Summary:

- PepsiCo has top-tier brands with pricing power, a fortress balance sheet, and a consistent dividend growth history.

- Despite negative headlines, PepsiCo’s recent earnings show sustained high-single-digit organic revenue growth and double-digit EPS growth.

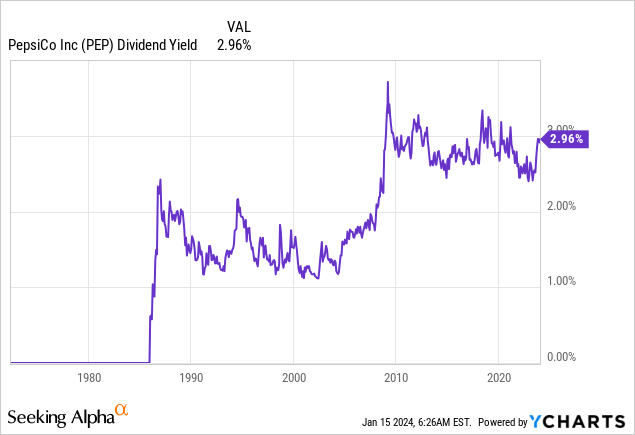

- The stock’s yield crossing 3% again makes it an appealing investment opportunity.

Justin Sullivan/Getty Images News

Introduction

It’s time to talk about my only investment in the consumer staples sector.

PepsiCo (NASDAQ:PEP) was one of the first five stocks I bought for my dividend growth portfolio when I decided to go “all in” on dividend stocks in 2020.

To me, buying PepsiCo was a no-brainer, as it had, and still has, all the qualities I’m looking for in a defensive investment.

- It has top-tier brands that come with pricing power. Especially in this market of sticky inflation, that’s key.

- It has a fortress balance sheet with an A- rating.

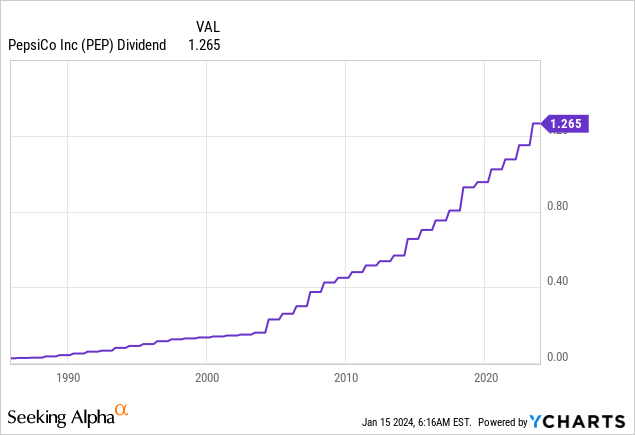

- Buying the stock comes with dividend consistency, as the company has hiked its dividend for more than 50 consecutive years, making it one of the few dividend kings on the market.

- After hiking its dividend by 10% in 2023 and recent stock price weakness, it now yields 3.0% again, protected by a 62% 2024E payout ratio.

- The five-year dividend CAGR is 6.6%, which is a great number for a stock yielding 3%.

- Unlike some slow-growing dividend-king peers, PepsiCo has shown to be capable of reporting consistently elevated EPS growth, which supports the dividend and capital gains.

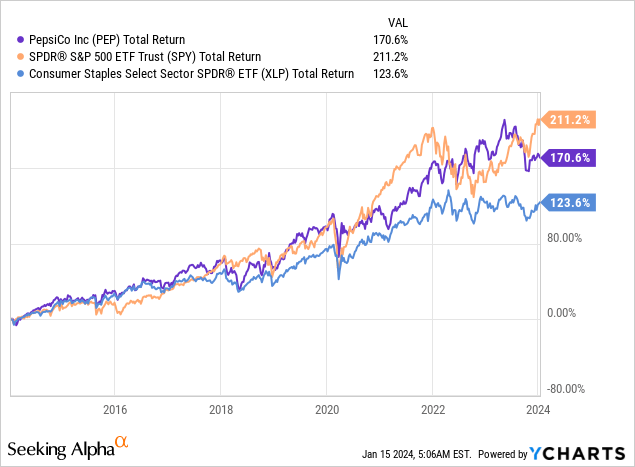

- Over the past ten years, PEP has returned 170%, beating its consumer staple peers (XLP) by a considerable margin.

PEP would have beaten the S&P 500 as well if it weren’t for the recent divergence.

That’s why I’m writing this article.

My most recent article on the stock was written on May 28, when I focused on its pricing power and ability to grow in a challenging market.

As an investor, I am cautious about consumer stocks due to unpredictable trends and intense competition. However, PepsiCo’s dominant position in the snack market, along with its well-known and high-quality brands, provides it with a significant advantage.

The company’s straightforward strategy of appealing to all consumers and expanding into new markets has proven successful.

Since then, a lot has happened, including the release of its 3Q23 earnings and negative headlines that have caused some investors to fear that PepsiCo’s pricing power is dwindling.

The good news is that these fears seem to be overblown, as I cannot make the case that the stock has lost its appeal.

Hence, I’m buying more PEP, as its yield just crossed 3% again.

So, without further ado, let’s dive into the details!

Negative Headlines

As I briefly mentioned in the intro, one of the reasons why I like PepsiCo is its ability to defend itself against generic brands and competition.

As almost everyone knows, the company, which owns the famous Pepsi brand, also owns brands like Doritos and Lay’s, which dominate the segments they target.

In many countries, its products dominate the snack aisle. That’s also one of the reasons why I bought PEP instead of Coca-Cola (KO), which is beverage-focused – although I am bullish on KO as well.

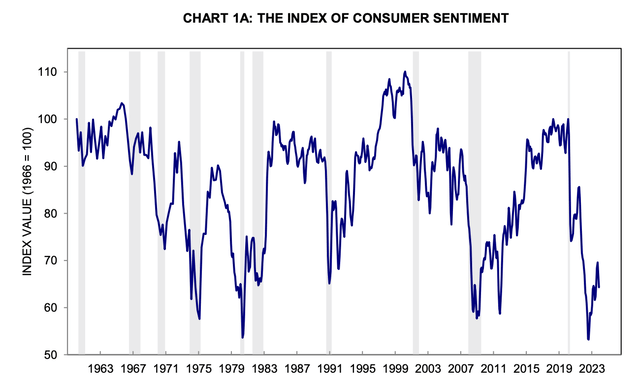

The most recent quarter (3Q23) is a testament to the company’s ability to grow, as it achieved 8.8% organic revenue growth.

This marked the tenth consecutive quarter of sustained high-single-digit organic revenue expansion, which emphasizes the company’s resilience in a market of sticky inflation and poor consumer health.

University of Michigan

Even better, core constant currency earnings per share witnessed a substantial increase, reaching a 16% growth rate.

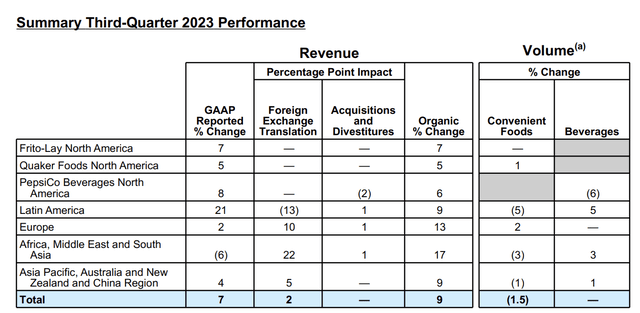

As we can see below, the company achieved this with flat volumes in its beverages segments and 1.5% lower volumes in its food segments.

Pricing benefits turned contracting volumes into elevated revenue growth.

PepsiCo

So far, so good.

The question is if its pricing power is lasting.

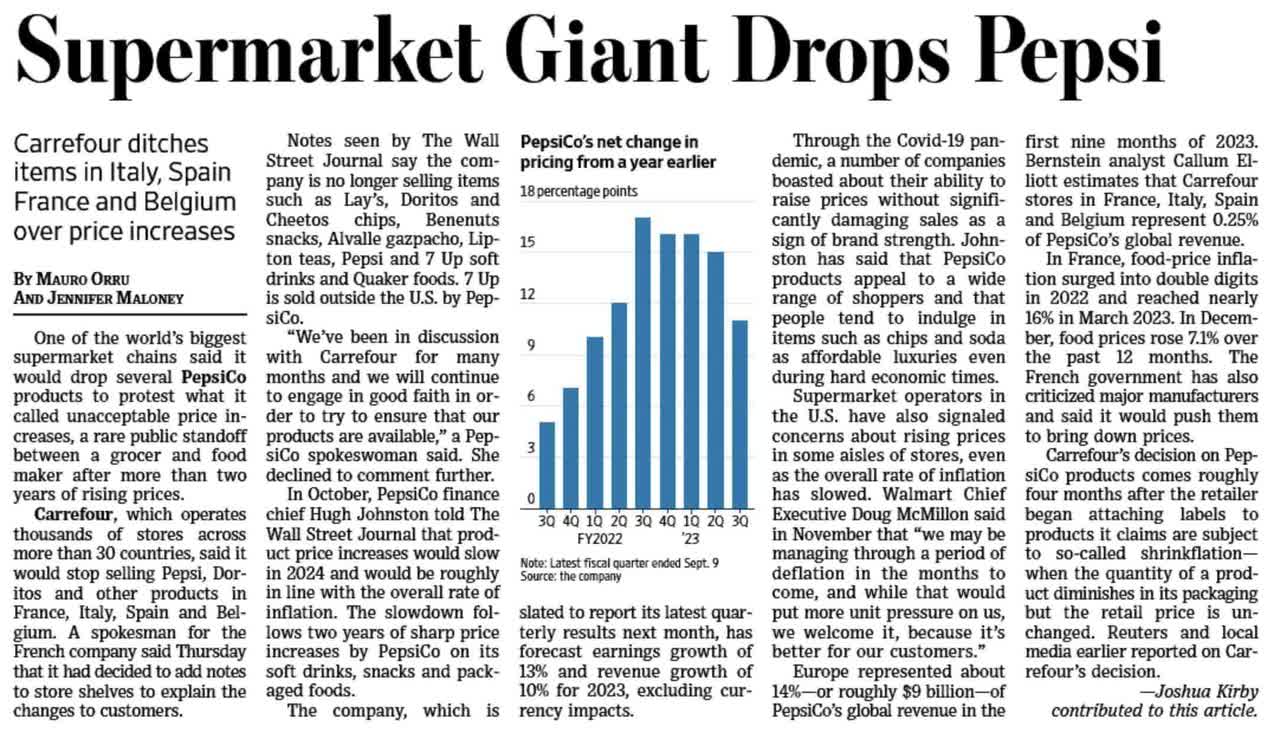

Earlier this month, the Wall Street Journal published a headline that caused some investors to doubt if they are still betting on the right horse.

Wall Street Journal

According to the article, Carrefour, one of the world’s major supermarket chains, has announced its decision to discontinue several PepsiCo products in France, Italy, Spain, and Belgium.

This move is in protest of what the supermarket considers unacceptable price increases by PepsiCo.

Carrefour will no longer sell items such as Lay’s, Doritos, Cheetos chips, Benenuts snacks, Alvalle gazpacho, Lipton teas, Pepsi, 7 Up soft drinks, and Quaker foods in the specified regions.

Carrefour’s decision impacts approximately 0.25% of PepsiCo’s global revenue, according to Bernstein analyst Callum Elliott.

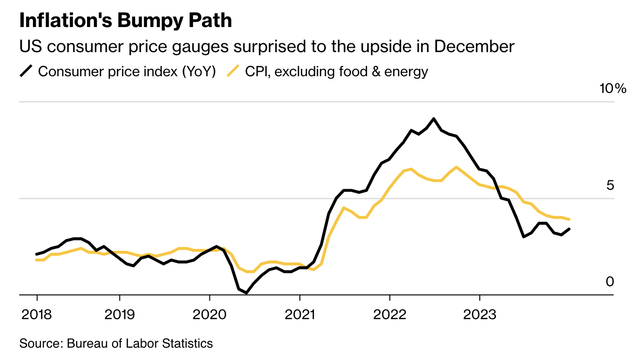

Even worse, according to the Journal, supermarkets in the U.S. have also expressed concerns about rising prices despite a general slowdown in the overall rate of inflation, although the latest numbers suggest that the fight against inflation is far from over.

Bloomberg

So far, the bad news.

The good news is that developments may not be as straightforward.

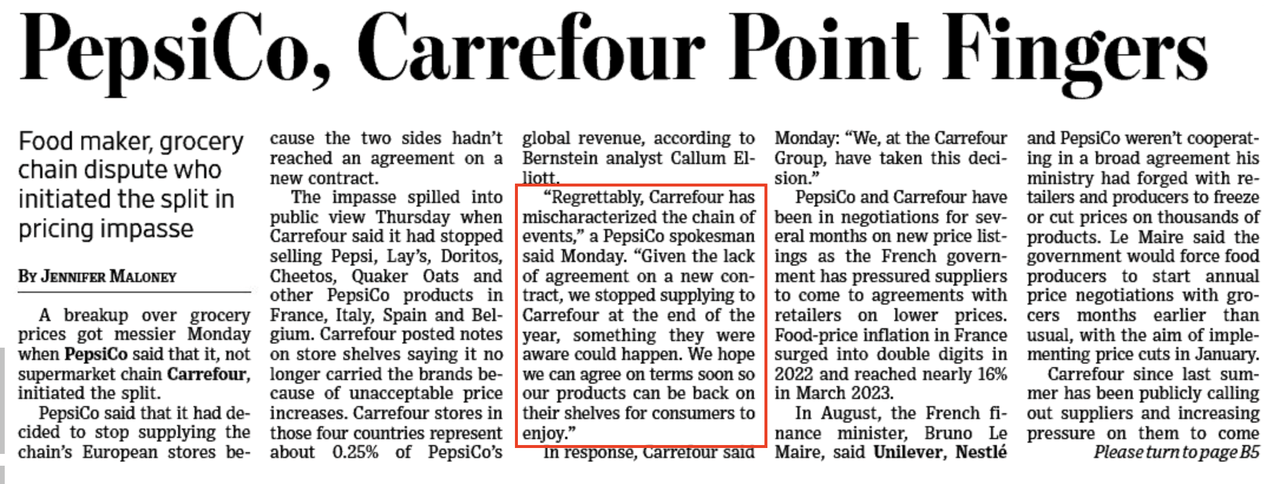

A few days later, the Wall Street Journal released a follow-up article.

Wall Street Journal

Apparently, things weren’t as straightforward as one might have thought, as PepsiCo has confirmed that it initiated the split with supermarket chain Carrefour over a disagreement on a new contract – not the other way around.

PepsiCo said that due to the lack of a new contract agreement, they stopped supplying Carrefour at the end of last year.

Essentially, the disagreement started amid negotiations on new price listings and increased pressure from the French government on suppliers to lower prices.

Both parties expect to reach an agreement soon.

In 2022, PepsiCo had similar issues with Loblaw (L:CA) in Canada.

Back then, the situation was almost the same. During the dispute, Loblaw promoted its own brands, which went into the background again when it reached an agreement with PepsiCo.

The extra volumes meant Neal Brothers was promoted to the main snack aisle at Loblaw stores from its typical home in the specialty food section — akin to a prospect on a farm team getting called up to the majors. Neal said he expects the resumption in PepsiCo shipments means his brand will get bounced back to specialty foods. But he said the brand benefited from the extra exposure and his team is working to pick up some extra shelf space in Loblaw stores. – Financial Post

I’m not making the case that these issues should be ignored. However, PepsiCo isn’t the only one with these issues, and supermarkets cannot leave major corporations out of their stores. PEP’s brands are too strong.

The major issue here is inflation, which neither PepsiCo nor its customers can influence.

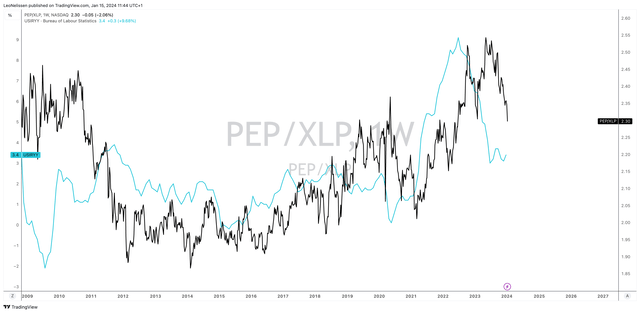

Also, evidence suggests that PEP is still the go-to consumer staples play when inflation rises.

The chart below compares the year-over-year inflation rate to the ratio between the PEP stock price and the XLP ETF price. We clearly see that rising inflation pushes investors into stocks with pricing power.

TradingView (PEP/XLP Ratio, U.S. Inflation)

The recent underperformance is unlikely to be caused by negative headlines but by falling inflation pushing investors into some of the most beaten-down peers.

Where’s The Shareholder Value?

Going back to its financial results, its core business remains as strong as ever.

For example, during the third quarter in North America, Frito-Lay achieved 7% organic revenue growth, maintaining market share in snack categories.

- Quaker Foods saw a 5% organic revenue growth, gaining share in various categories.

- PepsiCo Beverages North America reported 6% organic revenue growth.

- Internationally, the business contributed nearly 40% to total net revenue in 2022 and achieved a remarkable 12% organic revenue growth in the third quarter.

Mondelez (MDLZ), PepsiCo’s snack peer, also benefits from a similar strategy, where it uses significant international exposure to boost sales growth.

With that in mind, on February 9, the company is scheduled to release its earnings. Analysts are looking for $1.72 in EPS. In 4Q22, the company generated $1.67 in EPS, which hints at roughly 3% growth.

Over the past two years, the company has never missed earnings estimates.

On a full-year basis (2023), the company projects a 10% organic revenue growth rate, underlining its confidence in the market’s response to its offerings.

Notably, the company has heightened its focus on advancing holistic cost management initiatives, expecting to achieve a 13% core constant currency EPS growth in 2023.

The company has also set ambitious targets for fiscal 2024, aiming to deliver results towards the upper end of its long-term target ranges for both organic revenue and core constant currency EPS growth.

Analysts seem to agree with that.

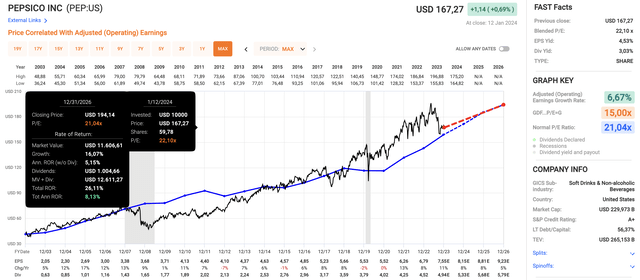

Using the data in the chart below:

- PEP is expected to grow EPS by 8% in both 2024 and 2025, followed by 5% growth in 2026.

- Currently, PEP is trading at a blended P/E ratio of 22.1x, which is a bit above its normalized valuation multiple of 21.0x.

- When combining the normal valuation with expected EPS growth and its dividend, the stock has an implied annual return of 8.1%, a bit below its long-term annual return of 8.4%.

FAST Graphs

In other words, I believe the stock has re-entered the buy area, as its dividend is now exceeding 3.0% again, with its current valuation close to its normal valuation.

Historically speaking, a yield exceeding 3% indicates a good buying opportunity. In this case, it’s confirmed by the aforementioned numbers as well.

While PEP will remain in a tough spot due to elevated inflation, which I consider to be the biggest risk to my thesis, I continue to believe that PEP is one of the best consumer staple stocks on the market, which helps me to add low volatility dividend growth to my portfolio.

Hence, at these levels, I will continue to expand my position.

Takeaway

I believe my focus on PepsiCo as a cornerstone in my dividend growth portfolio has proven resilient.

Despite recent negative headlines about pricing disputes with Carrefour, the fundamentals remain robust.

PepsiCo’s diverse product portfolio, including powerhouse brands like Doritos and Lay’s, continues to dominate the snack market.

The recent 3Q23 earnings report showed impressive organic revenue growth and a solid performance across key segments.

While inflation poses challenges, historical data suggests that PepsiCo’s pricing power makes it a reliable choice in turbulent times.

With a compelling dividend yield and a favorable valuation, I see the current dip as an opportunity to strengthen my position in this stalwart consumer staple.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PEP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.