Summary:

- Bank of America’s stock has seen a 20% increase since October 2023, but the latest earnings report suggests a less bullish short-term outlook.

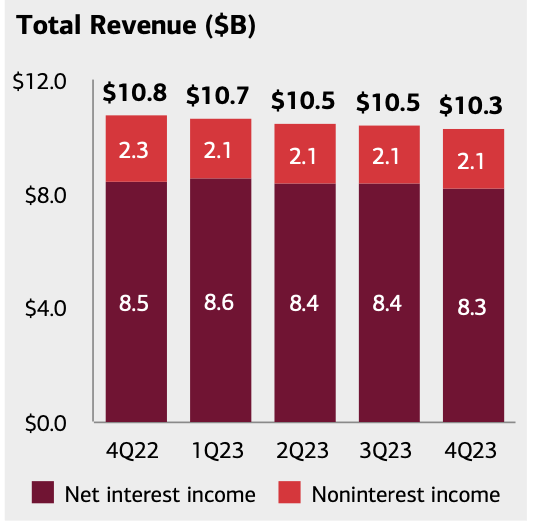

- The bank’s growth in deposits and loans is positive, but expenses have increased and the narrowing gap between loan earnings and deposit costs is impacting return on equity.

- Bank of America is focusing on private wealth management to generate fee income, but overall income is under pressure due to the tough economy and rate environment.

- Potential rate cuts in 2024 could alleviate pressure, but the timing and extent remain uncertain.

PeopleImages/iStock via Getty Images

Recap: Bank of America’s Performance and Rating Adjustment

The stock of Bank of America (NYSE:BAC) has been up 20% since we gave it a Strong Buy rating back in October 2023. That was an impressive return, especially for such a large company. We were excited to see the bank getting more deposits and assets again.

SA

After looking at their latest earnings report for Q4 though, we’re feeling a little less bullish on the short term, even though we still like their long-term potential. The tough economy and high-interest rates are putting pressure on the bank’s ability to grow earnings per share over the next few quarters.

If the Fed starts cutting rates in 2024 we expect, that would ease some of the pressure. But we just aren’t sure how quickly or how much rates will drop. So there’s still quite a bit of uncertainty ahead.

Given all that, we think the stock price right now is pretty fair based on the short-term outlook. So we are downgrading from Strong Buy to Buy for now. We still believe in the bank’s future, just not in outsized returns in the coming months.

Q4 Financial Highlights

Growth in Deposits and Loans

The bank’s average deposits grew by $29 billion to $1.91 trillion, up 2% from last quarter. Average loans also edged up a bit. And their core capital increased by $0.7 billion, putting them well above the minimum required level. So it seems like they have room to grow assets and support future business expansion.

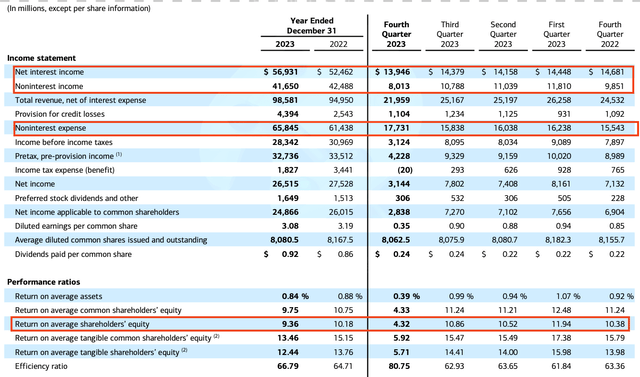

Expense Management and Return on Equity

Total expenses jumped 14% from a year ago, but that was mostly due to a one-time FDIC fee. If you exclude that, expenses were actually down 1% from last quarter. So they’re still keeping a tight lid on operating costs. The weak return on equity was mainly because of lower earnings, not out-of-control spending.

BAC

Narrowing Earnings Gap

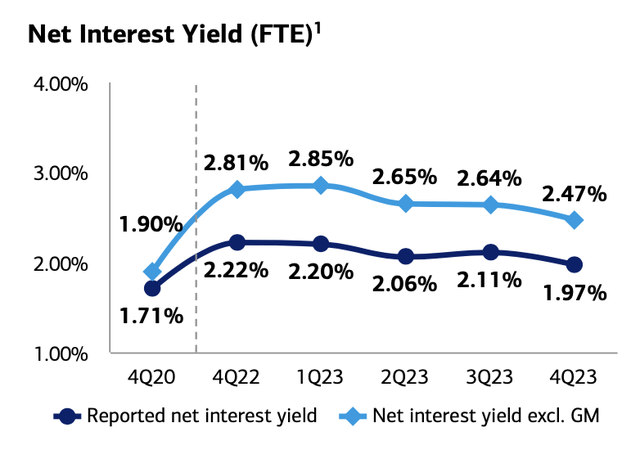

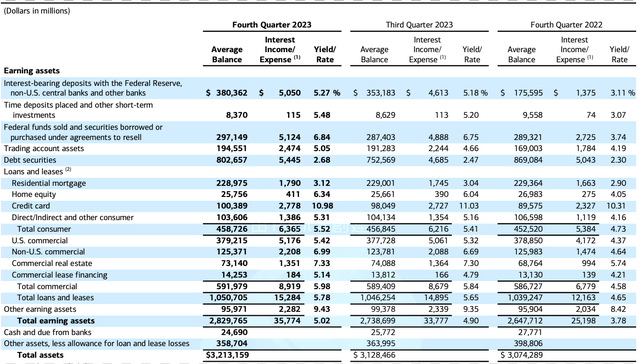

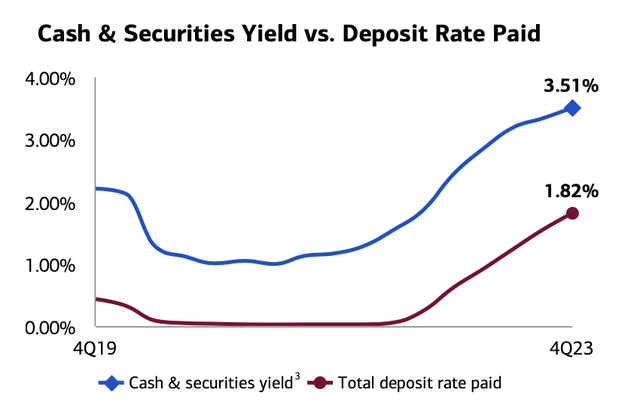

The main reason for the weak return on equity is the narrowing gap between what the bank earns on loans and what it pays for deposits. Looking at the chart, we see the overall net interest yield decline in the quarter, interest income only ticked up 12 basis points to 5.02%, while interest expense jumped 26 basis points.

BAC

BAC

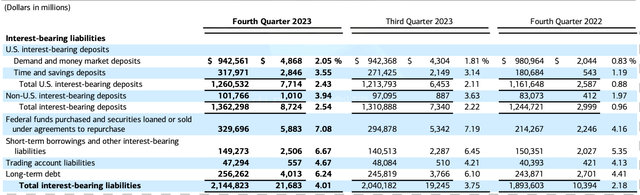

Funding Structure & Rising Borrowing Costs

The bank depends heavily on lower-cost deposits to fund lending – about 63% of their funding comes from deposits paying less than 4%. But the other 37% is from stuff like repos, debt, and other more expensive borrowing above 4%. As rates have risen, more and more customers are shifting their regular deposits into CDs or wealth management to get better yields.

BAC

BAC

The bank just couldn’t find enough high-return assets to offset the pressure on the deposit side. So in plain English, borrowing costs went up faster than lending income. And the bank relies a lot on low-cost deposits, which are getting more expensive. They need to either widen margins or find higher-yielding assets to turn this around.

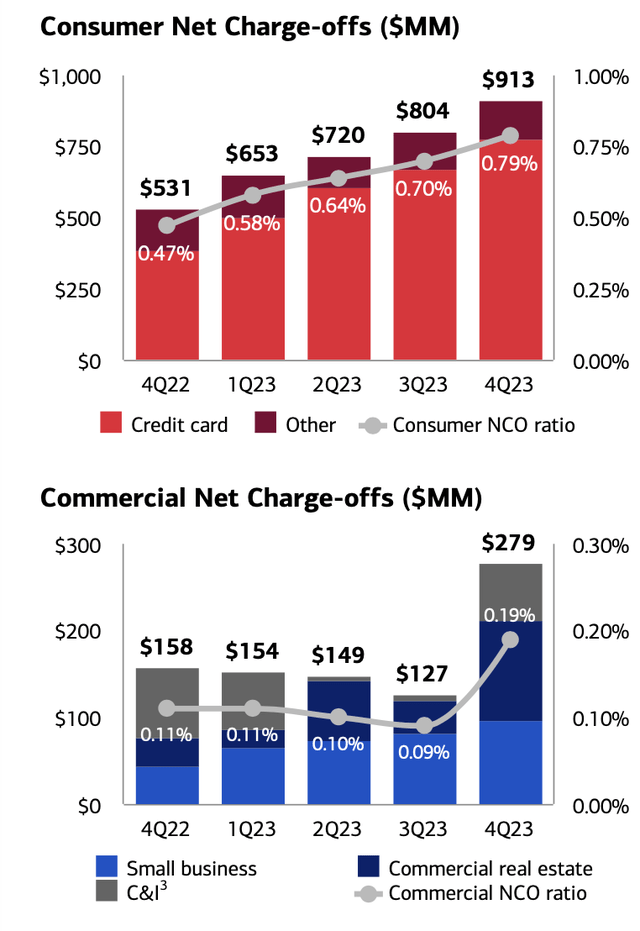

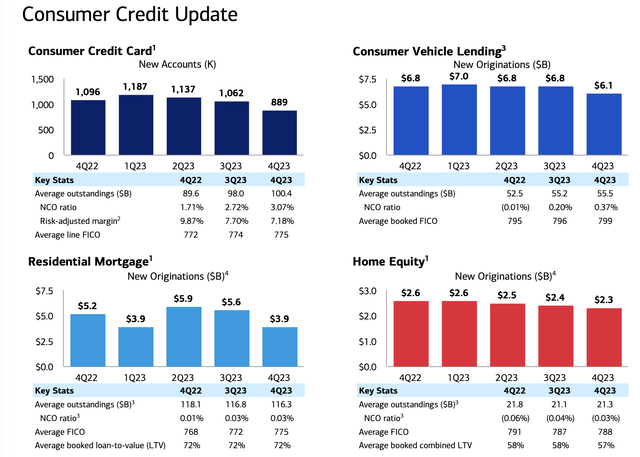

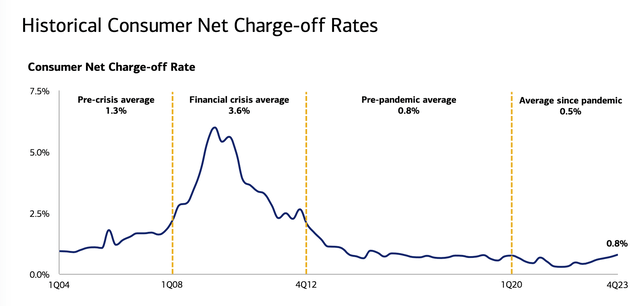

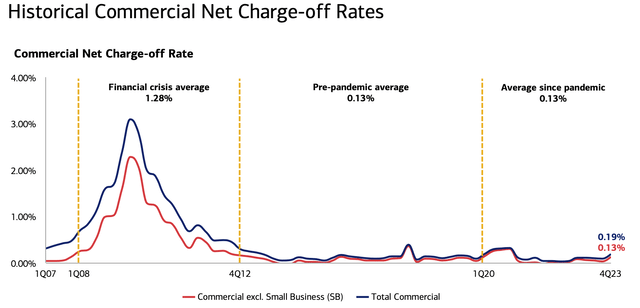

Both consumer and commercial charge-offs spiked in Q4, even as assets grew. This suggests it’s just not worth it right now for the bank to push more lending given the hit to profits and returns.

BAC

BAC

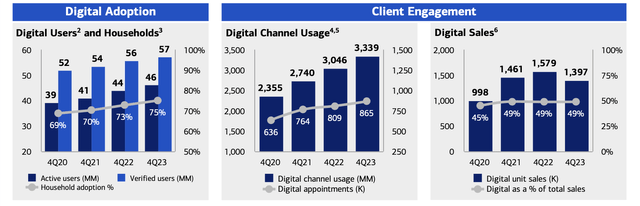

Private Wealth Management and Business Growth

Bank of America is focused on adding more private wealth management clients to generate fee income and cater to the demand for higher yields. They’ve had good success here – client balances are up to $5.4 trillion across deposits, loans, and investments. The bank mentioned the slowing economy and higher rates are impacting wealth clients. But so far, their high-net-worth customers seem to be holding up OK, and BofA has kept growing that part of the business. The problem is BofA relies more on interest income than fees. And with loan growth slowing, interest earnings could stall out. So even with the progress in wealth management, overall income is still under pressure from the tough rate environment. It looks like sluggish growth is likely in 2024 if the Fed maintains its hawkish stance. BofA just can’t offset the broader headwinds by pivoting to things like fee business.

BAC

BAC

Risk

The bank grew loans even as the economy slowed down. A lot is going on – geopolitics, bank failures, quick rate hikes. So it’s impressive their lending held up and kept expanding.

It sounds like clients are still in decent financial shape too. Charge-offs ticked up but remain way below historical averages. Plus, BofA added more consumer, wealth management, and commercial customers.

So the growth hurdles seem mostly tied to the tough economy and rates, rather than competitiveness. Their clients and market share appear healthy.

The main challenge is finding enough good lending opportunities when activity is slowing. But if rates ease and the economy stabilizes, BofA seems well-positioned to capture more business.

Their underlying franchise still looks strong even though growth is tougher for now. The client base and relationships seem resilient despite the headwinds.

BAC

BAC

BAC

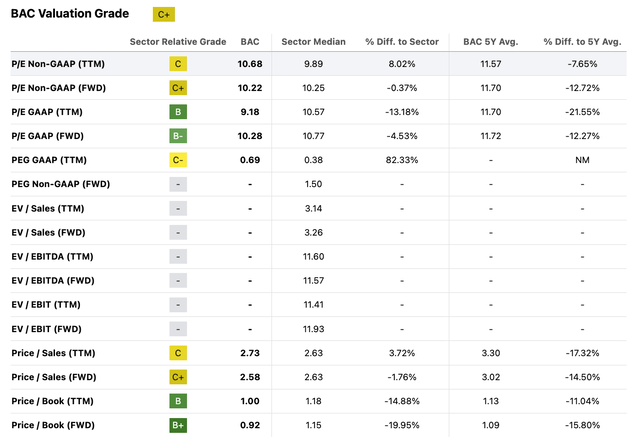

Valuation

BofA’s P/E and P/B ratios are below their 5-year averages, around 10x and 1x. Given the current slowdown in loan growth, we think the stock looks fairly valued for the near term.

If the Fed cuts rates in 2024 as expected, that would ease the pressure on BofA’s lending margins. But if not, earnings per share could face some downward pressure in the coming quarters.

However, BofA does keep adding customers across consumer banking, wealth management and commercial lending. That shows they remain competitive in building their brand and market share.

SA

So while growth is sluggish now, the metrics suggest BofA’s long-term prospects remain solid. They’re continuing to strengthen client relationships even in this tough environment.

We see the stock as reasonably priced based on the short-term challenges. But BofA’s underlying franchise and client base position it well for an earnings rebound once headwinds subside.

Conclusion

We’re downgrading the stock from Strong Buy to Buy due to near-term uncertainties. Interest rates and the slowing economy are squeezing profit growth. But long term, we still believe in this well-run bank. It has a loyal customer base, strong brand, and competitive position. Once economic visibility improves, earnings should rebound. But the timing is unclear right now. For investors seeking big upside soon, look elsewhere. But long-term investors can ride out volatility. When rates and growth stabilize, this quality bank should get back on track. For now, we’re waiting for more clarity on the turnaround before recommending outsized gains.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BAC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.