Summary:

- Despite modest growth rates, Accenture plc’s strong cash flows and (near) debt-free status enable a focus on returning capital to shareholders.

- Strategic investments in generative AI, cloud capabilities, and global acquisitions position Accenture for future success.

- Accenture’s commitment to capital returns, coupled with a forward run-rate of approximately $9 billion in free cash flow, positions the company as an attractive investment.

VioletaStoimenova/E+ via Getty Images

Investment Thesis

Accenture plc (NYSE:ACN) is a professional services firm specializing in consulting and outsourcing.

It’s a stably growing, well-managed business. The stock is not blemish-free. Indeed, I openly discuss that its growth rates are practically non-existent.

However, I maintain that ACN is an attractive stock to consider. Not because of its unappetizing growth rates, but rather because the business oozes cash flows, and its balance sheet is so strong.

Also, the fact that this high-quality management team is determined to return capital to shareholders.

On balance, there’s a lot to like in this stock.

Rapid Recap

I concluded my previous bullish analysis of Accenture by saying,

Despite some growth rate challenges, Accenture’s strong profitability, global reach, and strategic investments position it favorably for continued success. I’m bullish on Accenture plc stock.

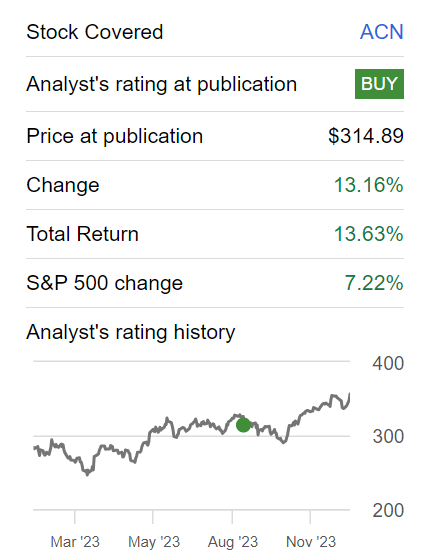

Author’s work on ACN

Since I made those comments, the stock has been a strong performer, outperforming the S&P500 (SP500). Accordingly, looking ahead, I remain bullish on this stock. Here’s why.

Why Accenture? Why Now?

Accenture is a global professional services company that helps businesses navigate and thrive in the digital era. They offer a wide range of services, including consulting, technology, and outsourcing, assisting clients in optimizing their operations, adopting cutting-edge technologies like artificial intelligence and generative AI, and driving innovation. Accenture’s expertise spans various industries, and they focus on delivering value by helping organizations adapt to evolving market trends, enhance their digital capabilities, and achieve strategic goals through tailored solutions and continuous learning initiatives.

Accenture’s prospects appear promising, as the company continues to demonstrate resilience in a challenging macroeconomic environment.

With a strategic focus on investments in generative AI, cloud capabilities, digital marketing, and business optimization, Accenture aims to drive future innovation.

The acquisition of companies in diverse geographic markets, such as Anser Advisory in North America and Innotec in Spain, underscores its commitment to expanding its global footprint and service offerings. Furthermore, Accenture’s leadership in generative AI positions it at the forefront of transformative technologies, with $450 million in GenAI sales in fiscal Q1 2024 (not calendar) and ongoing efforts to help clients realize value at scale in fiscal 2024.

However, despite these positive prospects, Accenture faces near-term challenges. The ongoing impact of the macroeconomic backdrop, characterized by lower discretionary spending and slower decision-making, poses challenges for consulting-type work and the Communications, Media, and Technology (”CMT”) industry group.

The structural costs reduction plan initiated in March to enhance resilience is underway, but the lingering effects of lower discretionary spend and challenges in the CMT sector continue to be headwinds. The UK market, in particular, presents greater challenges than anticipated, requiring efforts to reposition the business for growth.

Additionally, while Accenture has expanded its cybersecurity capabilities and made strategic acquisitions, the competitive landscape remains intense, and the company must navigate uncertainties in the global market.

With this background in mind, let’s discuss its financials.

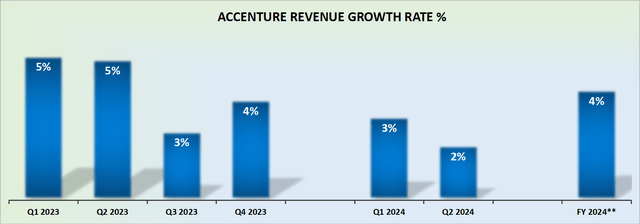

Revenue Growth Rates in the Low Single Digits

Accenture’s growth days are now a distant memory. The business is now on a path to deliver $70 billion of annual revenues and as such, its growth rates have all but evaporated.

To emphasize my argument that management isn’t low-balling estimates to allow for an easy beat later in the year, consider the graphic that follows.

SA Premium; November 2024 is fiscal Q1 2024

Above we see that in the past several quarters Accenture has just about met analysts’ revenue estimates. And once, in fiscal Q4 2023, Accenture actually missed consensus revenue estimates.

This reinforces my assertion that what you see in Accenture’s guidance is all there is. But this isn’t where the bull case is found. The bull case is discussed next.

Fully Focused on Capital Returns

Let’s get some perspective. Accenture holds approximately $7 billion of cash and equivalents while operating practically debt-free. Put another way, Accenture is on a forward run-rate of about $9 billion of free cash flow, which when taken together with its rock-solid balance sheet, means that Accenture can focus on returning capital to shareholders.

The majority of its capital returns are coming back to shareholders via share repurchase. I estimate that on a forward basis, Accenture’s total share repurchases program return will reach approximately 3% of its market cap.

On top of that, Accenture also has a dividend yield of just over 1%. This means that its total combined yield is just over 4%. This is irrespective of any growth in intrinsic value, which given its revenues are growing at about 4% CAGR, means that altogether, this business is delivering to shareholders about 8% to 9% return, which is a more than reasonable return.

Next, let’s discuss Accenture’s valuation.

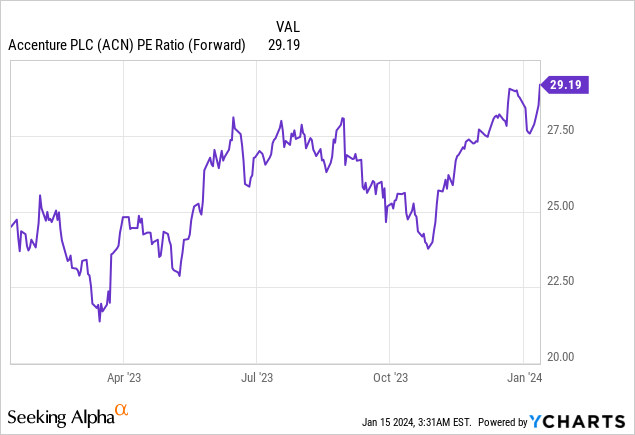

ACN Stock Valuation — 29x Forward EPS

As you can see above, the stock is priced at about 29x forward EPS. This is towards the high end of the range witnessed this year, but it’s not overly extended compared with the average for the past twelve months of about 27x forward EPS.

Furthermore, as already discussed, the fact that Accenture is not only carrying a rock-solid balance sheet with substantial cash, but is also eager to return capital to shareholders, makes Accenture a compelling investment that’s worthwhile considering.

The Bottom Line

Accenture stands as a stable and well-managed professional services firm, showcasing resilience in the face of macroeconomic challenges. While its growth rates appear modest, the company’s robust cash flows, strong balance sheet, and commitment to returning capital to shareholders contribute to its attractiveness.

Despite the near-term challenges posed by lower discretionary spending, especially in the UK, and the competitive landscape in cybersecurity, Accenture’s strategic investments in generative AI and global expansions position it for future success.

While revenue growth rates are in the low single digits, Accenture’s emphasis on capital returns, with an estimated total combined yield of over 8%, adds to its allure. The stock’s valuation, currently at 29x forward EPS, remains reasonable, making Accenture a compelling investment choice, given its financial strength and dedication to shareholder value.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.