Summary:

- Markets are implying that PayPal is a business at the end of its ropes.

- The stock price currently implies that PayPal will have 0% growth.

- Growth levers are underappreciated by market participants.

- The margin of safety in the intrinsic value presents a very rare opportunity.

Editor’s note: Seeking Alpha is proud to welcome Emir Mulahalilovic as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Justin Sullivan

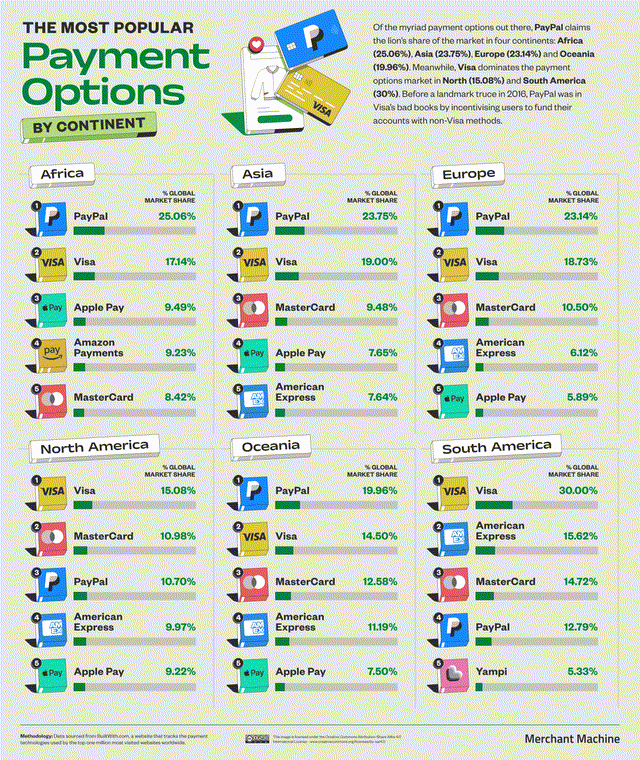

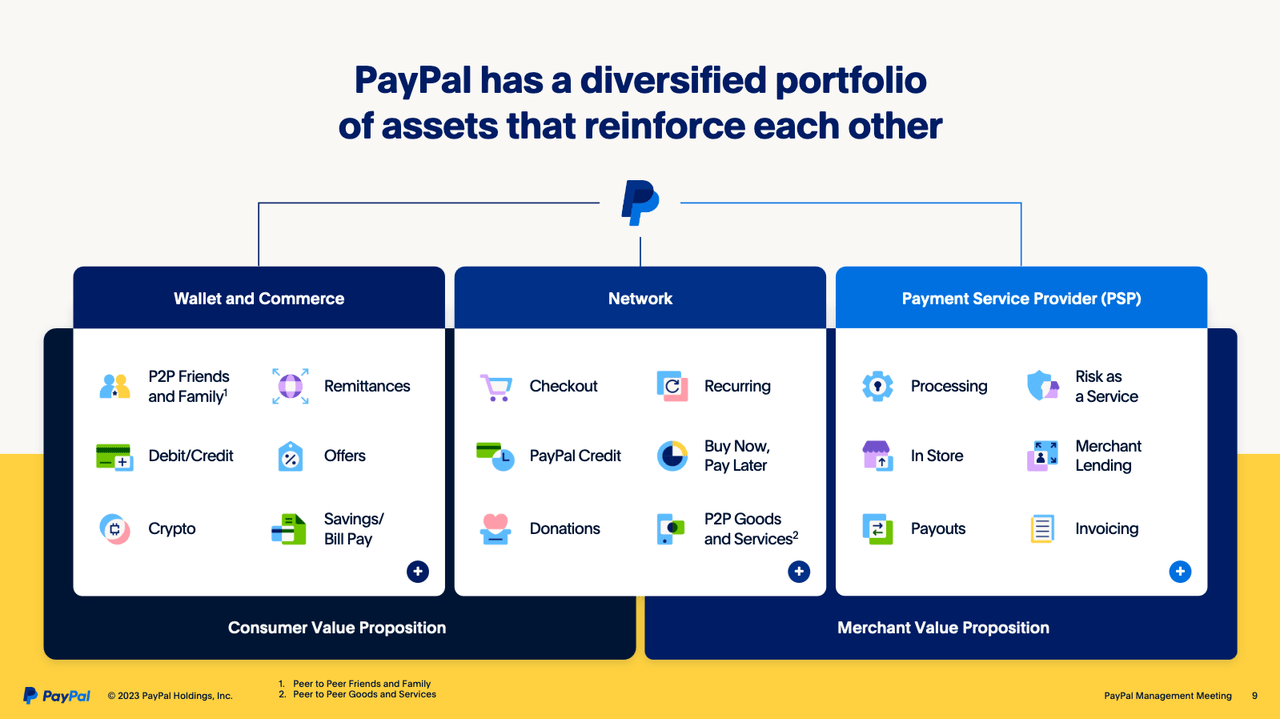

PayPal (NASDAQ:NASDAQ:PYPL) is a company that operates a payments ecosystem— everything from peer-to-peer transfers, digital wallets, checkout solutions as well as the processing infrastructure behind it. The product suite is a vast array of services that complement each other which is also needed in the ever-growing, ever-competitive market. In the payments space, outside of North- and South America, PayPal is the undisputed payments king, according to Merchant Machine.

Merchant Machine

I see a well-positioned business, set to benefit from further payment digitization trends globally as we become more of a cashless society. PayPal may not put up growth in parity with the digital payments market, but that is not necessary to justify a buy at current levels. Trading where it is now, if PayPal can post any sort of growth, then it is undervalued.

If they can accelerate growth, and they have the product pillars and roadmaps that indicate that they may, that is where it gets very interesting and justifies a strong buy and offers significant upside. I see PayPal achieving just that, and the opportunity is too big to pass up.

A company in distress according to the market; and the market is wrong

It has likely not escaped anyone’s attention that PayPal has been downtrending for quite some time; now trading at 2017 levels. However, it is important to try and understand why.

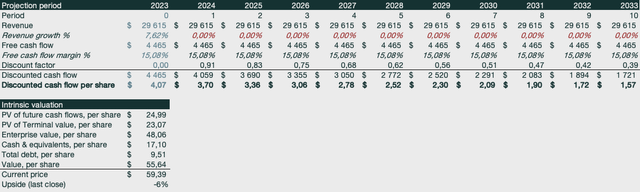

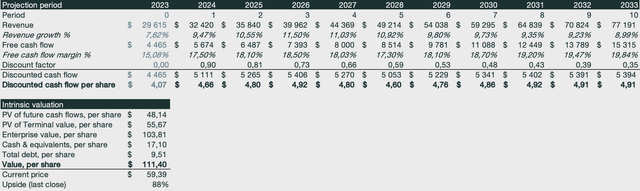

An easy exercise is to create a reverse discounted cash flow model (DCF). That way, we can get a better understanding of what the current stock price implies in terms of the present value of future cash flows.

The pictured DCF model uses a 10% weighted average cost of capital and 3% terminal growth assumptions.

Emir Mulahalilovic

Assuming current consensus estimates for fiscal year 2023 (Source: S&P Global Market Intelligence) for revenue and cash flow margins and then keeping it at 0% growth for 10 periods, we get some interesting results. The intrinsic value using these assumptions outputs a $55,64 value per share, which is roughly where PayPal has been trading recently.

- This implies that the market does not believe that PayPal will have any growth past 2023 and is pricing it as such.

The next question to ask is if that is a reasonable assumption or not.

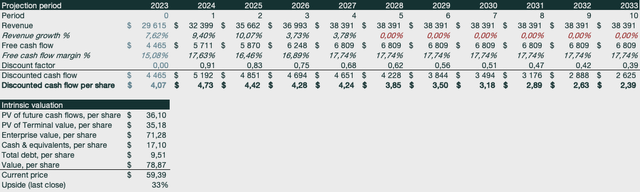

Looking at the analyst consensus estimates (Source: Canalyst, Bloomberg), PayPal is projected to grow net revenues to $38,391 billion by fiscal year 2027, which would mean a compounded annual growth rate (CAGR) of ~6,9%– an estimate that in itself seems a bit conservative.

The analyst consensus is also that PayPal will have free cash flow of $6,809 billion in 2027, which is roughly a 6% CAGR. Another seemingly conservative projection. If we give the analysts credibility in that there is likely to be some growth, at least until 2027, but then revert to 0% growth, what happens to the value per share in our intrinsic valuation?

Emir Mulahalilovic

The model now outputs a ~35% upside from the ~$60 stock price range, even though there’s no growth after the fourth period in the DCF. This means that the analyst consensus disagrees with the way the market is currently pricing PayPal.

Can PayPal actually keep growing, or are there actual concerns that they will stay flat for a 10 year period? If PayPal is to grow, where would the growth come from?

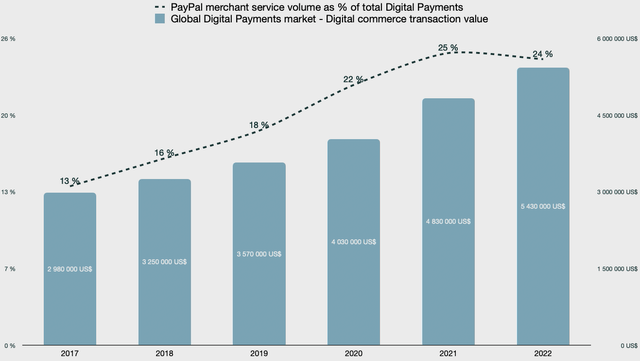

Looking at Total payment volume (TPV) as a percentage of the total global digital payments market (Source: statista.com), we can see that PayPal has increasingly been gaining market share over a 5 year period. We don’t have a 1:1 comparison here, as the reported data does not allow it. However, we can roughly gauge the metrics by doing the following as a proxy:

- The global digital payments volume only includes digital commerce

- PayPal stopped reporting merchant service volume as % of the TPV at the end of fiscal year 2021. I will use the quarterly averages per year and use the last reported figure (97%) for 2022.

Emir Mulahalilovic, PayPal SEC Filings

Looking at the above chart, we know that PayPal has been steadily growing their market share before posting a flat year in 2022. According to the same source, digital payments are set to grow at a 12% CAGR between 2024 and 2027. This means that whilst PayPal may not show the same impressive market share growth, they will likely grow revenues as the industry as a whole grows, despite flatlining or declining their total share.

There are data points and management commentary that suggest that PayPal will actually accelerate their growth. To understand where the growth may come from, it’s vital to be aware of the business segments PayPal operates. It is likely that you have used a PayPal product recently; it’s way more than a simple checkout button that reads “PayPal”.

PayPal Management Meeting, June 8, 2023

PayPal sports a diverse portfolio of products that caters to a vast market with a lot of growth opportunities. However, PayPal has outlined some specific opportunities that they are focusing on during the past year, both at various conferences and during their quarterly reports. The following products present growth opportunities moving forward.

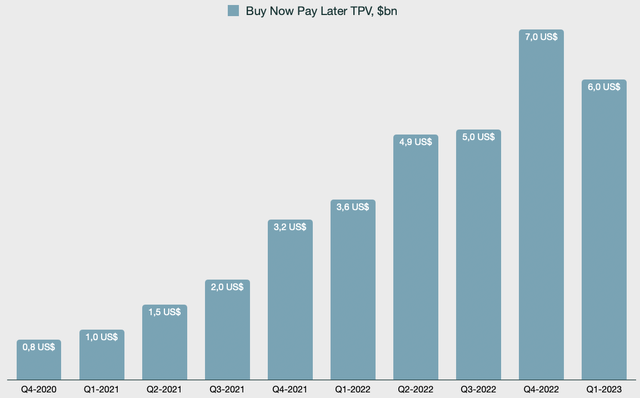

Buy Now Pay Later (BNPL)

BNPL is currently a small segment for PayPal, but it is growing exponentially. Unfortunately, we don’t have a complete up to date picture on these metrics, but we have numbers up until Q1 of 2023.

Emir Mulahalilovic, PayPal SEC Filings

The quarter over quarter decline of Q1 2023 against Q4 2022 can be explained as the holiday season during Q4 is historically a large volume driver of this type of product. The year over year growth has been in the triple digits for all reported quarters except Q1 2023, which was 70% on an FX neutral basis.

The BNPL product has a significant run rate considering we have been, and will likely continue to be in a tough economic situation globally as inflation lingers in large parts of the world. Newer generations, the type of generation that utilizes digital payments spaces the most, are saving less and spending more than older generations (Source: Fidelity published survey, 2022). During Visa’s Q3 2023 earnings call (NYSE:V), CFO Vasant Prabhy mentions that

the consumer has remained resilient so far

Conclusion: BNPL is likely to continue growing in the coming periods. It may be a smaller portion of PayPals current total payment volume and does not move the needle massively, but there is high potential in this segment. Remember, we need to find hints at growth, if we can do that, then PayPal is currently undervalued.

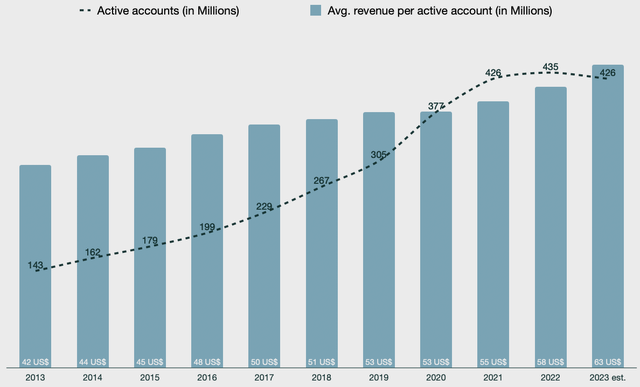

Active accounts and account activity

Another point that seems to concern the market is that PayPal has been losing active accounts rather than growing them the past fiscal period. This is due to PayPal acquiring many low quality accounts during, predominantly in the Latin America and Southeast Asia regions. This is how Gabrielle Rabinovitch, acting CFO comments during PayPals Q3 earnings call

…active accounts declined by 2.8 million as we continue to flush out low-quality customers predominantly in Latin America and Southeast Asia. As a reminder, we said this would be a year where we churn off lower-quality actives and in which total accounts would decline. Year to date, churn has been lower than our expectations. Customer growth is a vital pillar of our growth agenda

Let’s not take Gabrielle’s word at face value, let’s have a look at what the numbers tell us. After all, the data never lies.

Emir Mulahalilovic, PayPal SEC Filings

Average transaction revenue per active account keeps increasing. Despite the pandemic boost in both accounts and revenue, we still see a resilient positive trend in the quality aspect of the transaction revenues.

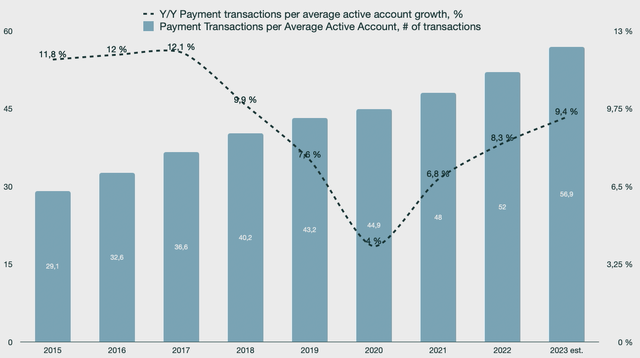

This is further bolstered if we look at the amount of transactions per average active account; we can actually see an acceleration of the trend. 2020 marked the end of a declining growth rate compared to prior periods, but since the Covid fears have dissipated, it’s been re-accelerating.

Emir Mulahalilovic, PayPal SEC Filings

The data shows that the total amount of active accounts is declining. It is a conscious decision to prune a vast amount of accounts due to low quality, as per PayPal’s Q3 earnings call comments. However, it does not affect the overall performance enough to turn the figures negative. Accounts are transacting more, they are spending more and the trend continues to accelerate.

Conclusion: The active users of PayPal are historically spending more and more. PayPal keeps providing more value to current customers and I don’t see the trend growing to a halt any time soon. As PayPal churns low quality accounts, these statistics will improve further. Again, these numbers hint at growth, which is what we want to prove to justify the stock being undervalued.

Payment processing and check out solutions

The processing segment is PayPal’s main growth driver moving forwards as per the reported numbers. These solutions are not dependent on a customer using PayPal as their checkout option. Consumers are welcome to use whichever card provider they want, including Visa, Mastercard (NYSE:MA) and American Express (NYSE:AXP). Consumers could even use mobile solutions like Apple pay (NASDAQ:AAPL), and PayPal can still make money.

The reported metrics are primarily comprised of Braintree full-stack volume. Unbranded processing also includes unbranded credit and debit card processing on the PayPal platform.

Looking at total payment volume for the unbranded processing segment, it grew 40% year over year on a FX neutral basis from 2021 to 2022– $299bn to $407,1bn. Looking at 2023, it has grown 30% on a FX neutral basis, or more, for each quarter and actually accelerated in Q3. Likely due to the holiday season in Q4, we should see further acceleration here.

However, the risk in this field lies in competition. Stripe and Adyen (OTCMKTS:OTCPK:ADYEY) are both fierce competition within the space and some are concerned for a race to the bottom in terms of margins. Essentially, each company undercutting each other for market share. However, new CEO Alex Chriss clearly states that he is not interested in a race to the bottom in this space during the Q3 earnings call (empahsis added):

We have proven that we can win in the market and take share with Braintree, serving the largest enterprises such as Adobe (NASDAQ:ADBE), Booking.com (NASDAQ:BKNG), DoorDash (NASDAQ:DASH), Ticketmaster and Uber (NYSE:UBER). In the last 12 months, we processed over $450 billion in volume out of an estimated $4 trillion to $5 trillion of global large enterprise e-commerce. That’s approximately 10% flowing through us.

We now have a beachhead to build upon. We will address additional customer needs such as payouts, fraud management, chargeback automation and FX. These value-added services not only address specific customer pain points but also help PayPal drive additional margin. To be clear, our focus here will be continuing to improve performance, provide additional services and expand margin.

There are several mentions of margin expansion in the transcript beyond the cited section. In addition, the CEO also lays out the plan for how they will be a more attractive partner. Namely, by adding more services beyond just processing; payouts, fraud management, chargeback automation and FX. The expansion outside of the U.S. will scale up and historically, these regions provide higher margins than the U.S. market.

The products in this segment are Braintree and PayPal Complete Payments (PPCP). PPCP is geared towards small and medium size businesses and has yet to be fully rolled out and scaled. This solution is not as customizable as Braintree offerings, which is a processor for large enterprises, but is essentially plug and play and can be rolled out to the mass market quickly. The key to quick scaling is to use their channel partners, such as Shopify (NYSE:SHOP) to roll it out to all their merchants.

PayPal has the largest data store out of any processor and as such has a tremendous advantage in what it can offer to businesses. The largest problem these businesses are facing are conversions. Less than 5% of merchants visits lead to a checkout. The question then becomes: How can PayPal solve this?

They have a vast dataset which they call the Vault. The Vault contains ~25% of all cards in circulation giving them a massive, unmatched advantage and can be seen as a moat for the business. The Vault can be used to:

- Pre-fill customer information, reducing friction

- Use AI to understand the context of the purchase; sort out payment instruments and shipping addresses based on historical data in the vault

- The information has a low risk of getting stale

- Attach shipping information (reduce costs on merchant end by reducing support considering shipping, reducing refunds due to lost packages) are conversions. Less than 5% of merchants visits lead to a checkout.

- Provide merchants with data to adapt and tailor the experience specifically to each customer, already knowing all their traits, preferences and habits

Conclusion. Not only is this segment likely to see growth, I am expecting this segment to carry the business for the coming years. PayPal has the whole tool kit in place to grow payments processing and has great leverage with their network effects and partnerships to ramp and scale PPCP and Braintree offerings.

Venmo, peer-to-peer and payments

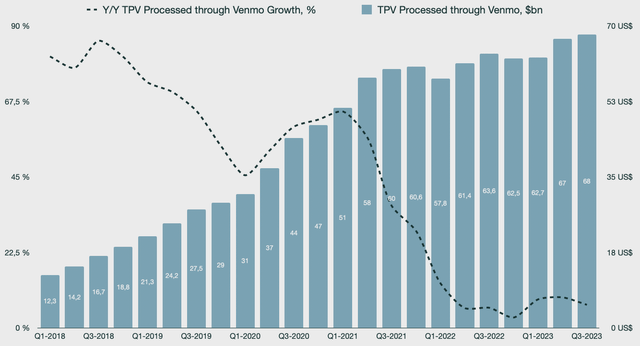

Venmo is one of the weaker growth verticals and there is currently no clear roadmap for the product where it is outlined how PayPal plans to grow the product. It is facing competition from Cash App (NASDAQ:SQ). However, Cash App is facing similar growth struggles the past year in the payments space and instead relies on their Bitcoin revenue. Looking at Q3 2023 results, Cash App transaction-based revenue only grew 1,96% year over year.

Emir Mulahalilovic, PayPal SEC Filings

We saw hints of PayPal’s road to increase Venmo growth rates with the Amazon (NASDAQ:AMZN) partnership. It has since ended with bleak results, but pursuing similar payment income streams is likely in the pipeline for Venmo. Considering the popularity of the app, a reasonable assumption would be that a checkout option using Venmo has potential in the future. However, until we see some evidence or clear road maps for the product, it would be safer to assume growth within the single digits for the coming periods.

Conclusion: Venmo is not as clear cut as the other product segments. Venmo has a very large user base which can be monetized with a clear roadmap, one they lack as of me writing this. I don’t assign growth to this segment beyond the single digits for the coming years, but it is nonetheless growth which is what we want to confirm for our intrinsic valuation.

A more realistic valuation

Revenue should gradually reaccelerate given the outlook outlined in the article. There’s a more focused management team, a clear roadmap for growing and scaling the product portfolio and data trends hinting towards an expansion. The processing scale and margin expansion are projected for the coming fiscal periods. Thereafter PayPal is assumed to stabilize growth and instead focus on increasing margins.

My projections have PayPal growing less than the digital payments market, implying a slight loss of market share. Despite that predicament, the intrinsic value presents a ~100% increase opportunity with significant margin of safety with my assumptions.

The model uses 11% WACC and 2% terminal growth rate assumptions. The assumptions are relatively pessimistic to incorporate uncertainty in execution. The management is actively repurchasing shares, this however is not factored into the model as to not double count the free cash flow output.

Emir Mulahalilovic, PayPal SEC Filings

Conclusion

Implied expectations for PayPal hint at a business with almost no hope. If the market is wrong and PayPal can post any type of growth, then the stock is undervalued and presents a rare opportunity with a significant margin of safety.

I assign PayPal a strong buy because I see evidence of continued growth trends, something the markets are currently disputing. With the markets implying zero growth, all I have to do is look for evidence of the opposite and value that.

Not only am I expecting continued growth, but I also see possibility of acceleration of growth as they streamline their portfolio, execute on their roadmap and leverage their vast data stores as a value proposition to merchants. The digital payments markets will continue to grow even if consumer spending slows down as we move towards a cashless society, which benefits PayPal.

Within the PayPal product suite, I see clear indications of growth here:

- Scaling processing solutions, providing value-added services and increasing margins by leveraging their moat-like data vault

- Despite a total active account hit, remaining accounts will keep increasing their transaction amount as lower-quality accounts are churned

- Buy Now Pay Later solution will keep growing at a strong rate as consumer spending is not slowing despite moving into difficult global economic outlooks

- The global payments market is set to grow at a 12% CAGR 2024 through 2027. PayPal now has a 25% merchant service volume of the total digital commerce transaction volume, up from 13% in 2017

However, there is execution risk, and as such, I charge a higher equity risk premium in my discount rate to account for this even though PayPal is generally seen as a stable business.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.