Summary:

- Waymo has the potential to be one of Alphabet’s most important businesses in the next decade, as the self-driving industry has the potential to be one of the largest in the world.

- Waymo is currently the clear front-runner in the self-driving race, with a fully operational robo-taxi business and exponential growth in rider-only miles.

- The cautious approach and utilization of proven technologies have allowed Waymo to pull far ahead of competitors, with massive financial implications in capturing a fraction of the self-driving market.

Justin Sullivan

Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG) has built an incredibly dominant business ecosystem over the past decade, with synergistic divisions that extend from search all the way to video hosting. The company has even started to gain steam in the highly profitable cloud segment, which has been traditionally dominated by the likes of Amazon (AMZN) and Microsoft (MSFT).

Given that the vast majority of Alphabet’s revenue currently comes from its Google Search, YouTube, and Google Cloud Platform businesses, many investors are overlooking the potential of the company’s autonomous vehicle subsidiary Waymo. In fact, Waymo has the potential to be one of Alphabet’s most important businesses over the course of the next decade.

Waymo

The Underappreciated Implications of Self-Driving

Self-driving has the potential to be one of the world’s largest industries from a revenue standpoint. The amount of money that humans spend on ride-hailing services is staggering, with ride-hailers spending $1-$2 per mile in large cities like NYC. What’s more, individuals who operate their own vehicles are also indirectly paying in the form of opportunity cost. The time spent driving a vehicle is time that cannot be used for work or leisure.

When accounting for the money directly paid for ride-hailing services and opportunity costs for those operating their own vehicles, trillions of dollars are currently being used on personal transport. If the self-driving industry can even capture a fraction of this value, the industry would be one of the largest in the world. As such, the first company to truly figure out self-driving could capture trillions of dollars in value even if competitors inevitably emerge to push down the cost of self-driving.

Well-Positioned in Game-Changing Industry

To say Waymo is well-positioned in the self-driving space is an understatement. Waymo is currently the only company making any real progress in the space, especially after the implosion of Waymo’s main competitor Cruise. While GM’s (GM) cruise has been ordered to halt operations in the most important self-driving market (California) Waymo has been expanding its operations in the area at an exponential rate.

Telsa (TSLA), Waymo’s other competitor of any note, is clearly failing to live up to its own self-driving promises. Tesla is utilizing a vastly different approach that relies more heavily on vision and neural nets, as opposed Waymo’s strategy of combining vision, lidar, neural nets, and pre-mapping. From Tesla’s FSD’s relative lack of progress over the past two years, at least in terms of real-world intervention data, it is clear that Tesla’s vision and neural-net approach is not ready for primetime.

Even after more than three years, Tesla’s FSD Beta is barely making any progress in terms of real-world interventions, at least according to intervention data collected from the community. This is far from the exponential growth and the “march to nines” that was predicted by Elon Musk.

teslafsdtracker

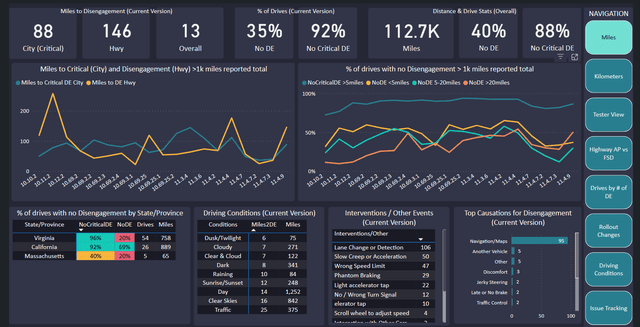

This currently leaves Waymo as the clear front-runner in the race to self-driving. In fact, Waymo already has a fully operation robo-taxi business, which is a dream that Tesla and its bulls have long dreamed of. While Waymo’s robo-taxi business, known as Waymo One, still has a very small impact on the overall ride-hailing market, it is making progress at a blistering rate. In fact, Waymo already has 7+ million miles of rider-only driving, which is a figure that is only growing exponentially and a figure that is far ahead of any competitors.

If Waymo’s progress continues on its current exponential path, the company should be able to record 100 million miles of rider-only miles by the end of the year. This puts Waymo way ahead of Cruise, which may not even have a long-term future in self-driving if current trends continue. In Tesla’s case, Tesla FSD is far from ready to even deploy a single robo-taxi given current Tesla FSD intervention data. Meanwhile, Waymo continues to ramp up its robo-taxi business in a growing number of cities.

Waymo’s steady approach of data collection, testing, and validation is proving to be the superior model. In an industry where tech’s traditional motto of moving fast and breaking things translates into fatalities, disproportionate news coverage, and increased regulatory scrutiny, Waymo’s cautious approach is clearly proving to be superior. This, combined with Waymo’s utilization of proven technologies, has allowed the company to pull far ahead of the competition.

Financial Implications

Cementing a dominant foothold in the largest self-driving markets will have massive financial implications. Just accounting for the US market, there are approximately three trillion miles driven annually. Even if Waymo can capture of small percentage of these miles at a fraction of today’s ride-hail costs, the company will be able to capture hundreds of billions of dollars in revenue per year. This is not even accounting for international markets.

In fact, the potential revenue that could come from an autonomous transportation economy become so astronomical that they are easy to dismiss as fanciful or unrealistic. However, the fact is that Waymo’s self-driving technology is already proving to be far safer than humans and will only continue to improve in safety as more data is collected. Moreover, the company’s Waymo One program is already proving that the robo-taxi business model is viable given the growing demand for Waymo’s self-driving ride-hailing service.

Over 100,000 people have already signed up for Waymo’s ride-hailing service, which is a figure that has likely grown exponentially since it was last reported. In fact, there is even a wait list to use the company’s self-driving ride-hailing service in certain areas of operation. Given Waymo’s current lead in the self-driving arena, it would not be surprising to see Waymo dominate the most important self-driving market in the coming years.

Biggest Risks

With the implosion of GM, Waymo is the clear leader in the geofenced autonomous riding space. In fact, GM has been Waymo’s only true competitor for the past few years. Although many will argue that Tesla’s FSD will eventually pose a significant threat to Waymo, there is little to no evidence that a pure neural net vision-only system is even capable of achieving anything resembling full self-driving in the near to mid-term.

Perhaps the biggest risk facing Waymo is the untested regulatory waters. Although Waymo has successfully navigated the regulatory landscape thus far as a result of its safety-first approach, the company has only done so in a relatively small market. There is no telling how regulators will respond to Waymo once the company starts to roll out its robo-taxis in far larger numbers. Moreover, there will almost certainly be major pushback from other groups that feel threatened by self-driving technology.

Conclusion

Alphabet is already relatively undervalued at a valuation of $1.79T and forward P/E ratio of 27 when compared to other tech giants in the Magnificent Seven like Microsoft or Apple (AAPL). Moreover, the company’s major businesses, including the likes of Google Search, Google Services, Google Cloud, and YouTube continue to grow at an impressive rate. Alphabet is also the only company that is even competitive on the generative AI front with Bard and Gemini.

As a result of Alphabet’s success in its other divisions, the company will be able to fund Waymo at a rate competitors simply will not be able to match. In a capital-intensive business like self-driving, this is a huge advantage. If Waymo continues to progress at its current rate, it could easily join Alphabet’s other divisions as one of the company’s major revenue generators. Investors are clearly overlooking the potential of Waymo, making Alphabet an even better bet at its current levels.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.