Summary:

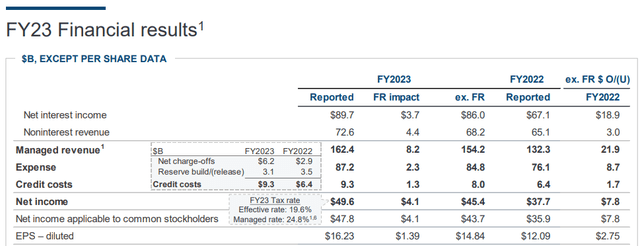

- JPMorgan reported weaker than expected revenues and earnings for Q4, but nonetheless achieved solid earnings results for the full year.

- The integration of First Republic Bank resulted in a positive earnings contribution of $4.1B for JPMorgan.

- JPMorgan is well-positioned for growth and issued a forecast that indicated flat net interest income growth in FY 2024.

- JPM trades at a much high multiplier factor than other Wall Street banks.

Michael M. Santiago

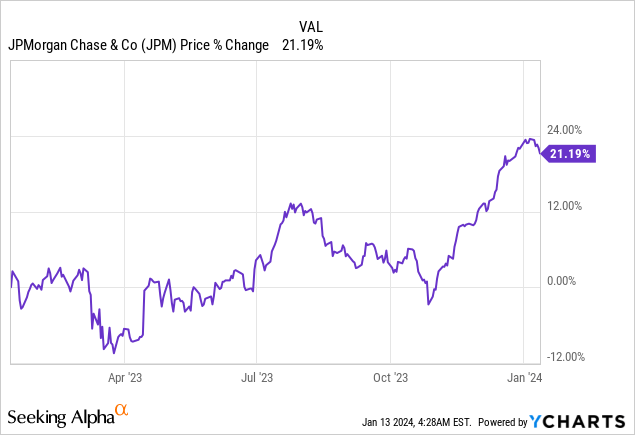

JPMorgan Chase (NYSE:JPM) was among the first banks that reported earnings for the fourth-quarter last week. Although JPMorgan reported a decline in profitability, the bank overall saw favorable trends in its business and the bank’s integration of First Republic Bank also resulted in a positive earnings contribution. JPMorgan also submitted its expectations for FY 2024 which imply stable net interest income this year. Shares of JPMorgan trade at a considerable premium to book value, which I believe is deserved given the systemically-important label attached to JPM. Considering that JPMorgan operates the largest bank franchise in the country, I believe that shares of the Wall Street bank are a hold!

Previous rating

I rated JPMorgan as a buy during the regional banking crisis as I believed that the bank’s large size and status as a systemically-important bank could make JPMorgan a beneficiary of regional bank failures. In part, this has proven to be accurate as the bank acquired First Republic Bank in 2023 at a fire-sale price. First Republic Bank, according to JPMorgan’s earnings disclosure for Q4’23, made a more than $4B earnings contribution to JPMorgan in FY 2023. The Wall Street bank is well-positioned for growth and has submitted a strong outlook for FY 2024 net interest income. However, I see limited valuation upside in a low-rate world.

JPMorgan missed on the top and the bottom line

JPMorgan reported weaker than expected revenues and earnings for its fourth-quarter. The bank generated $3.04 per-share in Q4’23 earnings which missed the consensus estimate by $0.56 per-share. Revenues were reported at $38.57B and fell short of expectations by $1.21B.

Double-digit Y/Y earnings growth due to strong U.S. economy, First Republic Integration

Despite missing on the top and bottom line for Q4’23, JPMorgan reported very solid earnings results for the full-year, largely because the U.S. economy hummed along nicely.

The bank said it generated almost $50.0B in net income in FY 2023, showing a year-over-year growth rate of 32%. Adjusting for the earnings accretion related to the First Republic Bank acquisition, JPMorgan’s earnings were still up a solid 20% year over year to $45.4B. The acquisition of First Republic Bank obviously was a smart move on the part of Jamie Dimon in May when he bought the regional bank from the Federal Deposit Insurance Corporation for $10.6B. First Republic Bank, at the time, was the second-largest bank failure in the U.S.

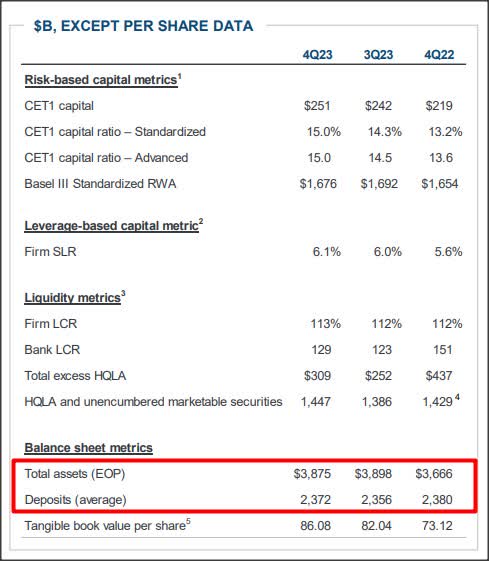

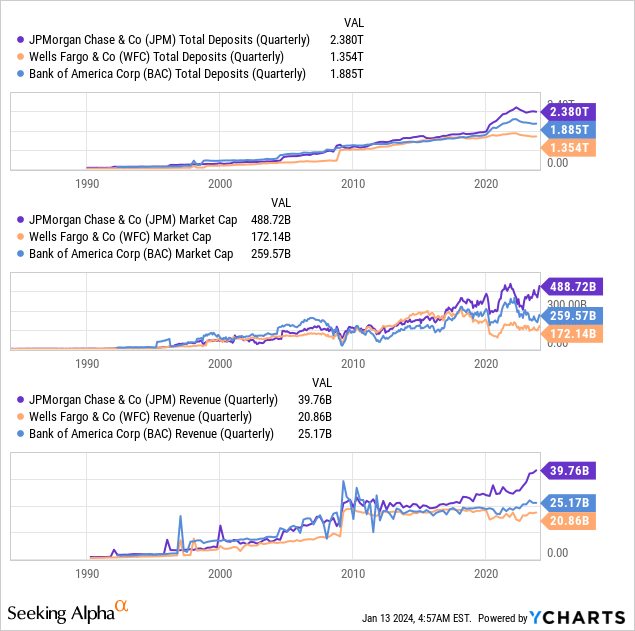

The reason why JPMorgan could afford to buy up First Republic’s 84 branches, $92B in deposits and $203B in loans/securities was because JPMorgan is the largest bank in the U.S. by asset and deposit size.

The bank had $3.88T in assets on its balance sheet at the end of the December quarter of which $2.37T related to deposits. JPMorgan’s deposits increased $16B quarter over quarter in Q4’23 and with the federal fund rate set to decline in FY 2024, according to the Federal Reserve’s December guidance, I believe more deposits are set to flow back to banks, including JPMorgan, this year.

In 2023, one of the biggest trends was that investors and savers engaged in cash-sorting behavior, meaning they shuffled funds from bank accounts to higher-yielding money market funds. With the federal fund rate now set to normalize in 2024, JPMorgan as the biggest deposit franchise in the country, could see favorable deposit tailwinds as well.

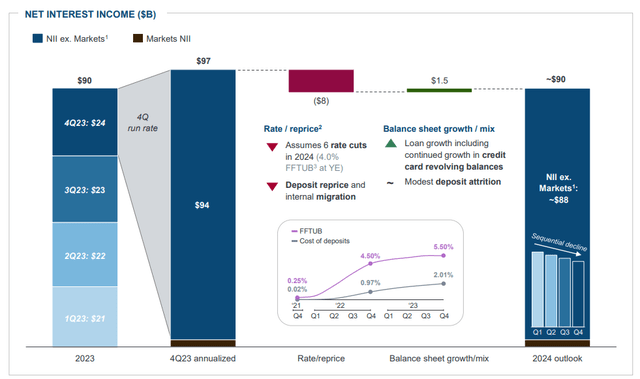

JPMorgan Chase

One cannot discuss the Wall Street bank’s deposits without also discussing JPMorgan’s expected net interest income trajectory. JPMorgan achieved net interest income totaling $90B in FY 2023. The bank’s net interest income bridge for FY 2024, as it was presented on Friday (see chart below), rests on the assumption that the Federal Reserve will cut the federal fund rate six times this year. Despite this assumption, the Wall Street bank predicts a massive $90B in net interest income for the current year which implies a flat NII picture relatively to FY 2023.

Valuation of JPMorgan compared to other large-cap Wall Street banks

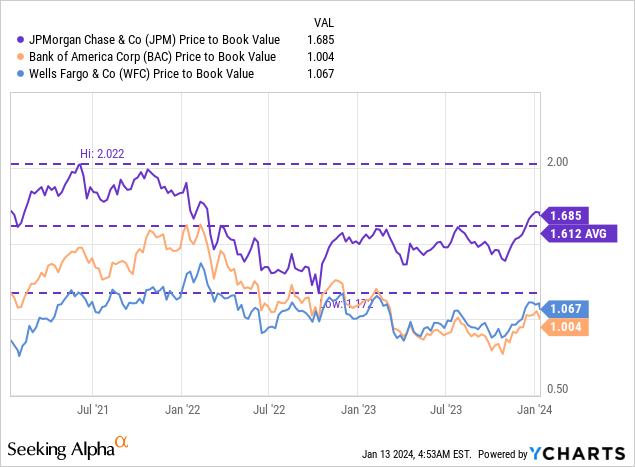

JPMorgan is trading at the biggest price-to-book ratio in the large-cap Wall Street bank category, in large part because Jamie Dimon has managed the bank well, steered JPM through a number of crises and has been making shrewd acquisitions in the past.

As the U.S.’s largest bank, JPMorgan also benefits from the fact that it is a systemically-important financial institution, meaning investors have reason to believe that the bank would get bailed out in case things went off the rails. JPMorgan easily leads even its closest banking rivals, Bank of America (BAC) and Wells Fargo (WFC) in terms of deposit size, market cap and revenue volume…

This perceived safe-harbor destination for investor capital comes with a heavy price tag, however, and explains why JPMorgan’s shares are trading at a 69% premium to book value while Bank of America and Wells Fargo are achieving much lower valuation multiplier factors based off of book value.

I consider JPMorgan’s shares to be approximately fairly valued here ($169 per-share), considering that they trade at about the 3-year average P/B ratio, ~1.6X P/B, and that JPMorgan has successfully integrated First Republic Bank. Given that JPMorgan also guided for flat Y/Y net interest income growth, I believe shares of limited upside in FY 2024.

Risks with JPMorgan

JPMorgan is possibly the bank with the lowest risk given its large size, market value, earnings power and systemically-important label that essentially guarantees a government bailout in case the market runs into trouble. In terms of performance, I believe the federal fund rate is the biggest challenge for JPMorgan as well as the entire banking market in FY 2024 as banks are looking at diminished net interest income potential in a low-rate world. An unexpectedly sharp decline in the federal fund rate, which I believe is unlikely, is therefore the biggest wild card for JPM this year.

Final thoughts

JPMorgan put a solid earnings sheet on the table last week and the bank reported a massive $50B in earnings for FY 2023, which were in part boosted by the opportunistic acquisition of First Republic Bank in the second-quarter of FY 2023. The integration of First Republic Bank has yielded a positive earnings contribution of $4.1B and JPMorgan will likely continue to see deposit growth in FY 2024 as investors rotate capital back from high-yielding money market funds to bank deposits.

The net interest income outlook, according to last week’s forecast, implies about flat net interest income and no longer any growth. I would continue to expect JPMorgan to trade at the largest price-to-book ratio given the bank’s leading size, market cap and revenue potential. However, I do see limited revaluation potential for JPM in FY 2024!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of JPM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.