment below what you think of Eli Lilly and the GLP-1 drugs, I would love to engage with your thoughts and opinions!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Thomas Potter is an independent investor as this publication has been produced for informational purposes only. This is not investment advice. Please do your own due diligence and invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.