Summary:

- The ad market outlook for 2024 looks robust, with projections indicating double-digit growth in connected TV ad spending.

- As the No. 1 TV streaming platform in the US, Canada, and Mexico, Roku is a natural beneficiary.

- Over the last couple of years, Roku’s key business metrics have improved considerably, with strong growth in active accounts and streaming hours.

- If ad markets recover in 2024, Roku stock could go parabolic given its depressed valuation.

Techa Tungateja/iStock via Getty Images

Introduction

One year ago to the day, I recommended Roku, Inc. (NASDAQ:ROKU) as a “Generational Buy” in the $40s, citing continued improvement in underlying business metrics and a dirt-cheap valuation:

Despite an uncertain macroeconomic environment, Roku’s key business metrics are heading in the right direction, with growth in active accounts and streaming hours re-accelerating in Q4 2022.

Starting in March, Roku will design and build its own TVs. By adding TVs to its rapidly-growing smart home product lineup, Roku is taking charge of its own destiny [reducing its dependence on OEM partners like TCL and Hisense]. The timing of this move is off-putting due to the capital-intensive nature of this business; however, Roku is building a powerful ecosystem of hardware and software to serve as a walled garden for selling ads. With its net cash balance of $2B+, Roku could easily afford to invest aggressively during this economic downturn. The long-term outlook for Roku remains bright as the shift in ad spending from linear TV to connected TV is only a matter of when not if, and hence, ignoring near-term macro pressures is of critical importance for investors. At ~2x annual Platform revenue, Roku is dirt cheap, and long-term investors buying it at $47 could potentially generate a CAGR return of ~42% over the next five years.

Key Takeaway: I rate Roku a generational buy in the $40s.

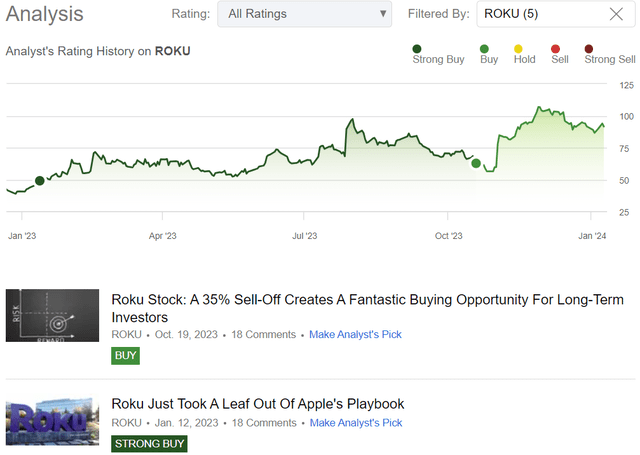

Over the last twelve months, Roku’s stock has risen by nearly ~70%. In investing, being contrarian and right is what drives market-beating performance, and I am pleased to see Roku getting much-deserved love from Mr. Market. While the ascent was quite bumpy, Roku finished 2023 with a stunning gain after announcing various cost-cutting measures in October [discussed in Roku Stock: A 35% Sell-Off Creates A Fantastic Buying Opportunity For Long-Term Investors].

Ahan Vashi’s SA Coverage on ROKU

Despite persistent macroeconomic uncertainty, the ad market outlook for 2024 [a US presidential election year] is improving. And given Roku’s strong subscriber count growth, a recovery in connected TV ad spending could very well accelerate Roku’s journey to sustained profitability!

In today’s note, we will discuss the connected TV ad spending forecast. Furthermore, I will present a 2024 outlook for Roku and our valuation for the streaming aggregator.

2024 Ad Spending Forecast

With soft landing becoming the consensus view in recent months, digital ad spending has rebounded, and market projections have gotten stronger. In early December 2023, agency-holding companies like Dentsu, Magna, and GroupM released their advertising forecasts, calling for a +4% to +7% y/y growth in global ad spending in 2024. While the macroeconomic environment remains uncertain, cooling inflation (improving business sentiment) and the U.S. presidential election are likely to boost the ad market.

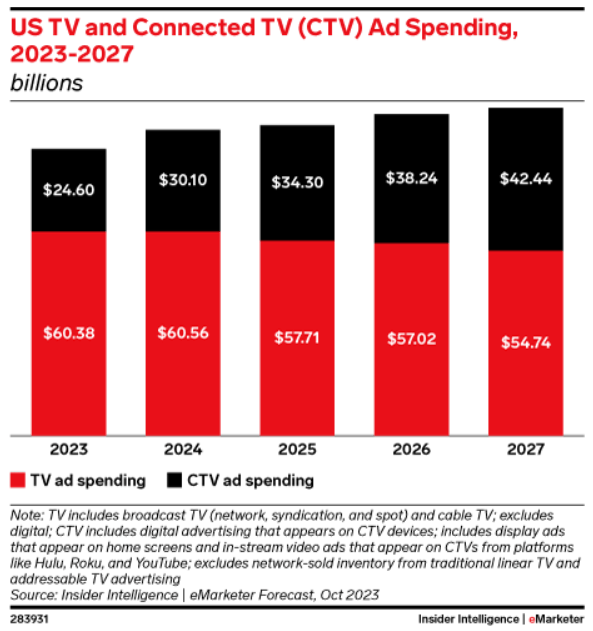

Now, the TV streaming / connected TV ad market (Roku’s TAM) is expected to be the fastest-growing digital advertising channel, with various agency projections indicating a double-digit growth rate.

According to eMarketer, CTV ad spending in the US will increase by +22.3% from $24.6B in 2023 to $30.1B in 2024, accounting for all growth in ad spending across TV (linear and connected/streaming).

eMarketer

Other agencies like Dentsu and BIA have forecasted even stronger growth in CTV ad spending at +30.8% (source) and +39.5% (source), respectively. According to Dentsu, major video platforms [i.e., Netflix (NFLX), Amazon (AMZN), Disney (DIS), etc.] launching or refining their ad offering are set to reshape the CTV advertising channel.

In Trade Desk’s (TTD) Q3 2023 earnings call, Jeff Green made some salient points about this transformation in connected TV advertising market:

Executives at every major streaming giant with both an ad-supported and an ad-free tier, (including Disney, Netflix, Paramount, Warner Bros Discovery and NBC Universal) say that total revenue per user is higher on the ad-supported plan than it is on the adfree plan. Not only do media companies generate more revenue per user within an ad supported option, but the potential for growth is much greater.

Ultimately, there’s a limit to how much viewers will spend on subscriptions. Economic pressures on the consumer, right now, are increasing the appeal of a free or low-cost option, that is supported by ads. However, this model is only sustainable if the ad load is significantly lower than traditional linear TV. And the only way we get there is if the ads are relevant to the viewer, so that advertisers are willing to pay more for each of them. It’s why we work closely with the world’s streaming services to fully realize the value of that exchange. This includes freeing up competitive biddable inventory, advancing new approaches to identity, unleashing the power of first- and third-party data and of course the technology infrastructure to transact and measure.”

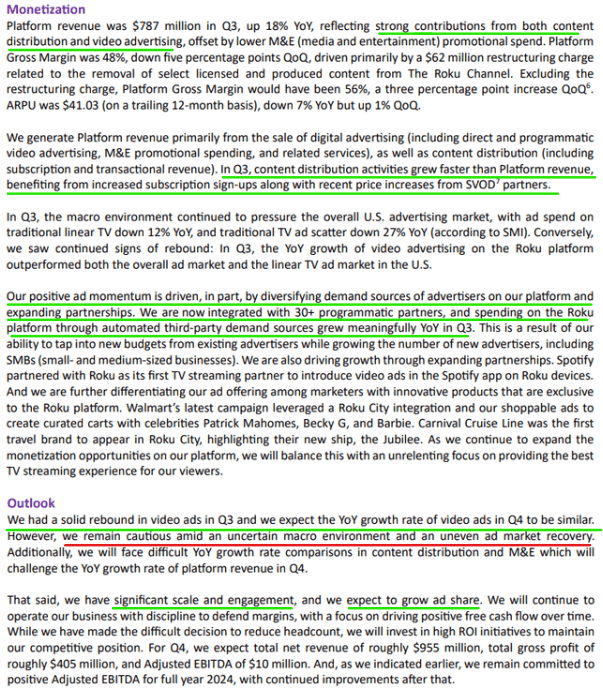

As the No. 1 TV streaming platform in the US, Mexico, and Canada, Roku is a natural beneficiary of growth in the connected TV ad market, given its rich first-party data [unique insights into viewers]. In Q3 2023, Roku reported platform revenue growth of +18% y/y, driven by strength in content distribution and video advertising:

Roku Q3 2023 Shareholder Letter

While Roku’s management prudently urged caution due to economic uncertainties and uneven recovery in the ad market, robust account growth over the last several years can pay off big time in 2024 if the CTV ad market were to register rapid double-digit growth as per the forecasts shared above.

Roku Forecast For 2024

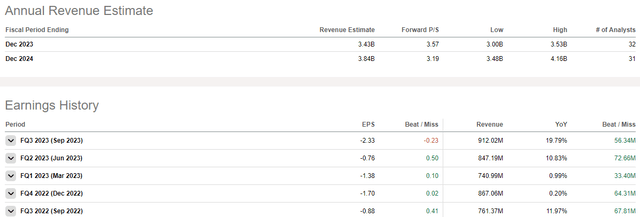

Consensus revenue forecast:

According to consensus analyst estimates, Roku is set to grow revenues by ~12% to $3.84B in 2024. Considering Roku’s underlying business trends, growth re-acceleration in recent quarters, and its history of outperforming top-line expectations, I believe these consensus estimates are too low.

My revenue forecast:

In 2023, Roku will likely end up adding ~10M net new active accounts to reach an active account base of 80M. Given Roku’s ongoing geographical expansion, I believe we can pragmatically see another ~10-12M account adds in 2024 [devices revenue of ~$500M].

Assuming a weighted average active account figure of 85M for 2024 and a conservative ARPU estimate of $45 [reflects a stronger ad pricing environment in 2024], I see Roku’s platform revenues landing at ~$3.83B for 2024 [up +27.5% from my $3B estimate for 2023 (a figure Roku is likely to beat when it reports Q4 2023 results next month)].

Overall, I see Roku’s total revenue landing at $4.33B for 2024, up by ~23.7% y/y [based on my 2023E revenue of $3.5B] and ~12.8% higher than consensus street estimates. In the event of a hard landing (recession), my estimate could prove to be overly optimistic; however, as things stand, this is my conservative 2024 top-line estimate for Roku.

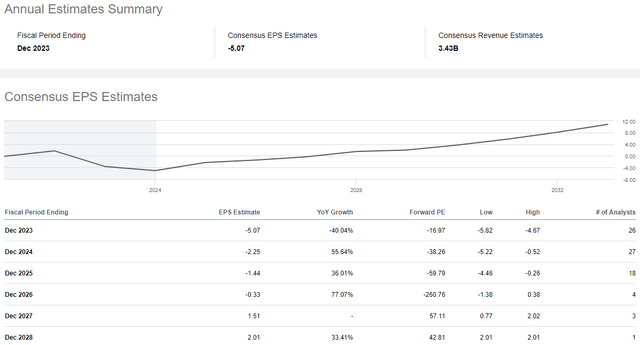

Consensus earnings forecast:

Over the last couple of years, Roku has been subsidizing its hardware (selling devices at a loss) to keep growing its ecosystem (user base). In my view, Roku’s strategy is to build a walled garden akin to Apple, but for TVs and smart home devices. From a long-term perspective, I think Roku is doing the right thing by growing its user base (as fast as possible), even if that means losses in the near-to-medium term.

As per consensus analyst estimates, Roku is poised to cut its losses by more than half this year, with EPS projected to improve from -5.07 in 2023 to -2.25 in 2024. However, Roku is expected to remain unprofitable for next 3 years.

My earnings forecast:

While I need to review post-restructuring margins in H1 2024 to fully comprehend Roku’s new margin profile, I think Roku can reach ~10-15% adj. EBITDA margin this year as revenue mix shifts toward platform revenue [gross margins: 50-60%] and monetization [ARPU] improves. If Roku achieves such a margin improvement in 2024, the adj. EBITDA would rise to $0.43-0.65B, catapulting Roku to GAAP profitability or breakeven EPS [as long as SBC growth is contained (very likely given the recent restructuring of the business) and no further restructurings are required]. Again, in the event of a hard landing, my revenue and margin estimates could prove to be too optimistic.

Concluding Thoughts: Is Roku Stock A Buy, Sell, or Hold?

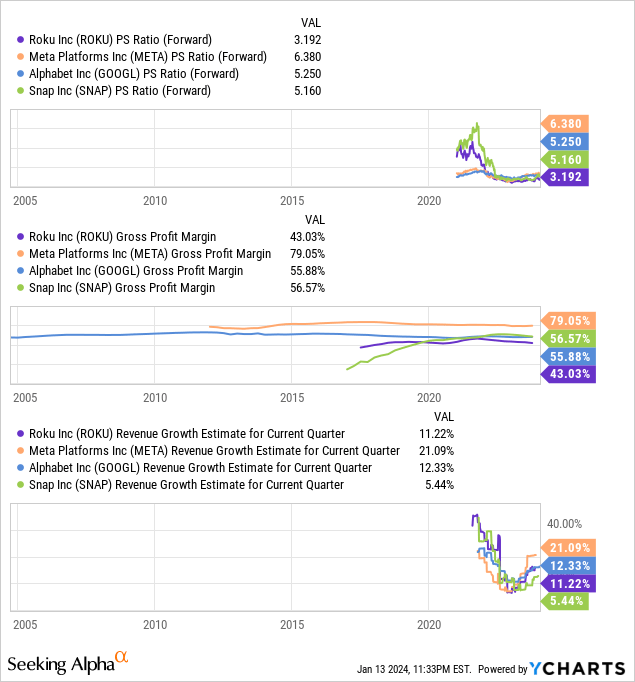

Despite an impending growth re-acceleration and margin expansion, Roku trades at a significant discount to digital advertising giants like Meta Platforms (META) and Alphabet (GOOGL). While Roku’s lower margin profile and current growth rates somewhat justify the discounted relative valuation, this gap is likely to be bridged in 2024 as Roku’s y/y revenue growth re-accelerates back to the 20-30% range, and margins expand on revenue mix shift toward higher-margin platform revenues.

As a greater share of TV ad spending (~$90B market) shifts to streaming/connected TV in the US, Roku is primed to experience secular growth for several more years to come, with the company boasting >30% market share of TV OS aggregator platforms in its domestic market [US].

While its international expansion is still in the nascent stages, I think Roku’s strong performance in Mexico and Canada speaks volumes for long-term growth potential.

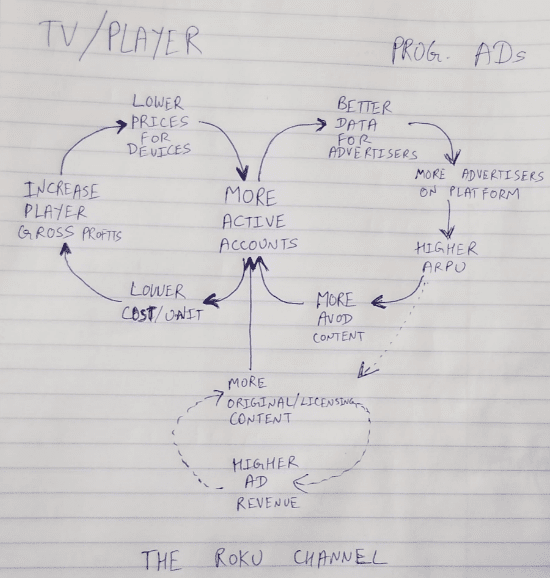

In the long run, I see the global TV OS market consolidating into 2 to 3 players (similar to what we have seen with the mobile OS and PC/Desktop OS markets), and given Roku’s current market-leading position and powerful flywheel, I think it is primed to be a top player in this attractive arena [$100B+ advertising TAM].

Roku Updated Flywheel (Author)

By the end of this decade, I view Roku as a $30-40B annual ad revenue business [200-250M active accounts (globally) & ARPU of ~$150], as shared in our previous report on the company. While net losses could stay elevated for the next couple of quarters, Roku’s underlying business trends have shown strong positive momentum, and the business is set to turn free cash flow generative in 2024. The near-term macroeconomic [ad market] outlook remains uncertain; however, Roku’s long-term future looks brighter than ever.

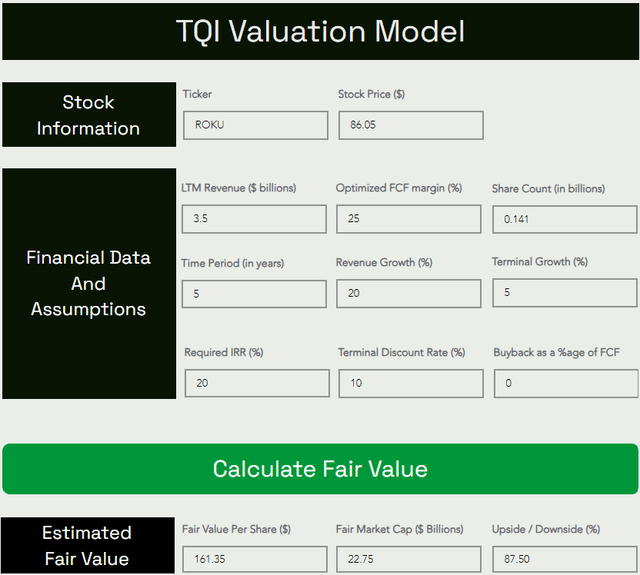

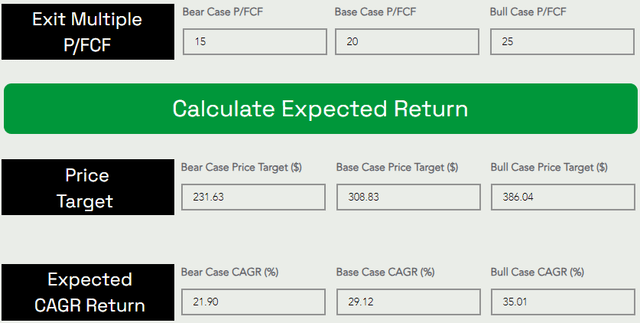

Here’s my updated valuation model for ROKU:

TQI Valuation Model (Free to use at TQIG.org) TQI Valuation Model (Free to use at TQIG.org)

According to TQI’s Valuation Model, Roku is worth $161.35 per share ($22.75B in market cap), i.e., it is still trading at a significant discount to its fair value. Furthermore, the base case assumption of ~20x P/FCF for exit multiple resulted in a 5-year expected CAGR of 29.1% for Roku.

Since this expected return is far greater than our investment hurdle rate of ~20% for growth stocks operating near FCF breakeven, I continue to rate Roku a “Strong Buy” in the $80s.

Key Takeaway: I rate Roku a “Strong Buy” in the $80s for long-term investors, with a preference for staggered accumulation and/or proactive risk management.

Thank you for reading, and happy investing. Please let me know if you have any thoughts, questions, or concerns in the comments section below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ROKU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

We’re currently running a special New Year’s sale at our investing group:

Get 50% Off On The Quantamental Investor

Note: A 14-day risk-free trial is available for new subscribers