Summary:

- Nvidia’s growth is accelerating in a $300 billion opportunity as the automotive industry is witnessing a shift to software-defined vehicles.

- Although Nvidia’s auto segment contributed just 3% of revenues YTD, the current growth trajectory and design win book set a path to 10% of revenues by FY28.

- A multifaceted opportunity with tailwinds in ADAS, mapping, simulation, and AVs presents a pathway to generate $6B in revenues by FY28.

- Nvidia faces competition from Qualcomm and Mobileye, among others and could be exposed to geopolitical risk in the auto segment.

Alex Wong/Getty Images News

Chip and AI giant Nvidia (NASDAQ:NVDA) is at the helm of the software-defined shift from semi-autonomous to autonomous vehicles, with a range of products and an expanding list of customers and partners supporting long-term growth in the segment. Nvidia has highlighted autonomous driving as one of five “tremendous” forces driving growth – its auto pipeline currently exceeds $11 billion over the next six years. With the adoption of semi-autonomous and fully-autonomous vehicles still in the very early innings, Nvidia’s automotive pipeline looks poised for substantial long-term growth and contribution to revenues over the course of the decade – this take is reaffirmed by strong growth metrics in FQ3 signaling that the growth story for automotive has kicked off.

Automotive Revenues Showing Strong Growth

It’s worth noting that automotive revenues, for Nvidia, are one of its smallest segments, accounting for just 3% of Nvidia’s YTD revenues in 2022, down from ~6% in YTD18 as data center growth has been nothing short of phenomenal.

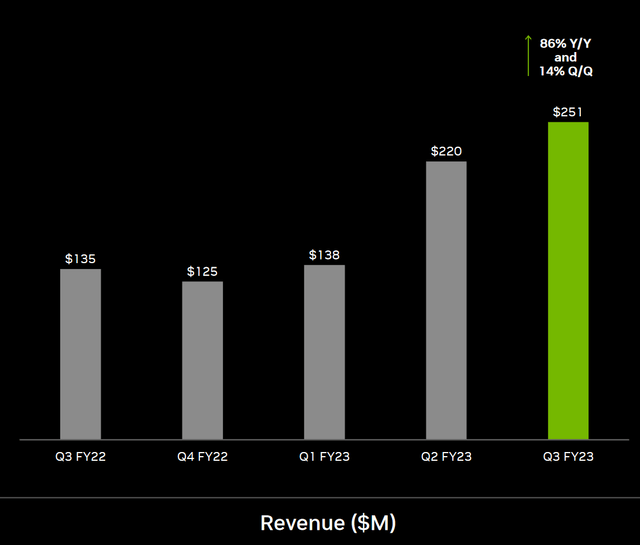

However, Nvidia’s automotive segment is showing strong growth for FY23, with revenues starting the year at $138 million in FQ1 and rising to a quarterly record of $251 million in FQ3. The segment is poised to record nearly $880 million to $900 million in FY23, with revenues potentially recording over +110% y/y growth in FQ4.

Again, automotive revenues reached a record in FQ3, reaching $251 million, +86% y/y and +14% q/q. Revenues for FQ4 are projected to rise another 12% q/q to ~$281 million, driven by new model wins with Nio (NIO), XPeng (XPEV), Hozon Auto, Polestar (PSNY), and the scaling of other models such as Volvo’s EX90 and potentially XPeng’s G9, among others.

Projected FY23 revenues of $890 million represent y/y growth of approximately +57%, a massive jump from FY22‘s near +6% increase to $566 million. With Nvidia’s total revenue placed at around $27 billion for FY23, the auto segment still will account for just about 3% of revenues, a small contribution thus far. It’s no surprise if the segment is overlooked, with a minimal contribution and minimal growth so far, with data center the dominant driver over the past few years. Yet, the segment deserves a deeper look – by FY28, automotive revenues are forecast at over $6 billion, contributing ~10% or more of Nvidia’s total revenues.

It’s this long-term growth potential and outright growth in revenues over the course of the decade that enforce Nvidia’s automotive segment as a burgeoning success story – the segment may not be there yet, but the future holds significant substantial revenue growth ahead.

A $300 Billion Opportunity

The auto industry is at the helm of a major transformation to software-defined, autonomous/semi-autonomous capable vehicles, unfolding into a tremendous $300B opportunity, according to Nvidia, which has growth outlets throughout the major facets of this transformation. Nvidia sees a potential opportunity of 100 million vehicles/year on the hardware side (autonomous driving chips – DRIVE Thor, Orin, etc.), and hundreds of millions of autonomous vehicles for the software side (DRIVE platform, DGX, etc.).

The ADAS space is entering a multi-year growth phase as leading OEMs begin rolling out ADAS products or investing heavily to roll products out in the latter half of the decade. Hyundai is adding its L3 Highway Driving Pilot on the Genesis G90 this year, Mercedes is targeting US approval for its L3 Drive Pilot system following approval in Germany earlier this year, and Volvo recently unveiled its EX90 outfitted with Nvidia’s DRIVE Orin for ADAS and advanced safety. Polestar (PSNY), Nio (NIO), XPeng (XPEV), Kia, Honda, Lucid, Toyota, BYD (OTCPK:BYDDY) – a wide range of major OEMs and EV startups – are all adding L2/conditional L3 ADAS to vehicles over the next few years, opening up massive tailwinds for Nvidia due to relationships with a majority of these OEMs.

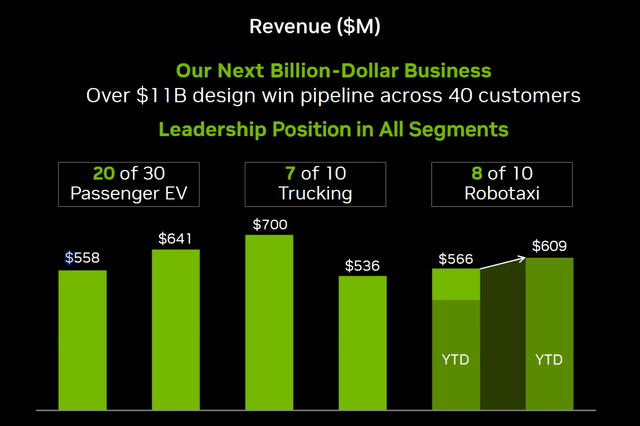

For Nvidia specifically, the opportunity remains quite large, with a number of platforms arising in 2024 and beyond. Nvidia commands a leading position with a majority of the top passenger EV, trucking, and robotaxi developers.

For example, Hyundai is deploying Nvidia DRIVE for infotainment and more across Hyundai, Kia, and Genesis brands; Mercedes, SAIC, and Jaguar Land Rover are all tapping into the DRIVE platform as well. JLR is adopting DRIVE, Hyperion 8, and Nvidia’s AV offerings for its 2025 vehicle lineup. Hozon’s NETA selected DRIVE for its upcoming EVs.

The opportunity does not only exist in ADAS-equipped passenger vehicles – the AV/robotaxi space also provides numerous growth opportunities for Nvidia, regardless of the timelines to AV deployment.

Zoox (AMZN), WeRide, Einride, Embark (EMBK), Pony.ai, AutoX autonomous vehicles are utilizing Nvidia DRIVE as their underlying platform. Innoviz (INVZ) is using DRIVE Sim to simulate safety testing at scale, while Einride is also turning to Nvidia Inception for product development and design resources. Nvidia also recently launched an AV mapping platform, DRIVE Map, set to launch in 2024 with over 300,000 miles mapped across Europe, N. America, and Asia. So although autonomous vehicles have yet to roll out at scale, with Cruise and Waymo among the first launching robotaxi services with trucking developers such as Aurora (AUR) aiming for launch in 2024, Nvidia still has multiple outlets of growth. Nvidia has arms in almost all edges of AV development – mapping, testing, simulation, chips, etc. – that will lead to growth even if the autonomous vehicles still take a few more years to get off the ground.

DRIVE Orin-powered vehicle production scaling is also a near-term tailwind for Nvidia, with Volvo’s EX90 starting production in 2023 along with volume growth from Nio, XPeng, Polestar, and others over the next four to six quarters.

Risks From China, Competition

Although the segment has bright tailwinds ahead, it faces steep competition from main rivals Qualcomm (QCOM) and Mobileye (MBLY), and geopolitical risk stemming from a heavy presence in Chinese OEMs.

Nvidia collaborates with SAIC, IM Motors, DeepRoute.ai, JiDU, Pony.ai, TuSimple, Hozon, Zeekr, BYD, Geely, and others, and recent ban on AI chips raises the risk that sales to Chinese automakers could potentially be threatened in the future. Given the size of the auto segment at the moment, the initial risk to revenues is likely to the tune of $200 million to $300 million per year. Nvidia also faces domestic competition from Black Sesame and Horizon Robotics, among others, who are advancing efforts to produce high-quality, high-power autonomous driving chips.

Qualcomm and Mobileye are two of the largest competitors Nvidia faces in the ADAS and software-defined vehicle sphere – Qualcomm commands an enviable position with a $30B automotive pipeline (rising by $19B in just over four months), while Mobileye projected a future volume of 54 million systems by 2030 as its order book continues to grow. Nvidia’s offerings are a bit more specialized towards empowering autonomy than Qualcomm and may see a bit of a smaller order book at the moment, possibly in the region of $14 billion to $17 billion.

Outlook

Again, Nvidia’s automotive segment contributes just 3% of revenues, but it has now reaffirmed signs of reaching an inflection to record strong sequential growth rates, putting it on a trajectory to reach $6 billion in revenues by FY28. A multi-year shift to ADAS-equipped vehicles combined with volume growth and more possible design wins, and a multifaceted AV suite capturing benefits from the prolonged development of autonomous vehicles entrench the segment as a winner for years to come for Nvidia.

Competition does pose a bit of a threat, with its main rivals Qualcomm and Mobileye having substantial order books over the next six to eight years. Nvidia likely commands a future order book worth $16 billion or so through FY28 with more design wins, setting the stage for continued growth over the next four to six years. Geopolitical risk is also at play due to a significant presence and adoption by Chinese OEMs.

Automotive has been a sleeper segment for Nvidia, but FY23 is kicking off a period of strong growth, bringing its revenue contribution up from ~3% in FY23 to ~10% by FY28, with the segment likely generating revenues far in excess of $5 billion by then.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.