Summary:

- There are big risks for JPMorgan, especially if the past examples of yield curve inversion come to pass even remotely.

- A return to the 200-day moving average is the best-case scenario for JPMorgan Chase.

- Investors may consider longer-dated covered calls to create some defense while matching best case upside for the stock.

WWJD: What Would Jamie Do? Drew Angerer/Getty Images News

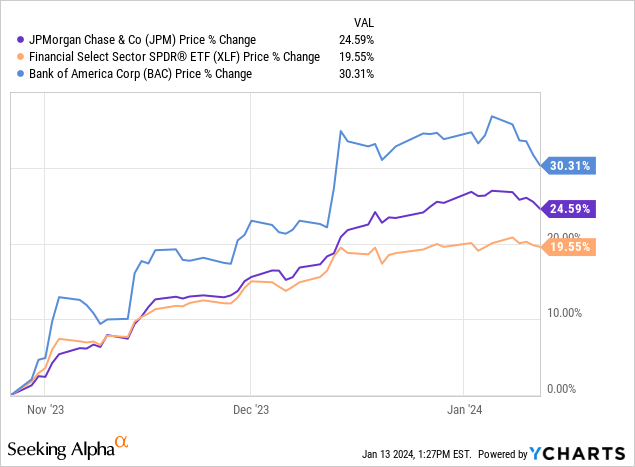

It has been a fun time for the bulls of all stripes since the October bottom. The Federal Reserve after ringing in multiple endorsements of “higher for longer”, said “you know what, we were just kidding”. JPMorgan Chase & Co. (JPM) also took part in the melee and has delivered a scintillating return since the famed trough. While Bank of America (BAC) did an even better 30% return, JPM’s returns were nothing to scoff at.

While we are not ready to come to a hard straight Sell rating here, we think there are 3 reasons why covered calls are likely to improve returns of those who are just plain long the stock.

1) The Fed Will Have To Backtrack, At Least A Bit

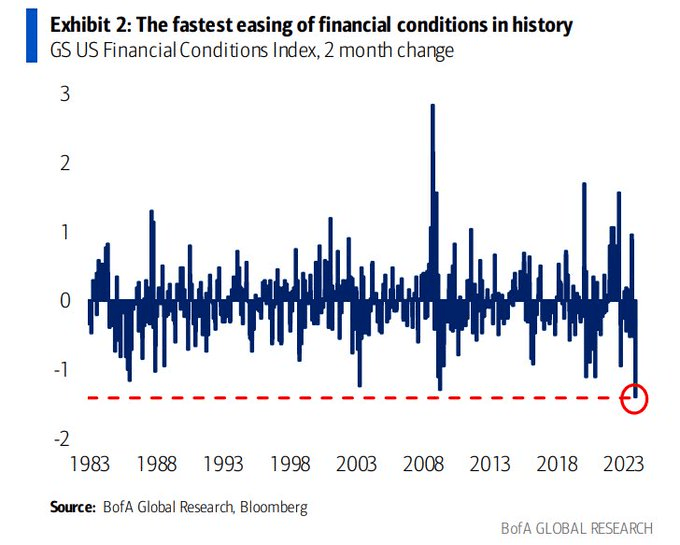

The best returns since the 2009 bottom were powered by the fastest easing of financial conditions since then.

Bank Of America

Even the dual firing of monetary and fiscal stimuli during COVID-19 did not come close. Such movements are often at the bottom of recessions, but the Federal Reserve chose to create this with unemployment at near all-time lows. The most likely outcome of this will stickier inflation and as long as wages stay strong, CPI measures will move back up. We think the Fed will start pushing back against the expectations of 7 rate cuts (yeah that is where we are today) and this should tighten conditions once more, forcing a rerating of the banks.

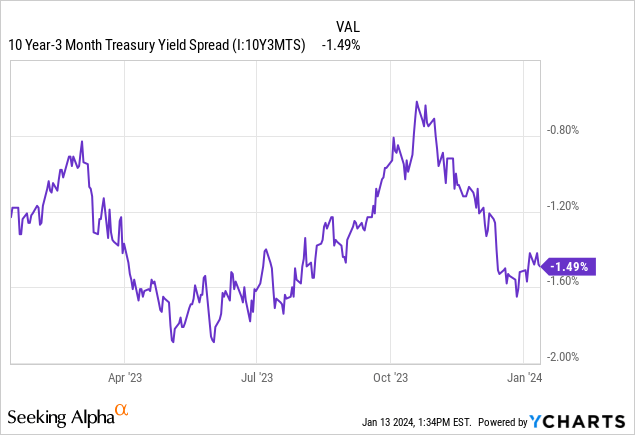

2) The Yield Curve Is Still Firing Off Warning Signs

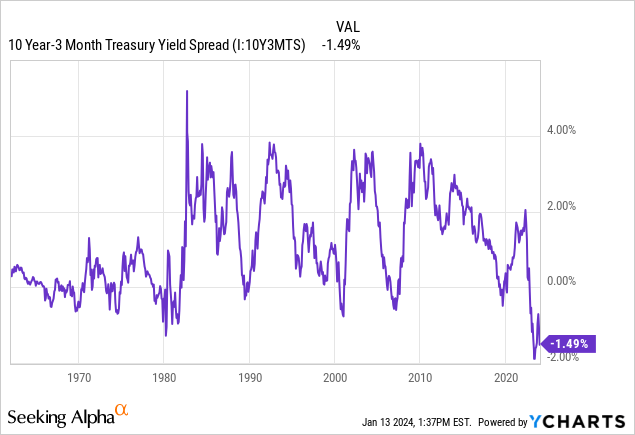

Probably one news item that you have put on snooze, is the inverted yield curve. We have been hearing about it for so long for the last 18 months that most have tuned it out. It looked like it was making a beeline to “un-invert” in October and that attempt failed.

Investor have probably started looking at this as “normal”. But it’s not and this degree of inversion is really, really not.

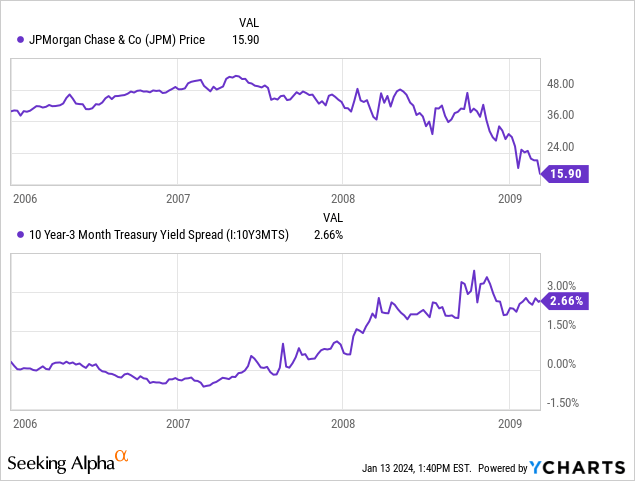

What you should note on there is that every single one of these depths did bring about a recession. What you should also know is that each of these inversions corrected extremely violently. Here is JPM during the 2006-2007 inversion (which was far milder). Note that JPM topped around when the inversion started “un-inverting”. It bottomed 70% lower and by then 3-10 spread was a positive 2.66%.

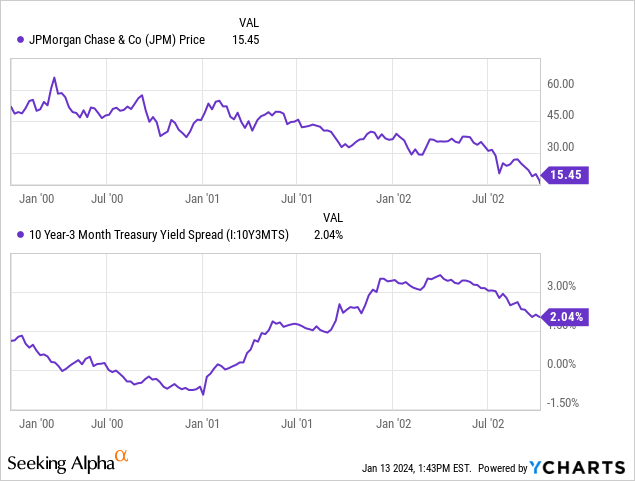

Here is 2000-2002 timeline where JPM topped just around when the yield curve began to invert. It rallied back to a similar level as the curve started inverting deeply. In January 2001, the curve started its un-inverting process with a vengeance and JPM started its 70% drop. Peak to trough drop was close to 78%.

Both those inversions were baby inversions relative to what we see today. Just know that chasing what has gone up is likely to prove a poor strategy in the years ahead. Equities are about as expensive as they get when we see household equity allocations and need to drop at least 40%-50% to restore historical return levels.

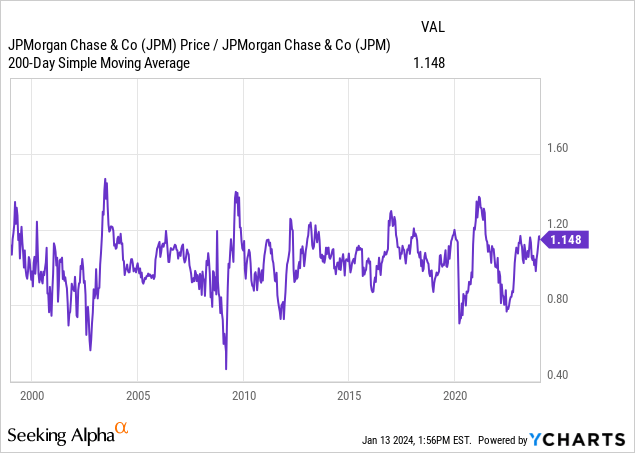

3) A Return To 200 Day Moving Average Is The Best Case Scenario

With the problems we see ahead, a soft landing outcome is the least likely. Either we do get the rate cuts because the economy crater or inflation proves to be stickier, thanks to a mistimed easing. Even if you assume a soft landing, JPM is stretched looking at its price relative to its 200 day moving average.

So our best case is a consolidation where gains will be hard to come by over the next 12 months.

Verdict

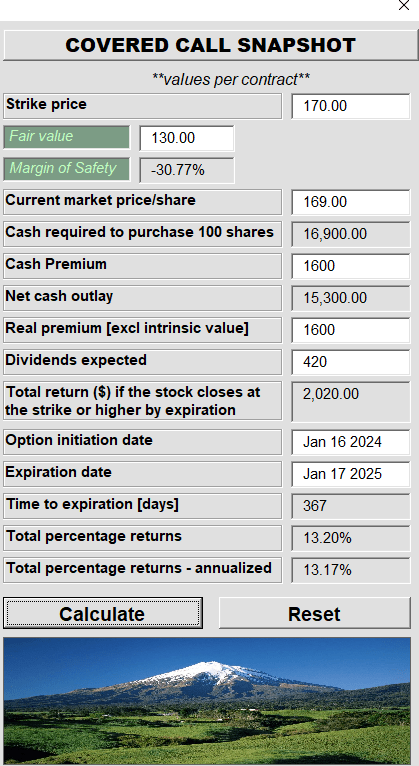

While investors may be hesitant to buy into the fallout from these signals, they might consider a way to increase the defense of their portfolio. Longer dated covered calls are likely to protect against some downside while almost certainly matching the best case upside. The covered call we think investors who are long should consider is the $170 strike for January 2025. Note that we are not remotely suggesting this as a new position. This idea is only for those holding shares and who buy into our thesis of using a modicum of caution here.

Author’s App

For JPM straight long position to outperform this covered call, it would have to close January 17, 2025 over $186.00. Something we see as a less than 10% chance presently.

The Preferred Shares

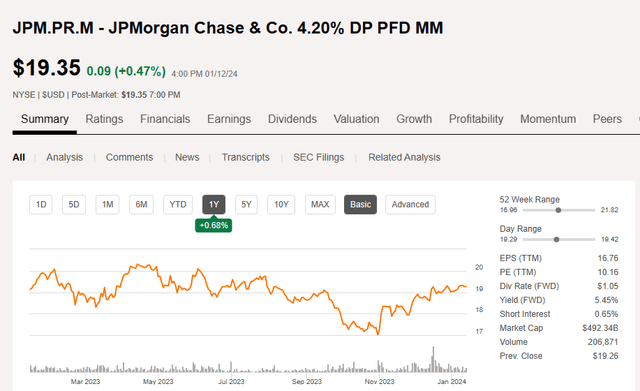

Income investors are also drawn to the large suite of JPM preferreds. They offer a safer and higher yield than the common. The yields on most have cratered at the current price, thanks to the epic rallies. Here, investors have a chance to be a bit more discriminating. For example, JPMorgan Chase & Co. 4.20% DP PFD MM (NYSE:JPM.PR.M) now yields about 5.5% on a stripped basis.

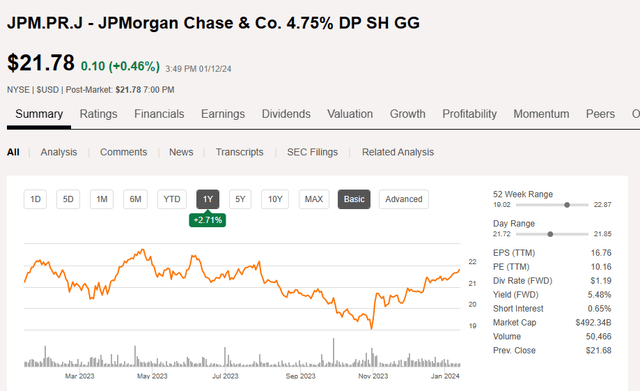

JPMorgan Chase & Co. 4.75% DP SH GG (NYSE:JPM.PR.J) is in the same boat, rallying 20% since the bottom and yielding around the same.

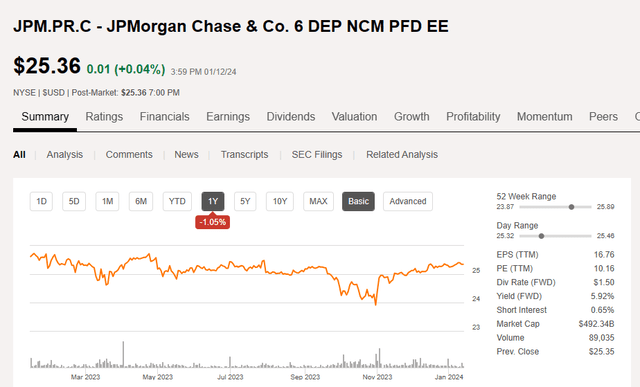

What we see here is the wholesale pricing of massive rate cuts and the risks are high if those cuts don’t come to pass. However those wanting to stay with JPM can consider switching to JPMorgan Chase & Co. 6 DEP NCM PFD EE (NYSE:JPM.PR.C). These preferred shares are no different than the others expect for their coupon. With a 6% fixed coupon they pay 37.50 cents per quarter.

They have also rallied the least since the bottom as the $25 par ceiling limits their gains. At $25.36, the stripped price is slightly over par as the next ex-dividend date is January 30, 2024.

JPMorgan Chase & Co. 6 DEP NCM PFD EE declares $0.375/share quarterly dividend, in line with previous. Payable March 1; for shareholders of record Jan. 31; ex-div Jan. 30.

Source: Seeking Alpha

These are a good place to hide as they are likely to lose the least value if the Fed pushes back against the most aggressive easing expectations. Their higher yield should also create a higher floor if markets conditions normalize. We like these relatively in the JPM preferred suite.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

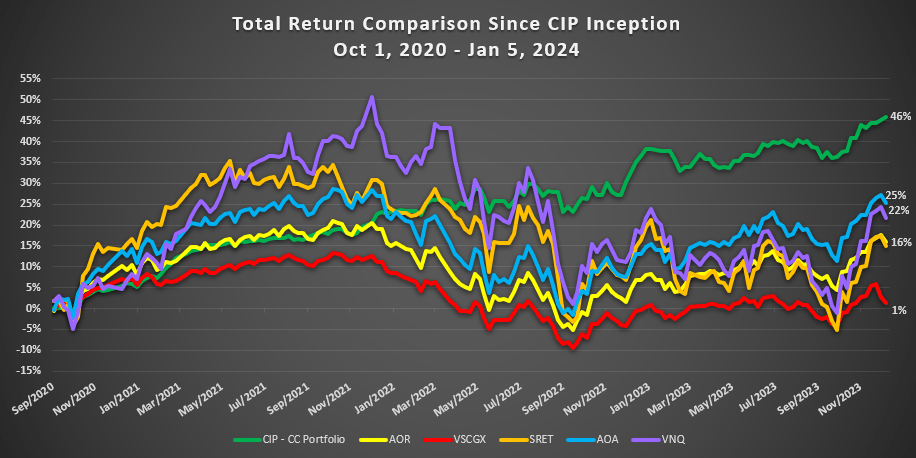

Are you looking for Real Yields which reduce portfolio volatility?

Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.

Take advantage of the currently offered discount on annual memberships and give CIP a try. The offer comes with a 11 month money guarantee, for first time members.