Summary:

- Bank of America had a slightly mute FY23 due to one-off special items and a challenging macroeconomic environment, but still grew its customer base and maintained a solid balance sheet.

- Speculation of rate cuts by the FED in early 2024 improved investor sentiment, leading to an almost 30% increase in share price since late October 2023.

- While the bank has a strong economic moat and performed well in its core business segments, the increase in nonperforming assets and charge-offs is concerning.

- The current macro environment creates uncertainty with regard to the intrinsic value of shares. Current prices could suggest between a 28% undervaluation and a fair valuation.

- Hold rating issued.

Justin Sullivan

Investment Thesis – Q4 FY23 Update

Bank of America (NYSE:BAC) is one of the largest banks in the United States with a huge raft of products and services targeted at both consumer and corporate clients.

The bank had a difficult FY23 as a result of one-off special items and a difficult macroeconomic environment weighing down on earnings. However, the bank continued to grow its customer base and client relationships all the while retaining a solid balance sheet and generating tangible profits.

Speculation of rate cuts by the FED in early 2024 has improved investor sentiment around BoA’s massive $33B paper losses on their HTM securities portfolio with a late 2023 rally sending shares almost 30% higher in just a month of trading.

Ultimately, while I still like the bank for its conservative approach to business and thanks to Moynihan’s leadership, current prices are too dear in my opinion to advocate expanding my position in the bank.

Hold rating issued.

Company Background

BAC Investor Relations

Bank of America (BoA) is one of the “big four” banks based in the U.S. ranking second in terms of market capitalization behind JPMorgan Chase (JPM) and ahead of Wells Fargo (WFC) and Citigroup (C).

The firm serves approximately 11% of all American bank deposits with its primary services revolving around consumer banking, global banking, wealth management, and investment banking.

Brian Moynihan continues to lead the bank as CEO into the ‘20s with a focus on continued growth in BoA’s core business segments at the forefront of his strategy.

The bank is also paying particular attention to expenses to ensure the bank’s operational efficiency does not become compromised through any growth achieved.

A very conservative approach to HTM investment securities left BoA exposed to the higher interest rate environment with the bank incurring significant paper losses on their assets while also suffering from relatively decreased interest income.

The reversal in interest rate hikes as suggested by the Fed may lead to BoA seeing growing interest income on securities and could leave the bank with an even more robust balance sheet should rates drop close to zero once more.

Economic Moat – Q4 FY23 Update

BoA has a wide economic moat that is primarily built upon its extensive set of services and retail banking networking driving a set of tangible switching costs for both consumer and enterprise-oriented clients.

I conducted a full in-depth fundamental analysis of BoA’s economic moat and business operations back in October 2023. Little has changed at the bank with regard to their economic moat, so I urge readers to have a look at that detailed analysis here.

In this update piece, I would like to discuss the continued strength of BoA’s consumer banking, wealth management, global banking, and global markets business segments in Q4 FY23.

BoA’s consumer banking segment continued to see significant growth achieving an impressive 20-quarter streak of consecutive growth. The bank saw 600,000 new checking accounts and more than 4.6MM new credit card accounts being opened in Q4 FY23.

While total deposit balances continued to fall from $1047 to just $959, the ability of BoA to continue attracting new consumers to the bank is impressive. A mix of great quality financial products combined with an outstanding branch network continues to attract consumers to BoA instead of competitors.

The bank’s GWIM segment also saw massive 47% YoY growth with their Merrill and Private Bank divisions seeing over 40,000 new customer relationships in FY23.

BoA’s global banking segment saw 100% YoY growth in their corporate clients with more than 2,500 new clients starting business with the bank. This resulted in business lending growth of 15% YoY and a total of 11.4B in global transaction services revenue.

The bank’s Global Markets segment also saw new institutional relationships up 11% YoY with annual average loan balances of $130B reaching record levels.

Such sustained growth across all of BoA’s business segments illustrates just how good of a service the bank is currently providing clients. I still believe their massive scale, wide range of products and solutions, and focus on customer satisfaction generates a wide economic moat for the firm.

This has been evidenced by the bank’s ability to attract a record number of customers to their product offerings despite the compromised macroeconomic environment and relative competitiveness of other key players such as JP Morgan Chase.

Financial Situation – Q4 FY23 Update

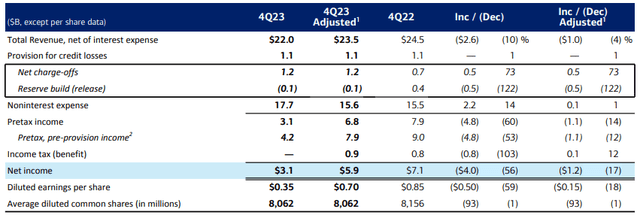

BAC FY23 Q4 Presentation

The final quarter of FY23 saw BoA’s total revenue net of interest expense decrease 10% YoY. This weakness was mainly due to an FDIC special assessment pretax noninterest expense of $2.1B as a result of the increased capital requirements resulting from the SVB collapse.

On an adjusted basis, Q4 net revenues were down $1B to $23.5B. This decrease occurred as a result of all four of BoA’s businesses saw 3-5% decreases in revenue, respectively.

BAC FY23 Q4 Presentation

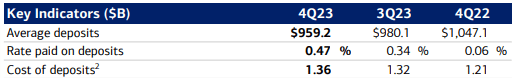

The consumer banking segment suffered mainly due to lower deposit balances, an increase of .15 in the average cost of deposit from 1.21 in Q4 2022 to 1.36 in Q4 2023. This occurred due to rates being paid on deposits rising a whopping 0.41% to 0.47%.

BoA’s GWIM, Global Banking, and Global Markets segments saw falling NII as a result of lower deposits, slightly increased rates paid on deposits, and lower overall trading volumes respectively.

These quantitative figures are in contrast to the otherwise strong growth BoA saw in client numbers, new accounts, and AUM flows and illustrate just how difficult the current macroeconomic environment makes expanding operating incomes.

Nevertheless, I would like to highlight a few key points that support my thesis that BoA is operating business well despite the difficult macroeconomic environment.

BAC FY23 Q4 Presentation

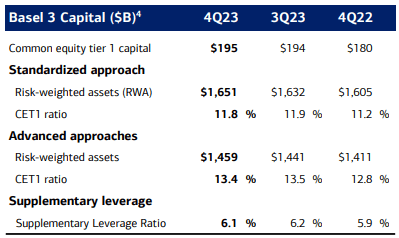

From a liquidity perspective, BoA’s CET1 ratio of 11.8% is 0.6% higher YoY thanks to a $0.7B increase in CET1 capital since Q3 FY23 and standardized RWAs increased by $18B in the same period.

BAC FY23 Q4 Presentation

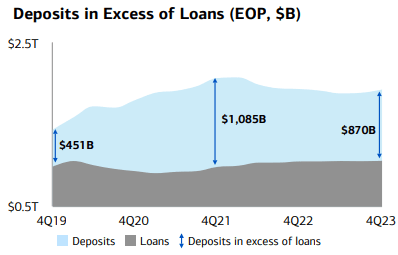

The bank’s total deposits in excess of loans are currently at $870B. While this delta is smaller than the superb liquidity seen at the end of FY21, BoA still has 92% more deposits in excess of loans compared to the end of FY19.

I am a huge advocator for conservative asset allocation and liquidity management when it comes to banking and view this excess of deposits very favorably, even if it has come down from the immediate post-pandemic highs.

BAC FY23 Q4 Presentation

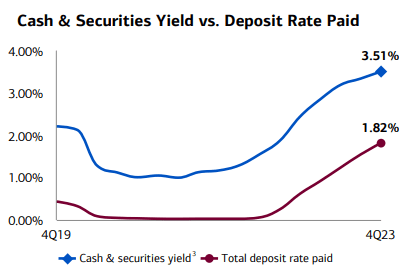

BoA’s margin between securities yield vs deposit rate paid is still excellent despite the overall increase in interest rates with the bank having continued to improve this key metric.

The current margin of 1.69% provides BoA with a great return on assets given their conservative securities portfolio with the margin likely to expand should interest rates move lower in 2024.

BAC FY23 Q4 Presentation

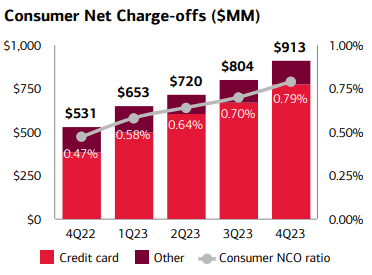

One concerning trend arising from the Q4 report is the rise in consumer NCOs. The credit card NCOs have risen sharply since Q4 FY22 in a worrying trend supporting my underlying belief that consumers are getting into significant and unsustainable debt.

While the percentage of consumer NPAs has not risen YoY and remains constant at 0.60% (as a % of loans and leases), the increase in net charge-offs could signal that NPAs are about to rise significantly too.

BAC FY23 Q4 Presentation

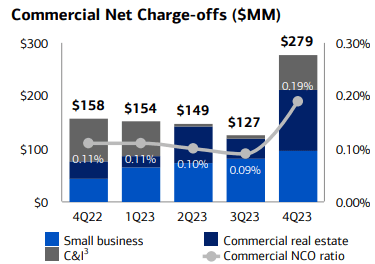

The situation becomes more concerning with regard to the commercial asset portfolio with a sudden increase in NPAs from 0.18% to 0.47% of total loans and leases coming largely from struggling CRE loans. BoA’s commercial NPA has increased by a whopping 160% YoY.

The CRE sector is finally being hit by the consequences of a higher interest rate environment with significant debt refinancing at higher rates leading to rapidly deteriorating credit quality.

I believe this worsening trend could result in BoA seeing some real losses in profitability and efficiency in their commercial loans portfolio which could ultimately impact the bank’s FY24 results tangibly.

While a sudden cut to interest rates could help the situation and BoA’s loan portfolio, predicting when the Fed might take action is quite speculative given the slower-than-expected cooling in the economy in December 2023.

Seeking Alpha | BAC | Profitability

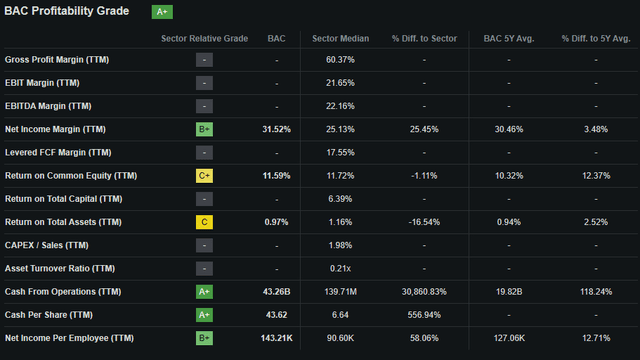

Seeking Alpha’s Quant calculates an “A+” profitability rating for Bank of America which I still believe to be an accurate relative representation of BoA’s fiscal performance.

While the overall growth in earnings and revenues for FY23 was not stellar, I believe the bank has made the most of a difficult macroeconomic environment.

Conservative loan underwriting, credit score monitoring, and securities investments should allow the firm to remain stable and robust even if a hard-landing U.S. recession event takes place.

The significant number of new clients, customers, and relationships forged by BoA in FY23 could also prove useful in a more growth-oriented economic landscape.

Valuation

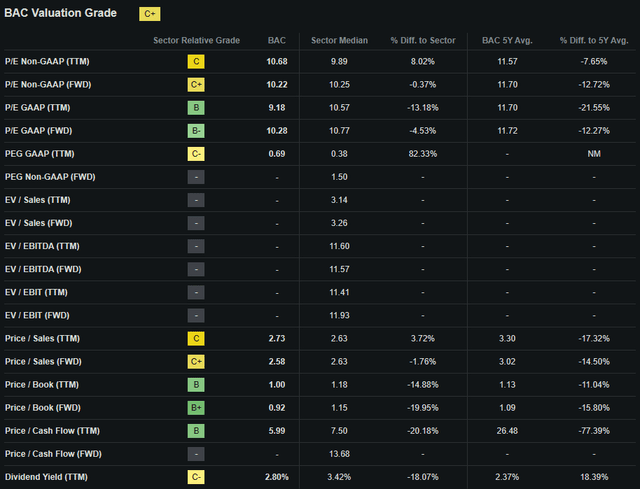

Seeking Alpha | BAC | Valuation

Seeking Alpha’s Quant assigns Bank of America with a “C+” Valuation grade. I believe this is a mostly fair representation of the value present in Bank of America shares especially after the massive bull run witnessed at the end of 2023.

The bank currently trades at a P/E GAAP FWD ratio of 10.28x. This still represents a significant 12% decrease in the firm’s P/E ratio compared to their running 5Y average but is up 36% since October lows of around 7.50x.

BoA’s TTM Price/Book of just 1.00x is still quite low given the 5Y average of 1.13x but once again up almost 35% since October lows.

Considering these valuation metrics alone I believe BoA may start to appear only slightly undervalued.

Seeking Alpha | BAC | 5YAdvanced Chart

From an absolute perspective, BoA shares are trading at what is still a significant discount relative to the highs seen in 2022.

However, when compared to the 84% growth seen in the S&P 500 tracking SPY index over the past five years, BoA has been soundly outperformed by the U.S. market index as a whole by about 60%.

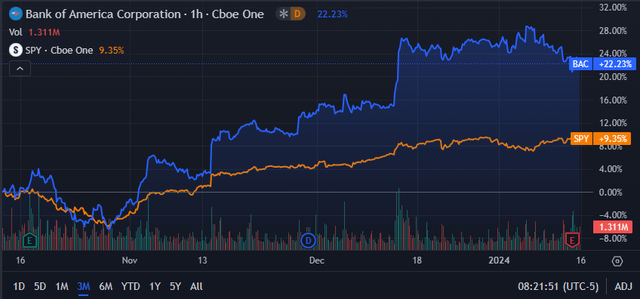

Seeking Alpha | BAC | 3M Advanced Chart

On a last 3-month basis BoA’s stock has seen a huge rally with valuations creeping up 23% since late October. This came largely on the heels of speculation about the Fed cutting rates in Q1/Q2 of 2024 which prompted significant investor optimism regarding BoA’s paper losses reversing.

The Value Corner

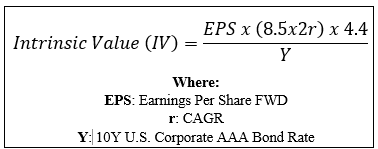

By utilizing The Value Corner’s specially formulated Intrinsic Valuation Calculation, we can better understand what value exists in the company from a more objective perspective.

Using BoA’s current share price of $32.80, an estimated 2024 EPS of $3.21, a realistic “r” value of 0.03 (3%), and the current Moody’s Seasoned AAA Corporate Bond Yield ratio of 4.47x, I derive a base-case IV of $45.80. This represents a still substantial 28% undervaluation in shares.

When using a more pessimistic CAGR value for r of 0.02 (2%) to reflect a scenario where a globally spanning recession causes BoA’s revenue growth to flatline all the while operating costs remain mostly unchanged, shares are valued at around $33.00 representing a fair valuation in the stock as of present time.

Considering the intrinsic value calculation and the recent rally in shares, I believe that Bank of America is now trading somewhere between a fair valuation and a modest undervaluation.

In the short term (3-12 months), it is very difficult to make any concrete predictions on share price movements.

Economic indicators remain mixed which makes predicting whether the U.S. economy will achieve a soft- or hard landing incredibly difficult. A soft-landing scenario would allow BoA to benefit from new customer relationships which could ignite topline growth while a hard recession could result in declining profitability despite the bank’s best efforts.

In the long-term (2-10 years), I see Bank of America continuing to benefit from a tangible competitive advantage thanks to the significant moatiness generated by its diverse business segments.

Their massive portfolio of services and products helps create multiple operational synergies while their huge scale assists in maximizing efficiency through minimizing the relative size of many fixed costs.

Risks Facing Bank of America – Q4 FY23 Update

Bank of America still faces significant risk from both regulatory changes and the threat of macroeconomic conditions impacting consumer and corporate fiscal habits.

To read an in-depth analysis of BoA’s risk profile, please click here.

In summary, BoA faces a tangible risk from the prevailing macroeconomic conditions as essentially all their revenue streams are directly tied to the greater performance of the U.S. economy.

A recessionary period combined with unfavorable phases of interest-rate cycles could expose the bank to worsening credit ratings and increasing levels of non-performing loans.

From an ESG perspective, BoA faces no tangible threats that could place a strain on its reputation or fiscal situation.

I still believe the overall lack of major environmental, societal, or governance concerns would make the bank an excellent pick for a more ESG-conscious investor.

Of course, opinions may vary and I implore you to conduct your own ESG and sustainability research before investing in Bank of America if these matters are of concern to you.

Summary

Bank of America is still a solid and well-run banking operation with conservative core principles underpinning its business practices.

I continue to like the direction Moynihan is taking the bank and believe their focus on growing their customer base, client relationships, and consumer banking operations despite the difficult macroeconomic conditions is a sound strategy to pursue.

Some one-off items combined with a difficult macroeconomic environment have resulted in Q4 and FY23 figures being slightly more muted than desired. However, I believe the bank is working well to maximize efficiency and continues to improve its setup for a more expansionary fiscal cycle.

I view the increase in NPAs and charge-offs as concerning less so of BoA’s business model but rather the entire economy as a whole. Any further worsening of credit could result in significant defaults which may impact profitability and the stability of the banking system as a whole.

Furthermore, Bank of America’s share price has witnessed a remarkable bull run since late October 2023 which has left shares trading somewhere between a 28% undervaluation and a fair valuation.

Given the uncertainty present in current macroeconomic conditions, I must downgrade Bank of America to a Hold and cannot advocate increasing one’s position in the bank as a result of a decreased margin of safety.

I must reiterate that I will not be selling my position in the bank, simply not adding any further exposure at present time due to shares being too pricey for my liking. I do, however, still believe the bank has solid long-term value generation potential for existing shareholders.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BAC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I do not provide or publish investment advice on Seeking Alpha. My articles are opinion pieces only and are not soliciting any content or security. Opinions expressed in my articles are purely my own. Please conduct your own research and analysis before purchasing a security or making investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.