Summary:

- Disney reported lackluster FY23 and may face headwinds in FY24-25.

- The strength of the consumer as a result of a global economic slowdown may affect Disney’s growth projections.

- Sports content accounts for 40% of total content spend in 2024, but its declining revenue generation and increased viewership on social medial platforms pose challenges for Disney’s growth.

Wirestock

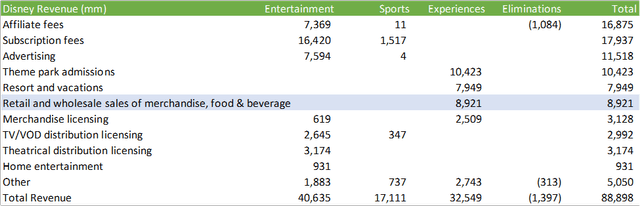

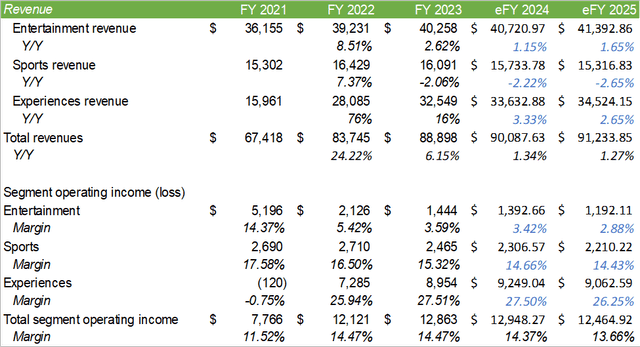

Disney (NYSE:DIS) reported a lackluster FY23 and forecasted significant growth for FY24 and beyond. Despite management’s optimism, I believe the strength of the consumer as a result of a global economic slowdown will affect Disney’s growth projections over the next two years. With sports content accounting for 40% of total content spend in 2024 and the segment’s declining revenue generation, I believe both the topline growth and margins face significant headwinds as the firm attempts to pull itself up by the bootstraps. I provide DIS shares a sell recommendation with a price target of $82.01/share.

Operations

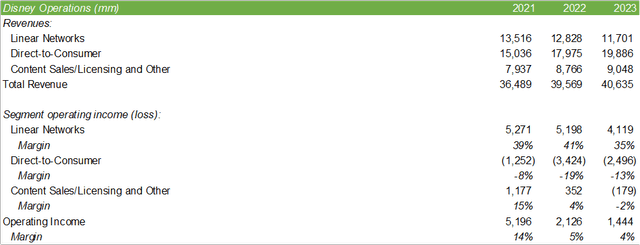

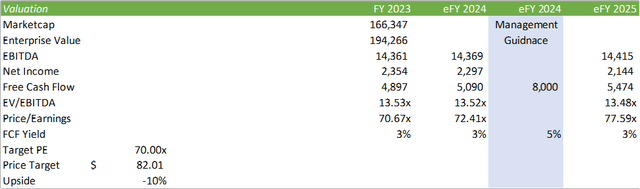

Bob Iger laid out a long-term roadmap in his FY23 earnings call, with plans to turn a profit in Disney+, growth in their cruise line, “turbocharged” experiences over the next decade, and generating $8b free cash flow in FY24, a 63% increase from FY23. The ultimate question is whether Disney can get back to their 2018 operational levels or will the firm continue to be burdened with lower profitability as a result of pivoting the business more heavily into streaming? I don’t believe the firm will achieve this level of free cash flow by 2024 nor do I expect DTC, or direct-to-consumer, to reach profitability in 2024.

One of the biggest challenges Disney faced next to park closure during the pandemic was enduring the transition from linear TV to streaming services. When first introduced, Disney+ was one of the most anticipated services by analysts that Disney brought to the table. It put the company in line with the hoard of content creators and what appears to be the never-ending challenge of becoming profitable. Disney+ launched in 2019, experienced one of the fastest growth rates, and has yet to turn a profit. Disney quickly found, similar to Discovery, now Warner Bros. Discovery (WBD), that offering ad-supported streaming services with a lower subscription fee is the most optimal combination of earning subscription premiums and advertisement dollars.

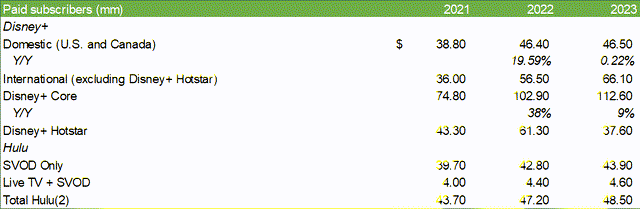

Disney’s streaming services covers multiple verticals, including Disney+, Hulu, ESPN+, and Star (India). Disney+ subscribers totaled 112.6mm at the end of 2023, a 9% increase from the previous year. Domestically, Disney+ only grew by 22bps to 46.5mm subscribers. Much of their growth is attributable to their international subscriber base.

Despite the revenue decline, linear networks continued to post strong margins. DTC remains in negative territory; however, Mr. Iger suggested that DTC will be profitable by the end of 2024. He discerned in the q4’23 earnings call that the firm plans to crack down on subscription sharing, similar to Netflix’s execution.

Though DTC has been improving and narrowing its loss, I don’t believe the firm will be successful in this trajectory as bundling the various services such as Hulu & Disney+ won’t appeal to as broad of a customer base as they expect. Though Hulu has experienced growth by its own respects, Disney+ commands nearly 3x the subscriber base. Given the small footprint of live TV on Hulu, I don’t expect either service to benefit Disney+ subscribers to the point that would make the combined product profitable.

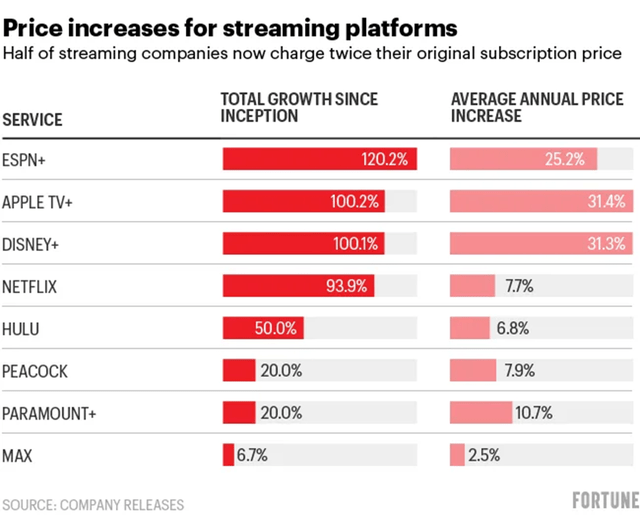

According to Cox Media, nearly all subscription platforms have substantially increased their prices since 2020, with Hulu with Live TV up nearly 40%, Netflix up nearly 20%, YouTube up 30%, and Disney+ up 27%, or 2x since launching at $6.99/month. According to Parks Associates, household spending on streaming subscriptions has declined by 25% from 2021 levels. Though Disney’s streaming services do not yet reflect this trend, I anticipate consumers to become more selective about which streaming services they maintain. Despite the rate of inflation declining to 3.10% in November, daily consumer costs remain at elevated levels and may lead to consumers on a tighter budget to be more selective with their discretionary spend.

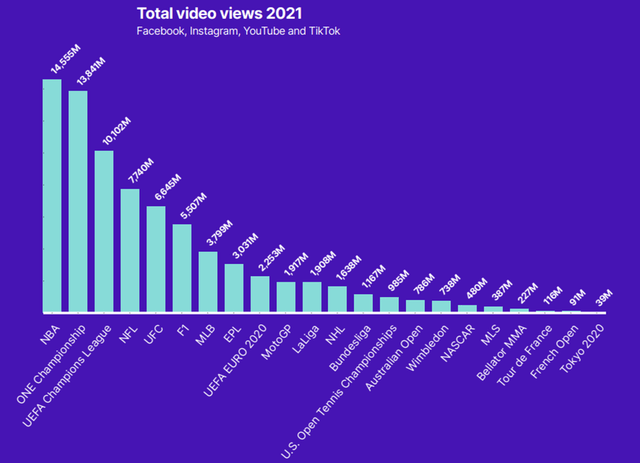

Management did discern on their q4’23 earnings call that ESPN is the top brand on TikTok. Despite this hype on social media, revenue for sports declined -92bps in FY23 with operating income margin shrinking to 14% on a -9% decline. I believe this trend may persist as more consumers cut the cord from linear TV. I believe this may be exacerbated as sports streaming continues to remain very fragmented, turning casual viewers away.

The fragmentation of sports rights is good for the leagues but confusing for consumers. The most passionate sports fans will subscribe to everything and find their sport wherever it is, but fragmentation creates a delicate tightrope for the leagues to walk in terms of maintaining mass appeal and engagement, which have driven a stellar sports advertising business.

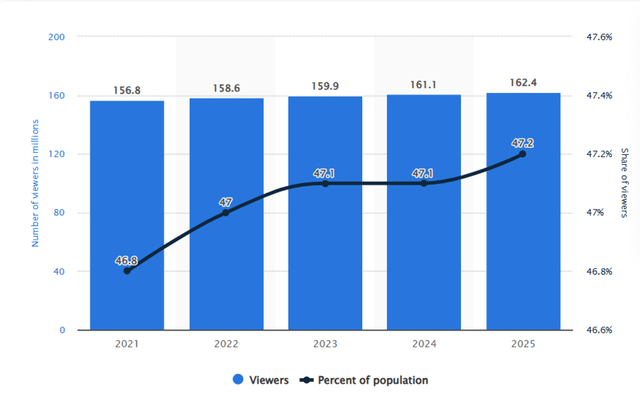

Despite my negative views, data provided by Statista suggests otherwise. Let’s just hope Taylor Swift continues dating Travis Kelce to keep viewership up. If not, that $10b spend on sports rights will all be worth it.

Overall advertising revenue was up 4% y/y for q4’23, partially offset by linear ad declines. Hulu experienced declines resulting from fewer political and technology advertising. According to Barron’s, consumer technology consumption declined by 3.1% and 2.7% in 2023 and 2022, respectively. Though the news outlet is optimistic about 2024 growth, I believe this optimism is misplaced and that consumers will remain cost conscious until the fog clears for the state of the US economy.

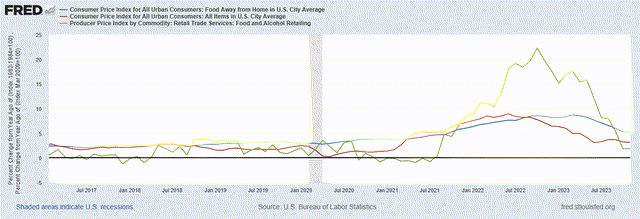

One of the data points I like to use is the CPI for eating away from home, which sat at 5.29% y/y in November 2023, well above the aggregate CPI rate of 3.1%.

Though this doesn’t affect all facets of Disney, merchandise and food & beverage accounts for 27% of revenue in their Experiences segment and 10% of total revenue. The food & beverage industry faced significant price increases and was only able to pass so much of the costs to consumers. Though revenue for this reporting segment increased 10% for FY23, COGS in this segment increased 11% due to inflationary pressures.

Looking ahead to 2024, I anticipate moderating growth across most segments as consumer demand slows down. Though I don’t believe an all-out global recession will hit, I do expect a significant slowdown in business activity and consumer spending. For the less budget-conscious consumers, I don’t expect demand for Disney’s product catalog to wane; however, I do expect those that have less flexibility on their discretionary spend to forego a trip to the parks this year as consumers continue to fight heightened prices resulting from inflation. Fitch forecasts global growth to fall sharply in 2024 as a result of tight monetary policy.

I do anticipate a continued decline in sports as more viewers turn to social media for sports content. According to research by MIT, more than 50% of viewers use social media platforms while watching live sports and that fans are opting for bite-sized clips over watching entire games. According to PR Newswire, more than 90% of Gen Z viewers use social media to consume sports content.

It won’t be effectively dead, but it will be significantly more expensive and have fewer subscribers. A lot of that has to do with the rising cost of sports rights. The new NFL rights extension deal will generate about twice as much cost per year starting in the 2023-24 season.

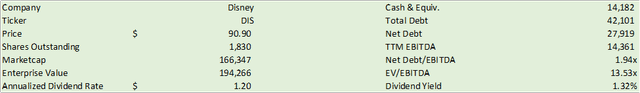

Valuation & Shareholder Value

Given my presumptions on the state of the economy and the consumer, I do anticipate Disney to experience some slowdown over the next two years. I do believe Disney is still in turnaround mode; however, I do not expect the turnaround to be as strong as management projects. Despite the lackluster year, management reinstated its dividend at $0.30/share. I don’t believe this is a signal for future growth; but rather, I believe this is management’s attempt to entice the broader shareholder base. The downside risk to my recommendation if this were the case is the risk of inclusion at the institutional level.

Given the business risk factors laid out above, I provide DIS shares a SELL recommendation with a price target of $82.01/share based on 70x eFY25 earnings.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.