Summary:

- PayPal’s less discussed growth drivers for 2024 include its buy-now-pay-later service, stable coin PYUSD, presence in China eCommerce sites, and potential benefits from a rate cut.

- The hidden potential is PYPL presence in Chinese eCommerce sites and its ability to enable cross-border trade.

- The Company’s business model relies on transaction fees and benefits from network effects and brand recognition.

- While facing competition and potential margin erosion, PayPal’s global network and strategic direction position it for long-term success.

Erikona

Investment Thesis

There have been numerous articles published on Seeking Alpha analyzing PayPal (NASDAQ:PYPL). Most discussions appropriately touched on PYPL’s share buyback program, their collaboration with KKR to sell buy-now-pay-later (BNPL) debt, the sale of Happy Returns, the new management team, opportunities with Braintree’s unbranded checkout solutions, and PYPL’s leadership position globally. While these represent PYPL’s strengths and several tailwinds, there are four additional areas of expansion that have received less attention but which I believe will be instrumental to PYPL’s success in 2024 and beyond.

Moving forward, I will explore these less-discussed yet highly consequential growth drivers that suggest PYPL remains well-positioned for the coming years despite recent market volatility.

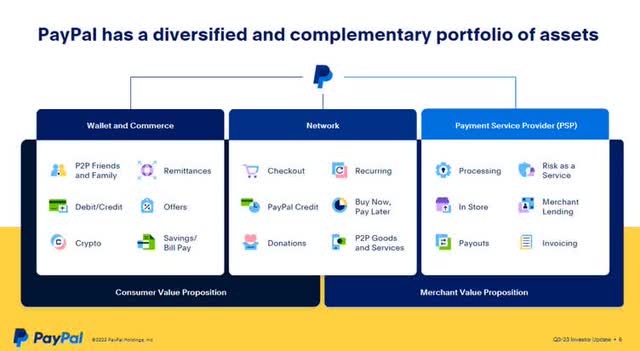

Business Model

Prior to delving into the subject, it is imperative to grasp the nuances of PYPL’s business model. PYPL generates revenue by charging a percentage fee on every transaction completed through its platform or subsidiaries. It operates a large, two-sided digital network that connects merchants and consumers. As of 30 Sep 2023, according to the latest 10-Q, PYPL boasts impressive active accounts of over 428 million active accounts spread across more than 200 global markets.

In light of the projected exponential growth of the digital payment realm, which is anticipated to skyrocket from 9.03 trillion in 2023 to a staggering 24.31 trillion by 2030, businesses are strongly motivated to continue capitalizing on PYPL’s services.

After understanding PYPL’s revenue drivers, one must recognize it benefits from two of Morningstar’s five enduring competitive moats – network effects and intangible assets.

Network Effects

The network effect occurs when the value of a product or service increases for both new and existing users as the user base expands. For PYPL, each additional merchant or consumer that joins its ecosystem enhances the value proposition for all participants.

However, in Q3 FY23, it was noted that the number of active accounts had actually reduced from 435 million accounts in FY22 to 428 million accounts in Q3 FY23. This decrease was insightfully explained by Emir Mulahalilovic in his Seeking Alpha article, where he mentions the attrition of lower-quality active accounts in Latin America and Southeast Asia did not affect the transaction volume. His analysis provided meaningful context around the user metrics.

Intangible Assets – Brand Recognition

Having been established since 1998, consumers exhibit a propensity to utilize PYPL rather than newer competitors due to its well-known brand. This strong brand equity also helps explicate PYPL position of leadership in digital transaction processing.

An esteemed and well-established name cultivates customer trust and confidence, further strengthening financial performance. PYPL renown has been constructed over decades of reliable service, cementing loyal customers and expanding the installed user base. The familiar brand provides both an advantage against upstarts and a prudent foundation for ongoing growth initiatives.

The 4 Less Discussed Yet Highly Consequential Growth Drivers In 2024

Now that we have analyzed PYPL business model and its relative moats, let us return our discussion to evaluating four key but less heralded growth drivers for the company in 2024.

BNPL

To be fair, some prior Seeking Alpha articles have discussed BNPL. Nevertheless, I aim to clarify the distinctive features that set PYPL apart from its competitors and emphasize the immense significance of this product line.

Unlike many rivals, PYPL does not charge interest on installment plans or late fees. It mainly generates revenue by collecting a larger cut from merchants on transactions through its Pay Later service as compared to its standard credit and debit card take rate.

Reader’s Digest Article (rd.com)

This consumer-friendly model renders PYPL more appealing to consumers compared to alternatives, as evidenced in a Nov 2023 Statista survey. Such popularity will ultimately encourage merchants to choose PYPL as their preferred BNPL service on websites.

As outlined in this article, BNPL represents the credit instrument of the future. With credit card debt reaching historic highs and interest rates remaining elevated, interest-free instalment-based purchases offer an attractive value proposition for budget-conscious shoppers.

Rather than accumulating expensive credit card balances, PYPL’s BNPL enables financial flexibility through scheduled payments devoid of costly interest accumulation. This proves a particularly prudent strategy amid inflationary headwinds. PYPL dominant market position and streamlined BNPL platform well-positioned the company to capitalize on the worldwide transition away from traditional credit as digital payment preferences continue advancing rapidly.

PYUSD

While my experience with cryptocurrencies is limited, stable coins present an ongoing challenge regarding reserve requirements and maintaining a 1:1 peg to fiat currency. PYPL entrance into this arena is notable, as the company offers financial transparency as a public company absent from many other such efforts.

The swift adoption of PYUSD since its 7 Aug 2023 launch date demonstrates meaningful underlying demand. In a short time, its market capitalization has reached over US$298 million, ranking it 158th in the cryptocurrency world.

Beyond external popularity, PYUSD could yield efficiencies for PYPL’s core operations by reducing transfer costs within its extensive payment network. After all, when PYPL began exploring buying and selling cryptocurrencies within its ecosystem, it also started exploring and investing in next-generation financial services infrastructure.

Offering an internal stable coin also allows PYPL, its customers, merchants and consumers to effortlessly transmit funds around its vast digital ecosystem. This presents the potential for meaningful cost savings through streamlined currency movements without third-party intermediation or fees.

While nascent in the space, PYPL’s transparent financial backing and aligned business motives afford PYUSD more credibility than alternatives – a factor that may further innovation and adoption across the burgeoning cryptocurrency sector overall.

Hidden Gem – Presence In Chinese eCommerce Sites

One extremely overlooked area primed for growth is PYPL’s presence in China. As the new CEO Alex highlighted in the Q3 FY23 earnings call:

As with TPV, we saw strengthening performance across Europe, which was most pronounced in the early to mid-summer, and in China, our seller business improved as well.

While concise, the quote conveyed robust insights. For those unfamiliar, PYPL maintains a presence in China, particularly serving Chinese merchants seeking to facilitate cross-border payments, especially when international consumers lack alternatives like Alipay or WeChat.

PYPL’s strategy in China has been to focus on powering cross-border trades rather than competing directly with Alipay and WeChat Pay domestically. Significantly, it became the first foreign operator granted full control of a Chinese digital payment platform, along with milestones such as collaborations with Baidu and UnionPay enabling Chinese consumers to pay abroad using domestic accounts.

Simultaneously, the international expansion of major Chinese e-commerce platforms like AliExpress (BABA), Vipshop (VIPS), Shein, Temu (PDD), and TikTok Shop presents new prospects for PYPL. As these players in Chinese e-commerce penetrate overseas, their global proliferation will augment PYPL revenue since they accept payments via PYPL. This relationship is evidenced explicitly in revenue figures outside of United States.

An example is the expansion of Temu. As per Wikipedia:

The Temu platform first went live in the United States in September 2022, becoming the most frequently downloaded app in the United States. In February 2023, Temu launched in Canada. That same month, the company aired a Super Bowl ad. In March 2023, Temu launched in Australia and New Zealand. In the following month, Temu was launched in France, Germany, Italy, the Netherlands, Spain and the UK. Temu eventually expanded into the Latin American market.

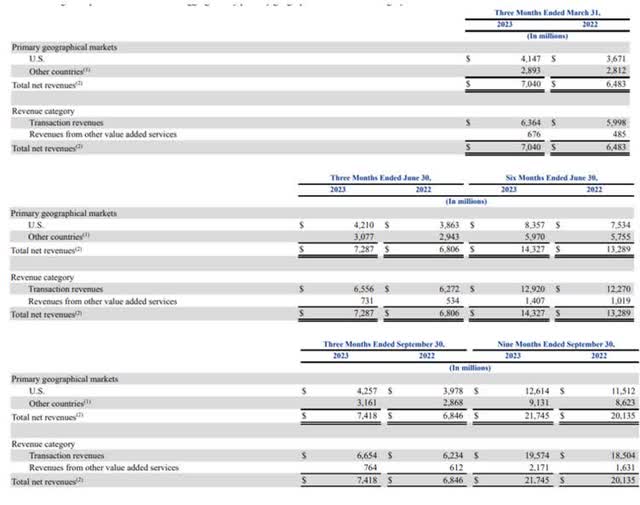

Notably, revenues from “Other Countries” in the past three 10Q reports have risen from US$2.893 billion in Q1 FY23 to US$3.161 billion in Q3 FY23.

PYPL Q1 FY23 10Q to Q3 FY23 10Q

Worth acknowledging, Shein is now expanding into Latin America as Temu is establishing itself in the US, Vipshop is growing in Southeast Asia, and TikTok Shop also pushing into the US. As these platforms broaden into new territories, PYPL is well-positioned to facilitate cross-border payments at scale.

Regulatory favor has further materialized – PYPL’s Chinese subsidiary recently doubled its registered capital, surpassing totals at Alipay and Tenpay. PYPL appears poised to meaningfully participate in China’s evolving digital payment revolution. As per another Statista survey, its market share in China is estimated to be 11% – leaving white space to potentially capture business migrating from entrenched competitors.

Gain From Expected Rate Cut

PYPL is well positioned to benefit should the Federal Reserve follow through with lowering interest rates in 2024. Like other financial and lending companies, lower rates tend to provide a boost to PYPL’s business in several key ways.

First, rate cuts make borrowing cheaper and encourage more consumer spending. As one of the largest online payment platforms, PYPL should see an uptick in transaction volumes as consumers have more flexibility in their budgets to make purchases.

Additionally, lower rates make PYPL’s own debt financing less expensive, especially on their revolving credit facilities. The company carries debt related to acquisitions and operations. Being able to refinance at lower rates, specifically for the 2022 issued notes, would gradually reduce PYPL interest expenses over time.

With the consumer economy continuing to drive PYPL growth, any macroeconomic boost from Fed easing could give revenues and profits an added lift heading into 2024. Investors hoping for a rate cut will be watching to see if PYPL can benefit on multiple fronts.

Risk

While PYPL has various risks associated with its business model, particularly regarding the successful realization of the growth drivers outlined previously, there exist two primary threats in my view that are most likely to impact PYPL’s operations in 2024.

Competition in Digital Payments

The digital payments industry faces extensive competition from numerous established and emerging platforms. In addition to longstanding leaders like Visa (V) and Mastercard (MA), PYPL must contend with technological heavyweights such as Apple Pay (AAPL), Google Pay (GOOG), and Amazon Pay (AMZN) that have penetrated multiple sectors.

Mitigation

However, PYPL’s multi-vertical presence, leadership position and global network provide meaningful advantages versus singular competitors concentrated in selective geographies or verticals. No individual payments processor currently matches PYPL’s expansive scale and omni-channel reach serving both merchants and consumers worldwide.

Potential Gross Margin Erosion

Another concern is PYPL historical declining gross profit margins, as the take rate on total payment volume has gradually decreased. Even as gross dollar amounts rise with increased transaction activity, compressing margins pose risks to earnings growth.

Mitigation

However, investors would be wise to acknowledge PYPL’s renewed strategic emphasis on sustainable, profitable expansion under new leadership. In fact, during the Q3 FY23 earnings call, CEO Alex repeatedly underscored the priority of “profitable growth”, using the phrase six times. This explicit focus signals a commitment to driving stronger financial performance through disciplined growth initiatives rather than unchecked expansion. By prioritizing margin preservation alongside growth, the new management aims to reassure investors that profitability will not be sacrificed at the altar of escalating total payment volume.

Valuation

Before commencing, I deem it essential to elucidate my valuation rationale. Over the course of time, I have encountered various approaches to valuing a company. However, of late, I have found myself inclined towards simply utilizing the method of assessing a company’s price-to-sales (PS) and price-to-earnings (PE) ratios over time, employing data sourced from the Macrotrends website, in order to ascertain a company’s fair value.

Admittedly, this method may not resonate with present-day investors; nonetheless, PS and PE ratios have been employed for several decades prior and offer the most accurate means by which investors have historically evaluated these companies over an extended timeframe.

Should the PS and PE ratios fall below the long-term median PS and PE ratios, it would indicate that the company may be undervalued vis-à-vis the market. Unprofitable companies tend to prioritize PS ratios, whereas profitable ones tend to focus more on PE ratios. Furthermore, these ratios will be multiplied by the projected revenue and earnings per share (EPS) by the analysts in order to ascertain a fair valuation for the company.

Regarding PYPL, my primary focus will lie on the PE ratio.

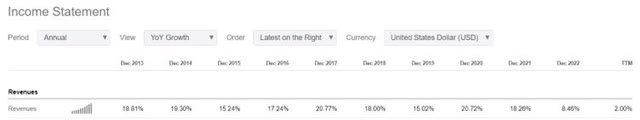

According to data from Macrotrends, the median PE ratio for PYPL across 31 quarters, from Jun 2016 to Sep 2023, stands at 49.18x. By applying this ratio to the Seeking Alpha consensus estimate of $5.55 for PYPL’s EPS in 2024, we arrive at an implied share price of $272.95 which implies an upside of over 350%!

Nevertheless, it is crucial to acknowledge that the aforementioned share price assumes that PYPL will have to maintain the robust growth rates observed prior to 2021, ranging from 15% to 20%. Thus, my implied share price of $272.95 is contingent upon PYPL re-accelerating its revenue growth to such levels over a span of at least the next three years.

PYPL Y-O-Y Revenue Growth Rate (Seeking Alpha )

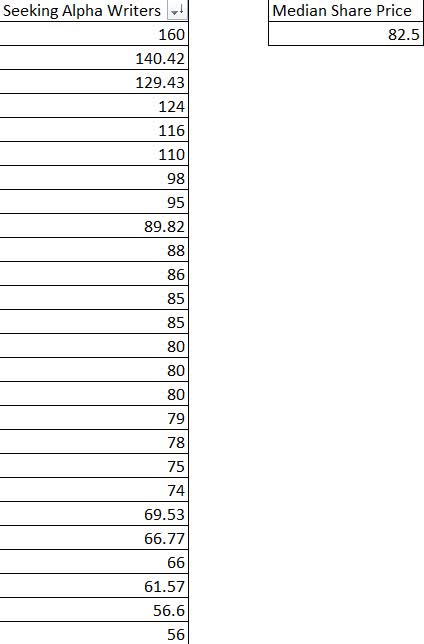

However, I sought to examine the shorter term horizon of 1 year (till end of 2024) by conducting a brief experiment analyzing Seeking Alpha articles from early Nov 2023 through the present, as well as using the analysts’ projected price targets within the next twelve months to truly comprehend the current market view of PYPL fair valuation.

Please note I only included pieces explicitly outlining a valuation estimate. Where multiple bullish and bearish cases existed, I selected the neutral valuation.

PYPL Fair Value Per SA articles (Seeking Alpha Article)

From the 26 articles reviewed, the fair value range deduced extended from $56 to $160 per share, yielding a median of $82.50 – still implying a modest 41% upside potential. Additionally, articles omitting a targeted price instead mentioned evaluating PYPL based on a forward PE ratio ranging from 15x to 20x, rather than the current 10.99x multiple against the FY2024 EPS estimate of $5.55.

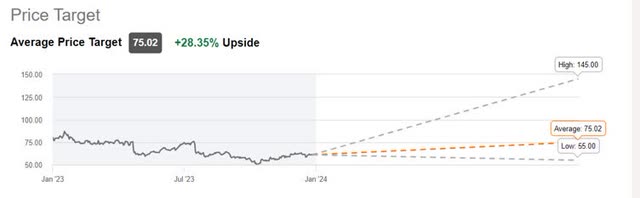

Wall Street Analyst Price Target Estimates (Seeking Alpha)

Meanwhile, averaged Wall Street analyst projections peg the target price at $75.02, representing a 28.35% premium.

Taken together, the overwhelming industry consensus deems PYPL undervalued, with an intrinsic fair value between $75 and $82 per share at minimum, and potential to reach $111 per share should the FY2024 EPS of $5.55 warrant a 20x forward multiple. Overall, the market predominantly feels PYPL deserves a higher valuation than currently reflected in its share price.

Conclusion

In summary, there are many positive catalysts boding well for PYPL trajectory moving into 2024 and likely 2025. As demonstrated through the analysis of numerous Seeking Alpha articles, the company appears poised to benefit from more tailwinds than headwinds.

Perhaps the greatest growth driver not yet fully appreciated or reflected in valuations involves the immense potential for cross-border transactions through increasingly popular Chinese e-commerce sites penetrating overseas markets, especially platforms like TikTok Shop and Temu now gaining widespread global usage.

Additionally, positive sentiment prevails around PYPL upcoming Q4 FY23 earnings call with CEO Alex slated for early Feb 24. Given how Alex successfully shifted narratives during the prior quarterly update, investors anticipate continuous bullish guidance that could further elevate share price momentum. However, a minor pullback in the next 3 months cannot be fully discounted if investors are disappointed with the earnings call.

In conclusion, I stand with prevailing market sentiment that PYPL remains substantially undervalued with an intrinsic fair value of $75-82 per share at minimum (by the end of 2024/next 12 months) based on compelling fundamentals and opportunities ahead. Should strong execution persist alongside realization of opportunities outlined, stretching toward $111 price target appears eminently achievable. Overall, the potential for PYPL appears unlimited as digital payments continue to ascend over the long term.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.