Summary:

- PepsiCo’s valuation has become attractive for new investors, trading at a lower multiple than The Coca-Cola Company.

- The company’s profitability and margins compared to its competitors have improved, making it a more enticing investment.

- PepsiCo’s dividend yield has crossed the 3% level and is now more attractive than The Coca-Cola Company’s dividend.

PM Images

The time has finally come when I think PepsiCo (NASDAQ:PEP) looks attractive for new investors. It’s hard to go wrong with PEP as it’s one of the most recognizable American brands that can be found in more than 200 countries and territories around the world. I have always wanted to own shares of PEP as its one of the most iconic American businesses and a Dividend King, providing shareholders with 51 consecutive years of dividend increases. I have constantly said that long-term shareholders were reaping the benefits of being invested in a well-run consumer staple conglomerate, as PEP has created tremendous value for its investors over the years. For more than a year, I have been on the sidelines waiting for an opportunity to add PEP to my portfolio, and the time has arrived. I have been a shareholder of The Coca-Cola Company (KO), and my hangup on PEP was the valuation. After looking at the metrics again, PEP is trading at a valuation that makes sense to me. I think Mr. Market is giving investors an opportunity to either add to a current position or start a new position in PEP.

Following up on my previous article about PepsiCo

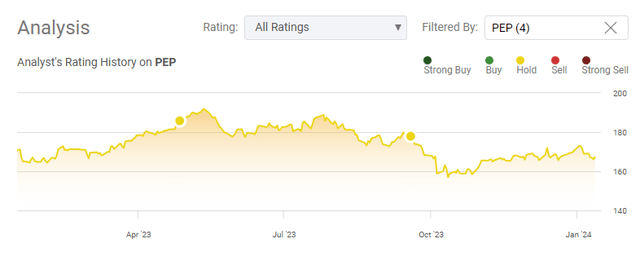

Since August 31st, 2022, I have written three dedicated articles about PEP, and my most recent article was published on September 18th, 2023 (can be read here). My common theme was that PEP was an outstanding company, but the valuation wasn’t necessarily enticing compared to where The Coca-Cola Company was trading. As you can see by the graphic below from my Seeking Alpha profile I have been neutral on PEP since the summer of 2022. In my previous article, I discussed why I thought they dodged a bullet by not acquiring Hostess Brands (TWNK) and that I still wanted to become a shareholder, but the selloff needed to be a bit steeper for the numbers to make sense for me. Now that PEP looks to have created a bottom, I wanted to follow up with a new article because I am bullish on starting a position in PEP at this level.

To me, numbers matter, and PepsiCo is trading at a valuation that I feel can create value for new shareholders entering the position

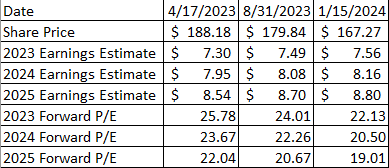

I went back to my previous articles from April 17th, 2023 (can be read here) and August 31st, 2023 (can be read here) and pulled the share price and EPS metrics. Since my article on April 17th, 2023, the share price of PEP has declined by -11.11% (-$20.91) while the consensus earnings estimates have increased. Today, there are twenty-one analysts with an estimate of $7.56 of EPS when PEP reports their full-year numbers this earnings season, while twenty-two analysts are projecting $8.16 of EPS in 2024, and fourteen analysts are projecting $8.80 in EPS for 2025. I created the table below to show how PEP’s valuation has become more attractive throughout 2023, and with shares trading at just over 20 times 2024 earnings and 19 times 2025 earnings, I feel the valuation is ripe for new capital to enter.

Steven Fiorillo, Seeking Alpha

I don’t base my decisions on technical analysis as I am not trading, but I do look at the charts and use momentum in my analysis. I can’t predict tops and bottoms accurately, and when I follow a declining stock, I look for a bottom to form and a new base to be established. PEP’s chart looks like a bottom formed in October, and a new base is forming as it consolidates around the $170 level. Anything can occur, and PEP could retrace back to the $160 level, but it doesn’t look like shares want to go much lower. If PEP beats on the top and bottom line when they report on February 9th, 2024, I wouldn’t be surprised if shares make a run on the $182 mark, as that is the number that shares failed to get past when trying to rally from the end of August to the middle of September.

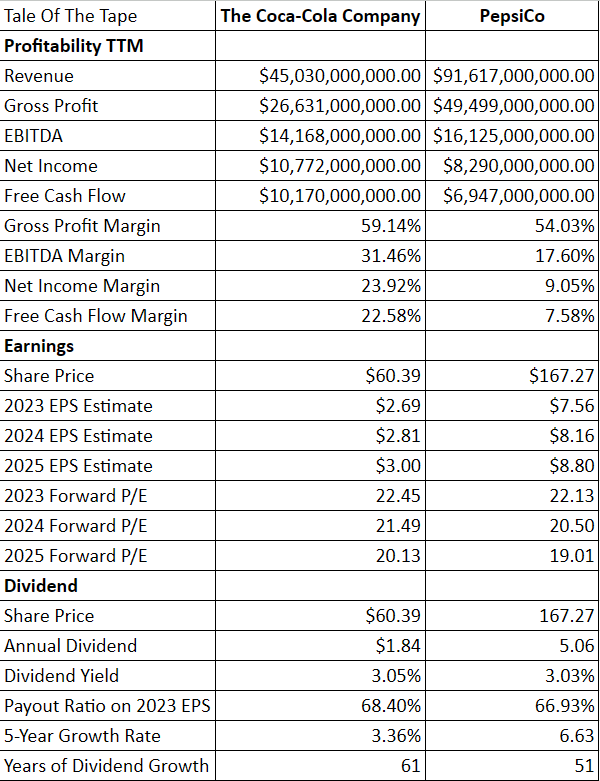

I have always compared PEP to The Coca-Cola Company and every time I try to make the justification to start a position in PEP, I couldn’t. Both are iconic American brands and extraordinary companies, but KO had always been the better investment for me. I created a table below where I compare both company’s profitability, forward earnings estimates, and the dividends to outline why I am upgrading my view on PEP and think this is a good entry point.

Steven Fiorillo, Seeking Alpha

Two of the main reasons why I wasn’t thrilled about starting a position in PEP were its profitability and margins compared to The Coca-Cola Company. PEP generates more than double the amount of revenue as The Coca-Cola Company, but from a profitability standpoint they are not as efficient. Over the TTM, PEP has generated 85.87% ($22.87 billion) more gross profit than The Coca-Cola Company, but their operating on thinner margins at 54.03% compared to 59.14%. When I look at the amount of EBITDA that is generated, PEP only squeezes out an additional $1.96 billion or 13.81% than The Coca-Cola Company but generates more than double the revenue and 85.87% more gross profit. PEP has a 17.60% EBITDA margin, whereas The Coca-Cola Company operates at a 31.46% EBITDA margin. Things get even thinner on the bottom line as PEP generated -23.04% (-$2.48 billion) less net income than The Coca-Cola Company and operated at a 9.05% profit margin. The Coca-Cola Company has a 23.92% profit margin and generates almost $11 billion in pure profitability from $45.03 billion in revenue. The same goes for Free Cash Flow (FCF) as PEP operates at a 7.58% FCF yield, whereas The Coca-Cola Company has a FCF yield of 22.58%.While PEP is a more diversified company as its entered into the snack sector, every dollar of additional revenue is only adding 9.05% to the bottom line, whereas The Coca-Cola Company is operating a much higher and more profitable business than PEP.

Due to these factors, I wasn’t willing to pay a higher multiple for PEP’s earnings over The Coca-Cola Company. Now that shares of PEP have declined from their one-year highs of $196.88 by -$29.61 or -15.04% and their earnings estimates have increased, the valuation on a forward P/E metric has become cheaper than The Coca-Cola Company. Looking at the forward P/E estimates for 2024, PEP trades at 20.50 times 2024 earnings while The Coca-Cola Company trades at 21.49 times. PEP is currently trading at 19.01 times 2025 earnings, whereas The Coca-Cola Company is trading at 20.13 times. I am not sure how much cheaper of a valuation PEP will get on its earnings, and shares may have already bottomed. I have been waiting for PEP to get cheaper on a valuation metric than The Coca-Cola Company as they are operating a lower margin business, and I am now able to pay less for PEP’s forward earnings than The Coca-Cola Company.

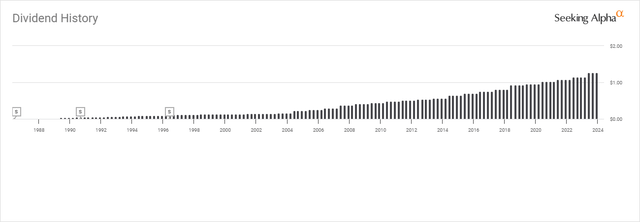

PepsiCo’s dividend has finally crossed the 3% level, and it could be more attractive than The Coca-Cola Company’s dividend at this point

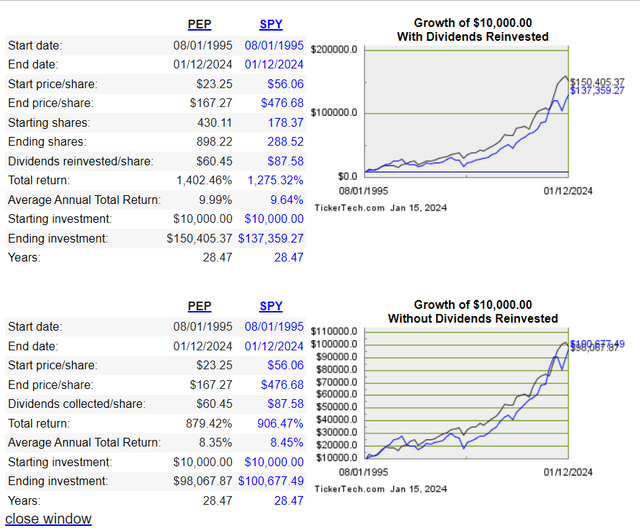

From a dividend investor standpoint, it’s hard to go wrong with PEP as it has provided 51 years of dividend growth to its shareholders. To put into perspective how impactful PEP’s dividend has been, going back to August 1st, 1995, a $10,000 investment in PEP would have grown to $98,067.87 without reinvesting the dividends compared to $100,677.49 if the same $10,000 was allocated to the SPDR S&P 500 Trust (SPY). When the dividends were reinvested, the same $10,000 invested in PEP increased to $150,405.37 and provided an additional $13,046.10 compared to investing in SPY. The $60.45 in dividends per share that were reinvested from PEP increased the overall share count by 468.11 or 108.83% while providing an additional 53.37% return on invested capital.

The combination of PEP increasing the dividend and shares retracing in value has pushed the yield just past 3%. PEP has provided 51 years of dividend growth to shareholders while having a 66.93% payout ratio compared to the expected EPS for 2023. PEP is finally in a position where the dividend looks more attractive than The Coca-Cola Company. Both companies are Dividend Kings, so longevity is a tie, and the dividend yields are 3.05% and 3.03%, so that’s also a tie. Both payout ratios on the 2023 expected earnings are both between 65-70% of EPS, so that is a tie for me also. The big difference is the 5-year average growth rate. The Coca-Cola Company has a 5-year growth rate of 3.36%, while PEP is growing its dividend at a 6.63% growth rate. Looking out over the next 5-10 years, the compounding effects from PEP’s growth will be more impactful than The Coca-Cola Company, and with the yields, payout ratios, and decades of growth basically the same, PEP’s growth rate is very enticing compared to The Coca-Cola Companies dividend.

Risks to my investment thesis in PepsiCo

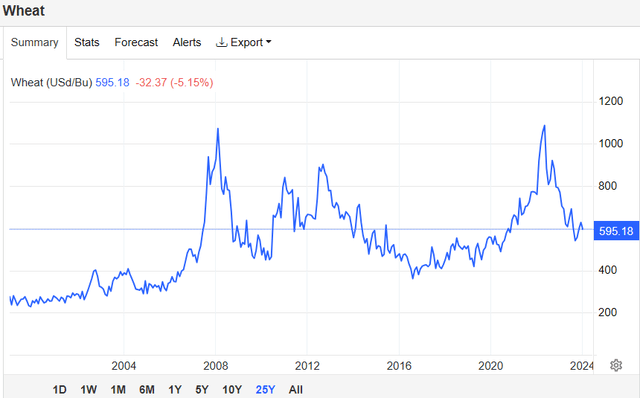

We have lived through an inflationary environment, and commodity prices have increased to the highest level in the past 25 years, especially during 2022. PepsiCo operates one of the largest food and beverage companies facing competitors with their branded and private label products, including The Coca-Cola Company, Hershey Company (HSY), and General Mills (GIS). Unlike The Coca-Cola Company, PEP is operating at thin margins, and if inflation enters another inflationary period, their margins and pricing power will come under attack. The good thing is that PEP operates a theoretically recession-proof business, but they are still subject to macroeconomic factors regarding the top and bottom lines. Many of the factors that can impact PEP financially are outside of its control, and given the current macroeconomic and geopolitical landscapes, it’s anyone’s guess as to what tomorrow brings. While PEP has the longevity of operating throughout every business environment, we’re living in uncertain times, and if an unexpected geopolitical or macroeconomic event occurs, it could make raw material prices increase, which could impact PEP’s margins and profitability, causing forward guidance to be reduced and shares to decline.

Conclusion

I think shares of PEP are trading at some of the most attractive levels I have seen since August of 2022. I am upgrading my view on PEP and think this is an opportunity to start a position. Shares of PEP have declined to the point where the dividend yield is basically the same as The Coca-Cola Company, while they are now trading at a cheaper valuation than The Coca-Cola Company on a forward P/E basis. I think paying around 19x 2025 earnings is more than fair value for PEP, and you are now getting the same yield as The Coca-Cola Company with a dividend that has been growing at double the pace over the past 5-years. I am not a shareholder yet, but I am excited to be adding PEP to my dividend portfolio in the near future.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of KO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.