Summary:

- NextEra Energy is a leading utilities provider in the US, with a strong market position and good relationship with regulators in Florida.

- The company operates the largest rate-regulated utility in the United States in the form of FPL and is developing their world-class renewable energy business.

- NextEra has excellent financial performance, with stable returns and profitability, making it a strong long-term investment.

- Shares may be valued by around 12% which is quite large in the context of NextEra’s historical valuation premium.

- Strong Buy rating issued.

pidjoe

Investment Thesis

NextEra Energy (NYSE:NEE) is one of the largest utilities providers in the United States. The firm’s utility, “Florida Power & Light” is the largest in the nation with the firm also developing a worldclass renewable energy business.

An attractive market position and good relationship with regulators in Florida allow FPL to act as a monopoly setting a price for utilities which guarantees a sufficient return on capital for the firm.

Excellent business economics allow these rates to still be lower than the national average illustrating the fiscally efficient manner in which FPL is run.

Overall, I like the company, I like its management team and I find the current valuation to offer around a 12% discount in shares relative to their intrinsic value.

I therefore rate NextEra a Strong Buy and have initiated a position in the utility worth 8% of my total portfolio value as of present time.

Company Background

NextEra Energy | Investor Relations

NextEra Energy is one of my favorite regulated utilities in the United States with the firm having a massive presence in Florida.

The firm’s regulated utility “Florida Power & Light” is the largest rate-regulated utility in the state with the firm distributing power to nearly 6 million customer accounts and owns around 32 gigawatts of electricity generation.

NextEra also has a renewable energy segment, “NextEra Energy Resources” generates and sells power throughout the U.S. and Canada with about 25 gigawatts of generation capacity achieved through a mix of natural gas, nuclear, solar and wind.

While utilities have long been shunned for their capital intensive and relatively slow revenue growth, I fundamentally believe these companies are great stable long-term investments thanks to their legal ability to set prices that result in sufficient ROICs and ROAs.

John Ketchum currently heads NextEra as chairman, president and CEO. Ketchum continues to place customer value at the forefront of NextEra’s business objectives with a strong belief that a transition towards more environmentally friendly energy generation solutions will help NextEra transition into a carbon-neutral economy in the future.

Ketchum is also a keen advocate for financial discipline, a strong balance sheet and continuous innovation and improvement in order to ensure NextEra remains competitive. The focus on financial discipline and a strong balance sheet in particular is excellent to see in my opinion as this is where many utilities can lose their competitive advantages especially over long time periods.

Economic Moat – In Depth Analysis

I believe that NextEra enjoy a robust and wide economic moat thanks to the almost monopolistic control the firm enjoys in Florida and thanks to fundamental characteristics that shape utility regulation in the United States.

NextEra’s Florida Power & Light utility has exclusive rights to charge their customers sufficient prices for electricity and power so as to earn what is deemed a “fair” return on the capital they invest to run their utility network.

The state of Florida has relatively positive regulatory environment for Florida Power & Light with the two working closely together to set the rates the utility may charge for their service.

While the capital requirements are quite large for utilities, I believe that this fundamental regulation and NextEra’s almost exclusive provision of power in Florida enables the firm to generate stable returns and ultimately helps guarantee the profitability of the firm’s core operations.

I believe that NextEra’s excellent cost control and focus on a solid balance sheet have allowed the firm to charge below-average retail rates for their service which ultimately helps present the company’s monopolistic business in a better light to already supportive regulators.

Florida Power & Light is also America’s largest utility which illustrates just how successfully NextEra has managed to grow this energy provider in the sunshine state.

NextEra also operates the aforementioned renewable energy business which I believe contributes another degree of moatiness to the firm’s overall business operations. The firm has placed a significant focus on their wind power generation facilities with a long-term objective to repower around 740MW through wind facilities by 2026.

The firm aims to achieve these goals by selling off legacy pipeline operations and focusing on high-yielding growth opportunities in the renewables categories. This proactive approach to decarbonizing their energy generation solutions has resulted in NextEra acquiring some highly lucrative renewable power sites.

On a global scale NextEra Energy Resources is one of the world’s largest wind energy producers operating more than 16,000MW of emissions-free wind energy. The firm also operates a leading portfolio of innovative solar energy generation plants including a mix of photovoltaic and solar-gas hybrid sites.

Florida itself naturally lends for great solar power generation opportunities with NextEra taking full advantage of this natural propensity for sunlight by installing more than 30 million new panels in Florida by 2030.

I believe that NextEra already has an infrastructural advantage in the renewable energy sector which ultimately should allow the firm to generate excess returns on their already invested capital compared to utility firms only just getting into the renewables sector.

Overall, I believe NextEra’s excellent Florida Power & Light utility combined with their great portfolio of worldclass renewable energy generation solutions should allow the firm to generate great returns on their invested capital while simultaneously operating a great quality business.

I must also add that I really like the management team at NextEra and believe they are some of the best professionals in the utilities sector. Their extensive focus on solid fundamentals, liquidity and sustained innovation are a rare mix of conservative fiscal planning and constant forward thinking.

Financial Situation

NextEra has been for the better part of a decade a highly profitable and well-run organization from an operational performance perspective.

NextEra’s 5Y (FY22-FY18) average ROA, ROE and ROIC have been 3.16%, 11.02% and 6.00% respectively. These returns are quite positive indeed with the firm tangibly outpacing inflation with their returns on both equity and invested capital.

It must also be considered from an absolute perspective that a NextEra’s ROE exceeds that of a government bond yielding say 2-4% by a significant margin which ultimately illustrates just how healthy of a business NextEra is operating.

The firm also has 5Y average (as measured from FY22-FY18) gross, operating and net margins of 55.22%, 23.54% and 20.61% respectively. The relatively high and unchanged gross margin in particular illustrates that NextEra’s core business operations are profitable and well operated as evidence by their substantial gross profit margin.

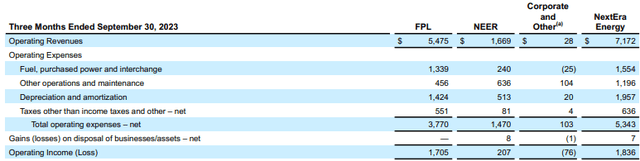

FY23 has been a mostly profitable year for the firm with their latest quarter seeing NextEra grow total group revenues by 8% YoY thanks to strong performance by the firm’s FPL business in particular.

FPL’s growth in the third quarter came from continued investment in the business leading to an increase in customers by a count of 65,000 compared to the same period last year. FPL continued to follow their strategic capital plan aimed at delivering outstanding value to its customers in one of the faster-growing states in the entire United States.

The utility also managed to grow revenues all the while keeping their bills well below the national average with reliability and value at the forefront of FPL’s business operations.

Overall operating income for FPL was up 13% YoY thanks to capital improvements decreasing COGS for the business segment all the while increasing the reliability and robustness of FPL’s infrastructure for the long-term.

NextEra’s NEER business saw flatline revenue growth YoY in Q3 despite delivering a record quarter of new renewables and storage origination adding approximately 3.245MW to its backlog since Q2. This total wattage comprised of 1.485MW of solar, 400MW of wind, 905MW of storage and around 455MW of wind repowering.

Adjusted earnings saw NEER generate $207M in operating income with the business still struggling to match the unit economics of their established FPL utility.

However, given that the NEER segment is still growing, it will take time for their infrastructure to begin yielding tangible returns from the invested capital and I fully expect that the firm will be able to achieve an operating margin of around 25% for the business.

NextEra’s Q3 result overall saw the business generate mostly flatline non-GAAP operating incomes with net income decreasing from $1.7B to just $1.2B in Q3 FY23 due to a 0.9B after-tax impairment on NEERs 2018 investment in NextEra Energy Partners.

Seeking Alpha | NEE | Profitability

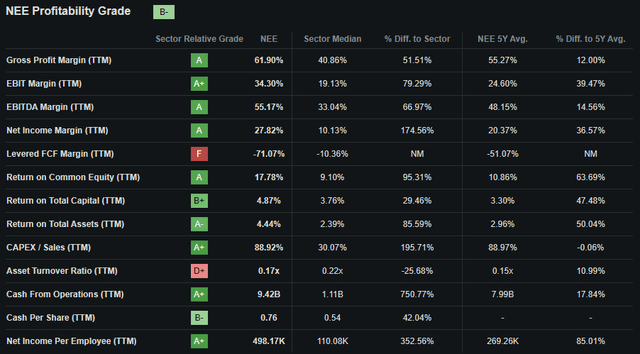

Seeking Alpha’s Quant calculates a “B-” profitability rating for NextEra which I believe to be a mostly accurate representation of the profit generating power currently present at the firm.

Nonetheless, it must be noted that NextEra is producing excellent margins and returns from their business relative to their 5Y average with the firm generating double digit gains compared to their running historic mean.

NextEra’s focus on innovation and investment into the renewables category of course has resulted in the firm spending an additional 4$B (an increase of 55%) on NEER’s renewable energy development with multiple on-going expansion projects taking up a significant portion of cash flows.

FPL also saw a $1B increase in capital expenditures used to improve and enhance existing utility infrastructure.

The net cash flow provided by operating activities of $7.27B was therefore all used in investing activities with the firm generating $2.78B from financing activities (primarily the issuance of long-term debt including premiums and discounts) and return from dividends & capital distributions.

This left NextEra with a net cash increase of $1.143B with total cash and cash equivalents positions at the end of Q3 totalling $4B.

This massive cash balance is only one of the many examples of excellent capital allocation present at NextEra with their balance sheet being in great shape too.

The firm has $14.24B in total current assets while total current liabilities amount to $28.5B. The massive current liabilities are partly due to a large portion of long-term debt maturing in the next 12 months along with substantial short-term borrowings and accounts payables of $6B.

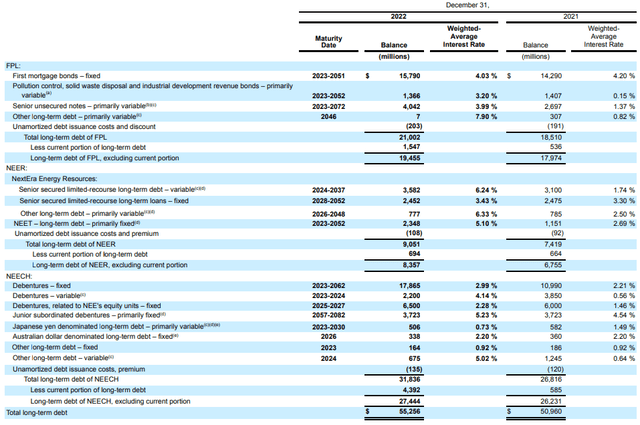

Nonetheless, this leaves NextEra with a pretty low quick ratio of 0.23x and a current ratio of 0.50x. NextEra’s Debt/Equity ratio is 1.56x while the firm operates on a financial leverage ratio of 3.65x.

While these liquidity metrics may seem quite limited, it must be compared to other utility firms such as Evergy (EVRG) who have a quick ratio of 0.08x and a current ratio of just 0.39x respectively.

Total assets for NextEra amount to $171.7B while total liabilities amount to just $115.1B. While the lack of great short-term liquidity will most likely leave the firm requiring refinancing some of their maturing long-term debt at a higher rate, I do not believe it will impact the firm as negatively as expected, especially if interest rates fall in 2024 as expected.

At the close of Q3, NextEra had $59.2B in long-term debt up from the $55B disclosed in their last FY22 10-K form. As illustrated by the table above (with little real change occurring as a result of the additional $2B increase since FY22 end), NextEra has a mostly well staggered long-term debt profile with a weighted average interest rate of around 3.5%.

Moody’s credit ratings agency affirmed a Baa1 credit rating for NextEra’s LT issuer rating and senior unsecured domestic notes. The outlook remains stable. Moody’s classifies “Baa1” credit ratings as being of the highest “speculative grade”, due to some speculative elements being present in their rating.

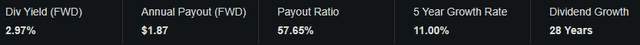

Seeking Alpha | NEE | Dividend

NextEra also pays a truly wonderful dividend to investors with a 28-year growth streak illustrating the firm’s absolute dedication to rewarding shareholders. The FWD yield of 2.97% is good with a payout ratio of 57.65%.

Considering that the dividend survived the dot-com crash and the 2008 financial services troubles, I believe this is one of the safest and most reliable dividends currently available for investors.

I eagerly await the Q4 earnings report which will hopefully provide investors with more guidance regarding FY24 expectations especially in a macroeconomic environment where rate-cuts may occur which could further bolster NextEra’s growth prospects.

Valuation

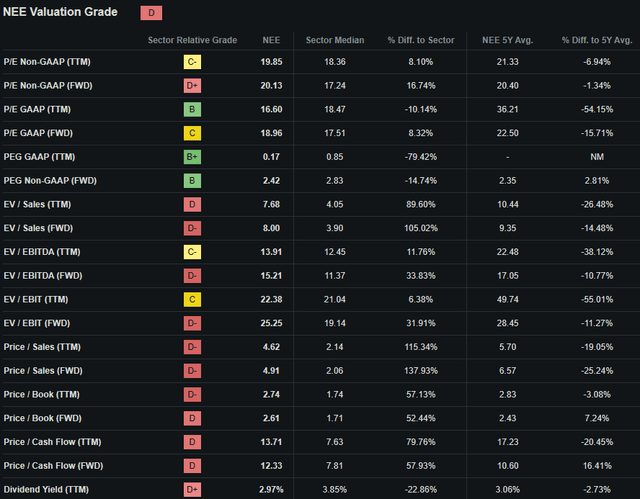

Seeking Alpha | NEE | Valuation

Seeking Alpha’s Quant assigns NextEra with a “D” Valuation grade. I believe this letter grade is an excessively pessimistic representation of the value present in NextEra stock and serves as an illustration of how very accurate quant metrics can sometimes give an imperfect understanding into the real value of a stock.

The firm currently trades at a P/E GAAP TTM ratio of 16.60x. This represents a 54% decrease in the ratio compared to their running 5Y average and is even 10.14% lower than the sector median.

NextEra’s P/CF TTM of just 13.71x is 21% below their running 5Y average while their TTM EV/EBITDA of just 13.91x is very low compared to a 5Y median of 22.48x. The firm’s Price/Sales TTM of 4.62x is quite high however even despite the consistent returns generated by the utility.

While many of these ratios may seem quite elevated compared to other sectors, utility firms generally trade at relatively high valuation metrics given the incredibly reliable and consistent returns generated by these firms.

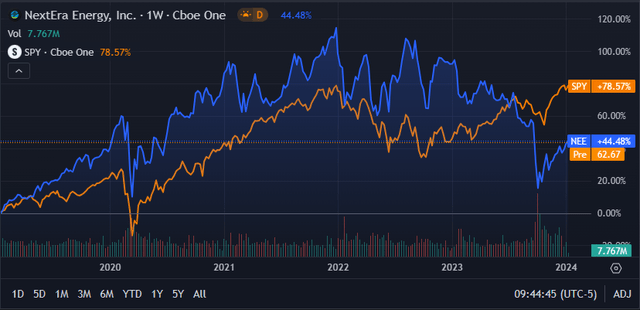

Seeking Alpha | NEE | Advanced Chart

From an absolute perspective, NextEra shares are trading at a significant discount relative to previous valuations with current share prices of around $62.65 representing significant 50% contraction relative to the high’s seen in mid-2022.

NextEra shares outperformed the popular S&P 500 tracking SPY index for over 85% of the last five years with the recent selloff and SPY gains ultimately resulting in the ETF beating the utility stock by around 30%.

The relative valuation provided by simple metrics and ratios along with the absolute comparison already allow for a basic understanding of the value present in NextEra shares to be obtained especially against their historic highs. However, a quantitative approach to valuing the stock is still essential.

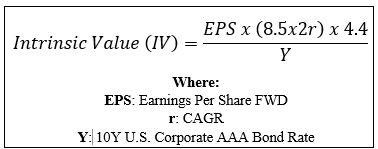

The Value Corner

By utilizing The Value Corner’s specially formulated Intrinsic Valuation Calculation, we can better understand what value exists in the company from a more objective perspective.

Using the firm’s current share price of $62.48, an estimated 2024 EPS of $3.40, a realistic “r” value of 0.07 (7%) and the current Moody’s Seasoned AAA Corporate Bond Yield ratio of 4.74x, I derive a base-case IV of $71.20. This represents a modest 12% undervaluation in shares.

When using a more pessimistic CAGR value for r of 0.06 (6%) to reflect a scenario where an unfavorable macroeconomic environment results in lower than anticipate revenue growth, shares are still valued at around $65.00 suggesting a roughly fair valuation in shares.

Considering the valuation metrics, absolute valuation and intrinsic value calculation, I believe that while shares are not trading at a massive discount, NextEra is in a good value position relative to previous valuations and the stability in returns offered by the firm.

In the short term (3-12 months), I find it difficult to say exactly what may happen to the energy firm’s valuation. Any acute recession in the U.S. or sudden shock to the economy could see shares tumble even despite the already discounted share price.

Because the short-term sees markets act more as voting machines than a value weighing scale, I cannot confidently make any short-term predications due to the inherent irrationality of the public.

In the long-term (2-10 years), I believe NextEra will continue to be a worldclass energy supplier. Florida Power & Light should continue to generate great returns for the company while simultaneously offering consumers great prices thanks to the cost-effective structure of the utility.

I also believe NextEra’s renewables section will generate greater operating margins as the segment ramps up with the firm’s infrastructural advantages suggesting a lasting cost-advantage will be enjoyed by the energy group.

Risks Facing NextEra

NextEra faces some risk primarily arising from a continuously changing regulatory environment for rate setting and from the firm’s significant investment into the renewables business.

While the state of Florida and FPL have recently enjoyed a great relationship with constructive rate setting being agreed by the two entities, such a positive situation is never a guarantee. The degradation in relations between WEC and the state of Illinois illustrates just how rapidly a changing regulatory environment can affect the firm’s underlying profitability.

Furthermore, FPL has been accused by multiple press outlets of campaign finance violations which if found to be true could result in a negative charge against the firm.

NextEra’s renewables business also faces some threats particularly from a higher interest rate environment derailing the firm’s growth prospects and overall profitability. The investment into renewables will require a huge amount of capital which could come at a much higher cost should the current macroeconomic environment persist.

Any increase in the overall cost of renewable energy production versus fossil fuel production could decrease the profitability and attractiveness of NextEra’s renewables portfolio. While the long-term outlook for renewables is positive, it is difficult to predict the timeframe in which renewables will overtake fossil fuels.

From an ESG perspective, NextEra faces little tangible threats with the firm working hard to contribute towards a net-zero carbon economy. Furthermore, I like that NextEra is working to make clean energy a real cost-saver for consumers rather than utilizing it to greenwash their operations.

NextEra is capitalizing on renewables becoming one of the lowest-cost options for many customers under various state and federal policies over the years while simultaneously decreasing the reliance of The United States energy infrastructure on fossil fuels.

Given the lack of tangible ESG threats, I believe NextEra could make for a compelling ESG conscious utility stock especially compared to some of their counterparts.

Of course, opinions may vary with regards to ESG material and I implore you to conduct your own ESG and sustainability research before investing in NextEra if these matters are of concern to you.

Summary

NextEra is a high-quality utilities company with excellent capital allocation, a great value offering to consumers and a continuous desire to innovate characterizing their core business operations.

The management team at NextEra is in my opinion superb with the team excelling at directing the firm through difficult macroeconomic environments by ensuring a conservative approach to their balance sheets and growth prospects is maintained.

While FY23 has been less impressive than previous years, the firm is well on track to regain their stride especially if interest rates were to fall in 2024. When combined with a relatively modest yet tangible 12% undervaluation in shares, I believe now could be a great time to build a position in this blue-chip utility.

Therefore, I rate NextEra a Strong Buy and have initiated a position worth 7% of my total portfolio value in the utility company.

Quite simply, I like the company, I like its management team and I find the current valuation attractive enough given the relative premium that utility companies usually trade at.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NEE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I do not provide or publish investment advice on Seeking Alpha. My articles are opinion pieces only and are not soliciting any content or security. Opinions expressed in my articles are purely my own. My opinions may change at any time and without notice. Please conduct your own research and analysis before purchasing a security or making investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.