Summary:

- Our September 2023 Hold rating has proven to be overly prudent then, with us over-reacting to META’s intensified FY2024 generative AI/ server capex commentary.

- It is apparent that Mark Zuckerberg’s Year of Efficiency is still in place, with new hiring to slow down and existing headcounts diverted to work with AI.

- The returning global ad spend, growing Monthly Active Users, and expanding ARPU have directly contributed to META’s accelerating top-line as well.

- With its operating margins already nearing pre-pandemic levels, we believe that the social media giant remains well poised to grow sustainably over the next few years.

- We are rerating the META stock as a Buy at every dips, with a long-term price target of $572.

Cimmerian

We previously covered Meta Platforms, Inc. (NASDAQ:META) in September 2023, discussing its successful social media execution, with growing Monthly Active Users and Average Revenue Per Person.

Combined with the returning ad spend and sustained bullish stock support, its prospects had been excellent then. However, we had chosen to rerate the stock as a Hold then, since the management’s intensified FY2024 generative AI/ server capex might reverse its previously aggressive Year of Efficiency.

In this article, we shall discuss why our fears have been overblown then, with the META management offering a relatively prudent FY2024 expense guidance against its accelerating top-line growth thus far.

Combined with the optimistic market projections for ad spending in 2024, we believe that META’s top/ bottom line tailwinds remain robust, warranting the premium growth valuations and stock recovery since the October 2022 bottom.

META’s Year Of Efficiency Is Still Printing Profits

For now, META’s year of efficiency has produced impressive results after all, with the most telling number being its reduced headcount of 66.185K as of September 2023 (-7.3% QoQ/ -24.1% YoY).

This has resulted in its highly efficient operating expenses of $13.82B (-12.7% QoQ/ -15.3% YoY) and improved operating income margins of 41.4% (+9.3 points QoQ/ +21 YoY), further aided by the returning advertising dollars and its expanding top-line to $34.14B (+6.7% QoQ/ +23.2% YoY).

Much of META’s tailwinds are attributed to the growing Family Daily Active People to 3.14B (+2.2% QoQ/ +7.1% YoY), expanding ad impression by +31% YoY, and growing global ARPU to $11.23 (+5.6% QoQ/ +19.3% YoY) by the latest quarter, despite the lower average price per ad by -6% YoY.

This feat is impressive indeed, with Reels now already being net neutral to its overall ad revenue and profitability likely not far behind. Threads has also reported improved user retention, with “just under 100M monthly actives” as of October 2023 compared to X’s reported 550M monthly actives.

Readers must also note that META has been able to record the excellent operating income improvements, despite the inherently unprofitable Reality Lab segment at an annualized losses of -$14.96B by the latest quarter (inline QoQ/ -1.9% YoY).

The management has also warned that losses are likely to accelerate as the management pits the Quest 3 headset against Apple’s (AAPL) Vision Pro spatial computing platform in 2024.

For now, the Family Of Apps’ robust profitability has directly contributed to META’s Free Cash Flow generation of $13.63B (+24.4% QoQ/ +4271.9% YoY) and margins of 40.6% (+5.9 points QoQ/ +39.5 YoY) in FQ3’23, with a much healthier balance sheet at a net cash position of $42.74B (+21.9% QoQ/ +34.1% YoY).

Despite not paying out dividends, shareholder returns have been decent as well, with the management already retiring 230M shares, or the equivalent 8% of its float since FY2019. Most importantly, readers must note that there is still $37.22B available in its authorized share repurchase program, likely to trigger further tailwinds to its adj EPS performance.

While we have chosen to re-rated the META stock as a Hold in our previous article, attributed to the management’s commentary on increased AI-related capex and higher cost technical hiring in 2024, it appears that our fears have been overblown after all.

For example, the management has guided intensified FY2024 capex of $32.5B (+16% YoY), with the investments in servers being highly indicative of the growing user stickiness and improving generative AI capability across different platforms.

At the same time, its FY2024 projected operating expenses of $64B (+6.6% YoY) remains reasonable, especially when compared to the sustained growth in its top-line thus far and the management’s choice to “shift people towards working with AI,” instead of hiring new headcounts.

Magna already expects the global ad revenues to grow by +7.2% YoY to $914.4B in 2024, with the global pure-play ad categories, such as META, accelerating by +7.3% YoY to $622.40B at the same time.

With META still in the process of streamlining its headcounts in the Reality Labs and Instagram division, we believe that the company may be very well positioned for bottom line expansion after all.

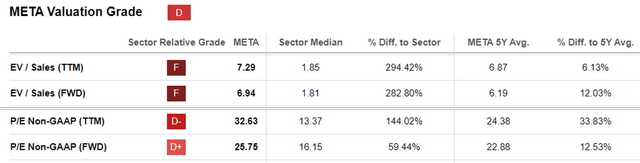

META Valuations

Perhaps this is why META’s FWD EV/ Sales valuation of 6.94x and FWD P/E valuation of 25.75x have been re-rated higher than the November 2022 bottom of 1.86x/ 12.33x and sector median of 1.81x/ 16.15x, closer to its 3Y pre-pandemic mean of 8.06x/ 24.68x, respectively.

The Consensus Forward Estimates

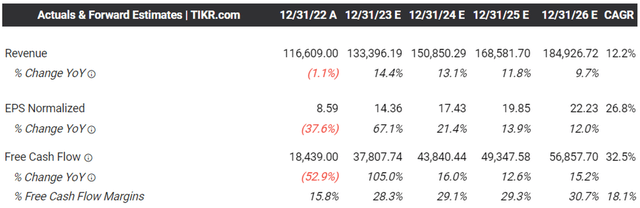

While its valuations have normalized, we believe that META is still a viable investment thesis, with the consensus estimating FQ4’23 revenues of $39.02B (+14.2% QoQ/ +21.3% YoY) and adj EPS of $4.93 (+12.3% QoQ/ +179.2% YoY), further demonstrating its profitable growth trend.

Its long-term top and bottom line growth has also been moderately upgraded to a CAGR of +12.2% and +26.8% through FY2025, compared to the previous estimates of +9.24%/ +11%, while building upon its historical growth at a CAGR of +33.7%/ +26.6% between FY2016 and FY2021, respectively.

Based on the META management’s FQ4’23 midpoint revenue guidance of $38.25B (+12% QoQ/ +18.9% YoY), operating expenses of $16.2B (+1.1% YoY), approximate 17% tax rate, and 2.64B in FQ3’23 share count, we are estimating FQ4’23 adj EPS of $4.75 (+8.2% QoQ/ +169.8% YoY). This number is notably conservative, compared to the consensus estimates above.

Despite so, when combined with its FWD P/E valuation of 25.75x, it appears that the stock is trading near its fair value of $368.70.

In addition, based on the consensus FY2026 adj EPS estimates of $22.23, there seems to be an impressive upside potential of +52.8% to our long-term price target of $572.40 as well.

So, Is META Stock A Buy, Sell, Or Hold?

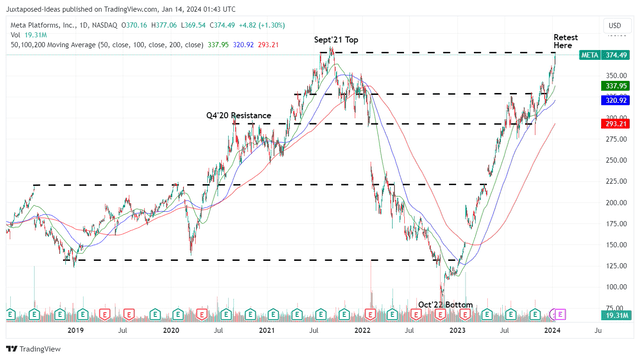

META 5Y Stock Price

As a result of the attractive long-term prospects, we continue to rate the META stock as a Buy, though with no specific entry point recommendation since it depends on individual investor’s dollar cost averages and risk appetite.

With the stock rapidly breaking out of its October 2022 bottom and 50/ 100/ 200 day moving averages while retesting its all-time September 2021 top, it appears that interested investors may want to wait for a moderate pullback before adding after all.

However, we maintain our conviction that META may be a long-term winner suitable for most growth oriented investors, especially given its profitable growth trend and the robust tailwinds from advertising/ social media/ generative AI capabilities.

Buy at any dips.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META, AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.