Summary:

- Federal Reserve is expected to lower the federal funds rate in 2024.

- If interest rates decline, AT&T dividends could be relatively more attractive creating a tailwind.

- AT&T’s core operations have been stable as well for the past several quarters warranting a buy rating.

Brandon Bell

Introduction

2024 could be a massive year for AT&T (NYSE:T). The company’s stock, naturally, does not fluctuate significantly as AT&T operates in the telecommunications sector, which is a mature industry. Yet, I strongly believe that AT&T’s stock could see a strong upward price movement in 2024 for two major reasons. First, the macroeconomic tailwind from the fluctuation in the federal funds rate will likely make AT&T’s stock more attractive. Second, AT&T’s execution has been stable as the company has been reducing its net debt for the past several quarters. Therefore, for these reasons, I believe AT&T’s stock could see a significant appreciation in 2024 resulting in my strong buy rating.

Macroeconomic Tailwind

Treasury bonds, CDs, and savings accounts are considered to be one of the safest forms of investment. Governments and banks back these investment options. Thus, when the federal funds rate increases bringing up the interest rate an investor can expect to receive a high interest rate for lending their money to the government or banks. This causes a problem for stocks like AT&T.

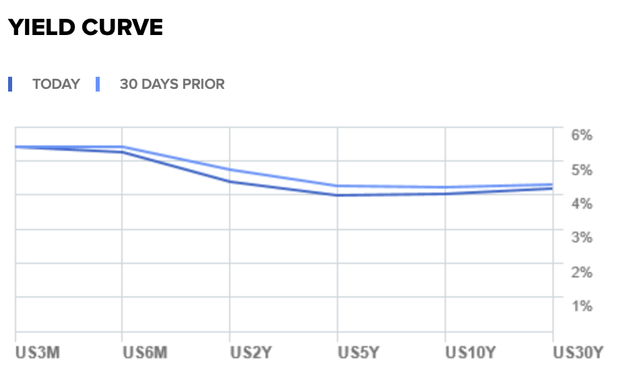

AT&T is a value stock with a high dividend rate of about 6.41% at the time of writing. On the other hand, the target federal funds rate is 5.25 to 5.50% and the 10-year treasury bond coupon rate is about 4% at the time of writing. Further, as the chart below shows, shorter-term treasury bonds and CDs yield around or above 5%.

[Source]

Investment in AT&T poses significantly higher risks relative to CDs or treasury bonds. The government backs treasury bonds, CDs, and savings accounts likely ensuring that you will not lose your money. However, in the case of AT&T, numerous risks involved in investing in private companies exist, dividends could be cut and stock prices could depreciate. Thus, the high interest rate environment has made AT&T stock less appealing over the past year.

Unlike the rising federal funds rate environment in 2023, the federal funds rate is expected to decline in 2024 bringing down the interest rates on bonds, CDs, and other safer investment options. In the previous FOMC meeting, Federal Reserve chair Jerome Powell indicated that there could be 3 rate cuts in 2024 directly hinting to the market the direction the organization will likely take in the coming quarters. The markets largely cheered and agreed with this view, Reuters, UBS (UBS), and more agree that it is likely for the Federal Reserve to cut interest rates in the coming few quarters.

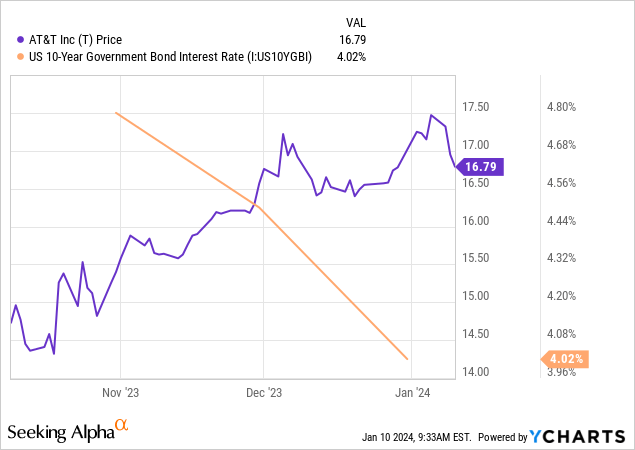

The current implications by the market and the Federal Reserve are critical for AT&T. As the federal funds rate and the market interest rate decline, the dividend offered by AT&T will likely become far more attractive over time bringing up the stock price. Naturally, the dividend rate declines as the stock price increases, but if the federal funds rate also declines during this period, AT&T’s dividend rate could continue to be attractive even as the rate declines. Finally, as the two charts below show, the correlation between declining interest rates and rising AT&T’s stock price is already happening. After the FED chair Jerome Powell indicated that there would be rate cuts, the 10-year treasury rate has declined while the AT&T stock price has increased. Therefore, I believe there could be a strong tailwind for AT&T going forward in 2024.

[Chart created by author using YCharts]

AT&T’s Performance

In 2022, AT&T divested Warner Bros assets to Discovery creating Warner Bros. Discovery (WBD). The divesture allowed AT&T to drop its ambitions in media and focus on telecommunications. It has been almost two years since the divesture, and the company, since then, has been moving in the right direction showing strong execution.

Looking at AT&T’s balance sheet, the company successfully started to reduce its net debt. From the quarter ending in June 2022 to the most recent quarter ending in September 2023, the company’s net debt declined from $158.24 billion to $154.97 billion showing an about 2% reduction in debt. The figure is not significant, but I think it is important. Telecommunication companies, like utility companies, have high debt as the cash flow is consistent and predictable. Also, the market is mature making the high debt load relative to other industries more manageable. Thus, AT&T’s direction with its overall balance sheet, in my opinion, is positive and is reflective of its strong execution.

Further, an expectation for a consistently growing EPS likely additionally strengthens my argument. Starting from the fiscal period ending in 2024, AT&T is expected by analysts to consistently grow their EPS at low single digits. Along with the bottom-line strengthening, the company is also expected to grow its revenue consistently, albeit at a slower pace of about 1% annually.

Overall, I believe the reduction in net debt and future estimates are reflective of the company’s strong operations. Since the divesture, it has been evident that the company’s focus is on its core telecommunications business, and the company has shown that it can show stable operations.

Risk to Thesis

My bullish thesis has two major risks. First, the underlying assumption of the Federal Reserve likely cutting rates could be wrong if the economic conditions change. For example, continuously high inflation rates creating the potential for accelerating inflation could hinder the rate cut schedule and forecasts. On January 11th, 2024, when the Bureau of Labor Statistics released the CPI report, the inflation rate came in slightly higher than expected at 3.4% year-over-year. Further, a significant hindrance to AT&T’s operations could affect the company’s ability to reduce debt and grow its bottom line. One of the primary risk factors today could be the EPA seeking telecommunication companies liable for damages regarding the lead cable. The outcomes of these events are not easily predictable; however, these could significantly affect AT&T.

Summary

2024 could be the year AT&T stock sees a significant upside. The company’s core operations are stable while the macroeconomic conditions are expected to provide a strong tailwind. AT&T’s net debt has been consistently declining after the company divested Warner Bros showing a strong operation, and the Federal Reserve is expected to lower the federal funds rate in 2024 making dividend stocks like AT&T relatively more attractive. Therefore, I believe AT&T is a buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.