Summary:

- Offshore contract drillers are seeing a favorable business climate as the price of Brent remains sustainable.

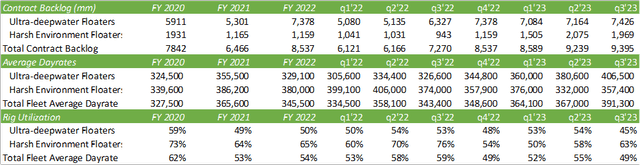

- Transocean’s average dayrates have climbed to $406,500/day for ultra-deepwater floaters.

- Despite the positive outlook, Transocean still faces challenges such as declining margins, flat oil prices, and a large amount of debt coming due through 2026.

Lichtwolke

Customers are violently opposed to a day rate that starts with a 5 at this point in time… they certainly don’t want to be the first to agree to a contract of that dayrate but it’s going to happen.

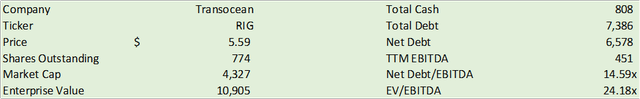

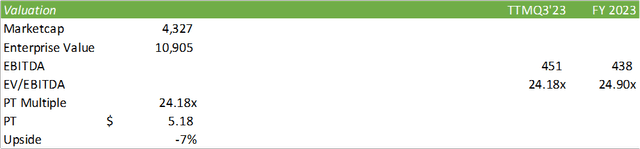

The business climate is gradually becoming favorable to offshore contract drillers as the price of Brent remains at sustainable levels. Despite the gradual step up in dayrates, Transocean (NYSE:RIG) has yet to find its point of breaking even in operations. Between the declining margins, flat outlook for oil prices in 2024, and the mountain of debt Transocean faces, I am updating my recommendation to a SELL with a price target of $5.18/share based on my forecasted eFY23 EBITDA on today’s EV/EBITDA multiple.

Operations

Transocean, like the rest of the industry, has experienced a huge upshift in business as more producers are seeking long-cycled production. Per their q3’23 results, Transocean now has 17 rigs contracted with a duration of 12+ months, a 42% increase from April 2022. Of those 17 rigs, 15 are contracted for over 24 months and 13 for over 36 months. 80% of the firm’s backlog now has a contracted duration for over a year. One of their big contract wins was with ONGC, India’s largest O&G producer, beginning February 2024 through October 2025.

Management continues to see strong demand offshore Brazil with 27 awards made in the last year. Transocean currently has 6 ultra-deepwater drillships contracted with Petrobras in the region with Deepwater Mykonos rolling off at the end of CY24, Deepwater Orion contracted through January 2027, KG2 through July 2026, and Petrobras through 2029. Management anticipates active rig count in the region to reach at least 36 between 2024-2025. Management with Noble Corp. (NE) anticipates rig count to reach 30 by the end of 2024.

TotalEnergies (TTE), as of December 15, 2023, has signed production-sharing contracts with QatarEnergy (30%) and Petronas (30%) for Block 64 offshore Suriname, which may offer Transocean an opportunity to redeploy their Maykonos rig at the end of the year. Though the location would be convenient for deployment, Noble Corp. has ties with both TotalEnergies and Petronas and may have the upper hand for rig deployment. Management also remains adamant about pulling harsh environment rigs out of Norway to tighten rig supply in the region. I believe that this could potentially push up dayrates as Norway will be seeking to increase production at the end of 2024 or early 2025.

I think most of those [increasing activity] for Norway are more 2025-related than 2024. We do believe the next demand goes to us… There’s also the potential upside of incremental production that could come from infill drilling, if there was any sort of gas shortage, whether that’s a regional event or a global event. So, there’s a little bit of upside, I don’t think there’s firm demand yet to declare 2025. It’s going to explode there in Norway from a demand perspective. But the dialogue is encouraging.

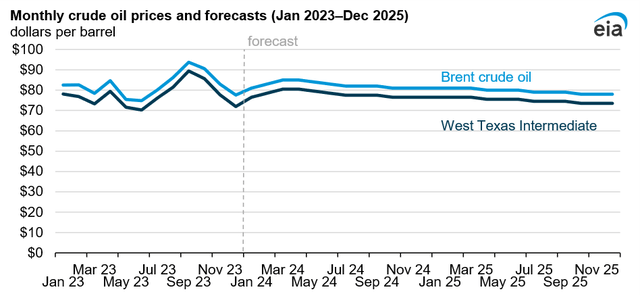

Management remains optimistic for offshore production as IOCs seek to balance out their short-cycle operations with long-cycle production. With the Brent strip floating around $75-77/bbl, I believe producers will remain cautious in new project development, especially if a global economic slowdown where to persist throughout 2024-2025. Though I don’t believe producers will pull out of projects, I expect projects to be pushed back or delayed. The EIA anticipates Brent to average $82/bbl in 2024 before falling to an average of $79/bbl in 2025 and expects production growth to slightly outpace demand. The agency forecasts US crude production to reach 13.2MMbbl/d in 2024 and grow to 13.4MMbbl/d in 2025. Contrary to their domestic outlook, it had been reported that member states of OPEC+ will be cutting production by 2.2MMbbl/d in q1’24. Despite this announcement made in December 2023, oil prices and futures have yet to have budged higher, suggesting a stronger supply/demand imbalance than anticipated as a result of global economic activity.

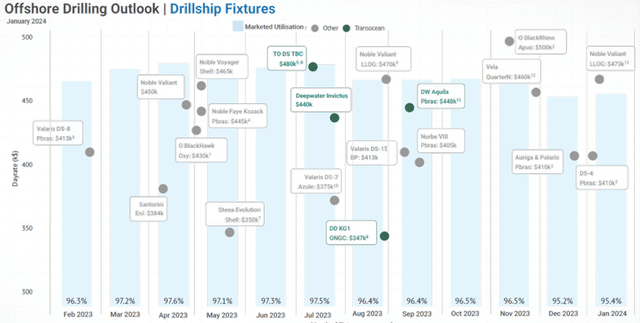

As for Transocean, the figures appear promising as dayrates continue to climb towards that $500k/day target with Transocean Barents being contracted out for $465k/day, Deepwater Invictus for $440k/day and Deepwater Aquila for $448k/day. Jumping back to Noble Corp., the firm contracted out Noble Valiant for a rate of $470k/day in the Gulf of Mexico in q3’23, suggesting a broader increase to average dayrates.

Transocean’s average dayrates continue to climb with ultra-deepwater floaters now up to $406,500/day at 45% utilization.

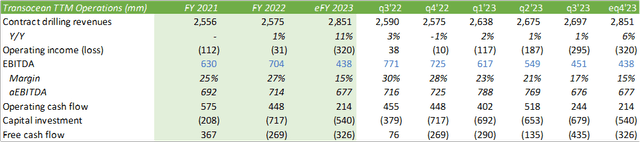

Q4’23 guidance is very promising with management anticipating $760mm in adjusted contract drilling revenue with $565mm in O&M expenses. The revenue guidance is a result of higher dayrates for KG1, Corcovado, Mykonos, and Petrobras 10,000 with more operating days. O&M expenses are expected to be higher as they commence operations for the KG2 in Brazil and the Transocean Barents in Cyprus.

Despite the improvement to topline growth, Transocean still remains riddled with debt and a persistent GAAP operating loss. Adjusting EBITDA for loss on impairment and disposal of assets, the firm remains challenged on growing their margins.

Transocean securitized both their Deepwater Titan and Deepwater Aquila for $525mm and $325mm in financing, respectively. Given where they stand, Transocean will owe $2.6b in scheduled amortization and maturities through 2026. Transocean currently has $1.4b in liquidity as of q3’23, requiring the firm to shore up $1.2b in cash throughout the next two years. Weighing free cash flow generation, increasing dayrates for rigs, and stagnant margins, the firm may be required to take on additional debt or push back maturities.

Valuation

Considering Transocean’s financial position and high leverage ratio, I am updating my recommendation to a SELL recommendation with a price target of $5.18/share based on their current EV/EBITDA multiple of 24.18x to eFY23 EBITDA. Given their challenges in generating free cash flow, I believe that there may be some financial challenges as their debt matures throughout the next two years. There may be some upside in the future as availability of rigs tightens; however, given the current strip price and EIA forecast, I anticipate a flat to down year for global production with the anticipated global economic slowdown. I do, however, expect dayrates to continue their gradual climb. The ultimate question is how much higher do they need to go before operations become sustainable for Transocean.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.