Summary:

- UNH is the largest healthcare company globally, providing medical insurance through its UnitedHealthcare division and primary care, PBM and data analytics through its Optum business.

- Since Q1 21, UNH’s insurance plans outperformed the industry by a wide margin with ~22% vs ~14% total $/member growth and an on average 360bps lower MLR.

- Leveraging Optum, UNH’s margins are roughly double that of industry peers with significant future headroom due to high-growth data analytics and primary care adding 20-30bps of annual segment margin expansion.

- Strong cash generation and potential relevering to 2.5x EBITDA could allow UNH to deploy up to $66bn towards share buybacks (~14% of current market cap) or value-accretive M&A in the coming years.

- On the back of its best-in-class profile and undemanding current valuation at ~14% discount to 3Y average, I initiate UNH with a Buy rating and a PT of $635 (22% upside to current).

Wolterk

Company Overview

UnitedHealth Group (NYSE:UNH) is the largest health insurer in the US and the largest healthcare company globally with a current market cap of $482bn and FY23 revenues of $372bn. It currently operates through 2 segments which are roughly equal in size and together cover most of the commercial healthcare value chain from insurance plans over pharmacy benefit management (“PBM”) to primary care. Key competitors include Cigna (CI), Elevance (ELV), CVS (CVS), Molina (MOH), Humana (HUM) and Centene (CNC), referred to as “peers”.

[Segment descriptions and figures from UNH Investor Handbook 2023]

UnitedHealthcare – 55% of FY23 Revenue

UnitedHealthcare is UNH’s medical insurance segment, offering commercial and government-sponsored plans for 52.7MM people as of December 2023. Of its total membership base ~52% fall into the commercial segment, ~38% are government-sponsored Medicaid and Medicare patients and ~11% are customers outside the US. 7.7MM people (~15% of total) are enrolled in the segments’ Medicare Advantage (“MA”) plans which currently serve as the key growth lever in the industry given favorable pricing.

Optum – 45% of FY23 Revenue

While the UnitedHealthcare segment focuses solely on medical insurance plans, Optum incorporates a variety of sub-businesses acting on different parts of the value chain.

Optum Rx is the company’s PBM, responsible for negotiating drug pricing with manufacturers and handling more than 1.5bn patient scripts per year for 62bn customers, making it the largest PBM in the US ahead of CVS Caremark, Cigna Evernorth and Elevance.

Optum Health is active in primary care, a field that has seen strong recent growth and has been defined as key lever in CVS’ ongoing strategic transformation towards a holistic healthcare provider (see my note on CVS here). The business currently serves more than 103MM patients in ~2,700 associated clinics, at home or virtually through its network of 130k healthcare professionals, giving it the US’ largest primary care network. Optum Health has recently shifted its focus further towards value-based care, aiming to leverage its network and capabilities to provide better patient outcomes and reduce the need for costly hospital admissions for currently ~4MM patients. The company notes that this value-based, preventive care can reduce admission rates by up to 18%, making Optum Health a key asset for maintaining and expanding profitability in UnitedHealthcare’s insurance plans.

Optum Insight is the third sub-business of the segment, leveraging data analytics and technology to drive clinical insights and improve administrative efficiency for both the group and external customers with 4 out of 5 US healthcare plans currently served.

Key Investment Thesis

Undisputed Industry Leader in Health Insurance with most favorable Cost Structure and highest $/Member Growth

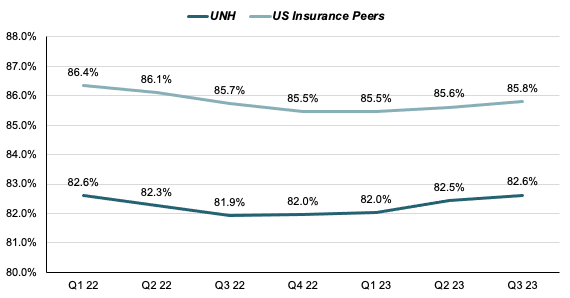

UNH has significantly outperformed its US Medical Insurance peers on the basis of a Medical Loss Ratio (“MLR”) that has been on average 360bps lower than the industry’s average at just ~200bps above the legal 80% payout requirement. I view the group’s Optum division as the key asset here, specifically the primary and value-based care business of Optum Health, allowing for lower hospitalization rates (as noted UNH estimates that fully value-based care covered Optum Health patients have on average a ~18% lower hospital admission rate) and thus lower reimbursements for UnitedHealthcare. This impact on UNH’s insurance margins is one of the key reasons for CVS’ push into the space, spending ~$20bn in 2022 to acquire two primary/value-based care focused businesses (see here).

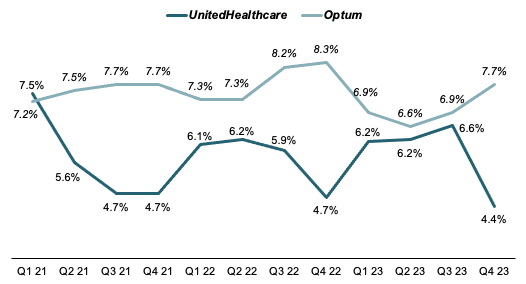

3Q Rolling MLR (Company Filings)

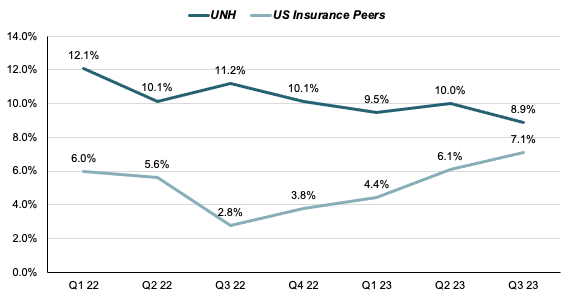

Next to leading its peers in cost structure, UNH has also shown the most consistent pricing growth profile, consistently being able to grow premia/member ($/member) by double-digits YoY before dipping to ~9% in Q3 23. On average UNH’ pricing yield has grown by ~10.3% YoY every quarter with peers growing their pricing on average around 5.1% YoY, giving UNH more than double the implied pricing power of the industry over the last 2 years.

YoY $/Member Growth (Company Filings)

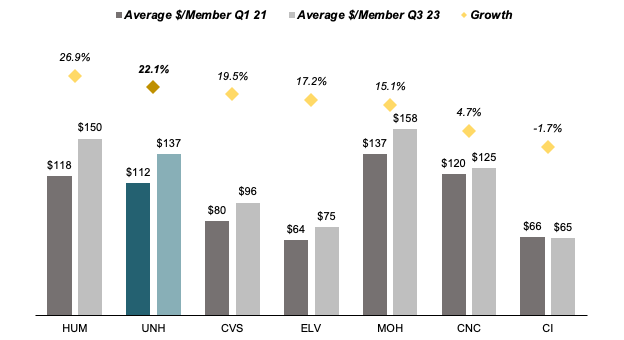

Through its resilient double-digit growth in average $/member, UNH has been able to increase its pricing by a total of ~22% since Q1 2021 from $112/member to $137/member, topping the peer group with HUM as notable exception. However, as HUM has shifted their plan mix to 100% higher premia government contracts over the period while UNH’ share of government contracts has remained largely flat at ~38% vs ~36%, I view it as reasonable to disregard this datapoint, making UNH the insurer that has been able to grow its premia the most organically at ~22% vs a peer average of ~14% or ~11% excluding HUM. I estimate this to be another benefit from its integrated model with UnitedHealthcare plans and Optum services and care creating an ecosystem for the patient that can offer him arguably the best service spectrum, giving UNH enormous pricing power.

Average $/Member Q1 21 vs Q3 23 (Company Filings)

Specifically in MA, UNH plans rank among the highest rated with 8 UNH plans among the 25 currently 5-Star rated for-profit MA plans, covering ~1MM customers ahead of HUM’s four 5-Star rated plans with in total ~800k members. In total UNH covered customers make up ~46% of all 5-Star MA plan enrolled patients.

Optum as Key Asset to reach Best-in-Class Efficiency and stabilize volatile Insurance Business

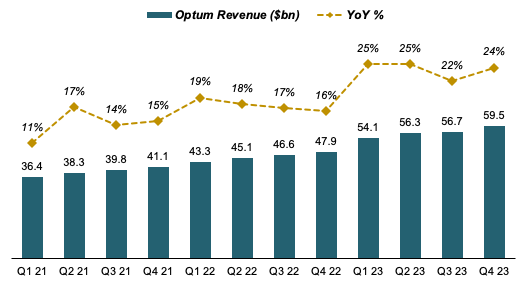

While UNH is most known for its role as a provider of health insurance plans through its UnitedHealthcare division, I would argue that the real strength of the company does lie in the Optum division. As noted above, Optum operates through 3 sub-divisions, creating a network throughout the entire managed care value chain. While UnitedHealthcare has been able to grow its $/member at a steady double-digit rate, member growth has only averaged around 2% per year implying approximate total growth in the LDD, Optum’s revenue has consistently grown in the MDD-HDD through both organic expansion and M&A with its share of total revenues rising from ~48% to ~55%. However I do note that 2023 growth rates have been inflated by the $13bn acquisition of health analytics firm Change Healthcare and subsequently integrated into the Optum Insight business, first impacting group revenues in Q1 23.

Optum Revenue Growth (Company Filings)

While Optum’s topline performance is impressive, I assign the most value to its ability to both lift and stabilize group margins. While medical insurance is in nature a volatile business with strong seasonal effects as hospital admissions and drug prescriptions increase over the Winter, Optum, with its diversified footprint in primary care, PBM and data analytics has a more predictable and stable margin profile. Optum’s margins have also on average been 170bps higher than those of UnitedHealthcare with specifically Insight’s data analytics and software portfolio operating at ~20% and Optum Health in the HSD respectively. While the group’s PBM Optum Rx has a lower margin profile of ~4%, with significantly higher growth rates achieved in Insight and Health (MDD, supported by ~$32bn in current backlog / LDD) than at Rx (5-8%) I see a lot of runway in the segment to further improve profitability. At constant growth rates and profitability, I estimate this to potentially grow Optum’s operating margins by 20-30bps each year.

Segment Margins (Company Filings)

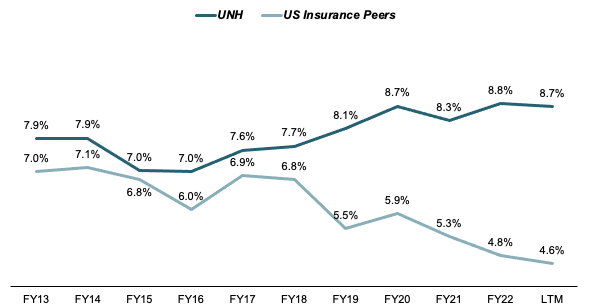

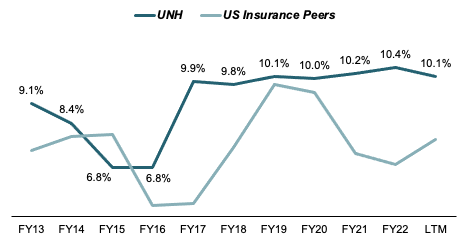

Over the last 10 years, this uplift from the Optum segment has significantly benefitted group margins, consistently scoring ahead of the industry. While only slightly ahead over the mid-2010s, notably UNH’ dominance vs peers has increased significantly post 2018, being able to grow margins when pure play insurance and less diversified peers have seen falling profitabilities amid regulatory cost pressure.

[Note: Segment margins are calculated on the basis of segment gross revenue while group margins are calculated on a net group revenue basis after eliminating intra-group sales]

EBIT Margins vs Peers (Company Filings)

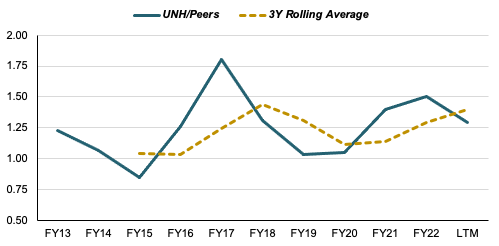

Due to its higher profitability, UNH has also (almost) constantly outperformed its peers in Returns on Invested Capital (ROIC) with its average ROIC over the period of ~9.2% roughly 170bps above peer average. Specifically for the period after 2017, UNH has managed to keep its ROIC highly stable at around 10% while peers have fluctuated significantly.

ROIC vs Peers (Company Filings)

Looking at ROIC on a relative basis, UNH has outperformed peers by up to 75% higher capital returns and only once generating below-industry returns (FY15). Notably, when looking at its 3Y rolling average ROIC/industry, UNH has shown a positive trend since 2020, roughly coinciding with the post-Covid era, indicating the innate strength of its business model to deal with even significant disruptions in the public’s health needs.

UNH ROIC relative to Peers (Company Filings)

Strong Cash Generation and underlevered Balance Sheet allow high M&A Flexibility and Potential for significant Increase in Share Buybacks

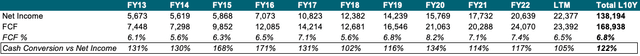

Since 2013, UNH has converted 122% of its total Net Income into Free Cash Flow at an FCF margin of ~6.8% with its FCF/Net Income cash conversion ratio constantly above 100%.

L10Y FCF Margins and Conversion (Company Filings)

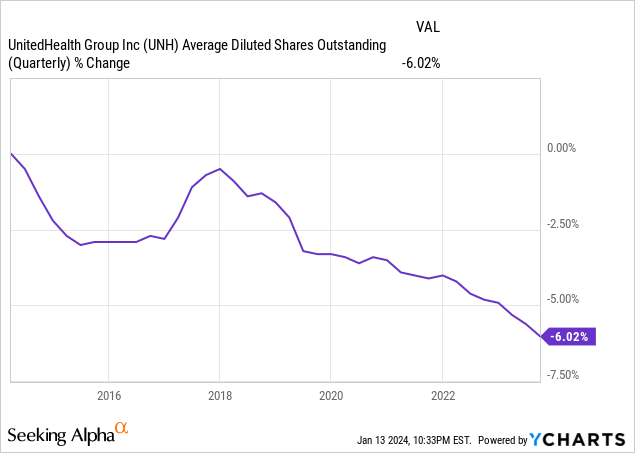

Due to this high stability and conversion of cash, the company has been able to grow its dividends at a CAGR of ~21% over the last 10 years while buying back ~6% of its outstanding shares. I note that this figure is somewhat distorted by a share issuance program in 2016/2017 which increased share count by ~3%.

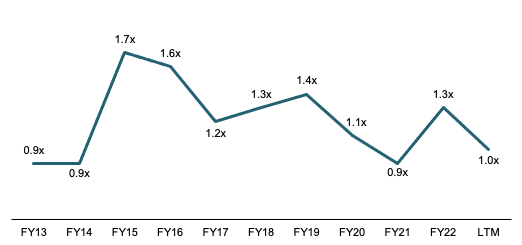

However, with current leverage sitting at a very undemanding 1x Net Debt / EBITDA, I see significant potential for UNH to significantly accelerate its buyback program in future years, both drawing on its strong cash generation and a potential relevering.

Net Debt / EBITDA (Company Filings)

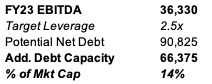

I estimate UNH could easily sustain a rise in leverage to at least 2.5x, especially in a future where interest rates come back down again. Assuming a target leverage of 2.5x, UNH could sustain up to ~$91bn in net debt, implying ~$66bn additional debt capacity or ~14% of current market cap.

Potential Debt Capacity (Company Filings)

Next to decreasing its share count, UNH could also deploy this significant amount of dry powder towards value-accretive M&A which, especially in Optum, could further grow the company’s footprint and topline.

Current Trading at ~14% Discount to 3Y Average and ~17% higher Discount relative to the S&P 500 on forward EBIT

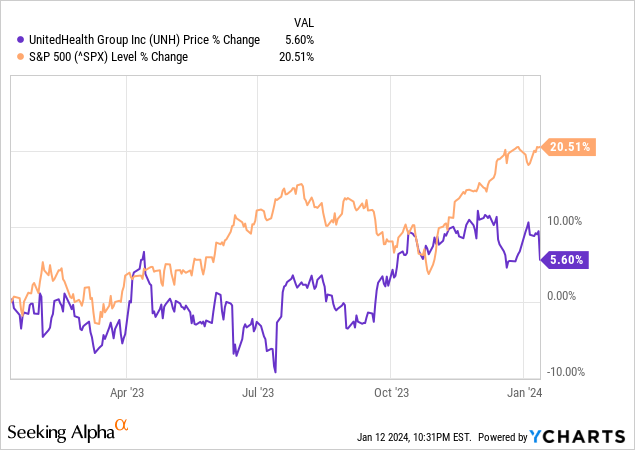

Over the past 12 months UNH has severely underperformed the market with gains of 5.6% vs 20.5% for the S&P 500 (SPX). Much of this underperformance has been driven by concerns about a rising MLR, caused by post-Covid catchup treatments. After rebounding from its lowest in years in July, Q4 earnings have once again raised concerns when UNH reported a 85% Q4 MLR, up 270bps from Q3, mainly attributed to RSV vaccinations and Covid-treatments among seniors. With such external effects being transitory in nature as communicated by management, I see the recent underperformance as an attractive entry point for long-term investors.

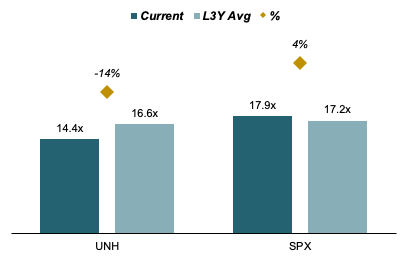

UNH currently trades at 14.4x FY24ae EBIT, ~14% below its average EV/EBIT over the last 3 years while valuation for the SPX is currently at a ~4% premium to L3Y average at 17.9x vs 17.2x. Relative to the SPX, UNH currently is valued at a 17% discount (UNH/SPX 0.8), significantly below its L3Y average of a 3% discount (UNH/SPX 0.97) making for an attractive valuation with strong rerating potential once the MLR stabilizes.

Forward EV/EBIT (S&P Market Intelligence)

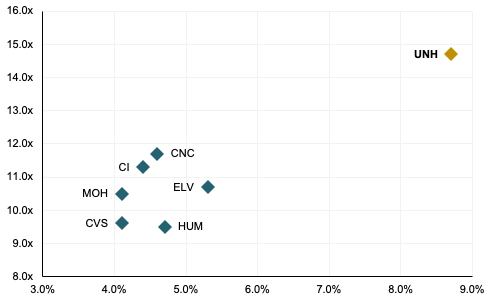

While on an absolute basis, UNH definitely commands a premium valuation vs US health insurance peers (and rightfully so), I would argue that relative to its EBIT margin which is around double that of peers, there could be even more headroom. At an LTM EBIT% of 8.8%, UNH is 92% above peer average of ~4.5% yet its current forward EV/EBIT stands at only ~39% premium to peer average of 10.6x. Assuming the same premium on assigned multiple as on margins, UNH could hypothetically trade at a “fair” 20.3x EBIT or ~38% above its current valuation. I am not implying that this is what UNH should be valued at, however it should serve as an argument to rebuke the common argument that UNH is too expensive vs peers.

Forward EV/EBIT vs LTM EBIT% Matrix (Company Filings, S&P Market Intelligence)

Valuation

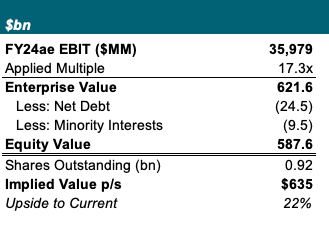

I value UNH based on an EV multiple on my FY24 estimated EBIT.

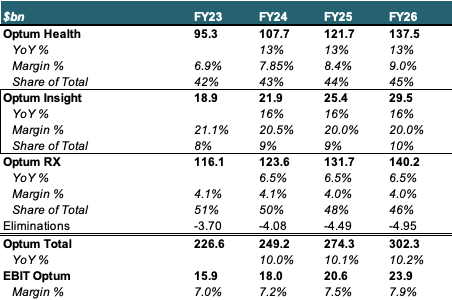

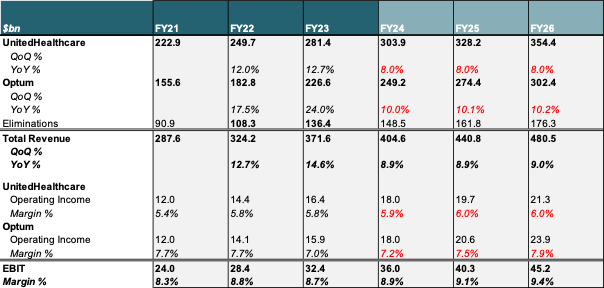

For Optum I estimate forward annual growth rates and margins in line with managements’ communication at UNH’ recent investor conference. I estimate Optum Health to grow revenues at 13% (guidance: LDD-MDD) with recently depressed margins returning to the midpoint of management’s targeted range of 8-10% by FY26. Optum’ Insight business is modeled to grow at 16% p.a. (guidance: MDD) with a gradual move towards the midpoint of managements targeted margin range of 18-22% while I estimate Optum Rx to grow revenues at 6.5% (guidance: 5-8%) at a constant 4.1% margin. For the entire segment, I therefore project a ~10% annual revenue growth rate with margins expanding 90bps from FY23 to FY26, reflecting a more favorable business mix towards higher profitability Health and Insight.

Optum Financial Model (Company Filings and Author’s Projections)

For the UnitedHealthcare division I model annual revenue growth of 8%, which I deem as reasonable given the historic ~2% contribution by an expanding member base and an anticipated weaker $/member growth of ~6% p.a. compared to the previous 3 years’ average of ~10% as inflation passthrough subsides. For margins I estimate a return to a sustainable 6% by FY25 with a 10bps YoY expansion in FY24.

Overall I project revenue growth rates of 8.9%/8.9%/9% for FY24/FY25/FY26 and a rise in group operating margins from 8.7% to 9.4% by FY26, largely on the back of Optum’s business mix shifting towards higher margin businesses.

UNH Financial Model (Company Filings and Author’s Projections)

I derive my price target by placing a 17.3x EV multiple on my FY24ae EBITDA of $35.8bn. 17.3x represents a discount of 3% to the S&P 500’s current forward EV/EBIT multiple of 17.9x, in line with UNH’ 3Y average discount vs the market. Adjusting total EV of $622bn for net debt and minority interests, I estimate a fair value of UNH’ equity of $588bn, implying a fair value per share of $635 and around 22% upside to current trading levels.

UNH Multiple Valuation (Company Filings and Author’s Projections)

Wrap-Up and Outlook

I see UNH as one of the cleanest long-term investment theses in the market with significant tailwinds on both top- and bottom-line, solidifying and further increasing its competitive and financial dominance versus peers. While its healthcare plans will remain a stable source of income, I estimate the market to place a higher and higher emphasis on Optum as key lever to improve profitability against the backdrop of the highly regulated medical insurance industry. With primary care’s and health analytics’ share of profits growing, I see mid-term potential for further multiple upside, while its undemanding balance sheet and strong cash generation grant a lot of flexibility to grow EPS inorganically through value-accretive M&A and share repurchases. Key risks to my thesis include a slower than anticipated MLR recovery as well as regulatory changes in the US medical insurance landscape.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of UNH, CVS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.