Summary:

- Walmart has benefited great from an inflationary environment, but that should be shifting.

- The company talked about a potential deflationary environment, which it has also shown it can outperform in, as well.

- Walmart has been attracting higher-income customers and is looking to leverage its tech investments to help keep them.

Scott Olson

I first wrote about Walmart (NYSE:WMT) stock back in March, placing a “Buy” rating on the stock, saying the retail giant should benefit from high food inflation and any consumer weakness due to its status as the low cost leader in the space. The stock has generated an over 10% return since then. Let’s catch up on the name, as the company has been at some investor conferences over the past few months.

Company Profile

As a refresher, WMT is a mass-merchant retailer that sells a plethora of items, including groceries, apparel, housewares, health & wellness, electronics, hardline goods, and more. It has operations in the U.S, as well as in several international markets including Canada, Chile, China, Africa, India, Mexico, and Central America. In total, it operates in 20 countries.

The company sells products both through its network of stores as well as through its e-commerce platform. It has several store formats, including Supercenters, Discount Stores, and Neighborhood markets. The retailer also owns majority stakes in e-commerce site Flipkart and payments platform PhonePe in India. In China, it has a partnership with JD.com (JD).

In addition to Walmart stores, the company also operates warehouse store Sam’s Club in the U.S. It charges between $50-110 for memberships, with add-on memberships costing $45.

From Inflation To Deflation

In my original write-up over nine months ago, part of my thesis was that WMT should benefit from an inflationary environment and outperform other mass merchandise retailers, such as rival Target (TGT). One of the reasons behind this was the company’s strength in groceries, as food and consumables make up about 60% of its sales. By contrast, about 20% of TGT’s sales come from food and beverage.

This certainly showed in the two retailers’ sales numbers over the past several quarters as inflation picked up. Beginning midyear 2022, WMT’s sales started to accelerate, while TGT’s sales started to lag, falling negative the past two quarters. The mix towards groceries and the benefits of being a low cost leader have been paying off, as consumers began trading down and WMT began to see an influx of customers with household incomes of $100,000 and more.

WMT Quarterly Sales (FinBox) TGT Quarterly Sales (FinBox)

However, more recently, WMT has been talking about a change in the environment to that of a period of disinflation, or even the possibility of deflation.

At a Morgan Stanley conference last month, CFO John Rainey talked about this possible economic shift saying:

“We called out the prospect of deflation as a possible outcome. It is not our base planning assumption necessarily. And it also doesn’t mean that if it happens that it’s going to persist into perpetuity. What we talked about is, given what we’re seeing in our business that the prospect does exist. And to put finer point on that, when you think about the components of our business, and I’ll just do it with food, consumables and general merchandise. General merchandise is deflating today in the 5% to 6% range. So, it’s been a pretty consistent trend and it’s actually prices are getting to a point where they are or lower than 2 years ago. Food is a category for us is, call it, flat to up slightly, and then consumables are a little bit higher than that. But if you look at the trends and you drag them out to the right, it could suggest that when you consider the overall mix of our business that we could be in the deflationary environment. If that’s the case, look, it underscores the importance to sell more units. We’re focused on that. And also, as we just talked about, presumably, customers can buy more general merchandise in that case. But also as a company, it underscores the importance of being focused on the things that we can control, notably our expenses.”

Now deflationary environments are pretty rare, and usually associated with difficult economic times. The last deflationary period was during the Great Recession between December 2007 and June 2009. And as WMT outperformed during this recent period of high inflation, it also outperformed during this deflationary period as well. In 2008 the retail giant posted strong 9% sales growth, followed by 7% growth in 2009. The two years following this period were a bit tougher, with it seeing growth of 1% in 2010 and 3% in 2011.

Now disinflation, where prices go up but at a slower pace, is a bit more of a normal environment, and the U.S. has seen long stretches of this from the 1980s onward. This is certainly the environment we began seeing in 2023 as inflationary pressure has been coming down. As inflation returns to more normal levels, I would no longer expect WMT to post the 5-9% sales growth it has seen over the past six quarters.

Over the past six quarters, WMT has benefited from a trade-down effect, and I would look for the company to aggressively try to keep these new higher-income customers. The retailer will always look to lead on price, and as inflation cools and becomes deflationary is some categories, I would expect the famous WMT rollbacks to start back up.

Meanwhile, WMT has recently introduced some new consumer-friendly technology features, which I think can help maintain these higher-income customers it has gained. One of the most interesting innovations the company is introducing is a replenishment service that will go beyond just autoship subscriptions and anticipate when customers will run out of the necessities that they use the most. Obviously, items such as milk run out at different times than something like toilet paper, so this is an intriguing offering. With families constantly on the run with work and kid activities, this is a service that should appeal to all customers, including higher income customers that might not necessarily be regular WMT shoppers.

The company introduced the product at the Consumer Electronic Show, or CES as it’s more commonly called, in Las Vegas earlier this month.

At CES, Whitney Pedgan, VP and GM of Walmart InHome, discussed the new innovative service, saying:

“Customers who are Walmart+ InHome members will soon have access to replenishment. It’s a feature we’re building using AI to create a personalized replenishment algorithm. It learns a customer’s purchase patterns to determine the perfect cadence to restock their essentials. So the long list of things you purchase frequently. Whether it’s the ones you need every week or the things you need every 17 days, they’ll be there the moment you open the fridge or pantry. And you didn’t have to lift a finger. It’s not a subscription. You might use a subscription for something predictable like dog food. Maybe you need a bag of that every month. When you’re trying to figure out how to replenish all your essentials, which is a bigger list with different items, each one with variable consumption rates, can get a bit complicated. For example, I know in my house, we consume a lot of yogurt, waffles, milk, some other things. But how much? And what exactly are those other things. Our replenishment service solves that. It personalized and adjusts based on your changing needs. Not only are we going to get you what you need. We’re going to get it to you when you need it and even where you need it, right to your refrigerator. So when you go for the milk, instead of nothing, something. You can always remove items from your automated basket. If, say, you know you’ll be away for vacation and you don’t want more milk showing up, that’s on your control. Bottom line, the entire shopping experience is automated from building the basket to delivering to your refrigerator, whether that’s in your kitchen or garage.”

To me, this service could be a game changer. Companies like Amazon (AMZN) and Chewy (CHWY) have strong autoship businesses, but this is taking that to another level. This is one of the more interesting consumer-facing generative AI technologies that I’ve seen in action from a retailer yet, showing WMT’s continued innovation on the tech side over the years. Much of WMT’s tech efforts have been around areas such the supply chain or focused on things such as shrink. As a result, I don’t think the company has gotten the credit it deserves with how cutting edge it has been with tech to help drive down prices.

While I thought WMT would be a winner in an inflationary environment, it has also proven the be a leader in a deflationary one as well. In a disinflationary environment, it gets a bit more tricky, but the company has proven it can grow in any macro environment. Meanwhile, I expect it to be aggressive not only in trying to keeping higher income shoppers but also in trying to draw in more. I think replenishment is a good start in this effort.

Valuation

WMT currently trades around 12.1x the FY2025 (ending January) consensus EBITDA of $40.86 billion and 11.4x the FY2025 consensus of $43.49 billion.

From an EBITDAR perspective, it trades at about 11.4x FY25 and 10.8x FY26 multiples.

It trades at a forward PE of nearly 23x the FY25 consensus of $7.11, and nearly 21x the FY25 analyst estimate of $7.77.

Revenue is expected to grow around 3-4% a year over the next several years.

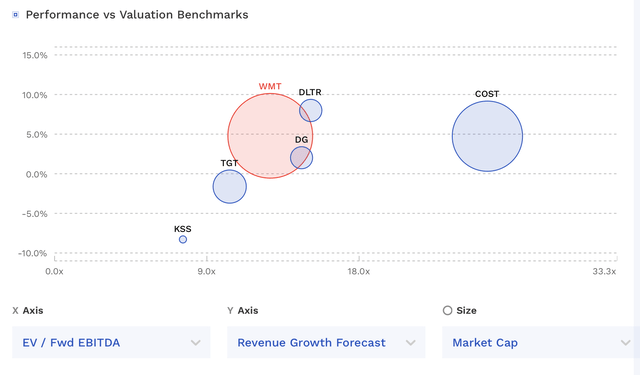

WMT Valuation Vs Peers (FinBox)

WMT trades at a slight premium to rival Target and well below Costco (COST). COST has always commanded a very big multiple, and it is expected to show some stronger revenue growth moving forward.

I’d value WMT between 12-13x 25 EBITDA, which would place a fair value range on the company between $172-$188.

Conclusion

While WMT may be viewed as an old school retailer, the company leans quite heavily into technology. It is now looking to use AI to both create efficiencies and improve the consumer experience. I’d expect it to be at the forefront of this moving forward when it comes to traditional retailers.

While investors are unlikely to see huge, outsized gains from WMT, I view it as a steady holding with solid upside over the long run. I also view it has a solid defensive name that can work in any economic environment. As such, I continue to rate the stock a “Buy.” My target is $188.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.