Summary:

- Macroeconomic conditions are worsening, with increasing loan delinquencies and declining consumer financial health.

- The demand for electric vehicles, including those of Tesla, Inc., has slowed significantly due to the macroeconomic conditions.

- While the current environment is negative for Tesla, the slowed investment by competitors could set Tesla up for a stronger future in the EV market.

jetcityimage

Introduction

Macroeconomic conditions are tough for electric vehicles, or EVs, and their makers today. This environment does not leave an exception, as it widely applies to all automakers, including Tesla, Inc. (NASDAQ:TSLA). Tesla’s growth has been nothing but amazing in the past few years. The company’s ability to scale should not be taken lightly. However, today’s macroeconomic conditions are taking a toll on the company’s potential growth and profitability, and I believe this will only get worse in the coming few quarters.

Consumers’ financial health is declining fast, which is reflected in numerous data, including the delinquency rates. As the economy continues to slow, an ever-increasing number of consumers will likely be pushed out of the market for a new car. Further, with the declining consumers’ financial health, many lenders will likely be more stringent. Overall, the macroeconomic conditions are expected to worsen, creating an even stronger headwind for Tesla going forward because the company’s premium valuation today does not leave significant room for a slowdown.

I believe it is reasonable to argue that Tesla faces major challenges ahead in the foreseeable future. On the other hand, the competitive landscape in the EV industry is starting to favor Tesla’s long-term growth. Key competitors have started to reduce their investment in EV infrastructure or delayed these investments, and as it is the case that these competitors are working to catch up with Tesla’s production volume to achieve a competitive unique economics, macroeconomic conditions hindering competitors’ progress could be beneficial for Tesla. Therefore, as the near-term potential negative impact from the macroeconomic conditions is expected while the long-term potential benefit from slowing investments by competitors is not, I believe Tesla is a long-term buy.

Macroeconomic Conditions

Macroeconomic conditions are worsening with an expectation for it to continue for the foreseeable future.

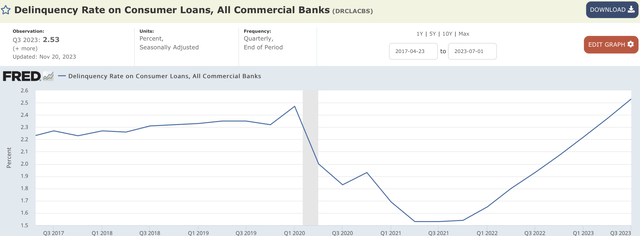

Starting with loan delinquencies, consumers are facing accelerating financial pressure. As the chart below shows, delinquency rates on all consumer loans are increasing at a sustained level from their trough in 2021Q3. Today, in 2023Q3, the delinquency rate has surpassed pre-pandemic levels. Further, beyond a high delinquency rate, the acceleration of the rate is alarming as well. From 2023Q2 to 2023Q3, the delinquency rates increased 6.75% quarter-over-quarter, which is comparable to 6.76% growth from 2023Q1 to 2023Q2.

Further, focusing just on auto loan delinquencies does not make the situation any better. Late auto loan payments hit the highest point since the 1990s, surpassing the great financial crisis in 2008.

The rise in loan delinquencies could be translated to weakening the financial health of the consumers. The ability of the consumers to pay off their loans has greatly reduced. This could mean that the future demand for products, such as cars, could be affected. Further, as delinquencies continue to climb with no indication of it slowing, lenders may be more stringent on their underwriting potentially aiding to the slowdown in demand. Already, some banks, including Capital One Financial Corporation (COF) and U.S. Bancorp (USB), have started scaling back their auto lending business.

Likely for the same reasons as the rising delinquency rates, the demand for electric vehicles has slowed significantly. As a result, numerous competitors to Tesla have started cutting investment in the industry. Ford Motor Company (F) postponed about $12 billion worth of EV investment to address the slowing demand. General Motors Company (GM) has also announced plans to push back volume production of popular vehicles including the Chevy Equinox EV and Silverado EV by a few months. Further, Honda Motor Co., Ltd. (HMC) also scrapped a $5 billion plan to make affordable EVs with GM. Finally, Tesla has also said that it will wait for more macroeconomic clarity before scaling its Mexico factory.

As such, as the direction of these companies suggests, the demand for EVs has slowed as a result of the macroeconomic conditions. Given the trajectory of the delinquency rates, the current negatively impactful environment will likely continue for the foreseeable future.

Competitive Condition and Tesla’s Move

The macroeconomic conditions are already impacting Tesla, with the likelihood of the current environment continuing for the foreseeable future. These conditions are negative for Tesla; however, when looking at the competitive environment, the macroeconomic headwinds, in actuality, could be better for Tesla in the long run.

As mentioned earlier, legacy automakers’ stance toward an EV investment is clear. They are holding back aggressive investments until the macroeconomic conditions warrant a reason to continue investing in the EV future. On the surface, this may seem terrible for Tesla, as the company is the biggest player in the industry; however, I do not think this is the case. I believe the company has the potential to continue or strengthen its leadership position in the industry as a result of a slowed investment by the competitors, setting Tesla up for a stronger future as the uncertainty in macroeconomic conditions subsides, whenever that may be.

While Tesla has successfully ramped up numerous popular models, including Model 3, Model Y, Model X, and Model S with the upcoming CyberTruck, albeit slowly, competitors are slowing down investments before even offering any popular models in scale to be competitive with Tesla’s volume and pricing. Further, on top of the slowdown in EV manufacturing plants by major competitors, they are also slowing down battery manufacturing plants. For example, Ford is delaying the construction of a battery plant in Michigan, which was worth about $3.5 billion.

It is likely a reasonable move for competitors to slow down an EV investment, and it is also the case that Tesla has delayed its Mexico factory. But, I would like to argue that the situation is different. Eventually, because the world is apparently moving toward an electric vehicle future, it is likely that electric vehicle demand will return shortly. When this future arrives, whenever it may be, Tesla’s competitors who have been struggling to catch up to Tesla even in an environment where they were aggressively investing in EVs, will have to resume or build manufacturing plants, supply chains, and battery plants, which Tesla already enjoys with its existing production sites that have achieved volume production. Therefore, while the macroeconomic conditions could temporarily hinder the company’s growth, in the long term, I believe the current slowdown could only help Tesla.

Financials and Valuations

Tesla’s financial position is strong, which will likely be enough for the company to last through a potential slowdown in the macroeconomic conditions. The company has about $26.08 billion in cash and short-term investments, with only about $2.15 billion in long-term debt. Considering that the company has about $16 billion in cash, the long-term debt levels are extremely healthy. Further, Tesla has a total liability of about $39.45 billion with total assets of about $93.94 billion, bringing the total liability to asset ratio to only about 42%. Thus, Tesla’s balance sheet is extremely healthy.

Tesla’s valuation, on the other hand, enjoys some premium. The company’s 2024 forward price-to-earnings ratio stands at about 60 while the 2025 forward price-to-earnings ratio sits at about 44. As it is expected that the company will have to navigate through tougher microeconomic conditions for the foreseeable future, I believe the current valuation multiple is on the expensive side. Therefore, I believe the company’s valuation has more risks to reward potential, in the short term.

Risk to Thesis

As the U.S. economy has proven to be resistant throughout 2023, many economists have started to guide for a potential soft landing in 2024. While this scenario will likely align with my arguments of potential macroeconomic risks in the short term and potential competitive benefits in the long term, any changes in the magnitude of the economic slowdown could alter my argument. If it is the case that the economic slowdown accelerates beyond our expectations today leading to a recession, the short-term risk for Tesla could be far greater than my current expectation, leading to an outsized risk to the company’s stock, especially given the company’s premium valuation today.

Summary

The economy is expected to slow down for the foreseeable future into 2024. This will likely affect Tesla’s top and bottom lines as consumer demand for new vehicles will likely decline along with the company’s pricing power. However, while this condition may seem detrimental to Tesla, the company could benefit from this environment in the long term. Major legacy automakers who were attempting to catch up to Tesla’s volume production and competitiveness in EVs have announced a delayed investment for a new EV factory and battery factories.

While Tesla has already achieved volume production, major competitors’ roadmap to this status has been delayed. As such, when the EV demand returns, whenever that may be, Tesla will likely continue to enjoy its market leader position without a new significant competitive challenge for the foreseeable future. Therefore, considering both the short-term risks and long-term potential, I believe Tesla stock is a buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.