Summary:

- Johnson & Johnson is a reliable stock and could be a low-risk staple in most portfolios.

- The company has agreed to a $700 million settlement of a lawsuit regarding talc-based baby powders, impacting its financials and consumer confidence.

- The settlement is seen as a strategic move to mitigate future costs and reduce long-term damage.

- JNJ’s moderate returns seem relatively safe, even taking the recent developments into consideration, and my rating for the stock is a Hold.

Mario Tama

Johnson & Johnson (NYSE:JNJ) isn’t one of the greatest stocks in the world to own right now for price returns, but it is at the top in profitability for its industry. The recent talc lawsuit settlements and acquisition of Ambrx Biopharma (AMAM) leave the stock still reliable, and it could act as a low-risk diversifier into healthcare for most portfolios. However, the operational updates do not constitute a stock with above-index returns over the long term. Instead, my general thesis is that JNJ is a safe haven for risk-averse capital, protecting the portion of a portfolio adverse to volatility, which is often experienced in higher growth sectors like technology.

Talc & Ambrx Updates

The company has agreed to pay approximately $700 million to settle a lawsuit by over 40 US states alleging it wrongfully marketed talc-based baby powders. The results of this are likely to affect the firm’s financials in the short-to-medium term and have a moderate negative impact on investor confidence. The settlement has been seen by some as a strategic move to mitigate future costs and negative feedback associated with the case, reducing damage over the long term.

Johnson & Johnson also announced its $2 billion acquisition of Ambrx Biopharma, representing its expansion into targeted cancer therapies. This strengthens its position in biopharmaceuticals, potentially having a positive impact on the firm’s future growth. It strengthens the organization’s portfolio and further diversifies its interests, specifically in precision medicine and oncology, in the case of this acquisition. More technically, the Ambrx deal should help to transform cancer treatment through advanced antibody-drug conjugates, or ADCs. This cancer treatment allows for targeted therapy that attacks cancer cells while limiting damage to healthy cells in the body, drastically reducing side effects when compared to chemotherapy.

Current Financials

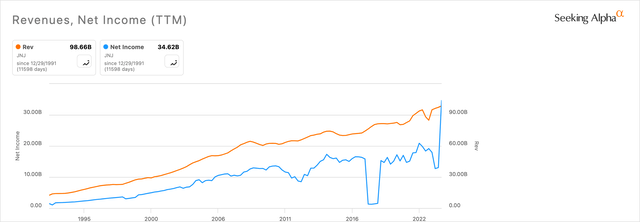

The company’s net income has been more volatile than its revenue growth historically, but both are healthily increasing over time:

Author, Using Seeking Alpha

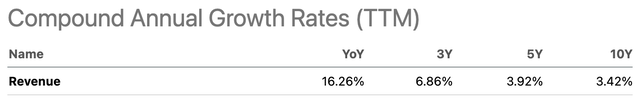

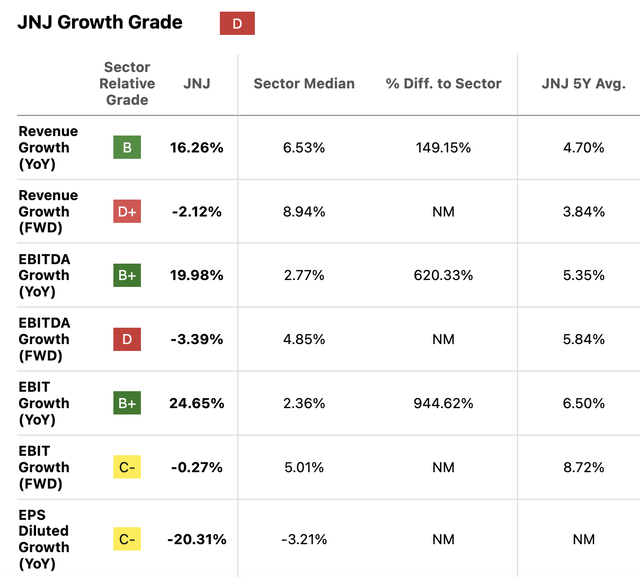

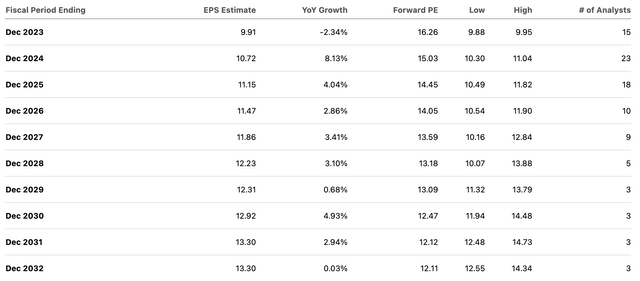

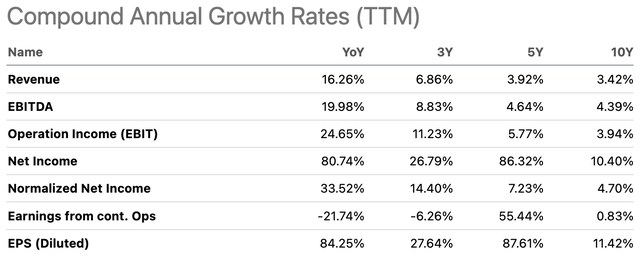

Compound annual growth rates for revenue are also increasing over a 10-year basis, which is positive news, even if the company’s growth rates are not great generally in comparison to market averages as indicated by Seeking Alpha’s Quant Factor Grades:

Seeking Alpha

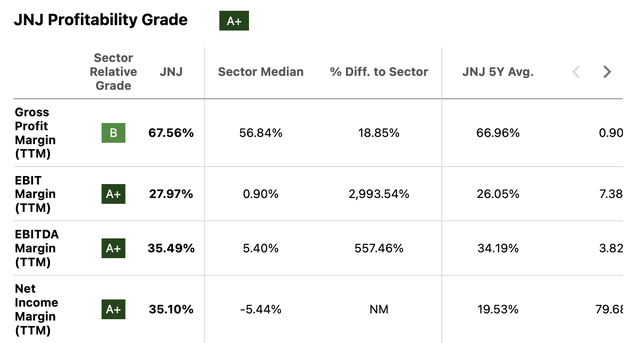

Seeking Alpha

The main weakness here is the firm’s EPS growth, not actually its profitability overall, which is strong. Its current gross margin is 67.56%, and its net income margin is 35.10%. However, consensus estimates reveal that the firm is likely facing relatively slow growth for the next decade in earnings, something to consider when looking for above index returns from the stock.

Seeking Alpha

Seeking Alpha

Valuation

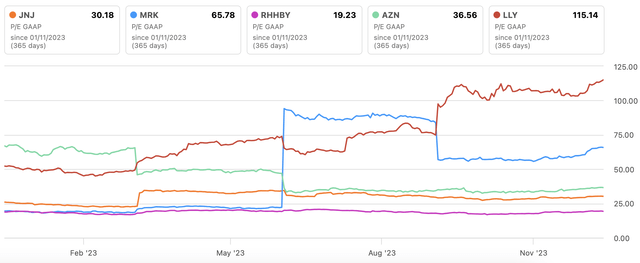

The company has a strong P/E GAAP ratio of around 15 but a PEG ratio of 3.8 (Factor Grade rating D+), indicating the growth weakness outlined above affects the firm’s valuation.

Seeking Alpha

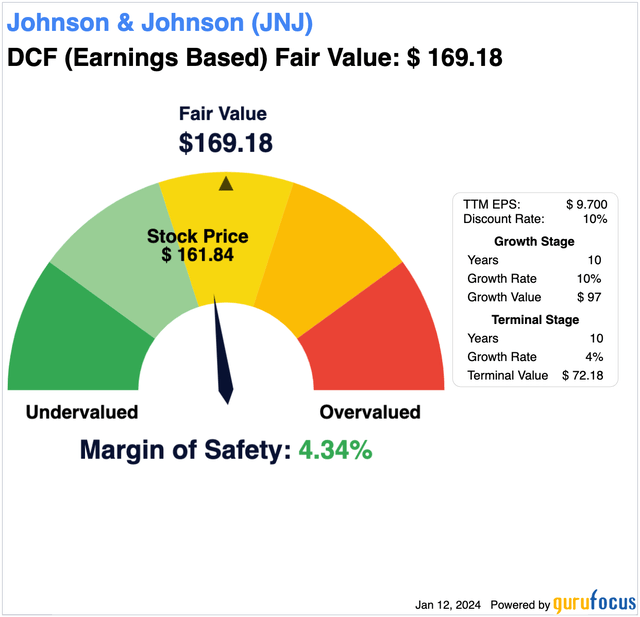

Assuming an optimistic scenario where JNJ generates 10% average annual EPS growth over the next 10 years, the stock seems relatively fairly valued based on a discounted cash flow analysis, which takes into account a 10-year growth stage and a 10-year terminal stage at a lower growth rate of 4%:

Seeking Alpha

Author, Using GuruFocus

This is a key component of why I think the stock is a good portfolio diversifier. It is not a high-return asset, but it can safely be considered to be a good return at low risk, indicated by its fair value at the moment on a DCF basis, but also by what I believe are relatively insignificant risks associated with its current operations.

A Closer Look At the Talc Lawsuit Risks

There are more than 50,000 lawsuits from individuals who claim that their use of JNJ products contributed to ovarian cancer or mesothelioma. These are serious claims and significantly counter the benefit that ADCs should provide in the acquisition of Ambrx Biopharma for advancing cancer treatments. The benefit of the Ambrx deal seems larger in the long term than the short-to-medium-term downside from the talc lawsuits. Still, the downside risks are a significant concern; according to the lawsuits, executives have known since the 1970s that JNJ products contained asbestos, which is a known carcinogen. JNJ’s subsidiary, LTL Management, has been established to handle the talc powder lawsuits, and they have tried to use bankruptcy through this subsidiary to avoid jury trials, but the attempts have failed.

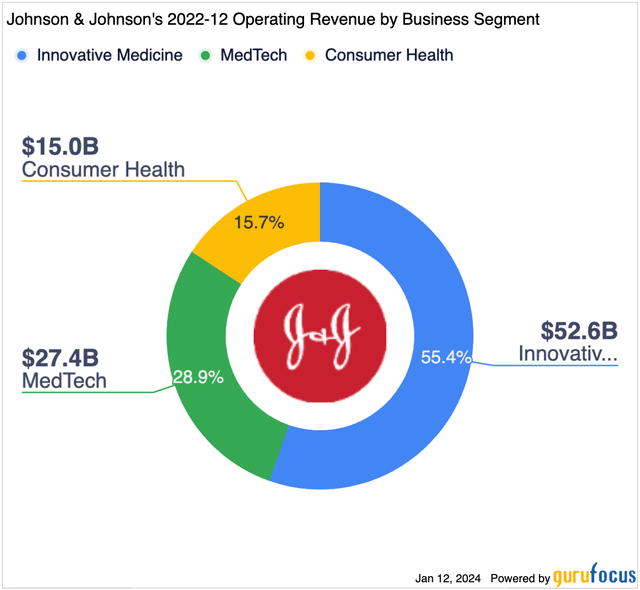

Considering that JNJ’s talcum powder comes under Consumer Health sales, the effects of this would likely be minimal on the firm’s top line initially. Yet, continued reputational issues such as this could indeed affect investor sentiment and consumer habits.

GuruFocus

Conclusion

JNJ remains a safe investment. The lawsuits recently are deep considerations that need to be addressed, yet this is arguably balanced by the strong cancer initiatives the company is taking in its acquisition of Ambrx. Due to the small nature of the talcum products in the entire product catalog, the stock is relatively risk-averse in regard to this issue. Therefore, I rate the shares a Hold.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.