Summary:

- Medical device stocks have made a strong comeback in the past three months, becoming market leaders.

- Medtronic is a medical technology firm with a below-market valuation and a high forward dividend yield.

- MDT has seen strong earnings growth and received FDA approval for a new device, with a positive outlook for future growth.

- Ahead of earnings due out in February, I outline key price levels to monitor.

Bojan89

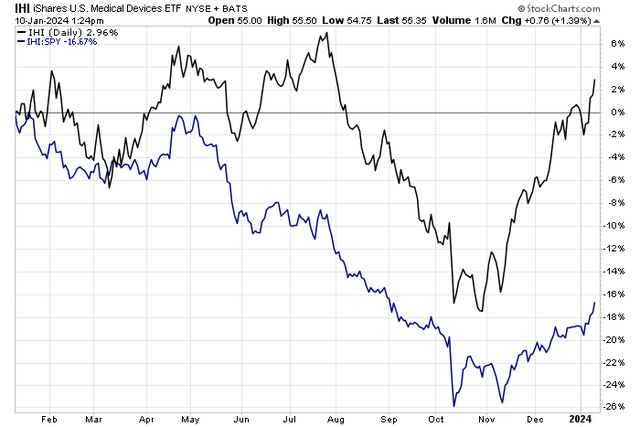

Medical device stocks have staged an impressive comeback on both an absolute and relative basis over the past three months. After crumbling compared to the S&P 500 into early October last year, partly due to fears the GLP-1 weight-loss drugs would stymie demand for invasive medical procedures, the group of Health Care sector equities has quickly become market leaders. Medtronic (NYSE:MDT) is up seven sessions in a row to jump-start the year.

I reiterate my buy rating on the company. I continue to see a growth recovery, while its valuation and yield are compelling from an investor’s perspective.

Medical Device ETF (IHI) Has Outperformed the S&P 500 since mid-November

According to Bank of America Global Research, Medtronic is a medical technology firm that develops, manufactures, and markets medical devices and technologies to hospitals, physicians, clinicians, and patients. The company operates in four business segments: Cardiac & Vascular Group, Medical Surgical, Neuroscience, and Diabetes.

The Ireland-based $115 billion market cap Health Care Equipment industry company within the Health Care sector trades at a below-market 16.8 forward 12-month non-GAAP price-to-earnings ratio and pays a high 3.2% forward dividend yield. Ahead of earnings in February, shares trade with low implied volatility of 17% while short interest on the stock is also modest at 0.6% as of January 9, 2024.

Back in November, MDT reported a strong set of Q2 results. Non-GAAP EPS of $1.25 beat the Wall Street consensus forecast of just $1.18 while $8 billion of revenue, up 5.4% versus year-ago levels, was a beat, too. It was the fourth straight quarter of mid-single digit top-line growth, an important sign amid a somewhat troubled industry lately. Organic revenue rose 5%, and the management team expects continued growth looking into 2025 (it is currently more than halfway through its FY 2024). Robust performance trends in the pelvic health and spinal neuromodulation market were a tailwind, along with strength in the transcatheter aortic valve replacement business.

Then in December, MDT declared a $0.69 quarterly dividend, which means its yield remains in ‘aristocrat’ territory. Shortly thereafter, Medtronic received FDA approval for PulseSelect, a single-shot PFA system used to treat paroxysmal and persistent afib. The approval news came earlier than expected, per BofA, and it’s the first FDA-approved PFA device. The news should help the firm while it waits for an FDA decision on its Affera focal PFA device (BofA notes that is expected in the second half of this year).

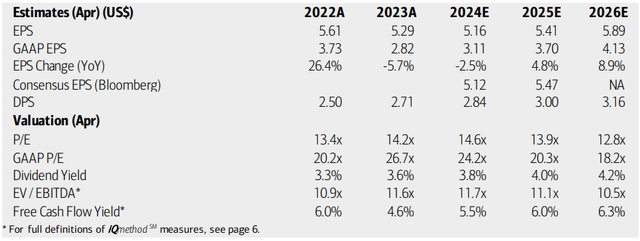

On valuation, analysts at BofA see earnings troughing this fiscal year, with an EPS rebound in 2025. Per-share operating profits may approach $6 by ‘26, which would be a multi-year high on an annual basis. The current consensus estimate, per Seeking Alpha, shows non-GAAP EPS rising to $5.45 in the out year and $5.86 by 2026. Along with accelerating earnings growth, MDT’s top line is seen rising at a low to mid-single-digit pace.

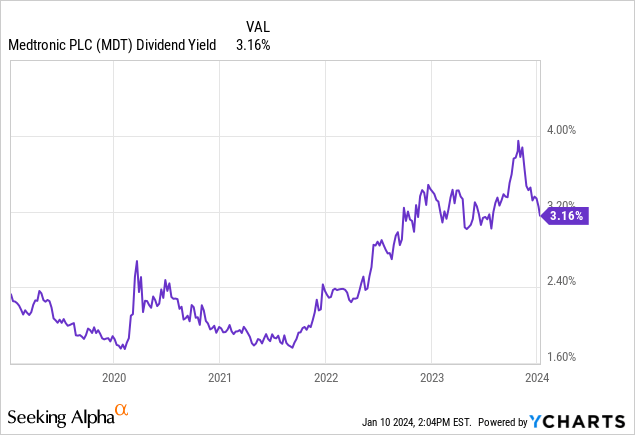

Dividends, meanwhile, are forecast to climb at a steadier pace, possibly leading to a yield north of 4%. Moreover, with an EV/EBITDA ratio that is about on par with that of the S&P 500, the valuation picture is not all that high on this company with robust and rising free cash flow levels.

Medtronic: Earnings, Valuation, Dividend Yield, Free Cash Flow Forecasts

Historically High Yield, Remains Above 3%

YCharts

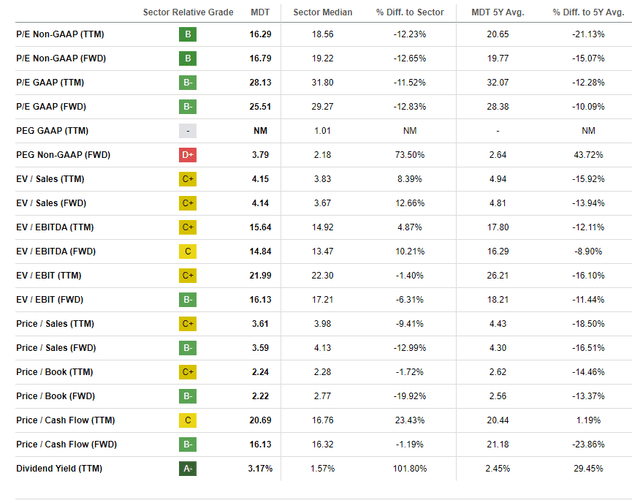

If we assume $5.30 of non-GAAP EPS over the coming 12 months and apply an 18 multiple, slightly below the stock’s 19.8 historical average due to the threats of the GLP-1s, then shares should trade near $95. It’s possible that there is an upside risk to that target should earnings growth verify strong and if fears of MedTech’s perceived decline in demand don’t materialize as much as some pundits expect.

MDT: A P/E That’s A Few Turns Lower Than History

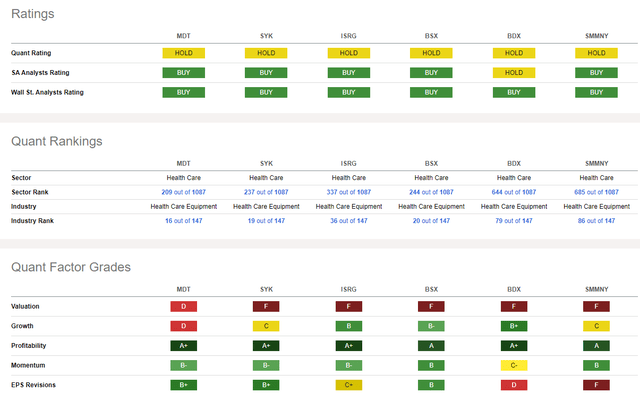

Compared to its peers, MDT features a rough valuation grade, but that is common across the space. And while the company’s growth trajectory has been weak, the inflection toward earnings growth should be seen in a positive light, in my view. Easy comps in the quarters ahead provide the chance of positive headline news potential, too.

Medtronic remains free cash flow positive, helping its profitability metrics, and share-price momentum has turned much improved over the last handful of weeks. Finally, MDT bulls should be excited about the 28:1 ratio of upward EPS revisions to downward revisions in the last few months.

Competitor Analysis

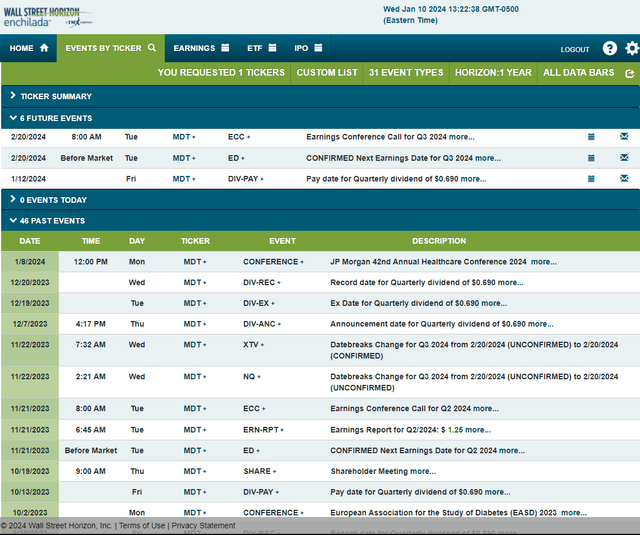

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed Q3, 2024 earnings date of Tuesday, February 20 BMO with a conference call immediately after the numbers hit the tape. You can listen live here. No other volatility catalysts are seen on the calendar.

Corporate Event Risk Calendar

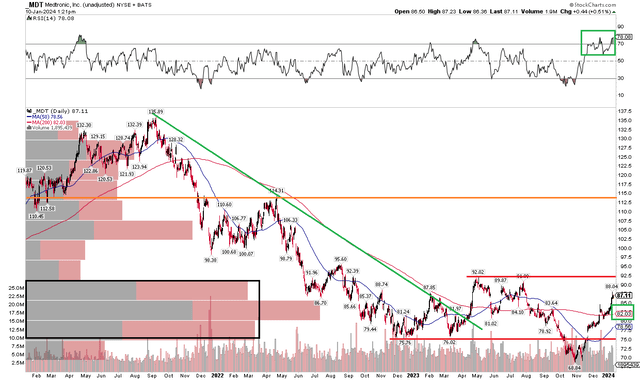

The Technical Take

With earnings upside ahead, a strong yield, and impressive free cash flow, the chart is generally constructive. Notice in the graph below that shares broke out from a severe downtrend off the high notched in Q3 of 2021. A trading range emerged with resistance in the low $90s while the mid-$70s, for a time, offered support. A bearish move then came at the end of October – following breaching support, MDT dropped about 10% before the bulls recharged. A gap higher in November, near $75, helped send shares higher, eventually hitting fresh highs since last summer to start 2024.

What I like about the move is that it comes with high momentum – as evidenced by the RSI momentum oscillator at the top of the chart. Still, there remains a high amount of volume by price up to about $92, so the bulls still have their work cut out for them here. But with a long-term 200-day moving average that is now about to turn higher, the trend may be turning more positive.

Overall, $92 remains resistance while $75 is support. If MDT rallies through the low $90s, then the next target may be its Q2 2022 peak near $114.

MDT: Shares Nearing Resistance, Improved Momentum

The Bottom Line

I reiterate my buy rating on MDT. Shares remain attractive on valuation, while this high-yield MedTech stock has improved technicals compared despite approaching near-term resistance.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.